Form FC-GPR: Foreign Currency Transfer of Shares

Form FC-GPR is issued by the Reserve Bank of India (RBI) when the company receives foreign investment. Accordingly, the company will issue shares to a foreign investor on such investment. Also, it is mandatory for the company to file details of such allotment of shares using the Form FC-GPR. In this article, we look at Form FC-GPR in detail.

File your form FC-GPR with help of Experts.

It usually takes 3 to 5 working days.

- Discussion about the matter with an Expert

- Preparation & Filing of Forms

- Business/Individuals making transfer of shares abroad.

- Upload documents on vault.

- Review the drafted forms by our experts.

- Filing of forms.

- Declaration: Declaration to be attached as other attachments as per the format given in the RBI user manual.

- CS certificate: CS certificate to be attached as other attachments as per the format given in the RBI user manual.

- Valuation certificate: Valuation certificate to be attached in the place of Valuation certificate as prescribed and applicable under FEMA 20(R). However, for the rights issue, the valuation certificate is not required. A declaration in the plain paper can be attached that the rights issue to persons or individual resident outside India is not within the range of price less than the price offered to a person resident in India.

- Relevant acknowledgement letters to be attached as other attachments for FC-TRS/FC-TRS filed for the original investment for rights or bonus issue.

- Board Resolution: Board resolution to be attached as other attachments with the relevant extracts.

- Memorandum of Association: Memorandum of Association (MOA) to be attached as other attachments with the relevant extracts if any.

- Merger/ Demerger/ Amalgamation: These to be attached at the specified attachment relevant approvals from the competent authority with the relevant extracts.

- FIRC and KYC: FIRC (Foreign Inward Remittance Certificate) and KYC to be attached in the place of the specified attachments.

Form Filing FC-GPR Rules & Guidelines

Form Filing FC-GPR Live Filing

All About Form FC-GPR

Conditions on Filing Form FC-GPR

Conditions on Filing Form FC-GPR

Any company having Foreign Investment is required to report RBI. The following are the conditions to be considered in case of FDI.

- Foreign investment should be in compliant to Foreign Direct Investment (FDI) policy.

- Securities issued should be in accordance with the foreign exchange management.

Note: Equity shares, Convertible preference shares and convertible debentures are the only securities considered under FDI.

Due Date for filing

Due Date for filing

The company should file the Form FC-GPR to the RBI within 30 days from the date of issue of securities. Before reporting the transactions, the applicant is required to obtain the following details while filling the form.

- Unique Identification Number (UIN) from RBI is required by reporting advance foreign remittance.

- KYC report of the beneficiary if the remitter and beneficiary are from different entities.

- Company Secretary certificate

- Certificate from the SEBI registered Character Accountant or Merchant Banker stating the method of arriving at the price of the shares allotted to the individual or person residing outside India.

- Disclaimer certificate

- Statutory Auditor Certificate

- Format of Board resolution

- Allocated Loan Registration Number (LRN)

- Certified copy of Foreign Investment Promotion Board (FIPB), if any

- Details of transfer of shares, if required

- No Objection Certificate (NOC) from the remitter for the shares which is being allotted to the third party mentioning their relationship.

- Copy of the letter from the foreign investor indicating the reasons for making a subscription to shares by the remitter on his behalf.

- Copy of board resolution or agreement from the investor company for issue and allotment of shares to the foreign investors, other than remitter.

- Reason for any delay in submission (if any)

Filing of Form FC-GPR

Filing of Form FC-GPR

Step 1: Registration for User

- Any applicant reporting the transaction with the RBI can use the login credentials which is authorised to him/her to report the transactions.

- To register as the new business user, the applicant has to visit the official website of firms.

- Click on the registration for new business user and fill up the details in the form.

- After filling the details, the business user needs to submit the registration form, the concerned authorised dealer bank branch will verify the same. The rejection or approval of the same would be intimated through email to the business user. Form FC-GPR is issued by the Reserve Bank of India (RBI) when the company receives the foreign investment, and against such investment the company will allot shares to a foreign investor then it is mandatory for the company to file details of such allotment of shares using the form FC-GPR.

Step 2: Log in to the firms

To login to the firms, the applicant needs to provide user name and password received via an email. After logging in to the FIRMS will lead to reaching out of your workplace.

Step 3: Log in to the Single Master Form (SMF)

- After completion of registration as a new user, you will be able to login into the firms and SMF and reach your workspace.

- Click on the navigation button and select Single Master Form (SMF).

