ESOP Filing with RBI – FEMA Compliance Made Easy

Employee Stock Option Plans (ESOPs) are one of the most powerful tools for retaining and rewarding employees, especially in startups and growing companies. However, when ESOPs are issued to non-resident employees or directors, RBI compliance under FEMA becomes mandatory. This involves reporting through the FIRMS portal by filing ESOP forms, FC-GPR, or FC-TRS depending on the transaction. Timely and accurate filing is critical, as delays can invite penalties and create hurdles during audits or future funding rounds. At TAXAJ, we provide end-to-end support for ESOP Filing with RBI—ensuring compliance, smooth coordination with your AD Bank, and complete peace of mind.

Get your ESOP approved with RBI in simplest manner.

It usually takes 20 to 25 working days.

- Drafting documents

- Filing of forms with Authorities

- Documented Follow-up

- Business hours - CA support

- Any business entity or Individual

- Purchase of plan

- Upload documents on Vault

- Drafting of documents

- Submission of documents and application with Department

- Receipt of Approval letter

COI, MOA, AOA, PAN, and shareholding pattern.

Board & Shareholder Resolutions approving ESOP Scheme.

Copy of ESOP Scheme.

Beneficiary list (with nationality, designation, options granted/exercised).

Valuation Report by CA/Registered Valuer.

Details of grant, vesting, exercise, and allotment.

FIRC & KYC from AD Bank (if funds received).

DSC of Authorised Signatory.

What is ESOP Filing with RBI?

Employee Stock Option Plans (ESOPs) allow companies to grant shares or options to their employees as part of compensation or retention strategies. While ESOPs issued to Indian residents are governed mainly under the Companies Act, 2013, the moment ESOPs are granted or exercised by non-resident employees or directors, it falls under the purview of the Reserve Bank of India (RBI) and FEMA (Foreign Exchange Management Act) regulations.

As per FEMA guidelines, companies are required to report such issuances to RBI through the FIRMS Portal by filing the prescribed forms. This is commonly referred to as ESOP Filing with RBI. Depending on the transaction type:

ESOP Form is filed for reporting grants of ESOPs to non-residents.

Form FC-GPR is filed when shares are actually allotted upon exercise of ESOPs.

Form FC-TRS is applicable if there is a transfer of shares to or from a non-resident.

The purpose of this filing is to keep track of foreign investment in Indian companies and ensure compliance with FEMA rules. Non-compliance or delay in filing can result in penalties, compounding fees, and complications during audits, due diligence, or future fund-raising rounds.

In short, ESOP Filing with RBI is a legal obligation for any Indian company issuing stock options to non-resident employees, and it safeguards both the company and its stakeholders by maintaining transparency in foreign exchange transactions.

Applicability of RBI ESOP Compliance

RBI ESOP compliance becomes applicable whenever an Indian company issues or allots Employee Stock Options (ESOPs), Sweat Equity Shares, or other share-based benefits to non-resident employees or directors. This includes:

Foreign nationals employed in an Indian company.

Indian citizens residing abroad (NRIs/OCIs) who are part of the company’s workforce or board.

Employees of an overseas subsidiary/holding company where the Indian entity extends its ESOP scheme across the group.

The compliance is triggered at two stages:

Grant Stage – When ESOPs are granted to a non-resident, it must be reported to RBI through the FIRMS portal in Form ESOP.

Exercise/Allotment Stage – When shares are actually allotted on exercise of ESOPs, companies must file Form FC-GPR within 30 days of allotment.

Transfer Stage (if applicable) – If ESOPs or shares are transferred between a resident and non-resident, Form FC-TRS is required.

In simple terms, any participation of a non-resident in an Indian company’s ESOP scheme requires FEMA and RBI reporting. This ensures that foreign investment into the company is legally tracked, recorded, and approved.

Non-compliance can attract FEMA penalties, delays in remittance processing, and hurdles during statutory audits or fund-raising rounds. Hence, timely ESOP filing with RBI is crucial for companies with cross-border teams.

Entry routes for investments in India Under the Foreign Direct

Investments can be made in shares, mandatorily and fully convertible debentures and mandatorily and fully convertible preference shares of an Indian company by non-residents through two routes:

Automatic Route: Under the Automatic Route, the foreign investor or the Indian company does not require any approval from the Reserve Bank or Government of India for the investment.

