SoftEx Form for Export of Software

In general exports refers to sending ‘goods and service’ to clients in foreign country that is outside territorial borders of India for reason of sale. Physical goods are exported by means of a physical port of shipping i.e. a sea port, airport or foreign post office and is monitored by Central Customs department.

When physical goods depart from India, the exporter is required to declare the value of goods exported. In India, this declaration by exporters is done in the GR Form or PP form together with invoice and other supporting documents. Of late, as part of simplification of process, the GR and PP form have been substituted by a form called ‘EDF’ (export declaration form) and SDF has been merged with the shipping bill. Further, the value of the goods exported must be accepted andcertified by the customs office, at the port of shipment. This is referred to as “valuation of export”. One time the valuation of export is finished, the value is accepted both by RBI and its authorized dealer i.e. the exporter’s bank). RBI then monitors, the payment of an equivalent value in exporter’s bank account. ‘Software’ exported on a media i.e. CD or DVD or magnetic on physical form are covered by the above two forms.

In case of any other type of software export, SOFTEX form must be filed by the exporter after the actual export of software has taken place. Hence, SOFTEX form is a post-facto authorisation.

Filing of Forms with RBI for Declaration of Export of Services

Depends upon case to case basis

- Filing of Forms with RBI for Declaration of Export of Services

- Business or Individual planning to export their software services.

- Purchase of Plan

- Expert Assigned

- Share the details as requested

- Preparation of Form and Filing with RBI

- Company Profile with 5 year Projected financial statements.

- Director's profile.

- Bank AD (Authorized dealer) code declaration.

- Address Proof ( lease deed/rent agreement etc.)

- Copy of MOA/AOA (if any)

- Board resolution for reg. with STPI( in case of company)

- IEC certificate.

- Copies of agreement with customer located outside India.

Software Technology Parks of India (STPI Registration)

The RBI had vide a Circular in September 2013, laid down a revised procedure for filing of SOFTEX making it mandatory for all exporters. The instruction takes precedence over a Notification from RBI in 2004 requiring the filing of SOFTEX only if the invoice value exceeded USD 25,000. To help exporting units who are not members of STPI scheme, abide by the regulatory requirement, the STPI started services for NON-STP units. This involves a simple registration process which then allows companies to file for STPI approvals for SOFTEX forms. Several companies who were earlier not required to file SOFTEX were unaware of the change and did not file the SOFTEX for export transactions.

What is included in "Software"?

Software is defined under the RBI regulations to mean any computer programme, database, drawing, design, audio/video signals, any information by whatever name called. The definition given is exhaustive and includes all kinds of software that may be shared in any medium other than in physical medium. It implies both Information Technology (IT) and Information Technology Enabled Services (ITES) exports.

'IT' covers both Software products including Software as a Service (SaaS) and Software services. Software services has a huge ambit to cover development, consulting, design, implementation, maintenance, reengineering of a Software or a Software product.

'ITeS' covers all those services that are delivered to clients across borders of India using an IT driven system and process over a telecom/internet link (include BPO, KPOs, Digitization, Call centres, Data processing etc.)

Who is required to file Softex?

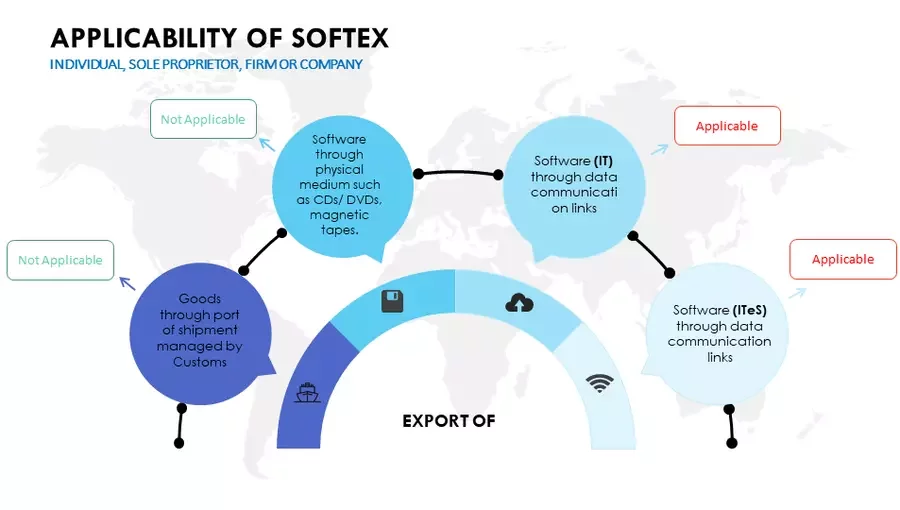

Simple answer is only those exporters whose exports are not goods or Software can escape the filing of SOFTEX.