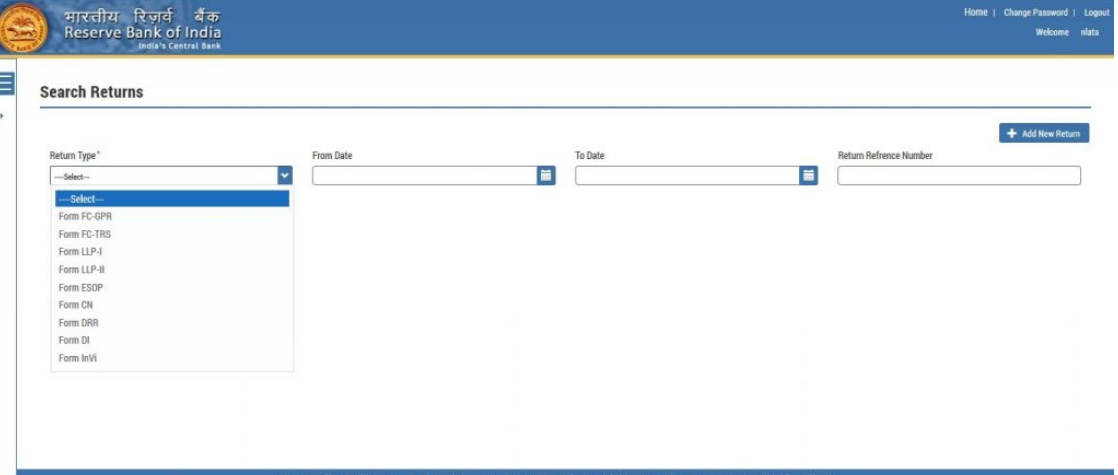

Step 4: Choose Return type- Form FC GPR

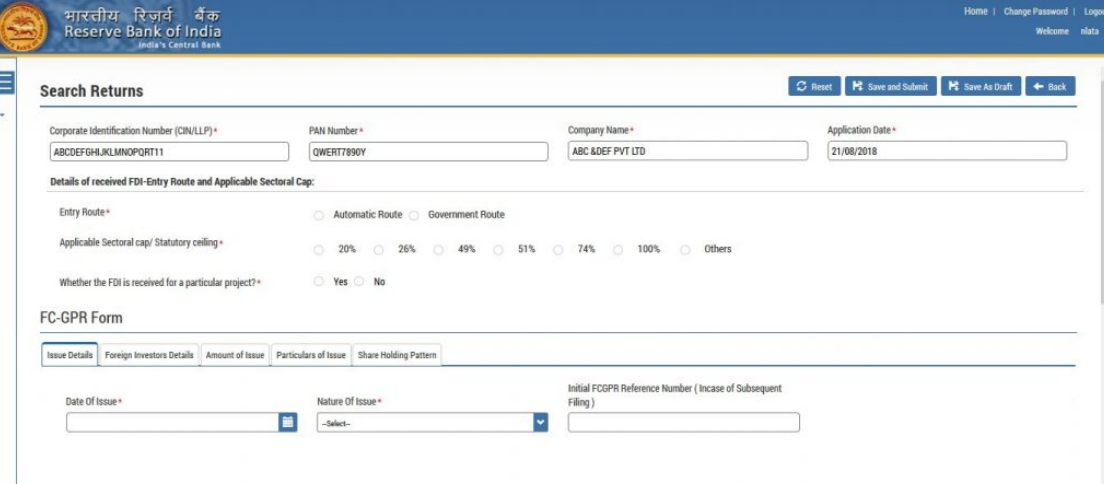

Click on Return type to view different types of forms and select Form FC GPR in which the details like CIN, PAN number, Company name, etc. are per-filled. While some details are to be filed manually.

