Conversion of Partnership Firm into LLP (Limited Liability Partnership)

The shift from traditional partnerships to Limited Liability Partnerships (LLPs) has increased in recent years. The reason behind this is that LLPs offer more flexibility, unlimited partners and the like. But the real driving force behind the shift is due to the fact that LLPs offer a major advantage in terms of limited liability. The strain on the personal assets of the partner is put to rest when it comes to LLPs since they are hybrid of both a partnership and a private limited company. Small and medium-sized businesses find this type of organisation structure to suit their needs very well.

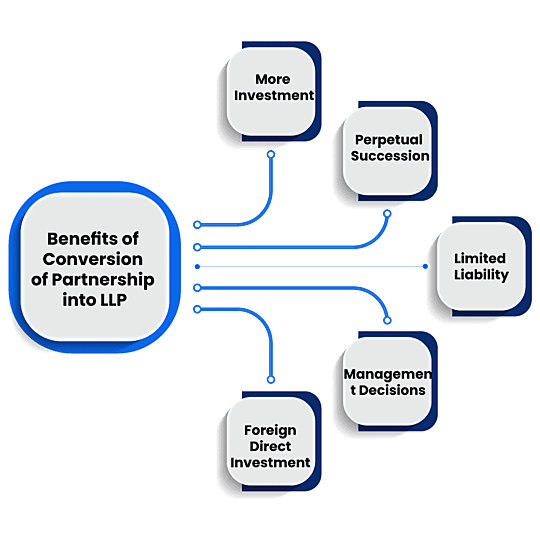

The advantages of the Limited Liability Partnership (LLP) form of business outweigh those of the traditional partnership. Limited liability, perpetual succession and unlimited partners are the key incentives for a partnership firm to convert itself into an LLP.

Get your Partnership Firm converted to Limited Liability Partnership in the fastest possible manner.

It usually takes 20 to 25 working days.

- DSC

- Filing of MCA Form

- Issue of Incorporation Certificate along with PAN and TAN

- Includes Govt Fees & Stamp duty for Authorised Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

- Excludes foreign national / Body Corporate as director or business needing RBI/SEBI approval

- Assistance in Opening Bank Account

- Businesses looking to expand or scale operations on higher level

- Startups looking to raise capital and issue ESOPs

- Businesses looking to convert their private limited company to public ltd company

- Businesses aiming to work globally or with reputed clients

DSC Application

Name approval form filing

Preparation of Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

- Name of the Proposed LLP

- Information related to the Partnership Deed of the partnership firm

- Digital Signature Certificate of the Respective Partners

- Authorised Capital of the LLP

- Any information related to the contribution by the partners

- Registered office information of the partnership limited entity

- Identification Documents of the Partnership- Voter ID and other related information

- Utility Bill of the Partnership Firm- Electricity Bill/ Water Bill or any other Bill

- Evidence or Proof of the Registered Office of the Partnership (Lease deed/Ownership Documents) of the property

- Permanent Account Number (PAN) of all the Partners of the Partnership

- Audited Information related to the Partnership

- Statements such as Bank Details of the Partnership

- Main objects of the Partnership Business

- NOC of the owner of the premises in case the premises is leased

Post Incorporation Documents

- Copy of the Certificate of Incorporation of the LLP

- Documents which are submitted for FillIP

All you need to know about converting your Partnership to Limited Liability Partnership (LLP)

Convert Partnership Firm to LLP – Documents Required, Procedure

Convert Partnership Firm to LLP – Documents Required, Procedure

Partnership firms are at a disadvantage when compared to the newly introduced Limited Liability Partnership (LLP) as they do not provide limited liability protection for the partners, separate legal entity status, ability to take on unlimited number of partners and ease of ownership transfer. The introduction of LLP’s through the Limited Liability Partnership Act, 2008 has made LLPs the premier choice for small and medium sized businesses. Inciting tremendous interest among Partners of a existing Partnership firms to convert their firms into LLP. In this article we look at the process for conversion of partnership into LLP.

Why LLP over Partnership Firm ?

Apart from the key differences, there are a few features that make the LLP a more desirable option over a standard partnership firm:-

- Freedom of Management/Flexibility: The partners are given a reasonable level of flexibility in conducting the operations and running the day to day affairs of the LLP. The LLP Agreement is not mostly influenced by the Limited Liability Partnership Act, 2008, which means to say that the Act is comparatively flexible on how the agreement can be drawn up.

