Your Tax Credit Statement or Form 26AS is an important document for tax filing which consolidates all the Taxes deducted from the payments made to you during the year and which shall be reduced from the Total Tax Due while calculating & filing your Income Tax for the year.

1. What is Form 26AS?

- Includes info on tax deducted on your income by deductors

- Details of tax collected by collectors

- Advance tax paid by the taxpayer

- Self-assessment tax payments

- Regular assessment tax deposited by the taxpayers (PAN holders)

- Details of refund received by you during the financial year

- Details of the High-value Transactions in respect of shares, mutual fund etc.

2. Parts of Form 26AS?

- Part A: Details of Tax Deducted at Source

- Part A1: Details of Tax Deducted at Source for Form 15G/Form 15H

- Part A2: Details of Tax Deducted at Source on sale of Immovable Property u/s194(IA) (For seller of Property)

- Part B: Details of Tax Collected at Source

- Part C: Details of Tax Paid (Other than TDS or TCS)

- Part D: Details of Paid Refund

- Part E: Details of AIR Transaction

- Part F: Details of Tax Deducted on sale of immovable property u/s194IA (For Buyer of property)

- Part G: TDS Defaults* (processing of defaults)

Part A: Details of Tax Deducted at Source Part A of Form 26AS contains details of TDS deducted on your salary, interest income, pension income and prize winnings etc. TAN of the deductor and the amount of TDS deducted and deposited are also mentioned. This information is provided on a quarterly basis.

Part A1: Details of Tax Deducted at Source for Form 15G/ Form 15H

Details of income where no TDS has been deducted is given since the taxpayer submitted Form 15G or Form 15H. You can verify the status of TDS deduction if you have submitted Form 15G or Form 15H. If you have not submitted Form 15G or Form 15H, this section will display ‘No transactions present’.

Details of Tax Deducted at Source on sale of Immovable Property u/s194(IA) (For seller of Property)

This is applicable if you have sold the property during the year and TDS was deducted from your receipts. You will find the relevant entries here.

Part B: Details of Tax Collected at Source

Part B has details of the tax collected at source (TCS) by the seller of goods. Entries are present here if you are a seller and tax is collected by you

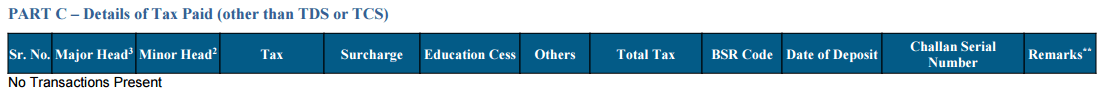

Part C: Details of Tax Paid (Other than TDS or TCS)

If you have deposited any tax yourself, that information will appear here. Details of advance tax as well as self-assessment tax are present here. It also contains details of the challan through which the tax was deposited.

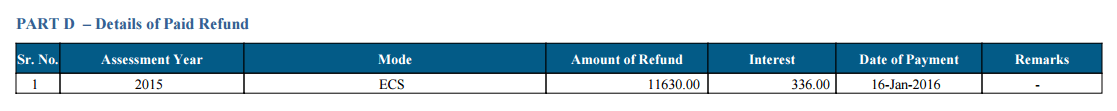

Part D: Details of Paid Refund

Information regarding your refund, if any, will be present in this section. Assessment year to which the refund pertains, along with mode of payment, amount paid and interest paid and also the date of payment is mentioned.

Part E: Details of AIR Transaction

Banks and other financial institutions must report high-value transactions to the tax authorities. Mutual fund purchases of high value, property purchases, high-value corporate bonds are all reported here.

Part F: Details of Tax Deducted on Sale of Immovable Property u/s 194IA (For Buyer of Property)

If you have bought a property, you have to deduct TDS before making payment to the seller. This section has details of TDS deducted & deposited by you.

