RERA License Registration

Real estate agents are the heart of real estate industry . They are the mediators facilitating transactions between Builder and Buyer. With RERA, that will soon come into force, all brokers will have to be mandatorily registered with the concerned state-level regulatory authorities. Real estate agents will be given a registration number by the authority which will be valid for 5 years and will be quoted in every transaction facilitated by him.

Real estate agents will also be penalised if they will falsely represent any information regarding project to buyers. Penalty will extend upto Rs 10,000 per day and maximum 5% of total project cost. Real estate agent is also required to keep books of accounts of the projects they are indulged in and are answerable for them.

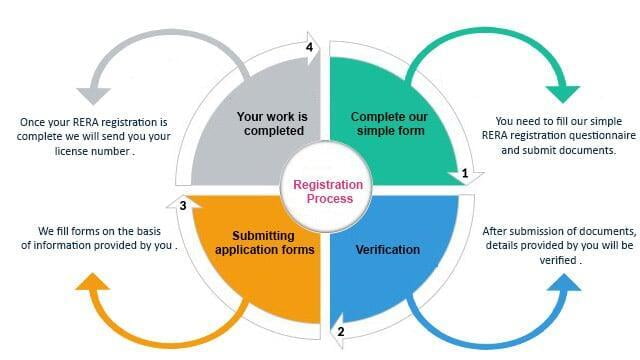

The Real Estate (Regulation and Development) Act, 2016 (RERA) is a landmark legislation that seeks to protect the interests of buyers of real estate and boost investments in the sector. The Act came into force on May 1, 2017, and all states and union territories were given a deadline of July 1, 2017, to notified their rules and set up a regulator. The RERA registration is a process that needs to be completed by real estate developers before they can sell or advertise any project. The registration must be done with the regulatory authority in the state where the project is located. The RERA registration process is as follows:

The developer needs to submit the following documents to the regulatory authority:

1. Application form

2. Approved plans, layout and land status

3. Copy of promoter's or developer's registration certificate

4. Promoter's or developer's details

5. Details of real estate agents authorised by the promoter or developer

6. Details of the project

7. declaration by the promoter or developer

Once the regulatory authority is satisfied with the documents submitted, they will issue a registration number to the developer, which needs to be mentioned in all future advertisements, sale agreements, and other documents related to the project. The RERA registration process is a simple and straightforward process that helps to ensure that buyers are protected from fraud and unscrupulous developers. It is important for all buyers to check that the developers they are dealing with are registered with the RERA before entering into any agreement.

File your RERA registration application online through us. Get help with RERA registration procedure, eligibility and documents required.

It usually takes 15 to 20 working days.

- Session with TAXAJ Expert

- Filing of Application for Registration

- Follow up till you secure RERA Registration Number & Certificate

- Real Estate Broker or Agent

- Real Estate Builder or Promoter

- Purchase of Plan

- Expert Assigned

- Upload documents on vault

- Registration Form Submission on RERA portal

- RERA Certificate Received (15-20 working days subject to Govt. approval)

- Pan, Aadhar, Photograph, Email & Phone

- Last 3 Year's ITR & Computation

- No Prior Experience Declaration/ Complete Experience Details along with Company Name and Tenure Served along with Any Experience Letter or Certificate if Available

- Declaration of No Police complain/ Complete Details of Police Complain

- Self-certified copy of letterhead along with rubber stamp

- Acknowledgement receipts proposed to be used by the real estate agent

- Additional Details depends on State

Everything about RERA License Explained here in this video!

Why RERA Registration/License is required?

Why RERA Registration/License is required?

Real estate agents are the heart of real estate industry . They are the mediators facilitating transactions between builder and buyer . With RERA, that will soon come into force, all brokers will have to be mandatorily registered with the concerned state-level regulatory authorities. Real estate agents will be given a registration number by the authority which will be valid for 5 years and will be quoted in every transaction facilitated by him.

