FCRA Registration - Foreign Currency Regulation Act

In the present scenario, the world is more focused towards social and environmental causes. Businesses themselves, apart from their regular objective of profit-making, are actively involved in activities that promote social, economic, cultural and environmental growth and prosperity.

The world today is so well connected and so well linked that accessibility to any part of the world is easy. Transactions between people, places and countries take place on a day to day basis. As a result, the flow of foreign currency into and out of each country is now completely natural and an absolute commonality.

The volume at which these transactions are carried on is at a pretty high level, and as a result, it is almost not possible to keep track of the inflow and outflow of foreign currency in a regular manner. This brought about the need for the Foreign Contribution Regulation Act, 2010.

Get your FCRA License in the fastest possible manner.

It usually takes 20 to 30 working days, depending upon government approval.

FCRA License

- Businesses looking to get FCRA License.

Preparation of Documents and filing with department

- Self-certified copy of registration certificate/Trust deed etc., of the association

- Self-certified copy of relevant pages of Memorandum of Association/ Article of Association showing aim and objects of the association.

- Activity Report indicating details of activities during the last three years;

- Copies of relevant audited statement of accounts for the past three years (Assets and Liabilities, Receipt and Payment, Income and Expenditure) clearly reflecting expenditure incurred on aims and objects of the association and on administrative expenditure;

The Objective of FCRA 2010

The Objective of FCRA 2010

The Foreign Contribution Regulation Act, 2010 was enacted with a view to:-

- Regulate the acceptance and utilization of foreign contribution or foreign hospitality by certain individual associations or companies.

- Prohibit the acceptance and utilization of foreign hospitality or foreign contribution for any activities unfavourable to national interest and for matters related to therewith or incidental thereto.

Eligibility Criteria

Eligibility Criteria

Normal Registration

Normal Registration

In order to be eligible for the normal registration, there are a few prerequisites:-

- The applicant must be registered under the Societies Registration Act, 1860 or the Indian Trusts Act, 1882 or registered as Section 8 Company as per the Companies Act, 2013 or any such Act as may be required.

- Must have made reasonable contributions by undertaking activities in its chosen field for the benefit of society.

- Must have spent a minimum of Rs. 10,00,000 in the last 3 years towards achieving its objectives (Excludes administrative expenditure).

- Must submit the copies of the financial statements of the last 3 years that are duly audited by qualified Chartered Accountants.

- If a newly registered entity likes to get foreign contributions, then an approval for a specific purpose, specific activity, and from a specific source can be made to the Ministry of Home Affairs via the Prior Permission (PP) method.

Prior Permission Registration

Prior Permission Registration

The Prior Permission route is ideally suited for those organizations which are newly registered and would like to receive foreign contributions. This is granted for receipt of a specific amount from a specific donor for carrying out specific activities/projects. The association must:-

- Be registered under the Societies Registration Act, 1860 or the Indian Trusts Act, 1882 or registered as Section 8 Company as per the Companies Act, 2013 or any such Act as may be required.

- Submit a specific commitment letter from the donor to the Ministry of Home Affairs which indicates:-

- Amount of contribution given

- Purpose for which it is proposed to be given

- Where the Indian recipient organization and foreign donor organization have common members, the following conditions need to be met:

- The Chief Functionary of the Indian organization can’t be part of the donor organization.

- At least 51% of the members/office-bearers of the governing body of the Indian recipient organization should not be employees/members of the foreign donor organization.

- Where the foreign donor is an individual:

- He cannot be the Chief Functionary of the Indian organization.

- At least 51% office bearers/members of the governing body of the recipient organization should not be the family members and close relatives of the donor.

Application Procedure

Application Procedure

In order to apply for registration under FCRA, the steps are as follows:-

- The first step is the one where the online portal of FCRA needs to be accessed.