Government Route: Under the Government Route, the foreign investor or the Indian company should obtain prior approval of the Government of India(Foreign Investment Promotion Board (FIPB), Department of Economic Affairs (DEA) Ministry of Finance or Department of Industrial Policy & Promotion, as the case may be) for the investment.

In case ESOPs are offered to employees working outside India, the FEMA provisions shall additionally apply. Applicable provisions of FEMA (Transfer or issue of security to a person resident outside India) Regulations, 2000 (FDI Regulations) & Consolidated FDI Policy, 2015 issued from time to time are as under:

Definition under FDI Regulations: “2 (iif) “employees‟ stock option” means the option given to the directors, officers or employees of a company or of its holding company or joint venture or wholly owned overseas subsidiary/subsidiaries, if any, which gives such directors, officers or employees, the benefit or right to purchase, or to subscribe for, the shares of the company at a future date at a pre-determined price.”

Formerly, the regulations did not cover sweat equity shares and stock options to directors, employees or officers of holding company. RBI vide Notification No. FEMA.344/2015 RB dated June 11, 2015 issued Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) (Fourth Amendment) Regulations, 2015, and permitted an Indian Company to issue shares under the Employee Stocks Options Scheme. (xa) “Sweat Equity Shares” means such equity shares as issued by a company to its directors or employees at a discount or for consideration other than cash, for providing their know-how or making available rights in the nature of intellectual property rights or value additions, by whatever name called.”

Regulation 8 of FDI Regulations:

1 (1) An Indian company may issue “employees stock option” and/or “sweat equity shares” to its employees/directors or employees/directors of its holding company or joint venture or wholly owned overseas subsidiary/subsidiaries who are resident outside India, provided that :

a. The scheme has been drawn either in terms of regulations issued under the Securities Exchange Board of India Act, 1992 or the Companies (Share Capital and Debentures) Rules, 2014 notified by the Central Government under the Companies Act 2013, as the case may be.

b. The employees stock option/sweat equity shares issued to non-resident employees/directors under the applicable rules/regulations are in compliance with the sectoral cap applicable to the said company.

c. Issue of employee stock option/sweat equity shares in a company where foreign investment is under the approval route shall require prior approval of the Foreign Investment Promotion Board (FIPB) of Government of India.

d. Issue of employees stock option/sweat equity shares under the applicable rules/regulations to an employee/director who is a citizen of Bangladesh/Pakistan shall require prior approval of the Foreign Investment Promotion Board (FIPB) of Government of India.

(2) The Reserve Bank may require the company issuing employees stock option and/or sweat equity shares to submit such reports and at such frequency as it may consider necessary

Para 3.5.5 of Consolidated FDI Policy, 2015:

(i) Listed Indian companies are allowed to issue shares under the Employees Stock Option Scheme (ESOPs), to its employees or employees of its joint venture or wholly owned subsidiary abroad, who are resident outside India, other than to the citizens of Pakistan.

(ii) ESOPs can be issued to citizens of Bangladesh with the prior approval of FIPB. Subject to this, Government approval is not required for issue of ESOPs in sectors under automatic route.

Shares under ESOPs can be issued directly or through a Trust subject to the condition that: (a) The scheme has been drawn in terms of relevant regulations issued by the SEBI.

(iii) Unlisted companies have to follow the provisions of the Companies Act, as applicable.