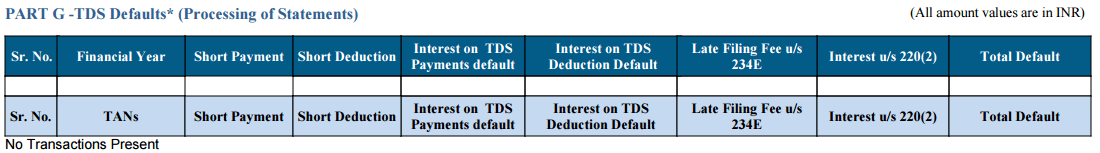

Part G: TDS Defaults*(Processing of Defaults)

Defaults relating to the processing of statements are mentioned here. They do not include demands raised by assessing officer.

3. How to view Form 26AS?

You can view Form 26AS on TRACES portal and download it. This income tax Form 26AS is linked with your PAN You can view Form 26AS from FY 2008-09 onwards – Via net-banking of your bank account. The facility is available to a PAN holder having a net banking account with any authorised bank. You can View Tax Credit Statement (Form 26AS), only if your PAN number is linked to that particular account. This facility is available for free.

List of banks registered with NSDL for providing a view of Tax Credit Statement (Form 26AS) are as below: List of banks registered with NSDL for providing view of Tax Credit Statement (Form 26AS) are as below:

- Axis Bank Limited

- Bank of India

- Bank of Maharashtra

- Bank of Baroda

- Citibank N.A.