- Perpetual Succession: Unlike in the traditional partnership, the death of the partner does not affect the existence of the LLP. The separate legal entity feature of the LLP allows it to carry on business.

- Investment Attraction: Foreign investors and venture capital funds look at LLPs as an investment opportunity as it has a corporate structure and is more organized as opposed to traditional partnerships.

- Multidisciplinary LLPs: Professionals of various disciplines can work together in an LLP, which is an exclusive feature and an advantage in itself.

- More Investment: Conversion of partnership to LLP would improve the amount of investment in the LLP. Through the process of conversion, the reputation of the entity would increase making more amounts of investors invest in the LLP.

- Limited Liability: Conversion of partnership to LLP would automatically grant the status of limited liability to the partners. Limited liability would afford some form of independence to the partners of the firm. Limited liability separates the liability of the partners from the firm.

- Foreign Direct Investment: The government of India has relaxed the regulations related to the FDI in an LLP. There is leniency for FDI in an LLP when compared to a partnership.

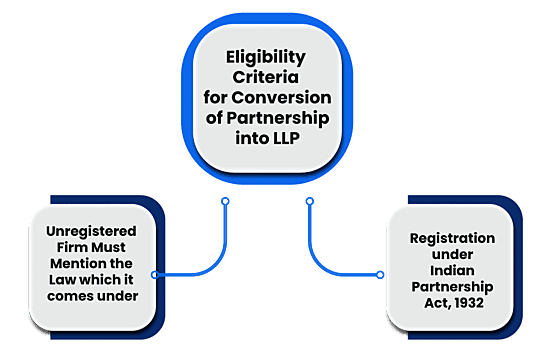

Conditions For Converting a Partnership Firm to LLP

Conditions For Converting a Partnership Firm to LLP

- The conversion of a partnership firm to LLP shall be done as per Section 55 of the Limited Liability Partnership Act 2008 read with Schedule II of the Act.

- All the partners of the firm shall be the partners of the LLP, which means there shall be no new partners or the existing partners cannot cease to be partners while making the application

- It is mandatory for all Partners to hold a valid Digital Signature Certificate (DSC) and at least two partners must have a DPIN before making such an application.

- The partnership firm to be converted must be registered under the Partnership Act, 1932.

- All the partners’ consent must be obtained.

- The LLP must have the same partners as that of the partnership firm. Any partner that wishes to be removed from the LLP may be removed after the conversion is complete.

- Director Identification Number (DIN)/Designated Partner Identification Number (DPIN) must be obtained for all Designated Partners.

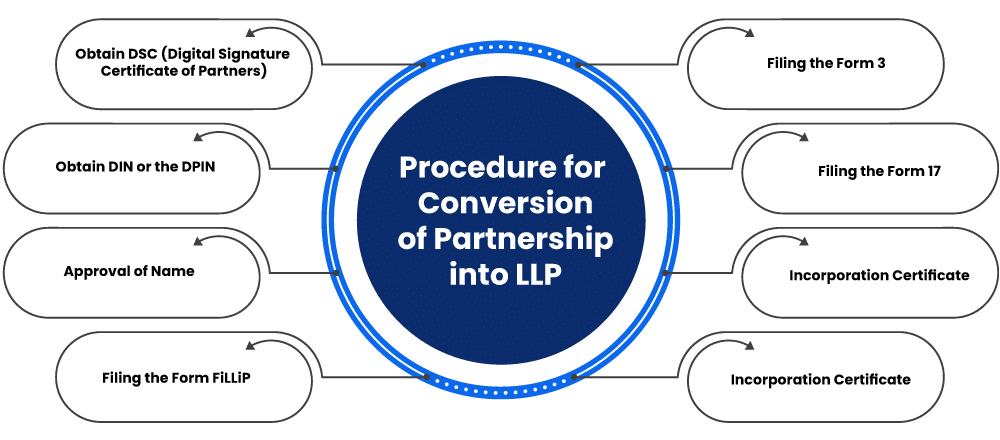

Procedure for Conversion of a Firm From Partnership to LLP

Procedure for Conversion of a Firm From Partnership to LLP

Step I – Name Approval and DSC

a. Name Approval

- Register and subsequently log on the MCA portal.

- Under the MCA Services tab, the “RUN – LLP” option is to be selected.

- RUN stands for Reserve Unique Name.

- In the dropdown list, the option “Conversion of Firm into LLP” is to be selected.

- Subsequently, there are two Proposed Names for the LLP to be given.

- Further, any supporting documents may be uploaded in the PDF format, after which the “Submit” button is to be clicked on.