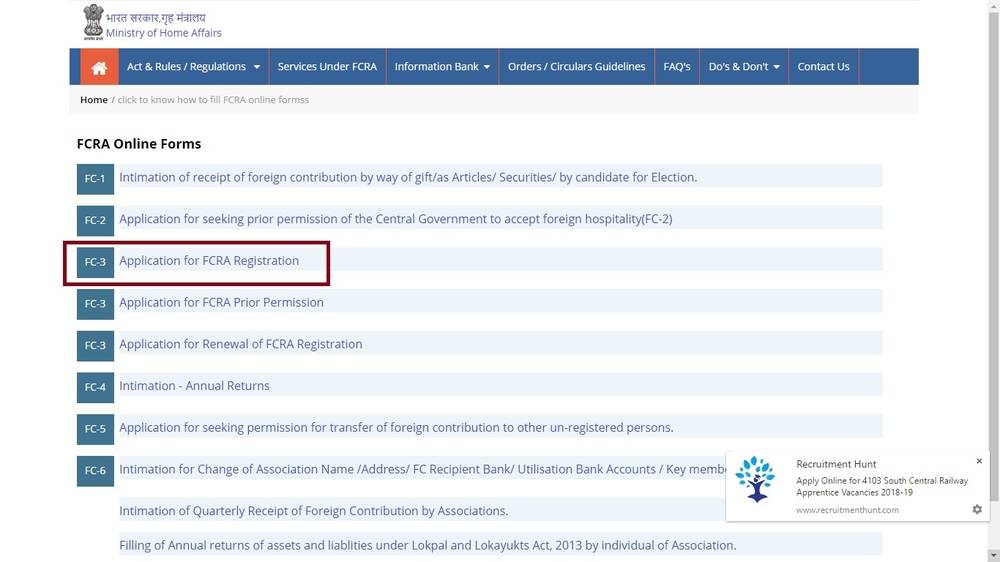

- Form FC – 3A (Application for FCRA Registration) or Form FC – 3B (Application for FCRA Prior Permission) is to be clicked on, as the case may be.

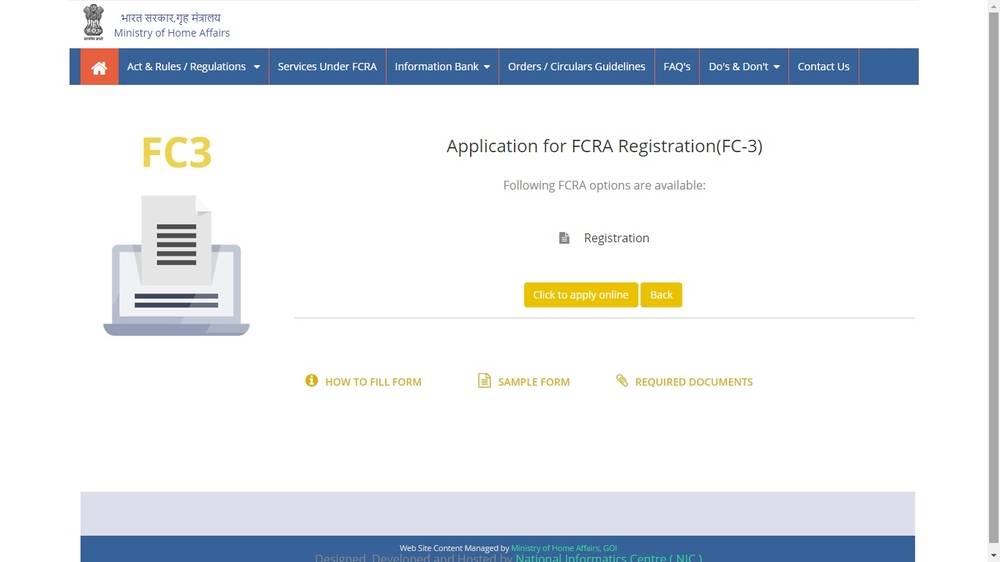

- The webpage will next present the user with an option to apply online.

