Conversion of LLP into Private Limited Company

Corporatization is the need of the hour. The entire world is gradually drifting towards one global market without any trade barriers between the countries. With the emergence of corporate work culture and promotional startup benefits, a great chunk of entrepreneurs are looking forward to corporatization. This step can be initiated in 2 ways as enumerated below:

1. Incorporation of a new corporate entity.

2. Conversion of existing entity (e.g. LLP/ Partnership Firm) into a Company.

The 2nd option of conversion of Limited Liability Partnership into a corporate entity might be practical for the existing entities to switch over from one mode of business to another. The process of conversion is a step by step procedure, which is a technical process but if handled with expert knowledge may be time and cost saving, as well.

There were no provisions under Companies act, 2013 regarding Conversion of Limited Liability Partnership into Company. Ministry of Corporate Affairs has passed a notification on 31st May, 2016 in such notification its allowed conversion of LLP into Company.These rules called as “the Companies Authorized to register Amendment Rules, 2016.

However, there are various requirements which need to be satisfied for converting an LLP into a Private Limited Company, for instance, an LLP must have at least 7 partners, approval from all the partners is required, advertisement in newspaper is to be done in a local and a national newspaper, a No Objection Certificate (NOC) is required from the ROC where such LLP is registered and then all the incorporation process has to be undertaken which includes:

Convert your LLP into Pvt Ltd Company at the affordable cost and fastest manner.

It Usually takes 15 to 20 working days.

- Filing of E-forms

- Drafting of LLP Deed

- Designated Partner Identification Numbers - DPINs (2 nos.)

- Digital Signature Certificates - DSC's (2 nos.)

- Issue of Incorporation Certificate

- Includes Government Fees upto Rs. 1 Lakh Capital Contribution by Designated Partners

- Stamp Duty upto Rs. 2000/- and its Notarisation in any state in India for LLP Deed

- Assistance in Opening Bank Account

- Minimum two Partners or Stakeholders

- Companies, body corporates or already existing partnerships

- LLPs registered outside India

- Startups and SMEs looking for carrying business with minimal legal formalities

- Purchase of Plan

- DSC

- Name Reservation

- Filing of LLP and DPIN application with Registrar

- Receipt of Registration Certificate

- Notarisation of LLP Deed

- Application for PAN and TAN

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office. (If Owned)

Rent Agreement from Landlord. (If Rented/Leased)

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Total Capital Contribution of the Company.

Conversion of LLP to Private Limited Explained

Choice of LLP vs Private Limited Company

Choice of LLP vs Private Limited Company

LLP is majorly suitable for small businesses that have annual sales turnover of fewer than Rs 40 lakhs and a capital contribution of fewer than Rs 25 lakhs. LLPs that satisfy these conditions do not have to go through the audit every year, on the other hand, it is necessary for a private limited company to conduct an audit of its financial statement each year. Though, in case, LLP has an annual turnover of Rs 40 lakhs or a capital contribution of more than 25 lakhs, the need for compliance become almost similar for both the private limited company and LLP, forcing the owners of LLP to convert into a Private Limited Company.

Corporatization has become the need of the current market situation. We live in a world where the ulterior goal of every market is to drift towards one global market removing the barriers between the countries. There are many start-ups and entrepreneurs who are eager to step into corporatization. Follow the below-mentioned steps to initiate the process:

Benefits of Conversion of LLP into Private Limited Company

Benefits of Conversion of LLP into Private Limited Company

- Preservation Of Brand Value

Conversion of LLP into Private Limited Company facilitates business entities to continue the brand name without making any further efforts on brand advertisements.

- Carry Forward Of Unabsorbed Losses And Depreciation

After the conversion, no expenditure will be incurred on bookkeeping, as the losses and depreciation incurred in LLP will be carried forward on the conversion of entity

- Employee Stock Ownership Plan To Employees

Conversion of LLP to Private Company facilitates Companies to offer stock ownership and ESOP plans. Such plans help companies to attract efficient employees, as it offers incentive plans for them to work in the company.

