TDS on Sale of Property - Form 26QB

The buyer has to pay several taxes, however, while making a purchase of the property, the buyer is liable to deduct and pay taxes. Section 194IA deals with the requirement of TDS deduction by the buyer at the time of purchase of the property.

TDS on Sale of property is required to be deducted @1% if the property value is more than Rs. 50 Lakhs. This TDS is required to be deducted for all transactions after 1st June 2013 if the property transaction value is more than Rs. 50 Lakhs. This is applicable on sale of all properties except on sale of Agricultural Land. It is also important to note here that 1% TDS is applicable only if the seller is Resident in India. If the seller is not-resident in India i.e. he is an NRI, then the rate of TDS will change.

The rate of TDS in case of sale of property by Non-Resident would be 20% + Surcharge + Cess. TDS on Sale of Property by NRI would be levied even if the Transaction Value is less than Rs. 50 Lakhs.

It usually takes 3 to 5 working days.

- Registration on TRACES

- Form 26QB (1 no.)

- Bulk PAN Verification

- Challan Verification

- Online FVU Generation and Submission

- Generation of Form 16A

- Any person buying property and need to comply to TDS Provision as per Income Tax Act

- Purchase of plan

- FIll in the details in the template provided

- Upload documents on vault

- Return form prepared by Tax Expert

- Generation of Form 16 & 16A

- Details of deductor

- Details of responsible person

- Details of deductee

- Challan details

- Deduction details

- Property Details

Compliance regarding TDS on Sale of Property - 26QB

How to Pay TDS on Sale of Property & File Form 26QB

Form 26QB Filing in case of Joint Buyers & Sellers

Requirements of Section 194IA

Requirements of Section 194IA

Are you planning to purchase property in India? If so, you should be aware of the TDS (Tax Deducted at Source) that is applicable on property transactions. Under the Indian Income Tax Act, TDS is applicable on sale of property at the rate of 1% of the transaction value. The TDS is deducted by the seller at the time of sale and is payable to the government.

As a buyer, you should be aware of the TDS that is applicable on property transactions so that you can plan your finances accordingly. Make sure to factor in the TDS when budgeting for your property purchase.

From 1 June 2013, when a buyer buys immovable property (i.e. a building or part of a building or any land other than agricultural land) costing more than Rs 50 lakhs, he has to deduct tax at source (TDS) when he pays the seller. This has been laid out in Section 194-IA of the Income Tax Act.

- The buyer has to deduct TDS at 1% of the total sale consideration. Here, the buyer is required to deduct TDS, not the seller

- No TDS is required to be deducted if sale consideration is less than Rs 50 lakhs.

- If the payment is made by instalments, then TDS has to be deducted on each instalment paid.

- ‘Consideration for immovable’ property shall include all charges like nature of club membership fee, car parking fee, electricity or water facility fee, maintenance fee, advance fee or any other charges of similar nature, which are incidental to the transfer of the immovable property. This is applicable for immovable property purchased on or after 1 September 2019 as per Budget 2019.

- TDS is to be paid on the entire sale amount. For example, if you have bought a house at Rs 55lakh, you have to pay TDS on Rs 55 lakh and not on Rs 5 lakh (i.e. Rs 55 lakh – Rs 50 lakh). This is applicable even when there is more than 1 buyer or seller. Post the budget 2019 amendment to section 194-IA, in the above example, if on 1 September 2019, you have paid Rs 2 lakh towards parking fee, Rs 1 lakh for water facility fee and Rs 1 lakh for electricity fee, your sale consideration would be Rs 59 lakh (55+2+1+1). You will have to pay TDS on Rs 59 lakh @ 1%. Your TDS payable would be Rs 59,000. In case the transaction is carried out from 14 May 2020 to 31 March 2021, the rate is 0.75%.

- The buyer of any immovable property need not obtain a TAN (Tax Deduction Account Number) for making payment of the TDS on immovable property. You can make the payment using your PAN.

- For the purpose of making payment of TDS on immovable property, the buyer has to obtain the PAN of the seller, else TDS is deducted at 20%. PAN of the buyer is also mandatory.

- TDS is deducted at the time of payment (including instalment payments) or at the time of giving credit to the seller, whichever is earlier.

- The TDS on the immovable property has to be paid using Form 26QB within 30 days from the end of the month in which TDS was deducted.

- After depositing TDS to the government, the buyer is required to furnish the TDS certificate in form 16B to the seller. This is available around 10-15 days after depositing the TDS. The buyer is required to obtain Form 16B and issues the form to the seller.