Rule 4. Reporting of ESOPs for Allotment of Equity Shares

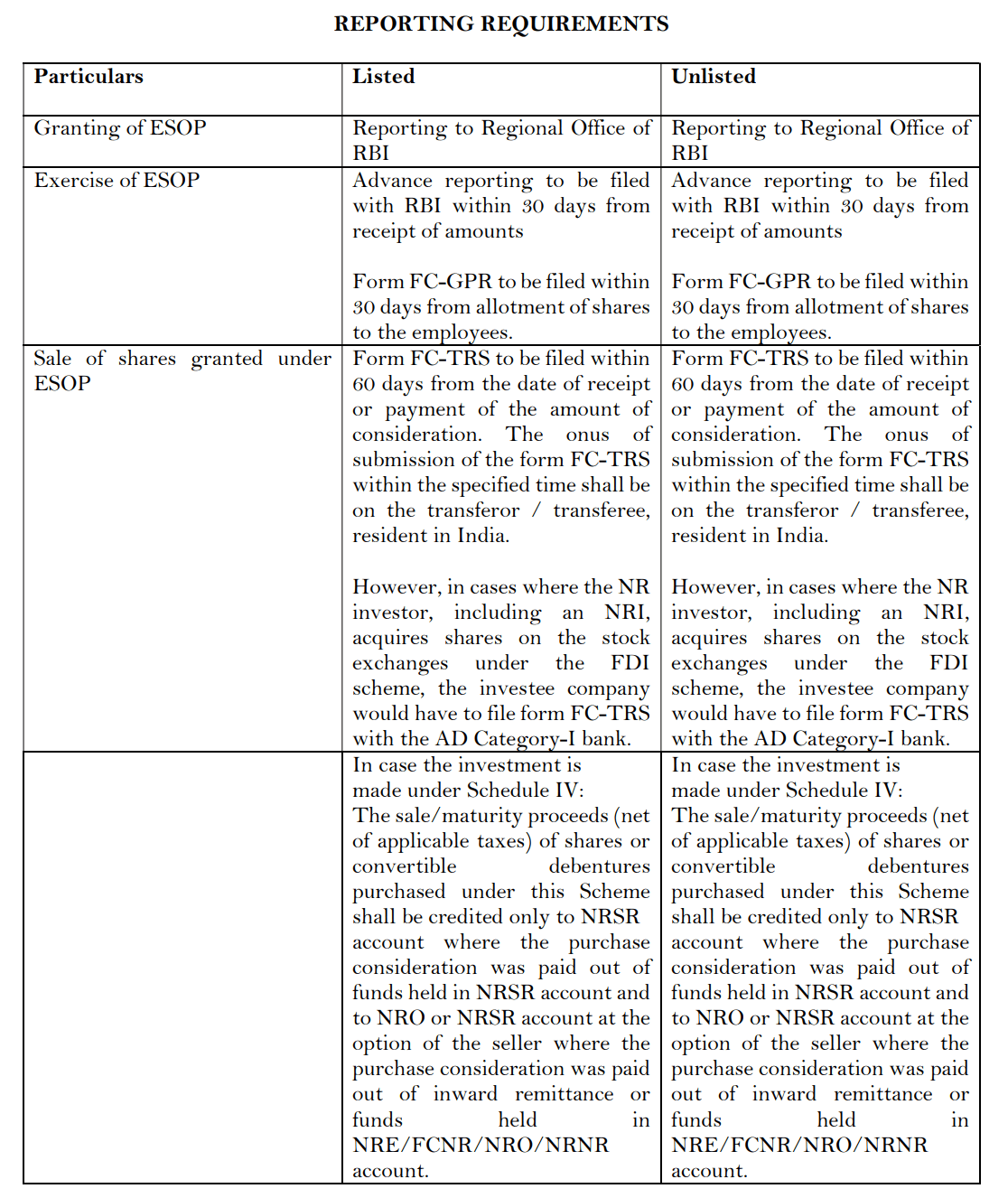

The issuing company is required to report the details of granting of stock options under the scheme to non-resident employees to the Regional Office concerned of the Reserve Bank. This Reporting to be made on plain paper. The details of issue of shares subsequent to the exercise of such stock options within 30 days from the date of issue of shares in Form FCGPR in format as Annexure-1

Companies (share capital and debenture) rules, 2014 anyways specifies the limit for issuance of sweat equity shares under rule 8 (4)

The company cannot issue sweat equity shares for more than fifteen percent of the existing paid up equity share capital in a year or shares of the issue value of rupees five crores, whichever is higher. Issuance of sweat equity shares in the Company shall not exceed twenty five percent, of the paid up equity capital of the Company at any time.

Compliance

Scheme to be compliant either in terms of regulations issued under the Securities Exchange Board of India Act, 1992 or the Companies (Share Capital and Debentures) Rules, 2014 notified by the Central Government under the Companies Act 2013, as the case may be.

Securities and Exchange Board of India (Issue of Sweat Equity) Regulations 2002; Section 54(1) of Companies Act 2013 read with Rule 8 of Companies (Share Capital and Debenture) Rules 2014 SEBI (Share Based Employee Benefits) Regulations, 2000 Section 62(1) (b) of Companies Act 2013 read with Rule 12 of Companies (Share Capital and Debenture) Rules 2014 (In our previous article, we have already discussed on various aspects of issuance of ESOP to resident employee for both unlisted company and listed company)

Such issue to be complaint with the sectoral cap applicable to the said company.

As stipulated under Consolidated FDI Policy, 2015

Prior approval of the Foreign Investment Promotion Board (FIPB) of Government of India will be required to be obtained in a Company where the foreign investment is under the ‘Approval Route’.

Prior approval of the FIPB will be required if the issue includes issue of shares to an employee/director who is a citizen of Bangladesh/Pakistan.

The issuing company will be required to furnish to the Regional Office concerned of the Reserve Bank of India under whose jurisdiction the registered office of the company operates, a return in Form-ESOP within 30 days from the date of issuance of ESOP.

Over and above the regulatory requirements, a company may set down certain criteria subject to which eligible employees will be identified. Most companies offer ESOPs to employees above a particular grade, number of years of service. In case of start-ups, the employees who joined the founders at the early stage of running the company may be offered ESOPs.

Acquisition of Shares under Employee Stock Ownership Plan (“ESOP”)

Pursuant to OI Framework, if a resident individual has acquired shares by way of acquisition of shares under ESOP or EBS, in each such case where the individual holds less than 10% of the equity capital of such foreign company whether listed or unlisted without control would be considered to be OPI.

OI Rules permit a resident individual to acquire, without limit, shares or interest under ESOP or EBS offered by the overseas entity subject to – (a) resident individual being an employee or a director of (i) an office in India or a branch of an overseas entity or (ii) a subsidiary in India of an overseas entity or (iii) an Indian entity in which the overseas entity has direct or indirect equity holding; and (b) issue of ESOP or EBS by the issuing overseas entity is done globally on a uniform basis. The expression ‘indirect equity holding’ has been defined to mean indirect foreign equity holding through a special purpose vehicle or step-down subsidiary. Accordingly, to fulfil the criteria in point (a)(iii) above, the overseas entity is required to have either (i) direct equity holding in the Indian entity; or (ii) an indirect equity holding through a special purpose vehicle or subsidiary which is controlled by such overseas entity.

OI Directions have clarified that while a resident individual is permitted to acquire foreign shares or interest under ESOP or EBS without limit, the value of such shares / interest will count towards such individual’s LRS limit of USD 250,000. In other words, if an individual has to remit USD 500,000 on exercise of the ESOPs or as a part of EBS in a financial year, the individual would be permitted to remit the same however, individual’s LRS limit of USD 250,000 would stand fully utilized towards this and no further remittance under LRS would be allowed during the relevant financial year.

Further, the overseas entity is allowed to repurchase the shares so issued to the resident individuals in India under any ESOP or EBS, provided – (a) the shares were issued in accordance with the rules/regulations framed under FEMA, 1999, (ii) the shares are being repurchased in terms of the initial offer document, and (iii) necessary reporting is done through the Authorized Dealer bank (“AD Bank”). Here, AD Bank is the banker in India involved in processing the remittances for acquisition of shares under ESOP or EBS.

As per the Foreign Exchange Management (Realisation, repatriation and surrender of foreign exchange) Regulations, 20155 (“Repatriation Regulations”), if a resident individual acquires securities that represent less than 10% of the company's share capital under ESOP or EBS (which being a OPI), the individual will be required to repatriate into India, any proceeds of such securities within 180 days of receipt, unless such proceeds are reinvested in compliance with OI Rules within the said time period. It is the individual's responsibility to comply with this norm.

New ESOP / EBS Reporting Norms

Under the erstwhile regime, Indian company (or office / branch office) were earlier required to file a simple and prescribed statement of shares allotted or repurchased by the issuing foreign entity under ESOP at the end of each financial year. This filing requirement, however, was not applicable for ‘cashless’ ESOP.