- Easy Fund Raising

If the company registration process is strict, it helps the company structure to be more credible among others. This leads to easy fundraising from external sources.

- Separate Legal Existence

Conversion of company facilitates the separate ownership and management to pay attention to their potential work. The Shareholders assign responsibility to run and operate the company without losing control in form of voting.

- Limited Liability Of Owners

Conversion prohibits the liability of the owners only to the capital subscribed and unpaid by them.

Reasons for LLP Registration

Reasons for LLP Registration

- Making small businesses aware with the concept of LLP.

- Easy to commence and control

- Gives the advantage of limited liability and also provides flexibility to organize their firm internally.

- Audit is not needed if an annual sale is more than Rs 40 lakhs and capital contribution does not cross the limit of Rs 25 lakhs.

- LLP is not bound to pay Dividend Distribution Tax (DDT).

- It is not necessary for a LLP to conduct Board meeting or annual meeting.

- Registration process of LLP is simple as compared to Private Limited Company.

Reasons for Private Limited Company Registration

Reasons for Private Limited Company Registration

- LLP does not entertain the concept of shareholders. All the owners in a LLP are considered as Partners in the LLP and are considered as unsuitable for investors such as Venture Capitalists and Private Equity investors who do not possess any desire to indulge in the management of the Company. Private Company is the best choice for investors. If the business is growing then the owners must convert it into a private limited company.

- FDI is becoming popular in Indian market. A private limited company does not require any approval from the government authorities for FDI while government approval is much needed for FDI in LLP.

Board Meeting & Resolution

Hold a meeting of the partners to take assent of majority of its members summoned for the purpose of registering the LLP under Section 366 of the Companies Act, 2013. To authorise one or more partners to take all steps necessary and to execute all papers, deeds, documents etc. pursuant to registration of the LLP as a Company.

LLP Have to apply for Availability of the Name in RUN. One of the major advantages is that the business can be run under the same name as that of the LLP (subject to availability of name as per Name Availability guidelines of Companies Act) except that in addition to the name of the LLP the words ‘limited’ or ‘private limited’ has to be added.