- Corporation Bank

- City Union Bank Limited

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Overseas Bank

- Indian Bank

- Kotak Mahindra Bank Limited

- Karnataka Bank

- Oriental Bank of Commerce

- State Bank of India

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Patiala

- The Federal Bank Limited

- The Saraswat Co-operative Bank Limited

- UCO Bank

- Union Bank of India

4. How to Download Form 26AS?

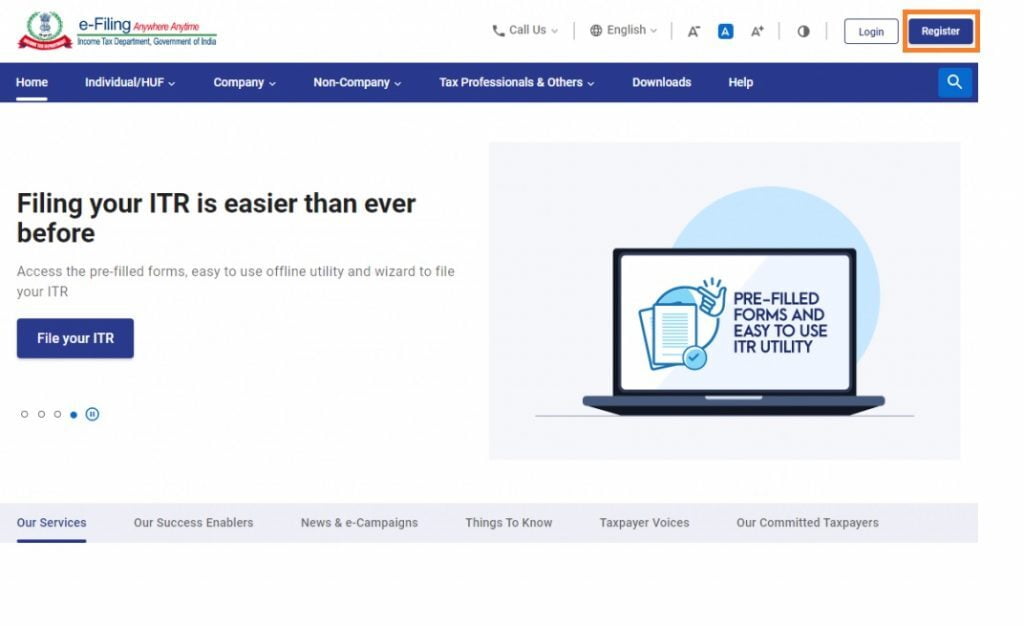

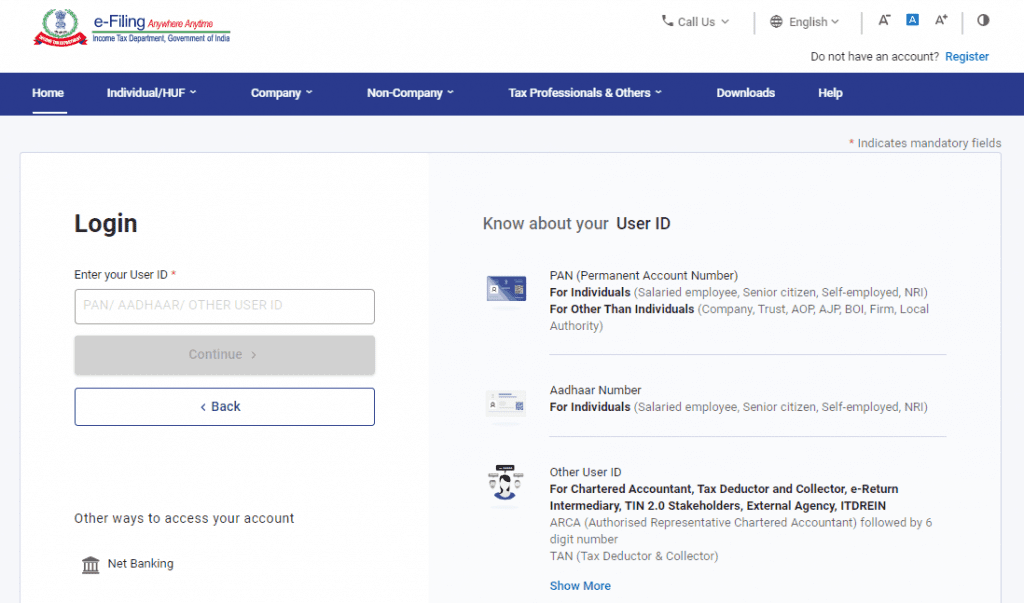

Form 26AS can be downloaded: On the TRACES website Or via Net Banking Facility of authorised banks Go to https://incometaxindiaefiling.gov.in and Login using your income tax department login & password. If you don’t have an account, you’ll need to Register first (see the button on top of LOGIN).

Step 1 of 8 Go to E-filing website

Step 2 of 8

Enter your PAN number, password and enter the captcha code. Now click on LOGIN.

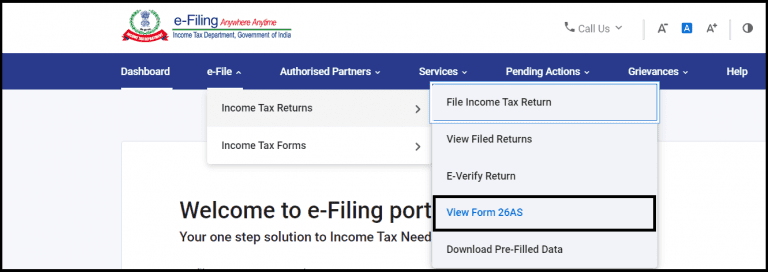

Step 3 of 8

Go to ‘E-file’ > 'Income Tax returns'> ‘View Form 26AS’.