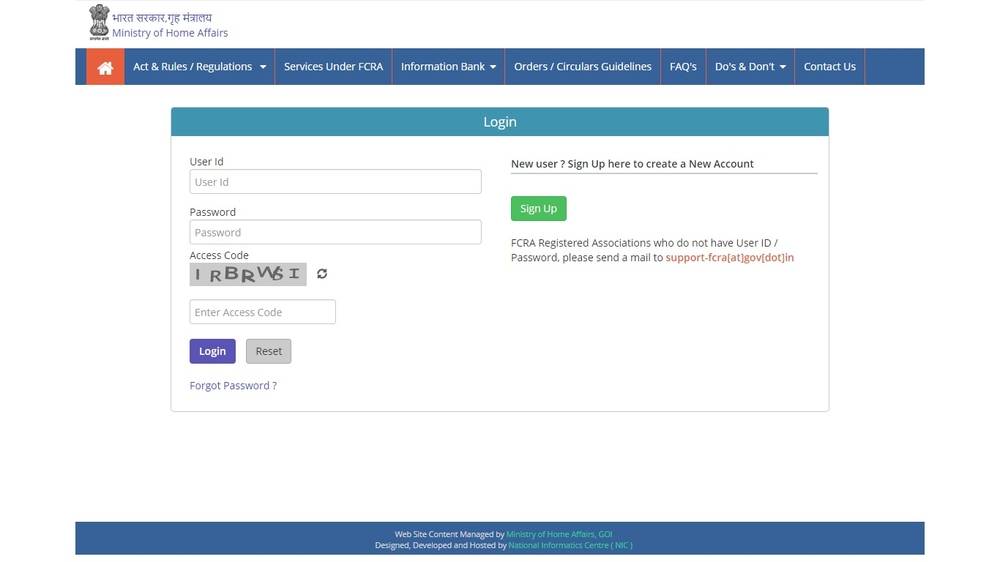

- Once the “Apply Online” option is selected, the next step is to create a username and password by clicking on “Sign Up”.

- Once a username and a password have been created, and the message regarding the same is displayed on the screen, the applicant may log in to the account.

- Once logged in, the “I am applying for” will have a dropdown list from which FCRA Registration has to be chosen. “Apply Online” is to be selected next, following which “Proceed Registration” has to be selected.

- Next, in the title bar, the FC-3 menu is to be clicked on to start the new registration procedure.

- This gives way to the association form where the relevant details have to be entered by the applicant along with the attachments containing the following documents:- – Darpan ID (not mandatory) – Association Address – Registration Number – Registration Date – Nature of the Association – Main object of the Association Once these details are filled in along with the attachments, the submit button is selected.

- The Executive Committee option has to be selected next from the menu bar. The details will be filled in the Executive Committee form.

- The option “Add details of Key Functionary” enables the applicant to add/delete/edit the details entered in the Executive Committee.

- Once all the Executive Committee details are entered in, the “Save” button must be clicked on.

- Further, bank details will have to be provided, including bank name, account number, IFSC code and address of the bank.

- Once the bank details are entered in, all the required documents are to be uploaded in PDF format.

- The place and date need to be entered in next after which the final submission button may be selected.

- The final step is to make the online payment by clicking on that particular button. Once the payment is made and the form is submitted, no changes can be made to the said form.

Once the FCRA registration is granted, the validity is for a five year period. Nevertheless, it is to be noted that an application for the renewal of the FCRA registration has to be made 6 months prior to the date of expiry.

Criteria for grant of FCRA Registration

Criteria for grant of FCRA Registration

Once, an FCRA application is made in the prescribed format, the following criteria are check before providing registration.

The ‘person’ or ‘entity’ making an application for registration or grant of prior permission-

- Is not fictitious or benami;

- Has not been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious faith to another;

- Has not been prosecuted or convicted for creating communal tension or disharmony in any specified district or any other part of the country;

- Has not been found guilty of diversion or mis-utilisation of its funds;

- Is not engaged or likely to engage in propagation of sedition or advocate violent methods to achieve its ends;

- Is not likely to use the foreign contribution for personal gains or divert it for undesirable purposes;

- Has not contravened any of the provisions of this Act;

- Has not been prohibited from accepting foreign contribution;

- The person being an individual, such individual has neither been convicted under any law for the time being in force nor any prosecution for any offence is pending against him.

