Conversion of Private Ltd to OPC (One Person Company)

The conversion of PLC (Private limited company) into an OPC (One Person Company) is provided as per the Companies Act, 2013, which implements a mechanism to convert one class of company into another. Section 18 of the Act, explicitly grants the conversion of an already registered private limited company starting from 1 April 2014.

The conversion of PLC to OPC would not affect the responsibilities and contractual obligations of the company before conversion, and such claims, liabilities, obligations shall be enforceable by law, and the resulting OPC shall be liable for them.

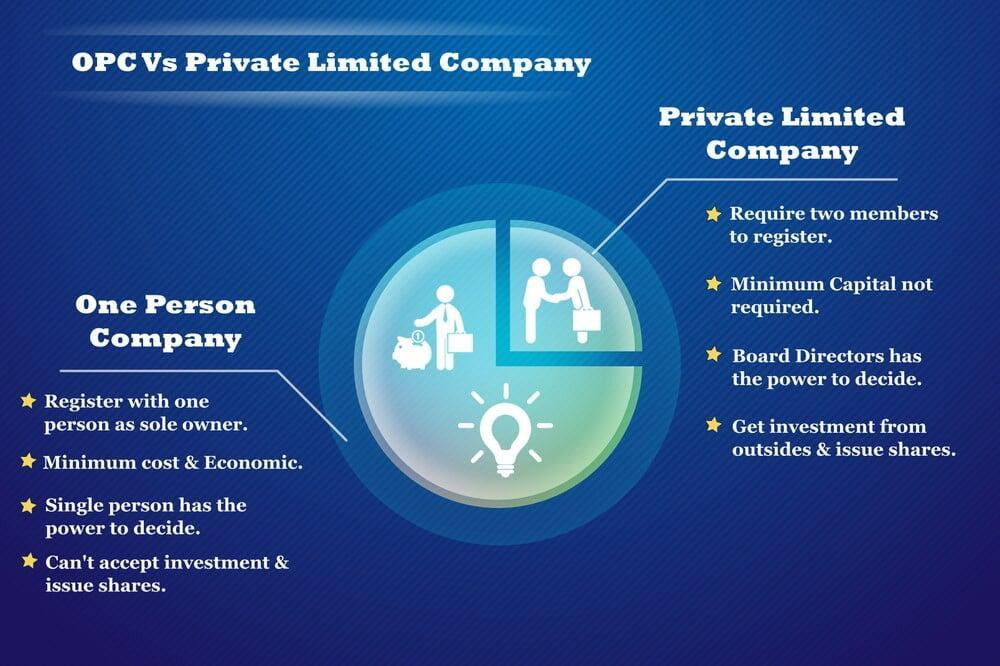

When a promoter of a private company chooses to resign from his position, the structure of the company tends to collapse. In such a situation, the professional suggests the option of conversion of private limited company to OPC. An OPC is a business structure that needs only one shareholder for its incorporation.

Get your Private Limited Company converted to One Person Private limited in the fastest possible manner.

It usually takes 20 to 25 working days.

- DSC

- Filing of SPICe+ Form

- Issue of Incorporation Certificate along with PAN and TAN

- Includes Govt Fees & Stamp duty for Authorised Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

- Excludes foreign national / Body Corporate as director or business needing RBI/SEBI approval

- Assistance in Opening Bank Account

- Businesses looking to expand or scale operations on higher level

- Startups looking to raise capital and issue ESOPs

- Businesses looking to convert their private limited company to public ltd company

- Businesses aiming to work globally or with reputed clients

DSC Application

Name approval form filing

Preparation of Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Latest Month Personal Bank statement of all the Stakeholders.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office, If Owned. (Download Template)

Rent Agreement from Landlord, If Rented/Leased. (Download Template)

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Authorised & Paid Up Share Capital of the Company.