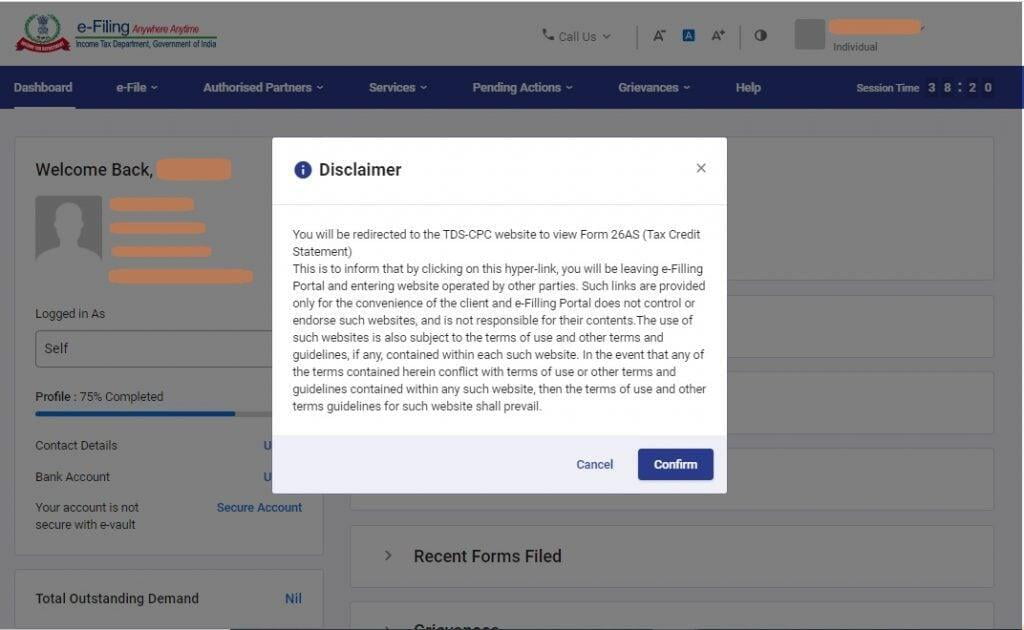

Step 4 of 8

Click on ‘Confirm’ so that you are redirected to the TRACES website. (Don’t worry, this is a necessary step and is completely safe since it is a government website).

Step 5 of 8

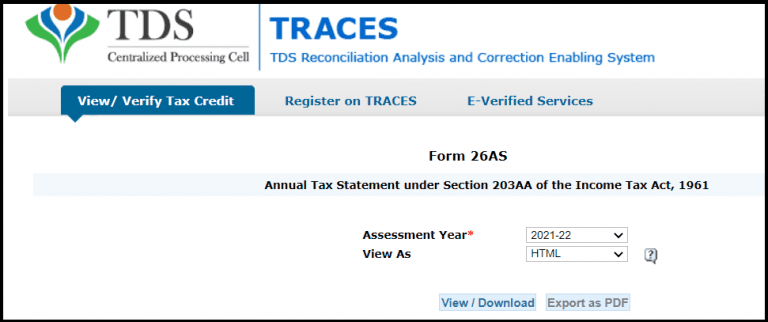

You are now on the TRACES (TDS-CPC) website. Select the box on the screen and click on ‘Proceed’.

Step 6 of 8

Click on the link at the bottom of the page – ‘Click View Tax Credit (Form 26AS) to view your Form 26AS’.

Step 7 of 8

a. Choose the Assessment Year and the format in which you want to see the Form 26AS. If you want to see it online, leave the format as HTML and click on ‘View/Download’.

b. TRACES Verification code

Step 8 (Final) You can also choose to download as a PDF by clicking on 'Export as PDF".

5. How to use the Income Tax Department’s e-Filing website?

The first step is to either login or register on the website After entering your PAN number, the website will tell you if you’re already registered If you’ve e-Filed before, chances are that you might already be registered. Please search your email inbox for “incometaxindiaefiling.gov.in” to look for information that might be useful If you remember your password, login. Note: Your User ID is your PAN number. If you don’t remember your password, you need to Reset your password If you’re not able to reset the password with any of the three options provided, please send an email to – validate@incometaxindia.gov.in with the following details- PAN:

- PAN holder’s Name:

- Date of Birth:

- Father’s Name:

- Registered PAN address:

- PAN holder’s Name:

- Date of Birth:

- Father’s Name:

- Registered PAN address: