Certification & Attestation by Chartered Accountant

The attestation of a Chartered Accountant on a certificate or any such document is of immense value since it usually signifies that the Chartered Accountant, in his professional opinion, has ensured that there is no misrepresentation by the entity issuing/submitting such a document. A prime example of this being an audit report issued by the auditor in respect of the financial statements of an entity stating the financial statements reflect a true and fair view of the state of affairs of the entity. It is because of this attestation or signature made by the Chartered Accountant that the investors and other stakeholders can rely on the performance of an entity.

Get the Certification & Attestations done

It usually takes 1 to 2 working days.

- Certifications & Attestations of documents.

- Any Individual or Business

- Purchase of plan

- Upload documents

- Verification of documents

- Attesting & Certifying

- Documents along with supporting that needs to be attested or certified.

Net Worth Certificate for Visa, Bank Loan from CA

Choose among the Certification you need

Here are the few popularly used certification service that you can choose from:

What is CA Certification Service?

“Certificate” is an official document which attests a fact. Certificate can be needed to attest any basic fact such as Date of Birth, Marriage, Death etc. or it can be required to attest any critical facts like Medical status of a person, Financial figures, Achievement in any course or training etc.

Every section of the society including individuals, partnerships, corporate entities, or business entities has an indispensable need of certification from Chartered Accountants under various statutes, rules, regulations, procedure in India and abroad.

This is considered to be one of the most comprehensive and essential services rendered.

Certification and Attestation can be carried out under various categories and there is no exhaustive list for that. However, following are few common areas where certificate from Chartered Accountant is mandatory :

- Certification under the Income Tax Act 1961

- Certificate under GST Law

- Certificate under Company Law

- Certification for LIC, passport, credit card, etc

- Documents for banking related requirement

- Net worth Certification

- Attestation and certification under various other laws

Apart from statutes, certificates from Chartered Accountants can be required by various other persons to authenticate correctness of facts such as Turnover certificate required in government tenders.

What are some popularly Issued certificates by a CA?

Following certificates are popularly issued:

1. Certificates which are issued on the basis of financial statements and books of accounts namely:

- Capital Contribution Certificate

- Gross Turnover Certificate

- Sundry Debtors Certificate

- Closing Stock Certificate

- Statutory Liabilities Certificate

2. Certificates which forms the basis of statutory records mandatory to be maintained under several laws such as the Companies Act 2013

3. Certificates under the ambit of merger and demerger

- Fair Value Certificate for Shares

- Buy-Back of Shares

- Allotment of Shares

- Transfer of Shares from Resident to Non-Resident and Vice Versa.

4. Form 15 CB is the certification issued under Income Tax Act, 1961 to determine liability of payer to deduct on TDS on payment made to non-residents.

5. Net worth Certificate. The major purpose of issuing this certificate being:

- For Bank Finances

- For Bank Guarantees

- Issuance for Visa

- Student Study Loan

- Some governmental tenders

6. Section 92 of the Income Tax Act 1961, requires a certification to determine arm’s length price of underlying transaction

7. Fund utilization or Grant utilization certificates are also required by the following clients:

- Non Governmental organizations

- Statutory bodies

- Autonomous bodies

- Charitable organizations

8. Deductions claimed under section 80IA, 80IB, 10A or 10B of the Income tax Act 1961 also requires certification to ensure that the concerned person complies with other requirements of statute

- Claim for refund under GST Act or other Indirect tax laws can be done only after it is certified by a chartered accountant.

- Exchange Control Legislation requires a certification for imports, ECB, EOU, DGFT, remittances, etc.

- Companies planning for initial public issue needs several certificates.

- Privilege and limitation certificates described under different laws and regulations.

- Transfer Pricing certificate.

- Certificate for different exemptions under federal tax regulations.

The above list is not all conclusive and exhaustive. TAXAJ has been undertaking certification work with an aim to fulfill the several needs of the client efficiently. We understand thoroughly that the certificate issued by us forms a basis to you for various laws and regulation compliance, enjoying claims, deductions and benefits, and various transactions of day to day business activities.

Thus we see to it that the certificate issued by us is true and fair to the best of our knowledge and forms the best advice and gives a conversant representation in front of various authorities.

Introduction

Introduction

It is being observed that certain unscrupulous individuals are forging signatures while posing as Chartered Accountants to issue certificates and other such documents with the intent of misleading the authorities. In view of the above, the Institute of Chartered Accountants of India (ICAI), has developed a method of securing the documents issued by a Chartered Accountant by issuing a Unique Document Identification Number (UDIN). The official announcement is available on the ICAI website.

What is UDIN?

What is UDIN?

It is a unique number generated on the UDIN portal for every certificate and other such documents that have been attested by a Chartered Accountant who’ve registered themselves on the portal.

How to Register on the UDIN portal?

How to Register on the UDIN portal?

Full time Practicing Chartered Accountants (CAs with COP) need to first register themselves on the UDIN portal in order to generate the UDIN for every document that is to be attested.

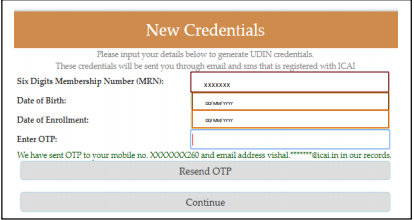

Step 1: Go to the following link: https://udin.icai.org/?mode=myicai

Step 2: Click on first-time users and enter the six-digit membership number, date of birth and date of enrolment and click on the button ‘Send OTP’.

