Packing & Weight License for Packers & Manufacturers

As per the laws of Legal Metrology, a packer or manufacturer who also sells or distributes pre-packaged commodities have to apply for the packing license registration of packaged commodity as per Rule 27 of the Legal Metrology rules of 2011. The registration is called Packaged Commodity registration.

The manufacturer or packer has to apply for packaged commodity registration or packing license registration within 90 days of starting the pre-packaging of the product. To get the License for Packing in India, interested Businesses must apply for the Packing license registration with the Department of LegalMetrology.

The registration procedure for the Packer License in India is clearly defined in the Legal Metrology Act of 2009. After mulling through the legal procedure for the requisite license acquisition, the Department of Legal Metrology offers Manufacturing Certificate to the Business.

Filing of Application for Packing & Weight License in India

Depends upon case to case basis

- Filing of Application for Packing & Weight License in India

- Business or Individual planning to Manufacture, Pack, Trade, Re-Pack in their Business.

- Purchase of Plan

- Expert Assigned

- Share the details as requested

- Preparation of Application & Filing

- Company COI, GST RC, MOA & PAN

- Electricity Bill & Rent Agreement for Address

- KYC of All Stakeholders

- Product Label

What is Legal Metrology Packaged Commodities Act and Why it’s Necessary

“To regulate net quantity errors, standardise Net contents, mandatory declarations on all pre-packed commodities sold in India or import in the country.”

These rules were framed under Legal Metrology Act, 2009 to regulate pre-packed retail packages which are intended for retail sales to the ultimate consumer for the purpose of consumption of the commodity contained therein and also to regulate imported packages. These rules elaborate the manners of labeling and provisions applicable to retail packages for the mandatory declarations like Max Retail Price (MRP), Net contents/ size of the commodity, address of Manufacturer, packer, and importer, packing date and identity of the commodity packed for information of the consumer. The said rules also ensure the detailed procedures for net content checking of the pre-packages along with maximum permissible error to eliminate deceptive packages.

These rules also specify the number of commodities to be packed and sold in recommended standard packages and also specify commodities to be sold by weight, measure or number as it would give accurate and adequate information to the consumer with regard to the commodity in the package.

These rules ensure the traceability of packers by way of registering of every manufacturer, importer, and packer who deals with pre-packed commodity.

What is a Pre-Packaged Commodity?

According to the law, Pre Packed Commodity is defined as a commodity placed in any packing without a purchaser's presence. The package can be sealed or unsealed so that the product inside the package has a pre-determined quantity.

The Government has regulated the packaging of significant pre-packaged commodities in the country through its pre-packaging regulations. These pre-packaging regulations are clearly defined in the Legal Metrology Act as well as the issued Legal Metrology Packaging Commodities Rules.

Every product must contain a decided description on its packing label or container. It can be printed or engraved if the container is metal. Such declarations are absolute. In the context of some food items, such as pulses, rice, wheat, and flour, the supply of these pre-packaged food commodities falls under the purview of the Legal Metrology Act of 2009.

Mandatory Commodities in Pre-Packed Forms by Legal Metrology

Every package shall bear definite, plain, and conspicuous declarations:

- The name and address of the manufacturer and packer or the importer.

- The generic or the common name of the commodity contained in the package.

- The net quantity in terms of the standard unit of weight or measure of the commodity contained in the package.

- If the commodity contained in the package is sold by the number the number of the commodity in a package shall be mentioned.

- The month and the year in which the commodity is manufactured or pre-packed or imported shall be mentioned on the package.

- Dimensions of the commodity contained in the package and if the dimensions of the different items are different then the dimension of each item shall be mentioned.

- Every package shall bear the name, address, telephone number, e-mail address.

Other Important Provisions in Packaged Commodities by LMPC

- A sticker cannot be used to change or make a statutory declaration.

- No person shall obliterate/smudge/alter the MRP.

- No person shall charge more than MRP.

- When the price is reversed downward, no person shall charge more than the revised price, irrespective of the month of packing.

- MRP includes all taxes, Freight, Transport, Packing, and Delivery Charges.

- While buying combo-packs of towels, bedsheets, napkins. etc look for-size of each item, No. of items, and the retail sale price of each item.

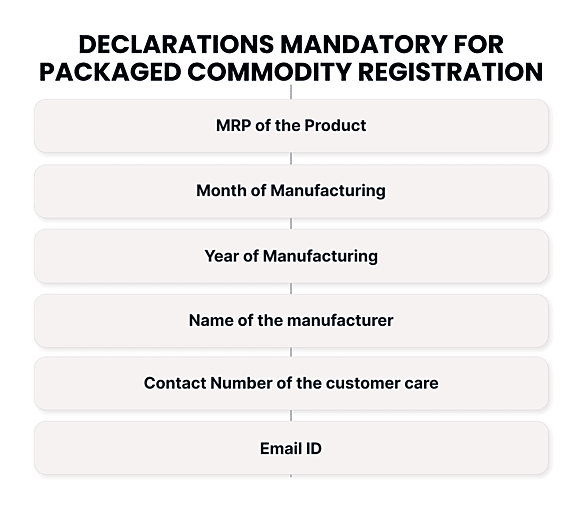

Declarations mandatory for Packaged Commodity registration

Eligibility Criteria for Packing License Registration in India

- To obtain the manufacturing license certificate, you must adhere to all the rules specified in the LMPC requirement.

- Every manufacturer or packer of weight or measure must maintain records and registers as prescribed by the LMPC certificate authority.

- The records and registers maintained must be produced at the inspection time to the persons authorized for the said purpose.

- Prohibition on Quotation

- No person can, in relation to any goods, things, or service:

- Quote, or make an announcement of any price or charge

- Issue or exhibit any price list, invoice, or cash memo

- Prepare or publish any advertisement or poster

- Indicate the net quantity of a pre-packaged commodity

- Express in relation to any transaction or protection, quantity or dimension, otherwise than in accordance with the standard unit of weight, measure, or enumeration

- The provisions must not be applicable for the export of any goods, things, or service

Penalty for the manufacture of non-standard weight or measure

Every person liable to pay the penalty who manufactures or packages any weight or measure which,

(a) Does not conform to the standards of weight or measure specified under the LMPC Act

(b) Which bears an inscription of weight, measure, or number that does not conform to the standards of weight, measure, or numeration specified under the Act.

The violator will be punished with a fine which may extend to twenty thousand rupees and for the second or subsequent offense with imprisonment for a term which may extend to three years or with a fine or both.

Important information on the Principal Display Panel for information of consumers by Legal Metrology Department

- Every mandatory declaration which is to be made on the pack shall be legible and prominent and conspicuously declared on Principal Display Panel and shall be free from any kind of ambiguity.

- The retail sale price and net content declared on a package should be in contrast color with the background of the label.

- When the package is provided with the outside container or wrapper, all the mandatory declaration should also appear on such a container or wrapper.

- Numerical for declaring net quantity should have space above and below the equal height of such numerical and at least twice the height of such numerical on the left and the right side in the declaration on Principal Display Panel.

- The height and width of the numerical for declaring net quantity should be as per rules.

- For imported goods, the complete address of the importer with a complete postal index number should be mentioned on the Principal Display Panel.