Steps to pay TDS through challan 26QB and to obtain Form 16

Steps to pay TDS through challan 26QB and to obtain Form 16

The steps to pay TDS through challan 26QB and to obtain Form 16B (for the seller) are as follows:

e-Payment through Challan 26QB (Online)

Step-1: Log in to your account on the Income Tax e-filing portal. Select e-File > click on e-Pay Tax from the dropdown as shown below

Step-2: Click on ‘+ New Payment’

Step-3: Click on the proceed button on the tab ‘26QB- TDS on Property’ as highlighted below

Note: In the next few steps, you will have to add the following details:

- Add Buyer's Details

- Add Seller's Details

- Add Property Transferred Details

- Add Payment Details

Step-4: Add Buyer's Details

All your details will be auto-filled, but you can also change them if needed. After entering the details, click on ‘Continue’

Step 5: Add Seller's Details

Add all the details of the Seller like their PAN, address

Step 6: Add Property Details

Add all the property details like type, address and also the sale details like date of agreement, value etc. The tax amount will be calculated automatically. Once done, click on 'continue'

Step 7: Add Payment Details

Select the payment mode and proceed to complete the payment. Once the payment is done, a challan will be generated.

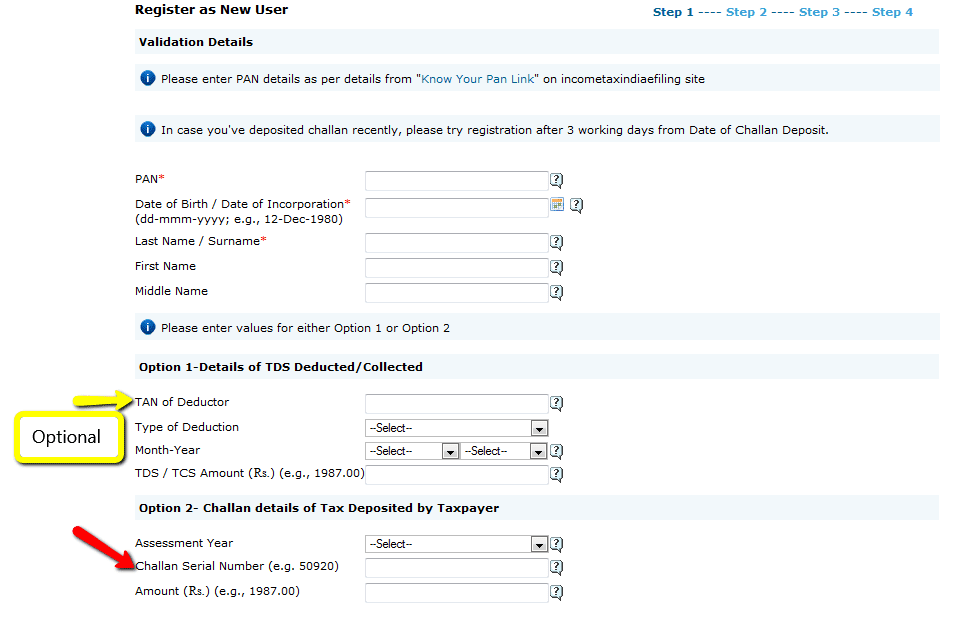

Step 2: Register in TRACES

Step 2: Register in TRACES

- If you are a first-time user, register on TRACES as a Tax Payer with your PAN Card Number and the Challan number registered during payment.

- Once you register, you will be able to obtain approved Form 16B (TDS certificate) and you can issue this Form to the Seller.

- Check your Form 26AS seven days after payment. You will see that your payment is reflected under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA) [For Buyer of Property]”.

- Part F gives you details such as TDS certificate number (which TRACES generates), name and PAN of deductee, transaction date and amount, acknowledgement number (which is the same as the one on your Form 26QB), date of deposit and TDS deposited.