- The person being other than an individual, any of its directors or office bearers has neither been convicted under any law for the time being in force nor any prosecution for any offence is pending against him.

The acceptance of foreign contribution by the entity / person is not likely to affect prejudicially –

- The sovereignty and integrity of India;

- The security, strategic, scientific or economic interest of the State;

- The public interest;

- Freedom or fairness of election to any Legislature;

- Friendly relation with any foreign State;

- Harmony between religious, racial, social, linguistic, regional groups, castes or communities.

The acceptance of foreign contribution-

- Shall not lead to incitement of an offence;

- Shall not endanger the life or physical safety of any person.

Online FCRA Registration Process

Online FCRA Registration Process

The procedure for online FCRA registration is explained here.

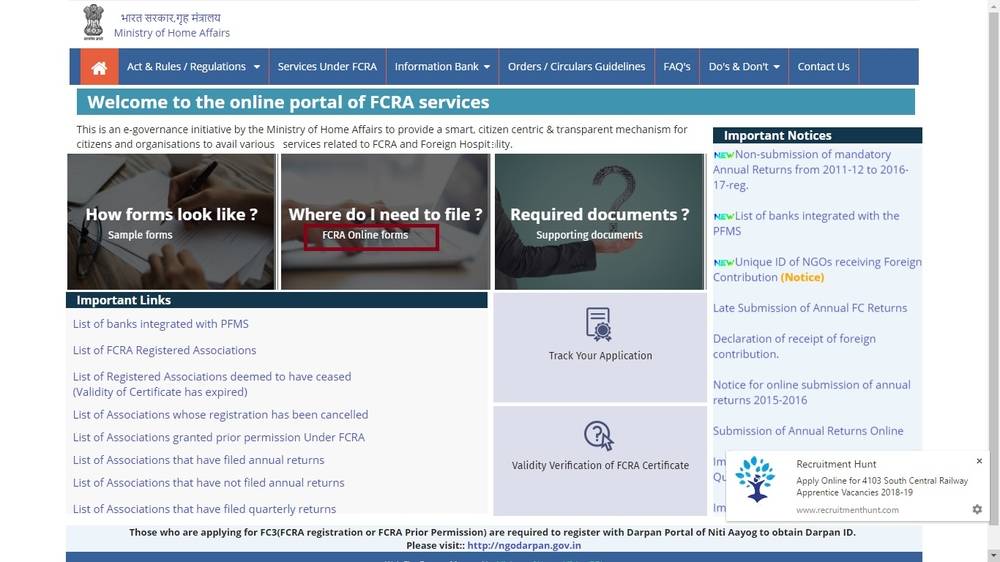

Step 1: Go to FCRA online portal.