- The page is redirected to a payment gateway where the fees amounting to Rs. 200 is to be paid for the form.

- The reserved name then holds a validity period of 90 days.

b. Digital Signature Certificates

- In order to proceed past the Name Incorporation stage, it is mandatory that the Designated Partners of the LLP possess their very own Digital Signature Certificates.

- Every e-form requires the DSCs of the Designated Partners to be affixed to the relevant forms in order to ensure a successful submission.

Step II – Filing of the Forms with the RoC

a. Form 17 (Application and Statement for conversion of a firm into LLP)

The application form has to be filled in with information such as:

- Service Request Number (SRN) of the RUN – LLP form.

- Name of the Proposed LLP.

- Name, address, registration and partnership agreement details of the firm.

- Details regarding the number of partners, capital contribution to be provided.

- Secured creditors details.

The following attachments are to be provided:

- Statement of Consent of Partners of the firm.

- Statement of assets and liabilities of the firm certified by a Chartered Accountant in practice.

- Copy of the latest Income Tax Return acknowledgement.

- List of all the secured creditors along with their consent.

- Any other supporting information (optional).

b. Form FiLLiP (Form for incorporation of LLP)

The application form is to be filled in with:

- Details of the RUN – LLP which will be auto-filed.

- Registered office address and email id of the LLP.

- Office of the Registrar.

- Nature of business activities.

- Details of the partners, designated partners, their DINs, DPINs and PANs.

- Amount of contribution by the partners in the LLP.

Both the forms are to be e-signed by the proposed designated partners and certified by a Cost Accountant, a Company Secretary, or a Chartered Accountant or any of whom must be in whole-time practice. The fee to be paid will vary in relation to the amount of capital contribution.

Step III – Issue of Registration Certificate

The Certificate of Registration of the LLP shall be granted by the Registrar on approval of the application.

Step IV – LLP Agreement

The LLP Agreement has to be submitted in Form LLP – 3 within 30 days of incorporation of the LLP. It shall contain the following particulars:

- Name of the LLP

- Name of the designated partners and other partners

- Form of capital contribution and profit sharing ratios

- Rules governing the LLP

- Rights and duties of the partners

Step V – Intimation to the Registrar of Firms

The Registrar of Firms has to be given intimation regarding the conversion into LLP and the related details of the LLP within 15 days from the date of the incorporation in Form – 14. The form has to be accompanied by:

– Copy of the LLP Incorporation Certificate.

– Copy of the incorporation documents submitted in Form FiLLiP. Once all these steps are complied with, it can be said that the conversion from a partnership to LLP is complete in all respects. Nevertheless, it is to be noted that the old licenses and permits do not transfer over to the LLP. They have to be freshly applied for post-conversion.

Registration

The Registrar, on receiving the relevant documents, may accept or refuse to register the LLP. If all documents are found correct in accordance with the provisions of the act, the Registrar shall issue a certificate of registration. The LLP will in less than 15 days of registration inform the Registrar of firms with which it is registered in Form 14. In the event of a refusal of registration by the Registrar, an appeal can be made with the tribunal.

Effect of Registration

- An LLP shall come into existence by the name stated in the certificate of registration.

- All the assets, liabilities, rights and privileges which vested in the firm shall vest in the LLP.

- The firm shall stand dissolved, and if it was registered under the Indian Partnership Act 1932, it shall be removed from the records maintained.

- All proceedings which were pending against the firm may be enforced against the LLP.

- Any order or judgement either in favour or against the firm may be enforced against the LLP.

- All existing contracts and agreements in which the firm was a party shall continue to be in force with the LLP as the party.

- Every existing appointment of the firm or authority conferred on the firm shall be as if it were conferred on the LLP.

Partners Liability Before Conversion

Partners Liability Before Conversion

Every partner will be jointly and severally liable for all the liabilities and obligations of the firm which were incurred before such conversion. If any partner discharges the obligation, then he shall be indemnified by the LLP.

Conversion Notice

The LLP shall provide for a period of 12 months, which begins from a date not later than 14 days after registration: – A statement that it was converted from a firm to a LLP as from the date of registration mentioned and – Name and registration number (if any) of the firm from which it was converted in every official correspondence of the LLP. In case the LLP contravenes the above provision it shall be punishable with a minimum fine of Rs 10,000 and a maximum fine of Rs 1,00,000. In case of continuing default, the minimum fine shall be Rs 50 per day, and the maximum shall be Rs 500 per day.