Slightly absurd right? Unfortunately, that’s how wide the applicability is. Check it out:

Here's the issue- the above definitions might mean that freelancers working with overseas Companies may also need to file a Softexform.

TAXAJ Pro-tip:

If you're a freelancer or employed with a foreign company, check out our comprehensive guide on tax for freelancers.

In light of the above, it might be in your best interest to file a Softex form if you are in any way providing IT related goods or services and claiming the same as exports.

Software through physical medium:

Software exported in physical medium is treated as goods and declarations as applicable for goods will equally apply to such software exported in physical medium. This means that to these exporters, softex will not apply.

STP or SEZ

Exporters i.e., both IT and ITS registered under Software Technology Park (STP) and Special Economic Zone (SEZ) must file SOFTEX form with the STPI or SEZ Division.

Non-STP and Non-SEZ

However, Exporters of Software that are not registered in STP or SEZ or other Export Oriented Units (EOU) must also file SOFTEX, according to the foreign trade policy. Such exporters are commonly called non-STP units and can file the SOFTEX form with the concerned jurisdictional Director of Software Technology Parks of India (STPI). Exports of services that do not fall under IT and ITeS category are not liable to file the export declarations or the SOFTEX form.

Penalties for Non Filing of Softex

If a softex is not filed, the remittance received is treated as 'general services' and not as an export proceed which shall act detrimental to the business entities in claiming that they have previous export performance for participation in tenders related to software projects.

Another issue that might creep up in the future is the zero-rated GST supply. Exporters are allowed to export goods or services without payment of GST by filing a Letter of Undertaking. When the eventual linking of the RBI database and GST database does happen, this might cause a headache.

Further, entities engaged in exports are entitled to claim refund of the input GST paid on inputs and input services received for undertaking exports. In order to process these refund claims, the concerned tax authorities insist the business entities engaged in software exports to submit softex forms for the purpose of processing of such refund claims.

Worst case, banks have been known to freeze accounts in case Softex forms are not filled. However, this is in extreme cases where multiple reminders have been sent.

I haven't filed Softex, What Now?

We know what you are thinking - I've been exporting goods/ services for years and no one has asked for a softex form. Why now?

Here's the thing - we're not trying to scare you. Based on our discussions with banks and authorities, we have come to the conclusion that filing softex may be required in all export cases where IT or ITeS is involved.

Good part is - there are no monetary penalties for non-filing of softex at this point of time. This might change in the future though. What we've been seeing is that systems are getting stronger. There might be a time 2-3 years from now when the RBI starts sending notices to everyone who exports IT related goods or services for non-filing of softex. Makes sense to file your softex forms to ensure compliance so you don't have any headaches in the future.

How do I file SoftEx?

Simple answer? Contact TAXAJ Advisors!

More complicated answer? See below:

- Generate Softex number through the RBI facility

- Fill in the online Softex Form available on the STPI website not later than 30 davs from the date of invoice or date of last invoice raised in a month.

- Upload the filled Softex Form along with the Invoices, Contracts (if not pre-registered), Softex letter as generated from the RBI facility portal and the data com bill.

- Download the application copy of Softex Form.

- Digitally sign the Application copy and submit it for certification of the STPI officer.

- The certification process will be smooth and generally the values declared in the invoices issued towards software exports will be accepted and certified. Rejections are only in cases where there exists a doubt on genuineness of the export transaction undertaken.

- The copy of SOFTEX form duly certified by the designated authority of STPI/SEZ shall be submitted to the banker for the purpose of realization of export proceeds.

- The data submitted through SOFTEX forms shall be transmitted electronically from STPI/SEZs to RBI.

- The data received by RBI will be made available in The Export Data Processing and Monitoring System (EDPMS) portal through which the bankers can access the said information to match the inward remittance of export proceeds and accordingly bankers shall issue a Bank Realisation Certificate.

Too complex? Don't worry. We've got your back. Just contact us and our team of experts will help you sort things out.

Who can become a NON-STP unit under STPI and how?

- Any company / partnership firm / proprietorship which is into development of Export Oriented Computer Software / IT Enabled Services can register itself as NON-STP unit under STPI to avail SOFTEX certification.

- In order to become a NON-STP unit under STPI, the company has to register itself with STPI on submission of application form along with the supporting documents, to the jurisdictional Director, STPI along with applicable processing fee of Rs. 1,000/- (one thousand only) + GST in the form of demand draft in favor of the Director, STPI.

Is it mandatory for any IT / ITES companies who are into exports, to get registered as NON-STP unit under STPI?