Real estate agents will also be penalized if they will falsely represent any information regarding project to buyers. Penalty will extend upto Rs 10,000 per day and maximum 5% of total project cost. Real estate agent is also required to keep books of accounts of the projects they are indulged in and are answerable for them.

What is RERA Registration for Brokers?

The terms – real estate agent, dealer, broker and consultant – all point to that a person who acts as the bridge between a builder and the buyer. A broker plays various roles in a typical transaction – Sales Manager, a registration agent and at times even an arbitrator between the builder and the buyer. For this article, we shall call this crucial person a Broker. A rough estimate is that there are 5,00,000 to 9,00,000 brokers in the market in India and most of them are in the unorganized and unregulated segment of this industry.

The Real Estate industry itself is very crucial to the economy as it contributes to 11 % of the nation’s GDP, approximately Rs 11 lac crores, and the Broking business is approximately Rs. 18,000 crores per annum. Real Estate Industry is one of the drivers of economic growth in India. This crucial segment of the economy was totally unregulated. Home Buyers and brokers were left in the lurch by builders. Not anymore. With effect from 01/05/2017, Government of India has implemented RERA to regulate this market. Both Builders and Brokers are covered under this Act. In this article, we look at RERA registration for Brokers in detail.

What is MahaRERA Project Research?

The MahaRERA Project Search is a new, one-of-a-kind initiative that aims to make the process of finding and selecting the right real estate project much easier for buyers. The search engine is designed to help buyers identify projects that match their specific requirements, and provides detailed information on each project to help them make an informed decision. The MahaRERA Project Search is a valuable tool for buyers who are looking for the right real estate project, and we encourage you to take full advantage of it.

What are the Roles of Real Estate Brokers?

1. The agents must have all the records and documents of the promoters as well as their projects.

2. The agents must present all the records and documents to the buyer as and when required.

3. The agents must not misguide or advertise the general public with false facts of the projects.

4. The agent should with responsibility fairly handle the hard earned money of common man.

What is the Real Account Rule under RERA?

The Real Estate (Regulation and Development) Act, 2016 has come into force from May 1, 2017. RERA Act has been passed to bring in transparency and accountability in the real estate sector. The act will ensure that the buyers get the possession of the property on time, with the promised amenities.

RERA has several provisions for the buyers as well as for the developers. According to RERA, every project must be registered with the RERA authority before its launch. The registration must be done within a period of 3 months from the date of launch of the project. It is mandatory for the developers to display all the information related to the project on their website as well as on the website of RERA. This information includes the layout plan, land status, details of the promoters, carpet area, and other such details.

The developers are also required to open a separate escrow account for every project. This account will be used to deposit the money collected from the buyers. The money can only be used for the purpose of that particular project. RERA has also introduced the concept of a real estate agent. These agents need to be registered with RERA and they can only promote and sell projects that are registered with RERA. The act also has a provision for a fast-track dispute resolution mechanism. This will help in resolving the disputes between the buyers and developers within a period of 60 days.

RERA has introduced several measures to bring in transparency and accountability in the real estate sector. These measures will help the buyers to get the possession of the property on time, with the promised amenities.

What are the Procedure of RERA Registration?

RERA Registration as an agent in Haryana:

a) Every real estate agent shall make an application in form no REA-I to the authority along with documents hereunder mentioned:

1. RERA agent registration form which shall be duly filled

2. Particulars about the type of organization (pvt ltd, public ltd, LLP, partnership firm, proprietary firm with their registration number, bye rules, memorandum of association, article of association etc)

3. Authenticated copy of address proof of the place of business

4. Authenticated copy of pan card

5. Details of registration in any other state and union territory

b) The agent shall also pay the registration fees at the time of filing the application either by the way of demand draft or bankers cheque drawn on any scheduled bank or online payment to Haryana real estate regulatory authority calculated in schedule

c) the authority shall grant registration certificate to real estate agent within 30 days of receipt of such application form or reject the same.

