Employees State Insurance

Having 20 or more employees in your firm or you wish to Voluntary Registration ? Apply for ESI registration with TAXAJ

It usually takes 3 to 5 working days.

- Drafting documents

- Filing of forms with Authorities

- Issue of ESI allotment letter

- Documented Follow-up

- Business hours -CA support

- Any business entity employing 20 or more employees

- Any business voluntarily wishes to comply with ESI & provide the benefits to employees

- Purchase of plan

- Upload documents on Vault

- Drafting of documents

- Submission of documents and application with Department

- Receipt of Registration letter

Name, Contact Number and Email Id of Stakeholder.

Self Attested PAN, Aadhar & Passport size photo of Stakeholder.

Specimen Signatures of Stakeholder.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office. (If Owned)

Rent Agreement from Landlord. (If Rented/Leased)

PAN, TAN, COI of the Business Entity

Authority Letter in the name of a Authorised Person for ESI

Employees List along with their KYC for whom ESI is to be complied thereupon.

Cancelled Cheque in business name

Know ESIC Registration Process & Eligibility Quickly!

Apply for ESI Registration now

Features of the scheme

The scheme is self-financing and being contributory. The funds in ESIC are built out of the contribution from both the employees and employers. Both make a fixed monthly contribution of wages. Currently, the percentage of employee contribution rate is 1.00% of the wages, and that of employers is 4.00% of the wages paid. For newly implemented areas, the contribution rate is 1% and 3%, respectively, for employees and employers for the first 24 months. The employer contributes its share in favour of those employees whose daily average wage is Rs 137 as they are exempted from their contribution. The employer must pay his contribution within 15 days from the last day of the calendar month in which the contribution falls due. The employer must also deduct employees’ contributions from wages and deposit the same with ESIC. The payment can either be done online or through designated and authorized public sector banks.

What is ESIC Registration?

Q. Who needs to register for ESI? (What establishments needs ESI registration?)

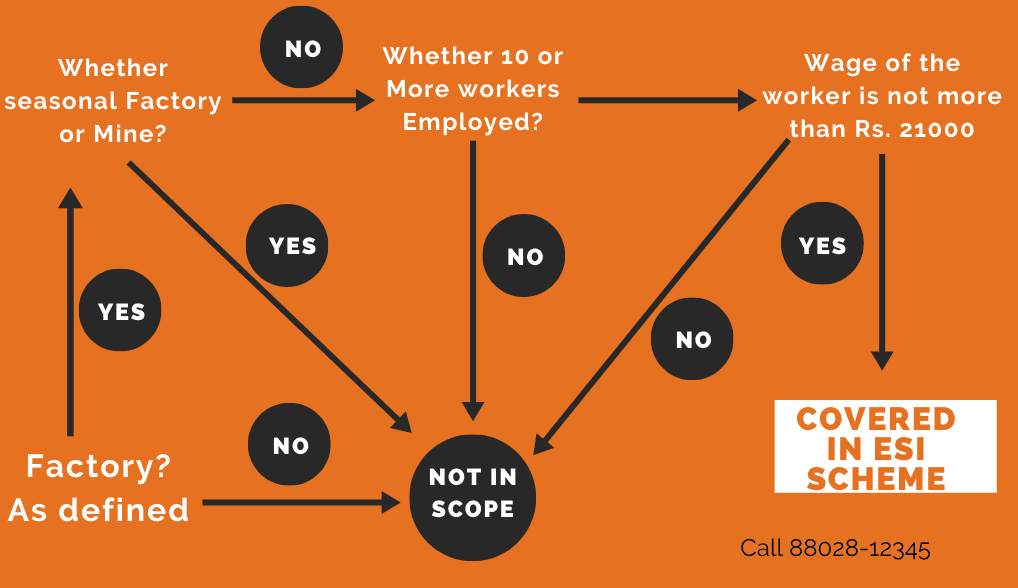

The following establishments having 10 or more employees attracts ESI coverage.

1. Shops

2. Hotels or restaurants not having any manufacturing activity, but only engaged in ‘sales’

3. Cinemas including preview theater

4. Road Motor Transport Establishments

5. News paper establishments

6. Private Educational Institutions (those run by individuals, trustees, societies or other organizations and Medical Institutions including Corporate, Joint Sector, trust, charitable, and private ownership hospitals, nursing homes, diagnostic centers, pathological labs)

Q. Rate of Contribution towards ESIC:

Currently the employee’s contribution rate towards ESIC (w.e.f. 01.07.2019) is 0.75% of the wages and that of the employer’s is 3.25% of the wages paid/payable in respect of the employees in every wage period.

However, this rate keeps on changing from time to time.

Q. Contribution Period and Benefit Period

There are dual contribution periods of six months and two corresponding benefit periods also of six months duration. ESIC registration is a statutory responsibility of the employers of the factory. It is mandatory according to the rules and regulations of the ESI Act 1948.

FAQ

An employer shall apply for FORM 01 within 15 days after the act becomes applicable to a unit or establishment.