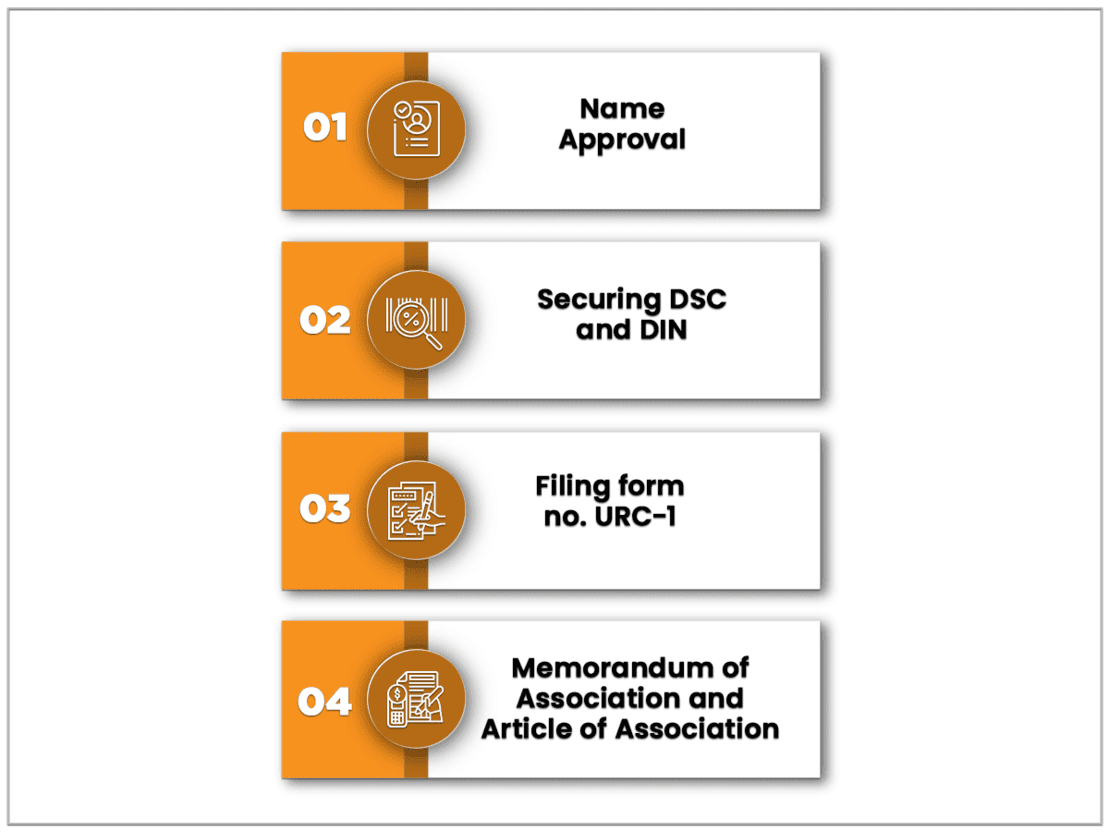

Approval of Name

Name Approval has to be obtained from the ROC (Registrar of Companies) by submitting an application in e-format. To apply for this, you need to choose various items that are mentioned in the form INC-1. The name once accepted by the authority will be valid for 60 days.

Securing DSC and DIN

In case all 7 members, who are future directors of the company after conversion, do not have the Digital Signature Certificate (DSC) and Director Identification Number (DIN) for all the future directors of the company must be obtained. For obtaining the DIN, an application form must be filed on MCA portal. DIN application is processed & approved by central government via the office of regional director, the ministry of corporate affairs. The form must be accompanied by self-attested address proof and identity proof with 1 recent passport size color photo of the applicant. All the required documents should be attested by a practicing cost accountant or a practicing chartered accountant or a practicing company secretary.

Filing form no. URC – 1

After getting the approval of name from Registrar of Companies, the applicant must prepare & file the form No URC-1 in addition to the following documents.

- List of the members with various details viz. names, address, shares held by them appropriately, etc.

- List of the first directors of the private company with various details viz. names, address, the DIN, passport number with an expiry date, etc.

- An affidavit from every person proposed as first directors, that he is not banned to be a director under section-164 and all the necessary documents filed with the registrar for the registration of firm must contain information which is complete and correct & true to be best of his belief and knowledge.

- A list including the names & addresses of partners of LLP and a copy of LLP agreement & certificate of registration duly verified by two designated partners of LLP must be enclosed.

- A statement indicating the following specifications q) the nominal share capital of firm & the number of shares into which it is separated b) the number of shares taken & the amount paid for every share c) the name of the firm, with the addition of word Limited or private limited is required.

- A written consent or No objection certificate from all creditors.

- Copy of newspaper advertisement, statement of accounts of the company which must not be 6 days preceding the date of the application and it must be duly certified by the auditor.

Memorandum of Association & Articles of Association

Memorandum of Association (MoA) & Articles of Association (AoA) is to be formulated and then filed with RoC after getting the name approval and sanction of form no. URC-1 – from the registrar.

Process of Conversion of LLP into a Private Limited Company

Process of Conversion of LLP into a Private Limited Company

Let’s dig in further and discuss each process in detail.

- Name Approval

Obtain ‘Name Approval’ from the ROC (Registrar of Companies) by giving an application in e-format.

- Securing DSC And DIN

It is necessary for all the seven directors of the company to obtain Digital Signature Certificate (DSC) and Director Identification Number (DIN). DIN can be obtained by filing an application form on MCA portal. Central government approves the application of DIN through the office of regional director, the ministry of corporate affairs. Before submitting the form make sure to self-attest it along with address proof and identity proof with one passport size photo of the applicant.

- Filing Of Form URC-1

Once you have obtained the approval of name from Registrar of Companies, the applicant is required to prepare and file the form No URC-1.

- Memorandum Of Association And Article Of Association

Formulate Memorandum of Association (MOA) and Articles of Association (AOA) and submit it to the Registrar of Companies. Once you have obtained approval of the company name, the Registrar of Companies issues the form URC-1.

The primary reason of conversion of LLP into Private Limited Company is the growth in business. LLP framework does not fit for venture capitalists or for private equity, also investors are more comfortable in investing in private limited company. For the purpose of FDI also, private limited companies are considered to be as the preferable choice over LLP. Hence, the conversion of LLP to private limited company can be a wise decision and shall be performed by taking all prescribed regulations into consideration.

Frequently Asked Questions

i. How to file the Conversion form in case of more than 7 partners in the LLP?

In case of more than 7 partners in the LLP at the time of conversion into Company then Company have to file Scan copy of Physically prepared MOA & AOA.

In above mentioned situation company have to file 1. URC-1 and 2. INC-32. No need of INC-33 and INC 34 in the above mentioned situations.

ii. Whether at the time of Conversion whether Latest deed shall be attached in the form URC-1?

As per Rules, at the time of Conversion LLP have to file “copies of the principal and all subsequent deeds including the latest deed” with the ROC in e-form URC-1

iii. Whether e-MOA & AOA can be file in case of MOA & AOA is signed by a person at a place outside of India?

In case of incorporation of a company where any of the subscribers of the MOA/AOA is signing at a place outside India, MOA & AOA shall be filled with INC 32 in the respective format as specified in Table A to J in Schedule I without filing form INC 33 and INC 34. (Means Physical attachment of MOA & AOA in e-form INC 32)

iv. How many DIN can be apply through SPICE Form?

Maximum 3 (Three) DIN can be apply through SPICE form.

If applicant want to incorporation Company with more than 3 Directors and more than 3 persons doesn’t have DIN. In such situation applicant have to incorporate Company with 3 Directors and have to appoint new directors later on after incorporation.

v. Whether there is need to file any separate form for PAN & TAN?

No need to file any separate form. Details in relation to Area Code and other details shall be mention in the form INC-32 itself and PAN & TAN shall be generate with Certificate of Incorporation.

Caution To Be Taken By Professionals in conversion of LLP into Company

There are various ways of converting a firm to a company, viz; slump sale, itemized sale, admitting the company as a partner, dissolution thereof and on dissolution, business being taken over by the company etc.,

In view of the choices available. Conversion should be made in a manner appropriate to a particular situation and in a way which is most beneficial.

1. Obtain engagement letter from subscriber: – As per certification in e-form SPICE i.e. INC-32, a professional declares that he has been engaged for the purpose of certification Therefore it is advisable to obtain an engagement letter.

2. Verification of original records pertaining to registered office: – As per certification in e-form Spice i.e. INC-32, a professional declares that he has verified all the particulars (including attachments) from original records.

3. Ensure all attachments are clear enough to read: – As per certification in e-form Spice i.e. INC-32, a professional declares that all attachments are completely and legibly attached.

4. Ensure registered office of the company is functioning for the business purposes of the company: As per certification in e-form Spice i.e. INC-32, a professional declares that he has personally visited the registered office.

Take a declaration to the effect that all the original documents have been handed over after incorporation. Since as per section 7(4) copies all documents/information as originally filed should be preserved at the registered office of the company, therefore a professional should take a declaration while handing over the incorporation documents.

5. MCA Circular 10/2014: – According to this circular ROC/RD in case of omission of material fact or submission of false/incomplete/ misleading information can after giving opportunity to explain refer the matter toe-governance division of MCA, which in turn may initiate proceedings under section 447 and/or ask the respective professional institute to take requisite disciplinary action.