d) the authority shall issue registration certificate in RE-II to the agent

e) in case of rejection, the authority shall inform such particulars to agent in form no RE-III

f) the registration granted shall be valid for 5 years

g) in case the real estate agent wants to renew the registration shall apply for such in form no RE IV with such sum mentioned in schedule

RERA Registration as an agent in Delhi:

a) Every real estate agent shall make an application in writing in form no G to the authority, until the application procedure is made we based along with documents hereunder mentioned such as

1. RERA agent registration form which shall be duly filled

2. Particulars in case of individuals- name, permanent address and the photograph and in case of enitied name, address and the type of organization (pvt ltd, public ltd, LLP, partnership firm, proprietary firm with their registration number, bye rules, memorandum of association, article of association etc)

3. Income tax returns of last 3 years and such declaration

4. Authenticated copy of address proof of the place of business

5. Authenticated copy of pan card

6. Details of registration in any other state and union territory

b) The agent shall also pay the registration fees at the time of filing the application either by the way of demand draft or bankers cheque drawn on any scheduled bank or online payment to Haryana real estate regulatory authority, sum of ten thousand rupees in case of individual and fifteen thousand rupees in case of entity

c) the authority shall grant registration certificate to real estate agent within 30 days of receipt of such application form or reject the same.

d)the authority shall issue registration certificate in H to the agent

e) in case of rejection, the authority shall inform such particulars to agent in form no I

f) the registration granted shall be valid for 5 years

g) in case the real estate agent wants to renew the registration shall apply for such in form no J accompanied with demand draft or bankers cheque drawn on any scheduled bank or through online payment of Rs. Five Thousand in case of individual or Rs. Twenty five thousand in case of entities

RERA Registration as an agent in Rajasthan:

a) Every real estate agent shall make an application in form no H to the authority along with documents hereunder mentioned such as

1. RERA agent registration form which shall be duly filled

2. Particulars about the registration including their registration number, bye rules, memorandum of association, article of association etc

3. Authenticated copy of pan card

4. Details of registration in any other state and union territory

b) he shall also pay the registration fees at the time of filing the application either by the way of demand draft or bankers cheque drawn on any scheduled bank or online payment to Haryana real estate regulatory authority, sum of ten thousand rupees in case of individual and fifteen thousand rupees in case of entity.

c) the authority shall grant registration certificate to real estate agent within 30 days of receipt of such application form or reject the same.

d) the authority shall issue registration certificate in form no I to the agent

e) in case of rejection, the authority shall inform such particulars to agent in form no J

f) the registration granted shall be valid for 5 years

g) in case the real estate agent wants to renew the registration shall apply for such in form no K accompanied with demand draft or bankers cheque drawn on any scheduled bank or through online payment of rs five thousand in case of individual or rs twenty five thousand in case of entities

RERA Registration as an agent in Uttar Pradesh:

a) Every real estate agent shall make an application in form no G to the authority along with documents hereunder mentioned such as

1. RERA agent registration form which shall be duly filled

2. Particulars such as name, contact details, address proof incase of individuals and name, address, contact details and photo in case of entities

3. Particulars about the registration including their registration number, bye rules, memorandum of association, article of association etc in case of entities

4. Authenticated copy of pan card

5. Income tax returns of last 3 preceding year from the date of such application

6. Authenticated copy of address proof of place of business

b) he shall also pay the registration fees at the time of filing the application either by the way of demand draft or bankers cheque drawn on any scheduled bank or online payment to Haryana real estate regulatory authority, sum of twenty five thousand rupees in case of individual and two lakh fifty thousand rupees in case of entity.

c) the authority shall grant registration certificate to real estate agent within 30 days of receipt of such application form or reject the same.

