Non-Banking Financial Company (NBFC) Incorporation

Get your NBFC company registered in the fastest possible manner.

It usually takes 6 to 10 months depending upon government approval.

- Name approval in RUN

- Digital Signature Tokens

- Filing of Forms

- Issue of Incorporation Certificate along with PAN and TAN

- Includes Govt Fees & Stamp duty for Authorised Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

- Body Corporate as director or business needing RBI/SEBI approval

- Assistance in Opening Bank Account

- Businesses looking to expand or scale operations on higher level

- Businesses aiming to work globally or with reputed clients

- Businesses looking to expand or scale their operations

DSC Application

Name approval form filing

Preparation of Incorporation Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Latest Month Personal Bank statement of all the Stakeholders.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office. (If Owned)

Rent Agreement from Landlord. (If Rented/Leased)

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Authorised & Paid Up Share Capital of the Company.

NBFC Explained in this short video!

How to Apply Online for NBFC Registration with RBI?

NBFC License must be taken from RBI u/s 45-IA of the RBI Act of 1934. The financial institution wishing to be registered as NBFC must, first, be duly registered either as per the Companies Act of 2013 or earlier Act of 1956.RBI strictly regulates and ensures that the NBFCs comply with the provisions and regulations provided in Chapter III B of the RBI Act. The principal business activity of NBFCs is to raise capital from the public depositors & investors and lend these further to the borrowers. NBFCs are the bridges that link the investors or depositors with the borrowers. They have become a better alternative to the banking and financial sector by providing financial solutions to the unbanked and unorganised segments of society. The Reserve Bank of India (RBI) formulates rules & regulations for NBFCs, therefore, a license from RBI is required for starting NBFC in India as per Section 45-IA of the RBI Act, 1934.

Mandatory Requirements for eligibility

- Total Assets comprises more than 50% financial assets

- More than 50% of the gross income should be generated from financial assets

Pre-requisite for NBFC Registration

For NBFC registration, below mentioned conditions must be fulfilled as per Section 45-IA of the RBI Act, 1934.

What is the procedure for NBFC Registration?

Note- Hiring an experienced NBFC registration consultant who having minimum of 10 years’ experience aids the steps in this process.

Step 1. Register a Private Limited or Public company (No Prior RBI Approval Needed)

Step 2. Obtain a certificate of Incorporation from R.O.C.

Step 3. Deposit Net Owned Funds in Company's Current account.

Step 4. Documentation for obtaining NBFC license

Step 5. Drafting of Business Plan for the next 5 years consisting:

Step 6. Apply for registration with RBI under RBI Act, 1934.

It usually takes around 6 months for the licence to be issued if all the criteria are fulfilled. The entire process can be made hassle-free if you receive support from the right people. Contact us to receive the correct support

Documents required for the NBFC Registration

The checklist must be completed for the NBFC Registration:

1. COI (Certificate of Incorporation)

2. MOA (Memorandum of Association

3. AOA (Article of Association.

4. Net Worth Certificate of All Directors.

5. Net Worth Certificate of All Shareholders.

6. Net Worth Certificate of Company

7. Educational qualification documents of proposed Directors

8. Directors & Shareholders Detailed business Profile

9. Credit report of directors (Must not contain any Defaults).

10. Credit report of shareholders (Should have a good Cibil Score)

11. KYC details of All Directors & Shareholders.

12. PAN of the Company.

13. GST Certificate.

14. Complete GST Filing History.

15. Address proof of the company (Electricity Bill & Rent Agreement)

16. Bank account details of the company [Rs. 2 Cr as Balance as NOF]

17. The Audited balance sheet of Last 3 years or from Incorporation

18. Income tax Returns (of the last 3 years or from Incorporation).

19. Format of board resolution regarding NBFC registration Underwriting model.

20. Detailed action plan of next 5 years.

21. Project & Draft Facility for Following Norms:

a. Fair Practice Code

b. Risk assessment policy.

c. Business Structure,

d. Loan Structure

e. IT Policy

Types of NBFC:

- Liabilities:

👉 The deposit accepting NBFCs and

👉 Non-Deposit accepting NBFCs,

(Non-deposit taking NBFCs are classified further as per their size:)

👉 systemically important (NBFC-NDSI) and

👉 others

- Activities:

👉 Factors

👉 Mortgage Guarantee Companies

👉 Investment Credit Company

👉 Infrastructure Debt Fund

👉 Micro Finance Institution

👉 Non-Operative Financial Holding Company

👉 Systemically Important Core Investment Company

Factors:

NBFCs have factoring as their principal business activity. Factoring is a financial transaction. A kind of debtor finance in which an entity can sell its invoice or bills (accounts receivables) to a third party (NBFC-Factor) at a discount, also commonly known as bill discounting or invoice financing.

Investment Credit Companies (NBFC-ICC)

They are such financial organization who carries its primary business as asset finance, the finance is provided in loans/advances mode or otherwise, for any activity other than its own and acquiring securities. And its activities must not fall under some other category defined by RBI.

Micro Finance Institution (NBFC-MFI)

- The loan provided to a borrower with a Rural Household Annual Income less than Rs. 60,000, or Urban and Semi-Urban Household Income of not over Rs. 1,20,000.