Standard Packages Commodities to be Packed in Specified Quantities Given by Legal Metrology Department

Standard Packages: Commodities to be Packed in Specified Quantities by Legal Metrology Department

| Sl. No | Name of Commodities | Quantities in which packed |

| 1. | Baby Food | 25g 50g 100g 200g 300g 350g 400g 450g 500g 600g 700g 800g 900g 1kg 2kg 5kg and 10kg |

| 2. | Weaning Food | Below 50g no restriction, 50g 100g 200g 300g, 400g 500g 600g 700g 800g 900g 1 kg 2 kg 5kg and 10kg (75g,125g,150g,250g w.e.f.6-6-2013) |

| 3. | Biscuits | 25g,50g, 60g, 75g,100g, 120g, 150, 200g, 250g,300g, (350g, 400g w.e.f. 6-6-2013) thereafter in multiple of 100g up to 1kg and thereafter in multiples of 500g up to 5kg |

| 4. | Bread including brown bread | 50g and thereafter in of multiples 50g up to 500g and above 500g in the multiples of 100g excluding bun. |

| 5. | Un-canned packages of butter and margarine | Below 25g no restriction, 25g, 50g, 100g, 200g, 500g, 1kg, 2kg, 5kg and thereafter in multiple of 5kg. |

| 6. | Cereals and Pulses | Below 100g no restriction,100g, 200g, 500g,1kg, 2kg, 5kg, and thereafter multiple of 5kg. |

| 7. | Coffee | Below 25g no restriction, 25g, 50g, 75g, 100g,150g, 200g, 250g, 500g (750g w.e.f. 6-6-6-2013) 1.5kg, 2kg and thereafter in multiple of 1kg. |

| 8. | Tea | Below 25g no restriction , 25g, 50g, 75g, 100g,150g, 200g, 250g, 500g (750g w.e.f. 6-6-6-2013) 1.5kg, 2kg and thereafter in multiple of 1kg. |

| 9. | Material which may be constituted or reconsidered as beverages | Below 50g no restriction, 50g, 75g, 100g, 125g,200g, 250g, 400g, 450g, 500g, 750g, 1kg and thereafter in multiple of 1kg. (56g and 61g for medical purpose only) |

| 10. | Edible Oils,Vanaspati, Ghee,Butter, oil | Below 50g no restriction, 50g, 100g, 175g,200g, 250g, 300g, 500g, 750g, 1kg, 2kg,3kg, 5kg and thereafter in multiple of 5kg. If net quantity declared by volume then below 50ml no restriction, 50ml, 100ml,175ml,200ml,300ml, 500ml, 750ml, 1litre, 2litre,3litre, 5litre and thereafter in multiple of 5 litre and the net quantity must be declared by mass also in the same size of letters numerals |

| 11. | Milk Powder | Below 50g no restriction, 50g, 100g, 150g,200g, 250g, 500g, 1kg and thereafter in multiple of 1kg. |

| 12. | Non-Soapy Detergents (powder) | Below 50g no restriction, 50g, 75g, 100g, 150g,200g, 250g, 500g, 700g, 750g, 1kg, 1.5kg, 2kg,2.5kg, 3kg and thereafter in multiple of 1kg. |

| 13. | Rice (Powder, flour,atta, rawa and suji) | 100g, 200g, 500g, 1kg, 1.25kg, 1.5kg, 1.75kg,2kg, 2.5kg, 5kg and thereafter in multiple of 5kg. |

| 14. | Salt | Below 50g in multiples of 10g, 50g, 100g, 200g,500g 750g, 1kg, 2kg, 2.5kg, 5kg and thereafter in multiple of 5kg. |

| 15. | (a)Laundry soap (b) No-soapy detergents cakes/bars (c)Toilet Soap including all kinds of bath soap | 25g, 50g, 75g, 100g, 125g, 150, and thereafter in multiples of 50g.Below 50g no restriction, 50g, 75g, 100g, 125g,150g, 200g, 250g, 300g, and thereafter in multiple of 100g.15g, 25g, 50g, 60g, 75g, 100g, 125g, 150, and thereafter in multiples of 50g |

| 16. | Aerated soft drinks, Non-alcoholic beverages. | 65ml, (fruit based drinks only), 100ml,125ml,(fruit based drinks only), 150 ml, 160 ml, 175ml,180 ml, 200 ml, 240 ml, 250 ml, 300ml, 330ml,350ml, 400ml, 475ml, 500ml, 600ml, 750ml,1 litre,1.2 litre, 1.25 litre, 1.5 litre, 1.75litre, 2 litre, 2.25 litre, 2.5 litre, 3 litre, 4 litre and 5 litre |

| 17. | Mineral water and drinking | 100ml, 150ml, 200ml, 250ml, 300ml, 500ml,750ml, 1 litre, 1.5 litre, 1.75 litre, 2 litre, 2.25 litre, 2.5 litre, 3 litre, 4 litre and 5 litre. |

| 18. | Cement in bags | 1kg, 2kg, 5kg, 10kg, 20kg, 25kg, 40kg, (for white cement only) and 50kg. |

| 19. | (a)Paint (other than paste paint or solid Paint) varnish, varnish stains, enamels(b)Paste paint and solid paint(C) Base Paint | 50ml, 100ml, 200ml, 500ml, 750ml, 1litre,2litre, 3 litre, 4litre and 5litre and thereafter in multiples of 5litre500g, 1kg, 1.5kg, 2kg, 3kg, 5kg, 7kg and thereafter in multiples of 5kg.100ml, 250ml, 400ml, 450ml, 500ml, 900ml, 925ml, 950ml, 975ml, 1litre, 1.5litre, 2litre,2.5 litre, 3.5 litre,3.6 litre 3.7 litre,3.8 litre, 3.9 litre and 4 litre and no restriction above 4 litre. |

Maximum Permissible Error in Pre-packed Commodities by Legal Metrology Department

Maximum permissible Error on net Quantities declared by Weight or By Volume

| Sl.No. | Declared quantity g or ml | Maximum permissible error in excess or deficiency | |

| As percentage of declared quantity | g or ml | ||

| 1. | Up to 50 | 9 | —— |

| 2. | 50 to 100 | —— | 4.5 |

| 3. | 100 to 200 | 405 | —— |

| 4. | 200 to 300 | —— | 9 |

| 5. | 300 to 500 | 3 | —— |

| 6. | 500 to 1000 | —— | 15 |

| 7. | 1000 to 10000 | 1.5 | —— |

| 8. | 10000 to 15000 | —— | 150 |

| 9. | More than 15000 | 1.0 | —— |

Registration Requirements of Manufacturer/Packer by Legal Metrology Department

Every manufacturer / Packer needs to get registered in the state where the business activity as the packer is being carried out and the list of all packers are updated at the central level to keep track of the address of the premises. It is central based registration, in other words, if any entity having registration of one premise and also doing business from other places then it need not get registered in the other place of business also. After getting the registration, the concerned entity will comply with the law regarding the packaging of products and weights and measure instruments as directed in this Act and Rules thereon.

| Penalties under Weights & Measures Laws (Legal Metrology Department) | ||

|---|---|---|

| Nature of Offences under Legal Metrology Act, 2009 | First Offence | Second and subsequent offense |

| Use of Nonstandard Weight and Measure | Fine upto Rs.25000 | Punished with imprisonment for a term which may extend to 6 months and also with fine. |

| Alteration of weight and measure | Fine upto Rs.50000 | Punished with imprisonment for a term which shall not be less then six months but may extend to one year or with fine or with both. |

| Manufacture or sale of nonstandard weight or measure | Fine upto Rs.20000 | Punished with imprisonment for a term which may extend to three years or with fine or with both. |

| Transaction, deal or contract in contravention of the prescribed standards. | Fine upto Rs.10000 | Punished with imprisonment for a term which may extend to one year, or with fine, or with both. |

| Quoting or publishing, etc., of non-standard units | Fine upto Rs.10000 | Punished with imprisonment for a term which may extend to one year, or with fine, or with both. |

| Transactions in contravention of standard weight or measure | Fine upto Rs.10000 | Punished with imprisonment for a term which may extend to one year, or with fine, or with both. |

| Non-production of documents, etc. | Fine upto Rs.5000 | Punished with imprisonment for a term which may extend to one year and also with fine. |

| Failure to get model approved | Fine not less than Rs.2000 but maybe upto Rs.10000 | Punished with imprisonment for a term which may extend to one year and also with fine. |

| Sale or delivery of commodities, etc., by nonstandard weight or measure. | Fine not less than Rs.2000 but maybe upto Rs.5000 | Punished with imprisonment for a term which shall not be less then three months but which may extend to one year, or with fine, or with both. |

| Rendering services by nonstandard weight, measure or number | Fine not less than Rs.2000 but may be upto Rs.5000 | Punished with imprisonment for a term which shall not be less than three months but which may extend to one year, or with fine, or with both. |

| Selling, etc. of non-standard packages (which does not conform to Declaration) | Fine upto Rs.25000 | Fine upto Rs.50000 and for the subsequent offence, with fine not less than fifty thousand rupees but which may extend to one lakh rupees or Punished with imprisonment for a term which may extend to one year or with both. |

| Selling, etc. of non-standard packages (Error in Net content) | fine which shall not be less than Rs.10000 but which may extend to Rs.50000 | Punished with fine which may extend to one lakh rupees or with imprisonment for a term which may extend to one year or with both. |

| Contravention by Government approved Test Centre (contravention of any of the provisions of this Act or the rules made there under, or the conditions of the license) | fine which may extend to one lakh rupees. | …………………………… |

| Contravention by Government approved Test Centre (will full verification or stamping of any weight or measure by Employee of GATC) | Punished with imprisonment for a term which may extend to one year or with fine which may extend to ten thousand rupees or with both. | ………………….. |

| Non-registration by importer of weight or measure | Fine Upto Rs.25000 | Punished with imprisonment for a term which may extend to six months, or with fine, or with both. |

| Import of nonstandard weight or measure. | Fine Upto Rs.50000 | Punished with imprisonment for a term which may extend to one year and also with fine. |

| Obstructing Director, Controller or legal Metrology officer. | Punished with imprisonment for a term which may extend to two years | Punished with imprisonment for a term which may extend to five years. |

Frequently Asked Questions - FAQs About Packer Manufacturer License

Q1. What is a Packer or Manufacturer license registration?

A. As per the laws of Legal Metrology, a packer or manufacturer who also sells or distributes pre-packaged commodities have to apply for the registration of packaged commodity as per Rule 27 of the Legal Metrology rules of 2011. The registration is called Packer's license registration.

Q2. Why should one apply for a Legal Metrology packer license online in India?

A. The manufacturer or packer has to apply for packaged commodity registration within 90 days of starting the pre-packaging of the product.

Q3. What is a pre-packed commodity?

A. According to the law, a pre-packed commodity is defined as a commodity placed in any package without a purchaser's presence. The package can be sealed or unsealed so that the product inside the package has a pre-determined quantity.

Q4. What are the declarations that must be made on a packaged commodity?

A. The declaration on the pre-packed commodity must be the following:

- MRP of the product

- Month of manufacturing

- Year of manufacturing

- Name of the manufacturer

- Contact number of the customer care

- Email ID

Q5. What makes one eligible for packer registration in India?

A. To obtain the manufacturer license, you must adhere to all the rules specified in the LMPC requirement.

Q6. What documents must be submitted along with India's manufacturer or packing license application?

A. Following are the documents required for manufacturer registration in India:

- Incorporation certificate

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- ID proof of the applicant

- Address proof of the manufacturing facility

- Details to be posted in the display pane

- DD of the manufacturer license fee.

Q7. How to get a packing license in India?

A. The process of obtaining packer certification in India is as follows:

- Fill out the packing license application form

- Submit the required documents along with it to the LMPC department

- Wait for assessment

- Obtain the packer license

Q8. How can TAXAJ help you in getting the packaging license India?

A. For LMPC certificate for packaging license in India, Registrationwala provides end to end Manufacturer certificate services that include:

- Application filing

- Document preparation

- Department follow up

- Error handling