All About Conversion of Private Ltd Company into One Person (OPC) Private Ltd Company

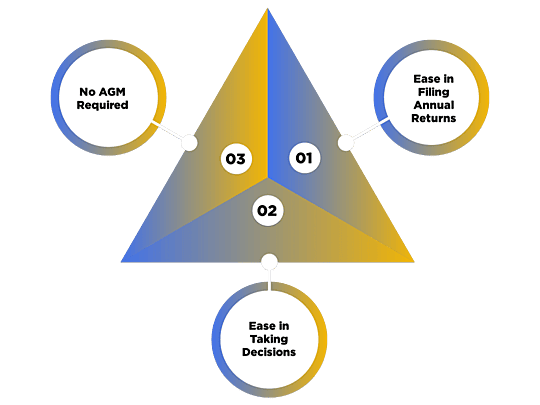

Benefits of One Person Company

1. Decision making: Decision making becomes easy as there is only one person to make a decision. This makes the decision-making process swift and time is utilized in other productive assignments.

2. Lesser Compliance: ROC and annual compliance are very less for One person companies.

3. Reduced workload: Work related to annual filing, share certificate etc. are reduced for One Person Company.

4. No AGM required: One person company does not need to hold an annual general meeting and does not need to comply with many other legal requirements which are mandatory for Private Limited Company.

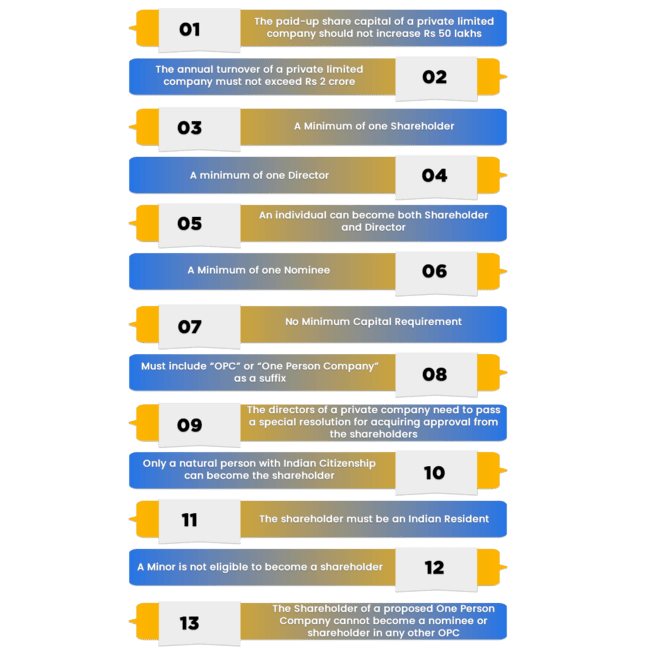

Checklist requirements for the conversion of PLC to OPC

Checklist requirements for the conversion of PLC to OPC

Here are some requirements to be followed to convert the private limited company into a one-person company:

- The company should have suitably prepared its books of accounts as well as its balance sheet.

- The company has listed and filed all ROC (Registrar of Companies) returns.

- To examine whether the company has paid requisite on the result of the share certificate and that the share certificates are properly matched with the payment of stamp duty.

- The company has deducted all TDS (Tax Deducted at Source) and filed relevant TDS returns.

- The company has paid VAT and Service Tax, or GST, and filed suitable returns before initiating the conversion.

- To check whether the company is maintaining a record of minutes of the meeting, for its board and shareholders, and keep updated registers at its registered office.

- The company is registered under the shop and the establishment acts as per the applicable state laws, where they control offices, shops, warehouses, etc.

- The company complies with the requirements of the professional tax, if applicable in the state where the registered office of the company is located and the states in which it has employees.

- The company is registered under PF, if the number of employees is more than 20 and with ESIC (Employees State Insurance Corporation), if the number of employees is more than 10, and if its listing monthly returns and paying dues as expected under PF and ESIC.

A private limited company can be changed into the one-person company based on the following provisions:

- The provided capital of the company is less than Rs. 50 lakhs.

- The annual turn over of the company should be less than Rs. 2 crores during the past three progressive financial years. Additionally, if the company is new, and has not completed three years, then the turnover shall be considered from the date of its incorporation.

- The shareholder of the resulting OPC shall be only one individual of Indian nationality.

- The shareholder of the OPC is a person residing in India for 180 days of one calendar year.

- The shareholder of the resulting OPC must not have incorporated any other OPC, or he/she is not a candidate of any other OPC.