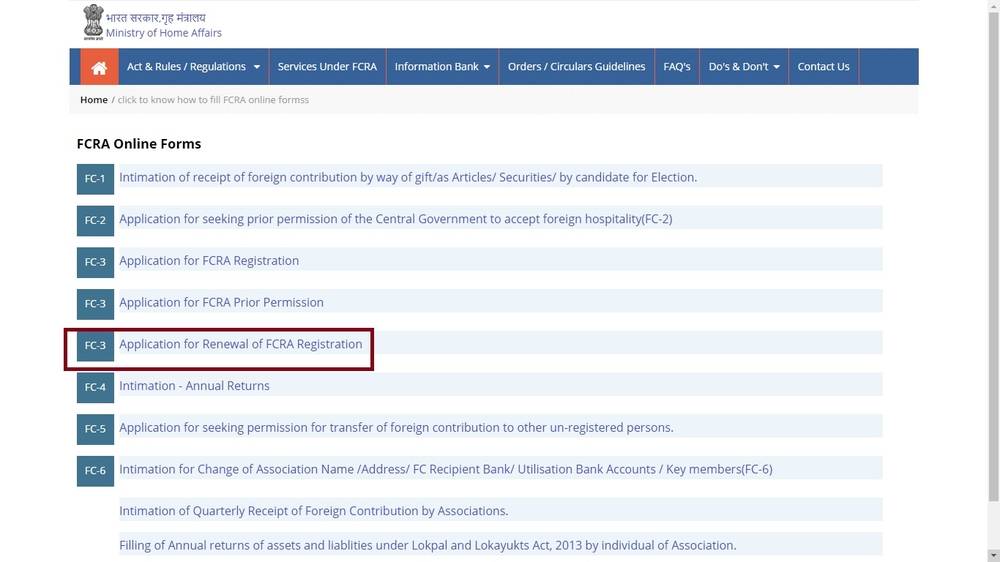

Step 2: Click on ‘FCRA online forms’ to register in FCRA.

Step 3: In the next screen select application for FCRA registration link. The link will redirect to next page.

Step 4: Click on ‘Click to apply online’ button to apply for FC3 (Registration).