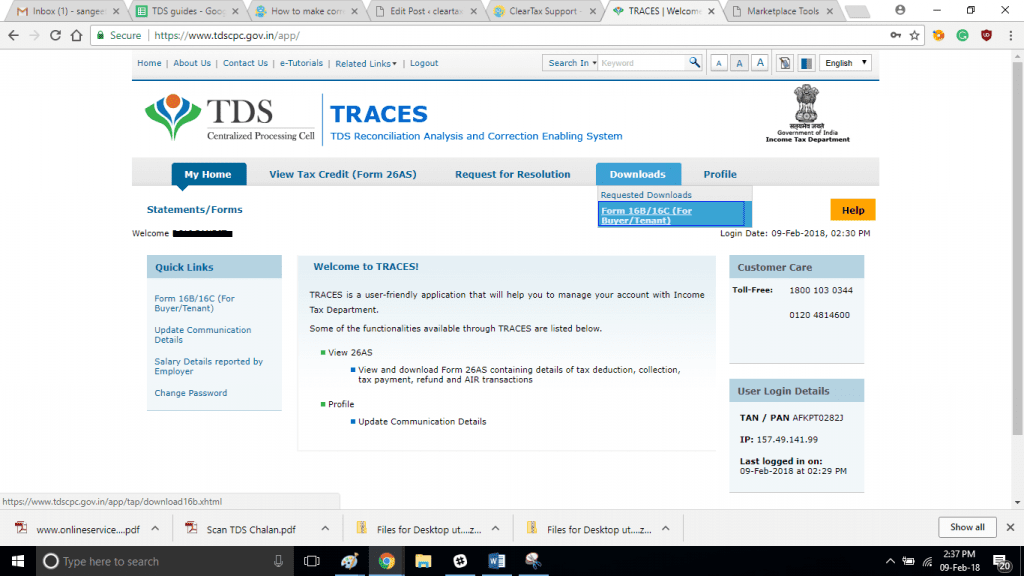

Step 3: Download your Form 16B

Step 3: Download your Form 16B

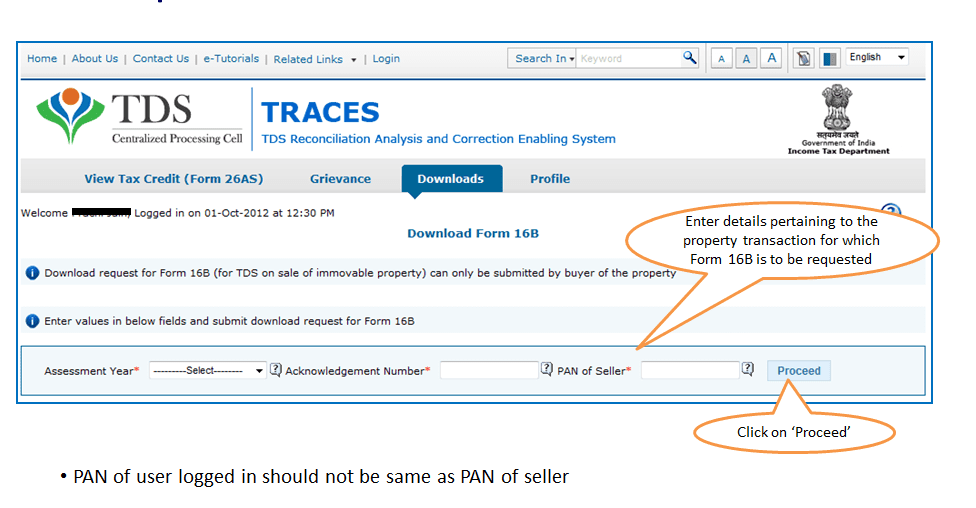

- After your payment in Form 26AS has been reflected, log in to TRACES. Go to the Download tab at the tab and click on “Form-16B (for the buyer)”.

- To finish this process, fill PAN of the seller and acknowledgement number details pertaining to the property transaction and click on “Proceed”.

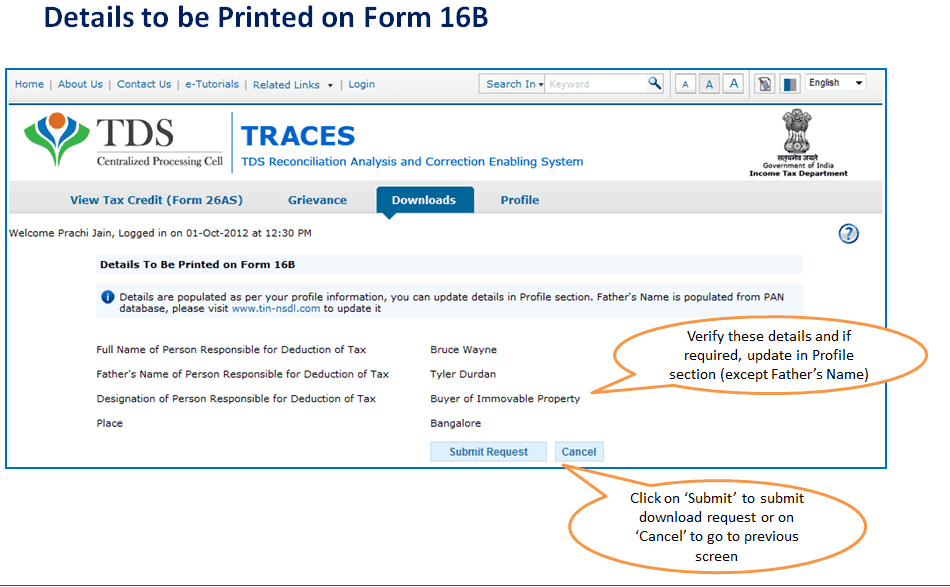

- Verify all the details once and click on “Submit a request”.