Now, Form OPI6 is one single form introduced under OI Framework and this consolidates and facilitates reporting of different nature of OPI investments permitted under OI Framework. Where the acquisition of shares under ESOP or EBS qualifies as OPI, Form OPI needs to be filed by the employer concerned. This reporting applies also for the repurchase of shares by the overseas entity. As clarified, Indian office or branch of an overseas entity or a subsidiary in India of overseas entity or the Indian entity in which the overseas entity has direct or indirect equity holding where the resident individual is an employee or director, is liable to undertake Form OPI reporting. Since OI Framework do not differentiate between cashless and cash-based ESOP or EBS, the reporting exemption previously available for cashless ESOP shall no longer be available.

Form OPI is a semi-annual reporting which needs to be reported within 60 days from the end of half-year periods ending March 31st and September 30th and therefore, to be filed by May-end and by November-end of every year, respectively. Where such investment qualifies as ODI, the resident individual concerned will need to report it in Form FC.

Practical Issues Pertaining to Additional Information

Additional Information are subject to various interpretation by the stakeholders. The rationale behind seeking these details by the regulator is not clearly known. There is neither practical guidance nor any clarifications issued as yet by the RBI.

No guidance available on how the Indian companies (or office / branch office) can gather some of this sensitive information from employees. For instance, reinvestment, disinvestment (other than in nature of repurchase) and repatriation amount are essentially the personal investment details. Due to sensitivity and confidentially around such information, there may be reluctance or avoidance in sharing details by the employees.

In case of resident individual employees who have acquired the shares of overseas entity under ESOP or EBS resign from the Indian company (or office / branch office), obtaining certain information (like reinvestment and disinvestment) for the relevant half year may not be possible. In such cases, whether the reporting entity has an option not to furnish details of resigned employees is not clear.

Practically, it could be a great operational burden on Indian reporting entity (particularly, the entities operating with a large number of employees in India) to put in place an in-house system for collection of data from the employees on a half-yearly basis.

Indian reporting entity may not be in a position to verify accuracy of certain information (like, reinvestment, disinvestment & repatriation) provided by the employees. Practically, the employees may be required to either furnish self-declaration or documentary proofs to the reporting entity and this would involve a lot of administrative efforts between the entity and its employees.

For cashless ESOP/EBS which do not involve remittance of funds from India, while Form OPI reporting would still apply, disclosure of ‘remittance amount’ becomes irrelevant. Further, how to determine and disclose investment details in terms of USD and INR in this scenario requires adequate clarity.

In case of delay or furnishing incorrect information by the employees, the reporting entity may be held liable for filing an incorrect/inaccurate information or may be exposed to the late submission fee.

Conclusion

Introduction of Form OPI to facilitate consolidated reporting of all forms of OPI investment is certainly a welcoming move. However, if the rationale behind seeking aforementioned additional disclosures in said form is not clear and necessary practical guidance for completing such reporting is not provided, this can lead the concerned entities staying in a state of reporting limbo for want of guidance. Regulatory objective behind said reporting also will not be fulfilled in spirit and may have wider ramifications. Hence, the timely guidance on this matter is most critical.

While these issues are pending redressal at RBI’s level, for the half-year ended September 30, 2022, Form OPI reporting is already due by November-end. In view of this, Indian reporting entities are advised to formally approach their respective AD Bank to seek necessary clarifications. In order to ensure timely reporting, in consultation with AD Bank, the entities can file Form OPI immediately based on the extent of information available and provide a disclaimer on the limitation of information being reported.

References

| 1. | Ministry of Corporate Affairs, Government of India. (2013). The Companies Act, 2013. Retrieved from https://www.mca.gov.in | |

| 2. | Securities and Exchange Board of India (SEBI). (2019). SEBI (Share Based Employee Benefits) Regulations, 2014. Retrieved from https://www.sebi.gov.in | |

| 3. | Reserve Bank of India (RBI). (2019). Foreign Exchange Management (Non-Debt Instruments) Rules, 2019. Retrieved from https://www.rbi.org.in | |

| 4. | Reserve Bank of India (RBI). (2020). Master Direction - Foreign Exchange Management Act (FEMA), 1999. Retrieved from https://www.rbi.org.in | |

| 5. | Department for Promotion of Industry and Internal Trade (DPIIT). (2020). FDI Policy. Retrieved from https://dpiit.gov.in |