LLP Form No 17

This form is an application and statement for the conversion of a firm into an LLP. The form is divided into 2 parts: Part A: Application and Part B: Statement.

Information to be Furnished in Part A: Application

Information to be Furnished in Part A: Application

- SRN of the Reserve Unique Number (RUN) form if it is already filed. If not the proposed name of the LLP.

- Name and address of the firm.

- Details of registration of the firm either under the Indian Partnership Act 1932 or under any other law.

- Date of agreement which provides the details around the formation of the firm.

- The total number of partners in the firm.

- The total number of partners in the LLP, which shall be auto-populated from the details provided as per the previous proint.

- Total capital contribution of the firm.

- Details of the consent of all partners.

- Details of all partners of the LLP being shareholders of the company and no one else.

- Details of the income tax return filed under the Income Tax Act 1961.

- Details of any pending proceedings in any court/tribunal/any other authority.

- Whether any previous application for conversion has been refused by the Registrar. If yes, SRN and reasons for refusal need to be provided.

- Details of any continuance of any conviction/order/judgement of any court/tribunal/other authority in favour or against the firm.

- Whether there are any secured creditors. If yes, whether the consent of all secured creditors has been obtained for the conversion.

- Whether any clearance or approval is required for the conversion into LLP. If yes whether the approval has been obtained.

Part B: Statement

Contents of the declaration

- Consent by the partner for conversion from firm to LLP.

- The partner shall state that he or she shall be liable both jointly as well as severally for all liabilities incurred before the conversion

- He or she shall state: – That all the requirements as per the LLP Act 2008 and the rules have been complied with. – That all the partners of the firm are the partners of the LLP and no one else. – That all the required approvals have been obtained. – That the consent of all secured creditors has been obtained. – That all the information provided in the form is to the best of his knowledge and belief.

Attachments

- Statement of Assets and Liabilities of a firm duly certified as true and correct by a Chartered Accountant in practice.

- Statement of the consent of partners of the company.

- List of all the secured creditors along with their consent to the conversion.

- Copy of acknowledgement of the most recent income tax return.

- Approval from any authority/body.

- Optional attachment(s)-if any.

The e-form shall be digitally signed by a designated partner with details of DIN/DPIN of the designated partner and PAN number in case none of the designated partners have a DIN. The certification shall be done by a Chartered Accountant/Company Secretary/Cost accountant in full time practice. Selection of associate or fellow needs to be done, and membership number/certificate of practice number shall be provided. Intimation to the Registrar shall be provided in Form 14.

The following information shall be provided:

Name of the firm.

Principal address of the firm.

Details of the registration of the firm either under the Partnership Act 1932 or any other statute.

Particulars of the LLP into which the firm has been converted shall also be provided.

The copy of the certificate of incorporation of the LLP shall be attached, and the partner shall digitally sign the form.

Frequently Asked Questions:

One of the main requirements for conversion of partnership to LLP is the requisite consent of all the individual partners of the firm. Apart from this all the compliances related to the conversion process must be fulfilled by the partners of the partnership company.

At the time of conversion, the number of partners must be the same. There must not be any form of increase or decrease in the amount of partners.

For the process of conversion of partnership into LLP, the name has to be reserved in advance by the partners of the firm. This procedure or process of name reservation can be conducted online. A maximum of six names would be allowed to be reserved for the partnership. Such names have to be in the order of preference for the partnership firm. The registrar may also ask the LLP to apply for a new name at the time of conversion of partnership into LLP.

The following rules related to naming the partnership must be followed by the partners:

• The name must not be against any rules of intellectual property in India.

• The name of the LLP must be unique and distinctive in character.

• It must not mislead any individual including the public.

• The name of the LLP must not go against any public law or constitutional law of India.

For conversion of partnership into LLP, the amount of capital contribution must be disclosed by the respective partners.

Usually, an LLP would have partners. Any director who is appointed to carry out the responsibilities of an LLP would have to have a director identification number (DIN). Such requirements have to be complied by the independent directors of an LLP.

The following pre-requisites must be followed for becoming a partner of an LLP:

• The partner have to be more than 18 years of age

• The partner must not have any form of disqualifications

• The partner must not be criminally liable

• The partner must not be insolvent.

The main regulatory authority for registering an LLP in India is the Ministry of Corporate Affairs (MCA). However, the main regulatory authority for registering a partnership firm is the Registrar of Firms.

Yes an LLP can only change the number of partners or add any new partners once the firm is converted.