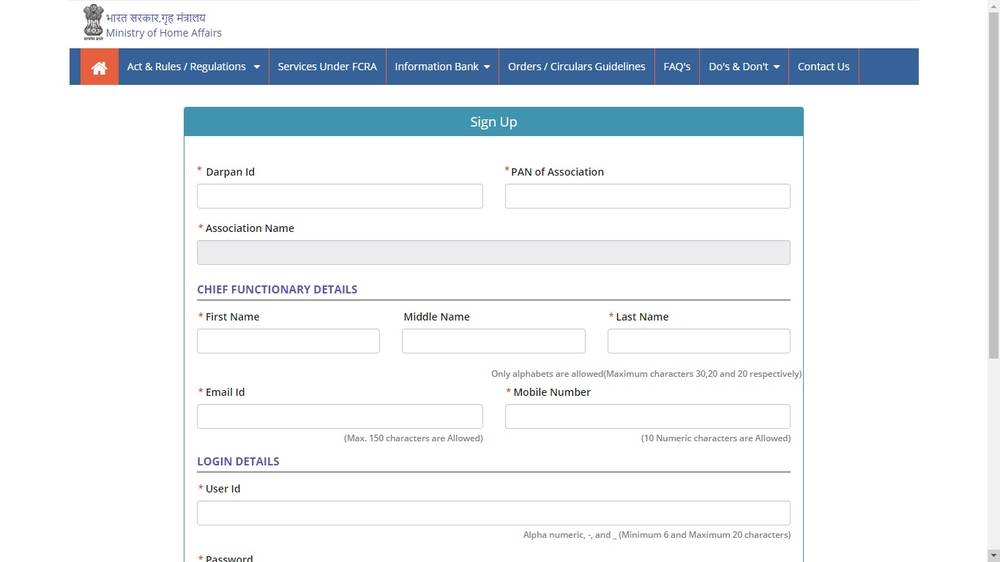

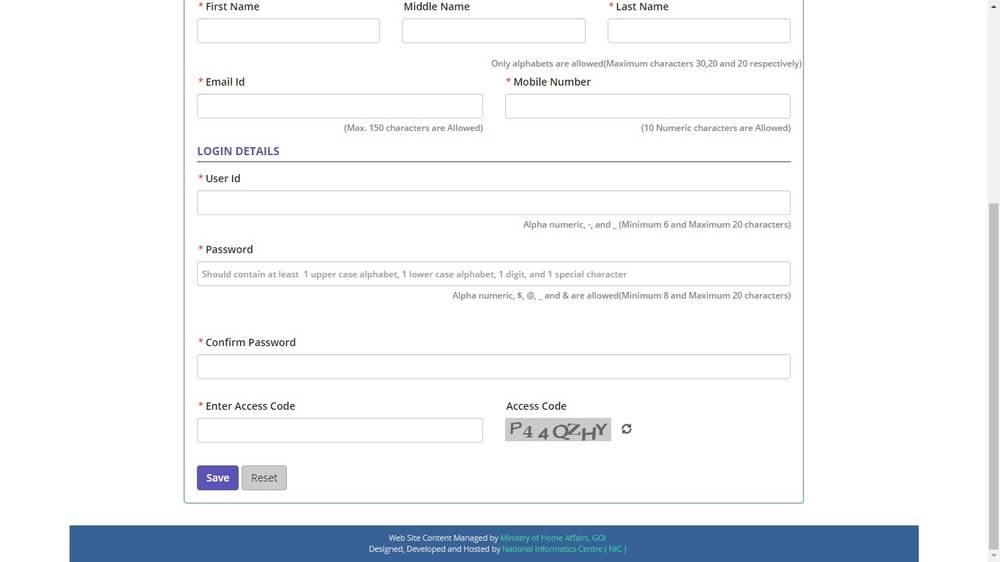

Sign up for FCRA Account

Step 5: You need to sign up into FCRA, select sign-up option. The link will move to next page.

Step 6: Enter all mandatory details and click on save.

Step 7: On clicking on save a message will be shown in the screen ‘User ID successfully created and Your user ID is:’

Login to FCRA

Step 8: Login into the portal using this User ID and password.

Step 9: You can see an option ‘I am applying for’ select FCRA registration from drop-down menu. Click on Apply online.

Step 10: To proceed registration ‘click here to Proceed New Registration’

Step 11: Click on FC3 Menu in title bar for proceedings step by step registration.

Association Details

Step 12: Select Association Details from the menu. The association detail form will be displayed. Enter all below mentioned mandatory details.

- Darpan ID

- Address of Association

- Registration number

- Place of registration

- Date of registration

- Nature of association

- Main aim of the association

Step 13: Click on submit button to save data.

Executive Committee Form

Step 14: Now go to Executive Committee Form by clicking on Executive Committee option from menu bar.

Step 16: Enter all details about Executive Committee.

Step 17: Select ‘Add details of Key Functionary’, you can now edit/delete/add Details of Information of Executive Committee.

Step 18: To add further foreigner details, select checkbox of the record which one you want and click on Add/View button.

Step 19: New screen will be displayed, add related foreigner details. You can able to Edit/Delete Record by clicking on the appropriate option.

EC detail and others

Step 20: You need to fill EC details and others. Select this option from the menu list.

Step 21: Click on save after entering all mandatory details of EC.

Bank Details

Step 22: In this section provide your bank details such as Bank Name, IFSC code, Account Number, Address of the bank.

Other details Section

Step 23: Click on Other Details option from the menu to provide all other information.

Upload documents

Step 24: You need to upload all relevant documents in PDF format.

Final Submission

Step 25: Click on final submission from the menu bar. You have to declare the application form, enter place and date and click on final submit.

Step 26: Once you submitted finally, a pop-up window will appear, click on OK.

Note: After final submission, you can’t modify application details.

Online payment

Step 27: After clicking on Make Online Payment button from menu bar, the payment screen will be displayed.

Step 28: Click on Continue for Payment button in this screen, a screen will be pop up on the screen. Select the payment gateway and click on payment.

Renewal of FCRA Registration

Renewal of FCRA Registration

Once FCRA registration is granted, it is valid for a period of five years. An application for renewal of FCRA registration can be made 6 months prior to the date of expiry, to keep the registration valid.

Step 1: Select Application for Renewal of FCRA Registration from FCRA Online Forms.

Step 2: On clicking on this, the page will be redirected to next page. Select Click to apply online.

Step 3: Enter your user ID & password and login to the FCRA portal.

Step 4: You can see an option ‘I am applying for’ select FCRA renewal from drop-down menu. For renewing FCRA registration follow above given steps 10 to 28.