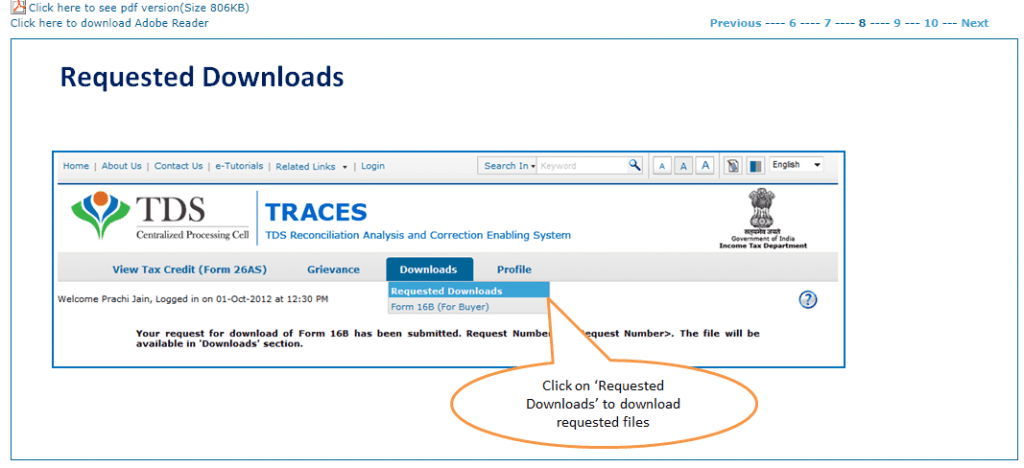

- After a few hours, your request will be processed. Click on the Downloads tab and select Requested Downloads from the drop-down menu.

- You should be able to see that the status of your Form 16B download request is ‘available‘.

- If the status says ‘submitted‘ wait for a few hours more before repeating the last step.

- Download the ‘.zip file’. The password to open the ‘.zip file’ is the date of birth of the deductor (the format is DDMMYYYY). Your form will be available inside the .zip file as a pdf. Print this out.

Notice for Non-Filing of Form 26QB

Mandatory Filing of Form 26QB

As per the Finance Act of 2013, TDS is applicable on the transfer of immovable property, wherein the consideration of the property exceeds or is equal to Rs 50 Lakhs.

Section 194 IA of the Income Tax Act, 1961 read with Rule 30, 31 & 31A of Income Tax Rules states that:

- For all such transactions with effect from June 1, 2013, Tax @ 1% should be deducted by the purchaser of the property at the time of making payment of sale consideration.

- Tax so deducted should be deposited to the Government Account through e-tax Payment option (Netbanking) or any of the authorised bank branches.

- Any sum so deducted under section 194-IA shall be required to be paid to the credit of the Central Government within a period of seven days from the end of the month in which the deduction is made.

- PAN of the seller, as well as Purchaser, should be mandatorily furnished in an online form (Form 26QB) for furnishing information regarding the property transaction. Facility for furnishing information regarding the transaction of sale of immovable property and payment of TDS thereof is available on the website www.tin-nsdl.com (http://www.tin-nsdl.com/).

- TDS certificate in Form 16B is required to be issued by the Buyer of property to the Seller, in respect of the taxes deducted and deposited into the Government Account.

- Form 16B will be available for download by registering on the website of Centralized Processing Cell (TDS) www.tdscpc.gov.in (http://www.tdscpc.gov.in/).

Implications of Non-Late Filing of TDS Statement

For Buyer of Property

- In case of default on account of non/late filing of Form 26QB, a fee shall be levied u/s 234E of the Act.

- He shall be liable to pay, by way of fee, a sum of Rs. 200 (two hundred) for every day during which such failure continues.

- The buyer would also be liable for defaults of Late Deduction, Late Payment and Interest thereon. Penalty under Section 271H may also be levied on him by the Assessing Officer.

For Seller of Property

- In case of non/ late filing of Form 26QB, the seller will not be able to claim the TDS Credit.

- Tax so deducted should be deposited to the Government Account through the e-tax payment option (Netbanking) or any of the authorised bank branches. Any sum so deducted under section 194-IA shall be required to be paid to the credit of the Central Government within a period of seven days from the end of the month in which the deduction is made.