- The amount of lending does not exceed Rs. 35,000 in the first cycle and Rs. 50,000 in all subsequent cycles.

- The total obligation of the borrower doesn’t exceed Rs. 50,000.

- If the amount is more than Rs. 15,000, a loan term of at least 24 months, with prepayment without penalty,

- Loan to be extended without any mortgage,

- The aggregate of loans provided for income generation must not be less than 75% of the total loans given by the MFI,

- The frequency of repayment, whether weekly, fortnightly or monthly instalments, to be selected by the borrower.

Non-Operative Financial Holding Company

These NBFCs obtain shares, stocks, and securities. The transactions must fulfill the below conditions: The financial organization through which promoter or promoter groups will be permitted to set up a new bank. It is a wholly-owned NOFHC that shall hold the bank and all other companies involved in financial services, regulated by RBI or other regulators, to the extent permissible under the applicable regulatory prescriptions.

Mortgage Guarantee Companies (NBFC-MGC)

NBFC-MGC is generally registered with RBI as a Mortgage Guarantee Company. Its principal business is that of granting a mortgage guarantee. This guarantee is provided for repaying an outstanding housing loan and interest accrued on it. Up to the guaranteed amount to a creditor institution when a trigger event happens. The minimum NOF requirement and financial asset criteria are different for this kind of NBFC.

Infrastructure Finance Companies (NBFC-IFC)

These companies invest in infrastructure debt securities or public-private partnership projects, having a minimum NOF of Rs. 300 crore. The principal business and rating requirements are also different for such NBFCs.

Systemically Important Core Investment Company

These NBFCs obtain shares, stocks, and securities. The transactions must fulfill the below conditions:

- It holds at least 90% of its Total Assets as an investment in equity or preference shares and debt/loans in group companies,

- Its investments in the equity stock/shares (including instruments that are convertible into equity shares within a period of not more than 10-years from the date of issue, in group companies, form not less than 60% of its Total Assets.

- It does not trade in its investments in stocks, debt or loans in group companies except by way of block sale for dilution or disinvestment,

- No financial activity, which is listed u/s 45-I(c) & 45-I(f) of the RBI Act, is being carried out by it. Other than for investments in bank deposits, government securities, money market instruments, loans to and investments in debt issuances of group companies or guarantees declared on behalf of group companies,

- Its asset size is Rs. 100 crore or above,

- It accepts public funds.

Pre-Conditions of NBFC Registration

According to Section 45-IA of RBI, below conditions must be fulfilled for a company to be registered as an NBFC:

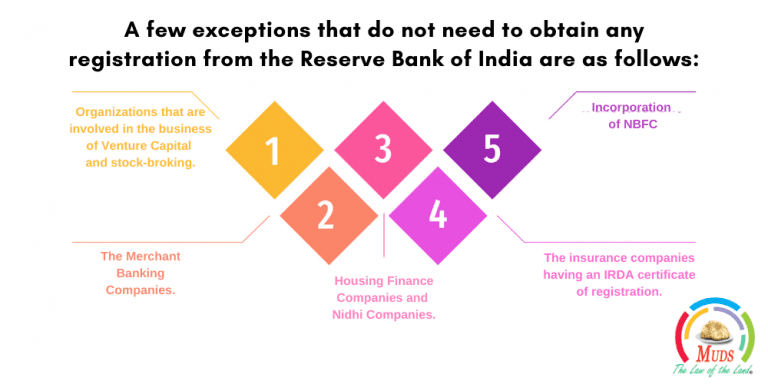

A few exceptions that do not need to obtain any registration from the Reserve Bank of India are as follows:-

A few exceptions that do not need to obtain any registration from the Reserve Bank of India are as follows:-

The various Core Investment Companies whose assets are valued at less than one hundred crores or in case their public funds are not taken.

- Organizations that are involved in the business of Venture Capital and stock-broking.

- The Merchant Banking Companies

- Housing Finance Companies and Nidhi Companies

- The insurance companies having an IRDA certificate of registration.

- Incorporation of NBFC

The NBFC procedure is as follows:-

- The company ought to be registered first either under the Companies Act 2013 or the Companies Act 1956.

- The company should have a minimum of two crores net owned funds.

- The company should at least have a full-time senior banker or one director (full-time or other).

- The company should have clean CIBL records.

- Once all the above-mentioned conditions have been fulfilled, the RBI online application needs to be filled from the RBI website along with the requisition documents.

- Generation of the CARN number takes place next.

- The company has to send the hard copy of the application to the regional branch of the RBI.

- The application needs to be examined closely and only on approval the company would receive the license.

Guidelines to be followed by an NBFC:

Guidelines to be followed by an NBFC:

Once the company receives the license, it has to comply with the following guidelines:

- The deposits that are payable on demand cannot be received by them.

- Public Deposits being accepted by the company should be a minimum of twelve months and a maximum time period of sixty months.

- The ceiling prescribed by the RBI has to be religiously followed by all the companies and no one can charge more interest than the prescribed limit.

- The repayment of the amount (in case any), taken up by the company would not be guaranteed by the RBI.

- The entire information about the company along with details of the change in its composition has to be supplied to the RBI.

- The public deposits would be unsecured.

- Every year, the company also has to submit its audited balance sheet.

- The RBI also requires the report of the credit rating to be taken every six months.