d)the authority shall issue registration certificate in form no H to the agent

e) in case of rejection, the authority shall inform such particulars to agent in form no I

f) the registration granted shall be valid for 5 years

g) in case the real estate agent wants to renew the registration shall apply for such in form no J accompanied with demand draft or bankers cheque drawn on any scheduled bank or through online payment of rs five thousand in case of individual or rs fifty thousand in case of entities

RERA Registration as an agent in Maharashtra:

a) Every real estate agent shall make an application in form no G to the authority along with documents hereunder mentioned such as

1. RERA agent registration form which shall be duly filled

2. Details of enterprise such as name, place of business, type, DIN and aadhar copy

3. Particulars about the registration including their registration number, bye rules, memorandum of association, article of association etc

4. Recent color photograph

5. ITR for last 3 financial year preceding the application or incase the applicant is exempted from such, the declaration to that effect

6. Details of all real estate projects and their promoters on whose behalf he has acted as agent in preceding 5 financial years

7. Details of all civil and criminal cases pending against him in case of individual and all persons in case of entities

8. Authenticated of all letter heads, rubber stamp images proposed to be used by agents

9. Authenticated copy of pan card

10. Details of registration in any other state and union territory

b) he shall also pay the registration fees at the time of filing the application either by the way of NEFT or RTGS, a sum of ten thousand rupees in case of individual or one lakh in case of entity.

c) the authority shall grant registration certificate to real estate agent within 30 days of receipt of such application form or reject the same.

d) the authority shall issue registration certificate in form no H to the agent

e) in case of rejection, the authority shall inform such particulars to agent in form no I

f) the registration granted shall be valid for 5 years

g) in case the real estate agent wants to renew the registration shall apply for such in form no J accompanied with fees notified by new rules

What is the Fee for RERA Registration?

The fee for RERA registration varies from State to State. The following is the RERA registration fee for Maharashtra:

- Rs 10,000 for individual or proprietorship firm.

- Rs 1,00,000 for One Person Company, Partnership firm, Society, LLP, Private Limited Company, Public Limited Company.

Once the above application and fee is submitted, the authorities will issue RERA registration certificate within 30 days of application. The RERA registration certificate should be displayed at the place of business. All promotional materials such as advertisements and brochures of the broker must mention the RERA registration number.

Validity of RERA Registration

The validity of a RERA registration can be checked online through the RERA website. The registration is valid for a period of 5 years from the date of issuance. After the expiry of the registration, the registration can be renewed for a further period of 5 years.

The RERA registration is a must for all real estate developers in India. It is a act that was brought in to protect buyers from builders who duped them. The act ensures that all builders register their projects with the RERA before they can start selling them. This helps buyers to be aware of all the details of the project before they make a purchase.

Conclusion

Real estate agents are the backbone of the real estate market. The government has wisely chosen the registration process to create a long run trust building between agent and the buyer.

Are you looking for a real estate broker in India? There are many brokers to choose from, but finding the right one can be a challenge. Here are some tips to help you find the right broker for your needs.

1. Decide what type of property you're interested in.

Do you want to buy a home, land, or commercial property? Once you know what type of property you're interested in, you can start narrowing down your search for a broker.

2. Research different brokers.

Not all brokers are created equal. Some specialize in certain types of properties, while others have more experience with the Indian real estate market. It's important to do your research to find a broker that's a good fit for you.

3. Ask for referrals.

If you know anyone who's recently bought or sold property in India, ask them for referrals. They may have some good recommendations for brokers in your area.

4. Interview multiple brokers.

Once you've compiled a list of potential brokers, it's time to start interviewing them. This is a crucial step in finding the right broker for you. Ask each broker about their experience, what type of properties they specialize in, and what they would do to help you find the right property.

5. Choose a broker you're comfortable with.

The most important factor in choosing a broker is finding one you're comfortable with. You should feel like you can trust them and that they have your best interests at heart. If you don't feel comfortable with a broker, move on to someone else.

Finding the right real estate broker in India doesn't have to be difficult. By following these