- As per the prevailing RBI Master Circular No. RBI/2013-14/14 dated 1st July 2013 (Para B15), RBI Circular No.80 dated 15th February 2012 and RBI Circular No.43 dated 13th September 2013, any company who does IT / ITES exports through data communication links needs to submit the SOFTEX form for certification.

- For getting the SOFTEX certification by STPI (which is the Designated Authority), the companies have to become STP members by either registering under STP scheme or as NON-STP unit with STPI. Nevertheless, the companies registered under STP scheme will have other benefits apart from getting their Software Exports certified.

Once the Non-STP registered unit Letter of Permission (LoP) expires after 3 years, what is the procedure to be followed for renewal of LoP?

Letter of Permission for Non-STP registration is issued for the period of 3 years. During the last three months prior to the expiry of LoP, Non-STP registered unit should approach Director, STPI for renewal of LoP. There shall be no charges for renewal of LoP.

Once the company gets registered as Non-STP unit, what will be the procedure to certify the SOFTEX forms from STPI?

Non-STP units should register each of their export contracts prior to submission of SOFTEX against that contract. Unit also need to submit its projected imports during the next financial year as well as applicable STPI service charges.

What is the proof of Non-STP registration?

The company registered under STPI as Non-STP unit will be issued a Registration Certificate with a validity of 3 years by the respective jurisdictional STPI Director. Renewal of registration will have to be applied three months prior to the expiry of the registration.

Fee for Non-STPI Units:

STPI will collect service charges from Non-STPI units for certifying the SOFTEX forms. The service charges are collected in advance prior to registering of contracts and immediately after obtaining the registration. The amount of service charges payable are slab wise which shall be determined based on the value of contracts registered. In the event of non-certification of SOFTEX forms due to any reason (non-submission of required documents or cancellation of contract etc.,.), STPI will retain 20% of the service charges paid and the balance amount shall be refunded.

The service charges payable are mentioned as under:

S No | Export Turnover for the Year | Annual Services Charges (INR) |

1 | Upto 12.5 lakhs | INR 4,000 |

2 | Above 12.5 lakhs to 25 lakhs | INR 8,000 |

3 | Above 25 lakhs to 50 lakhs | INR 16,000 |

4 | Above 50 lakhs to 3 Cr | INR 55,000 |

5 | Above 3 Cr to 10 Cr | INR 1,10,000 |

6 | Above 10 Cr to 25 Cr | INR 2,25,000 |

7 | Above 25 Cr to 50 Cr | INR 2,50,000 |

8 | Above 50 Cr to 100 Cr | INR 3,50,000 |

9 | Above 100 Cr to 500 Cr | INR 5,75,000 |

10 | Above 500 Cr to 1000 Cr | INR 6,00,000 |

11 | Above 1000 Cr | INR 6,50,000 |

Interested in the history of SoftEx?

Exports generally means sending 'goods and service' to clients in foreign country (outside territorial borders of India) for purpose of sale. Physical goods are exported through a physical port of shipping la sea port, airport or foreign post office) monitored by Central customs department.

When physical goods leave borders, from any port of shipment, the exporter in India is required to declared value of goods in a form called 'EDF' (Export Declaration Form). The value so declared is required to be accepted and certified by the customs office, at the port of shipment. This process is called "valuation of export". Once the valuation of export is complete, the value so certified by the Customs Officer is accepted both by RBI and the exporter's bank that then monitors, the inward remittance of an equivalent value in foreign currency in exporter's bank account.

A 'Software' exported through a physical medium (CD/DVD, magnetic tapes etc.) has to pass through similar steps as when exported physically through a port of shipment, it is treated as physical goods.

In early 1990s, when Software Technology Park (STP) scheme came in to existence, the need to export Software through data communication links emerged. Customs department had difficulty in managing this, as nothing physical was visible in a Software transmitted through the telecom links.

DeitY (then Department of Electronics) thus enabled an innovation in government policy and could get RBI to announce SOFTEX form and STPI being the administrative authority of ST scheme, became the designated authority for "Software export valuation" and certification of softex form, in place of Customs. As on date the jurisdictional STPI Directors and SEZ Commissioners are the designated authority for softex valuation.

Thus the purpose with which softex form is introduced is to certify the value of software exports made by a software exporter. The only difference between certification of value for physical goods through the EDF and that for Software exports through the Softex is that EDFs are submitted and valued, simultaneous to the exports actually happening from port of shipment whereas, Softex form is a post-facto approval, after the actual export of Software has actually taken place.

Under the Foreign Trade Policy, Software (IT and ITeS) thus carries a special status in international trade equivalent to 'goods'.