- A minor cannot be a member or part of an OPC.

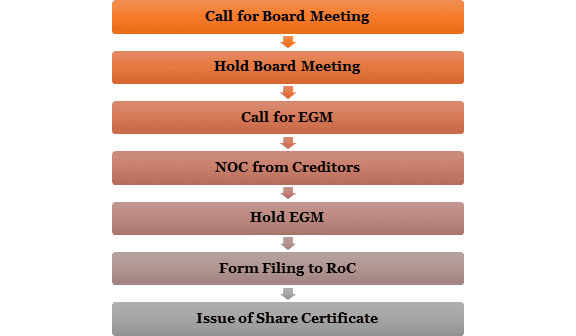

What is the process for conversion of Pvt Ltd to OPC?

Intimating to ROC (Registrar of Companies)

The concerned ROC should first be communicated through the prescribed method that the OPC is now required for converting itself into a private limited company.

Passing the Board Resolution

The shareholders of the OPC should hold a General Meeting for passing the resolution for raising the paid-up capital (if needed), no. of shareholders, and appointment of directors for meeting the requirements of the Private Limited Company. For converting an OPC to a Private Limited Company, there should be at least 2 shareholders and 2 directors.

Furthermore, a board resolution should be passed by the shareholders for approving the alteration of the Memorandum of Association (MOA) and Articles of Association (AOA) of the OPC.

Application for conversion of Private Limited Company to OPC

Application for conversion of Private Limited Company to OPC

Once the above steps are completed, the company needs to file an application to the registrar along with a copy of the resolution within fifteen days of passing the resolution. The registrar then confirms on the application details filled to be correct and fees are being paid against the registration. Then the registrar makes a decision by finally studying the application and other documents thoroughly and issues the certificate of conversion.

Nowadays E-Forms are also available with the Registrar of Companies. There will a penalty is this type of conversion if any officer contravenes the provisions of these rules, and will be punished with a fine amounting to Rs.10 thousand and a further fine of one thousand rupees for every day after the first such contravention being continued.

The introduction of One Person Company into legal system came into existence to encourage the entrepreneurs to enter into the corporate world. It will not only enable the individual capabilities to contribute economic growth but will also generate employment opportunity.

Forms filing with Registrar of Companies

For the purpose of Conversion of Private Company into One Person Company (OPC), certain e-Forms are to be filed with the concerned Registrar of Companies (RoC). The forms to be filed with the concerned Registrar are as follows:

Form MGT-14

After passing of the Special Resolution in EGM, Form MGT-14 should be filed with the RoC. The Form MGT-14 should be filed with RoC within 30 days of passing of the Special Resolution. The following attachments should be made with the Form MGT-14:

- The notice of EGM with the copy of the explanatory statement.

- A true certified copy of the Special Resolution.

- The Altered Memorandum of Association (MoA) and Articles of Association (AoA) of the Company.

- A true certified copy of the Board Resolution.

Form INC-6

The application for the Conversion of Private Company into OPC should be filed to the RoC. The application should be filed in Form INC-6 with the following attachments:

- The total list of members and creditors

- The latest balance sheet of the Company

- The copy of No Objection Letter

- An affidavit of the declaration of the Directors of Company that all the creditors and shareholders have given consent for the Conversion of Private Company into OPC, the paid-up capital of the Company is 50 lakh rupees or less, and the turnover of the Private Company is less than 2 crore rupees.

Issue of Share Certificate

The Registrar of Companies (RoC) will verify all the e-Forms submitted and all attached documents filed by Private Company for Conversion of Private Company into OPC. Once the Registrar of Companies (RoC) is satisfied that the Private Company has complied with the prescribed requirements, should Issue Share Certificate for the Conversion of Private Company into OPC.

Conclusion

One Person Company (OPC) can be easily managed with very fewer compliances to be followed as compared to Private Company. The Conversion of Private Company into OPC will benefit most people associated with the Company. The process of Conversion of Private Company into OPC is long-lasting and lengthy. We at TAXAJ have experienced professionals who will assist you with the process of Conversion of Private Company into OPC. Our professionals will help you and will assure the successful completion of your work.