Step 5: Investment Details

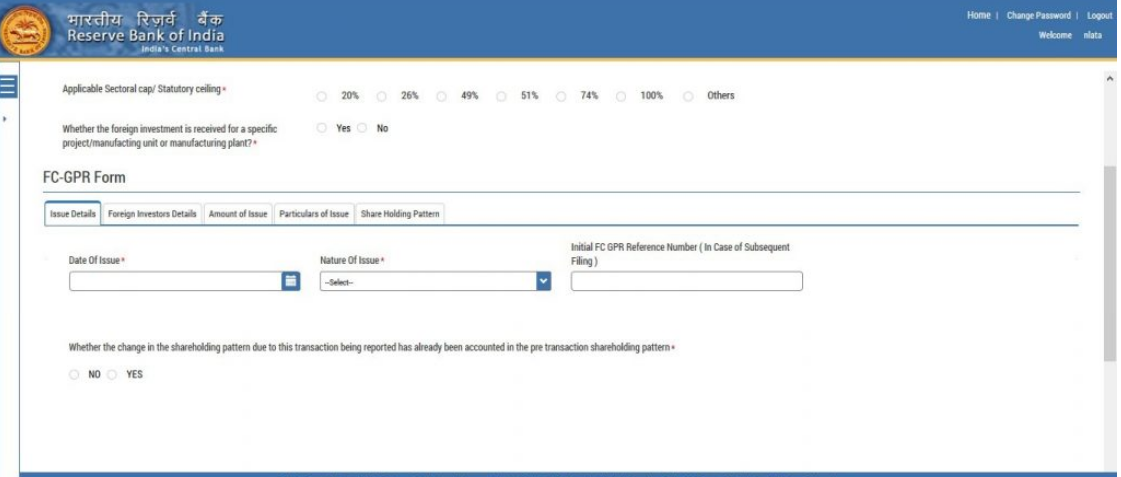

Now, the investment details like shareholding pattern and date of issue of shares etc. are to be reported in Single Master Form (Form FC-GPR).

Step 6: Issue Details

Details like nature of the issue, date of issue, initial FC-GRP reference number in case of subsequent filing has to be provided.

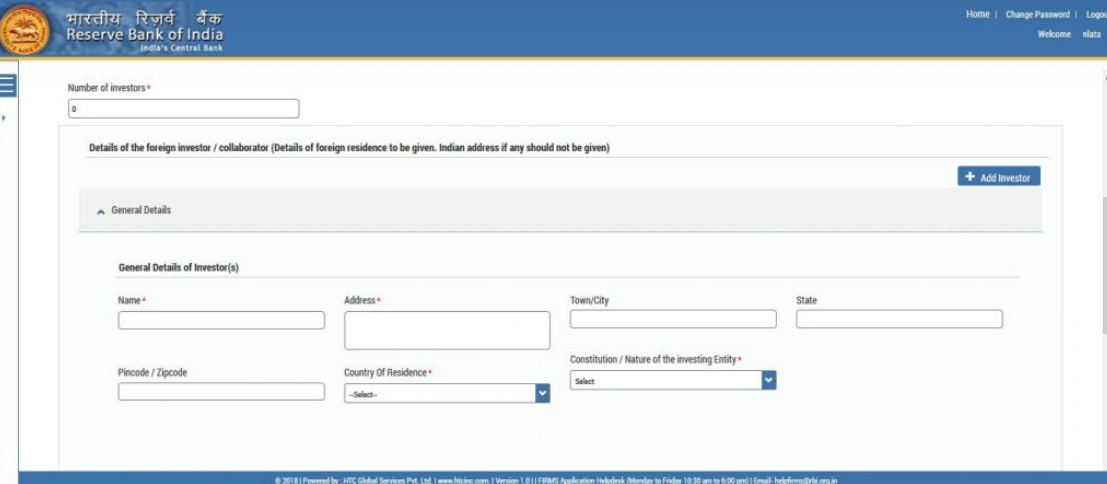

Step 7: Foreign Investment Details

Foreign investment details such as a number of investors, address o residence constitution and nature of the investing entity.

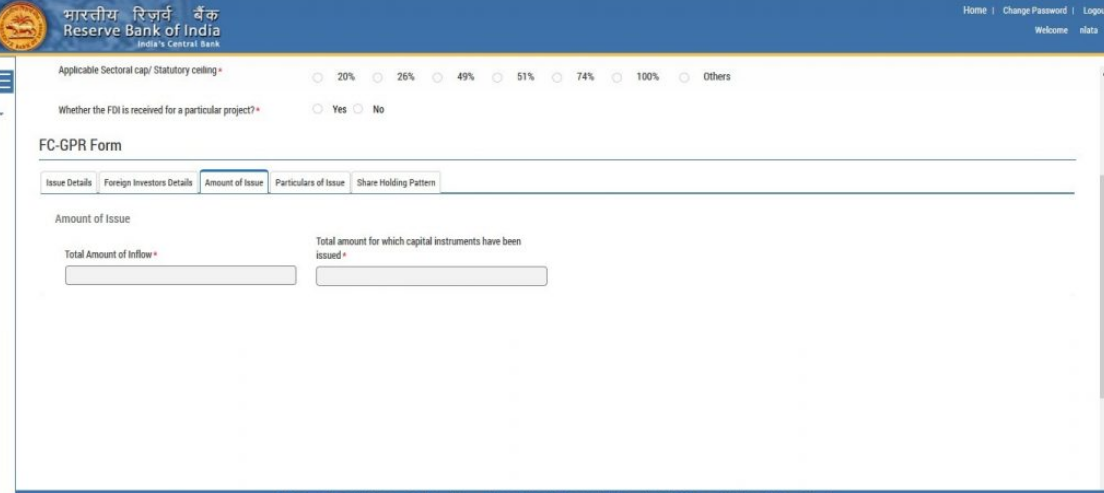

Step 8: Amount of Issue

Fill the total amount of inflow and the total amount for which the capital instruments have been issued.

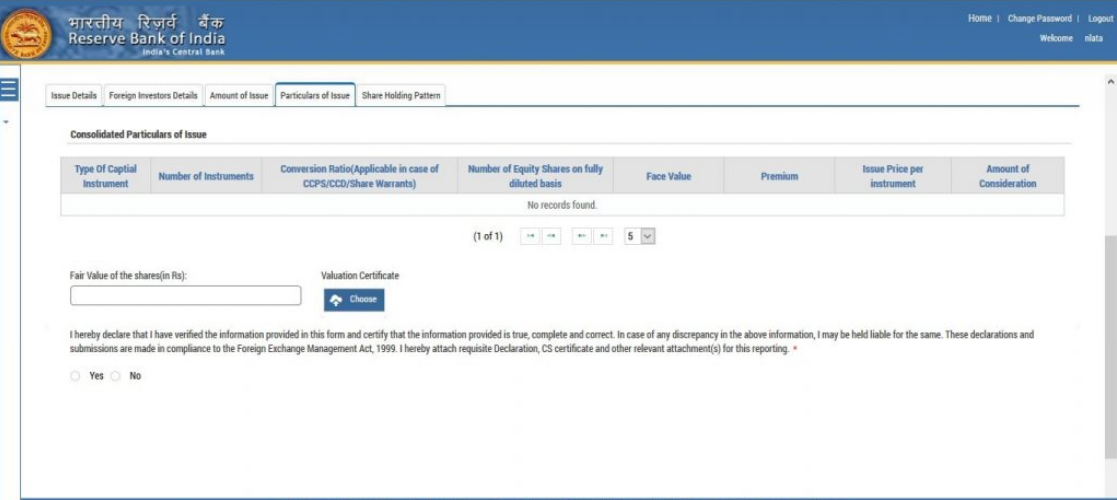

Step 9: Particulars of Issue

Now, fill the fair value of issue in rupees as per the valuation certified issued by the authorised person along with the attachment as valuation certificate.

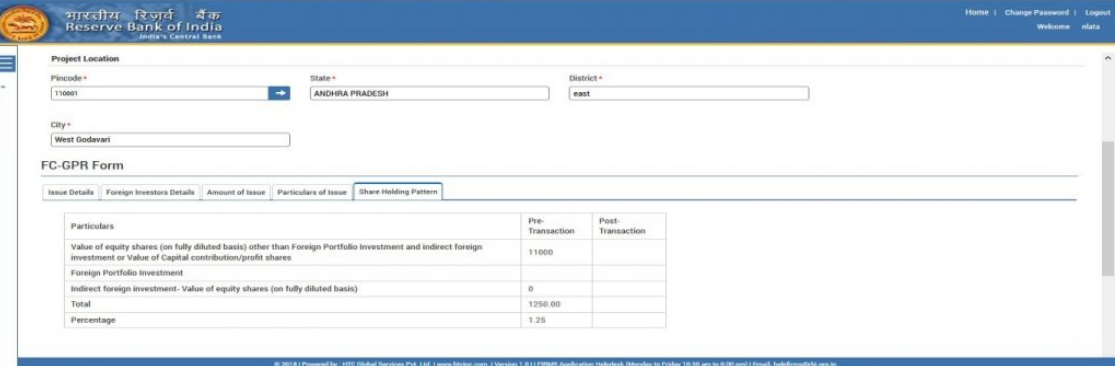

Step 10: Shareholding Pattern

- The value of equity shares and indirect foreign investment-value of equity shares will be displayed under the option shareholding.

- Further, pre-transaction and post-transaction values are auto-calculated based on the details provided in the form.

- Then the user is required to conform with the details provided are filled correctly, so that the shareholding pattern which is auto-calculated is correct.

Step 11: Submission of Form

On filling the required details, click on the save and submit button for submitting the form.