Step 3: Enter the OTP as received on the mobile number and e-mail address registered with ICAI and click on ‘Continue’. The system-generated login credentials for the UDIN portal will be sent on the e-mail address registered with ICAI.

How to generate UDIN for a document?

The following steps need to be followed after registering on the UDIN portal:

Step 1: Go to the following link: https://udin.icai.org/?mode=myicai Log in using the credentials received on the e-mail address registered with ICAI.

Note: The password for the UDIN portal can be changed at any time. It is recommended to do so after the first login.

Step 2: Click on ‘Generate UDIN’.

Step 3: Enter the required details such as Membership Registration Number, Name, E-mail ID, Firm Registration Number, Firm Name, Client Reference Code / Number, Document Description, Date of Document, Keywords and values and click on ‘Send OTP’. The ‘keyword’ as mentioned above implies any keyword and its corresponding value / amount as contained in the document for which the UDIN is generated. For example, if the Chartered Accountant is certifying the turnover of an entity, one of the keywords could be ‘Turnover’ along with the corresponding turnover amount as its value. Note that at least 3 keywords and their corresponding values need to be provided for a document. The maximum number of keywords that can be given are 5.

Step 4: The OTP will be sent on the e-mail address and mobile number registered with ICAI. After entering the OTP, a preview of the details entered will be available for verification. In case there are any changes in the details, press ‘Back’, else click on ‘Submit’.

Note that once the data is submitted, it cannot be deleted or modified. Therefore it is advised that all the entered details should be carefully checked before submission.

Step 5: The UDIN will now be generated. Such UDIN may be used on the document by mentioning it using a pen or as a watermark on the document.

What is the format of UDIN?

What is the format of UDIN?

The UDIN would be a 15 digit number generated in the following format:

- The first 6 digits would be the Membership Registration Number of the Chartered Accountant.

- The next 6 digits would be the date of issuance of certificate in dd/mm/yy format and

- The last 3 digits would be the serial number of the document as generated by the UDIN portal.

X X X X X X / X X X X X X / X X X Membership no. / d d m m y y / Sl. No.

Verification of Documents using UDIN

Verification of Documents using UDIN

As discussed earlier, the UDIN is an initiative taken by ICAI in an effort to curb misrepresentation by third persons posing as Chartered Accountants who forge signatures on documents to mislead authorities.

With the UDIN, the respective authorities such as banks, RBI, Income Tax Department, etc. can check the validity of the documents issued by the Chartered Accountant. Since the UDIN can be generated by the Chartered Accountants only via the UDIN portal, the validity of the attested document can be checked by using its UDIN. The document can also be found by using the Firm Registration Number (FRN), Client Reference Code, Date of Document, etc. through the UDIN portal.

Major Types of Certificates to be issued by Chartered Accountants:

| S. No. | Type of Certificates to be registered at UDIN Portal |

| 1 | Certificates issued on the basis of Financial books of accounts and annual financial statements-Capital Contribution Certificate/net worth certificate |

| 2 | Certificates issued on the basis of Financial books of accounts and annual financial statements – Turnover Certificate |

| 3 | Certificates issued on the basis of Financial books of accounts and annual financial statements -Working Capital Certificate/ Net Working Capital Certificate |

| 4 | Certificates issued on the basis of Statutory records being maintained under Indian Companies Act, 2013 and applicable provisions |

| 5 | Certification of Fair Values of Shares of Company for the scope of merger/ de-merger, Buy Back, Allotment of further shares and transfer of shares from resident to non-resident. |

| 6 | Certificates for Foreign Remittance outside India in form 15CB. |

| 7 | Net worth Certificates for Bank finances |

| 8 | Net worth Certificates for Bank Guarantee |

| 9 | Net worth Certificates for Student Study Loan |

| 10 | Net worth Certificates for Issuance of Visa by Foreign Embassy |

| 11 | Certificate in respect of Liquid Asset under Section 45-IB of RBI Act, 1945 |

| 12 | Certification of arms length price u/s 92 of the income Tax Act, 1961. |

| 13 | Certificates for funds/ Grants utilisation for NGO’s |

| 14 | Certificates for funds/ Grants utilisation for Statutory Authority |

| 15 | Certificates for funds/ Grants utilisation |

| Under FERA/FEMA/other Laws | |

| 16 | Certificates for funds/ Grants utilisation |

| Charitable trust/institution | |

| 17 | Certification under the Income-Tax laws for various Deductions, etc. |

| 18 | Certification for claim of refund under GST Act and other Indirect Taxes. |

| 19 | Certification under Exchange Control legislation for imports, remittances, ECB,DGFT,EOU, etc |

| 20 | Certificates in relation to initial Public Issue/ compliances under ICDR and LODR. |

| 21 | Certificate issued by Statutory Auditors of Banks |

| 22 | Certificate issued by Statutory Auditors of Insurance Companies |

| 23 | Additional Certification by Concurrent Auditors of Banks not forming part of the concurrent audit assignment |

| 24 | Certificate of Short Sale of securities issued by Concurrent Auditors of Treasury Department of Banks |

| 25 | Certificate of physical verification of securities issued by Concurrent Auditors of Treasury Department of Banks |

| 26 | Certificate issued for KYC purpose to banks confirming sole proprietorship |

| 27 | Certificate Regarding Sources of Income |

| 28 | Certificates for Claiming Deductions and Exemptions under various Rules and Regulations |

| 29 | Certificates issued under LLP Act |

| 30 | RBI Statutory Auditor Certificate for NBFCs |

| 31 | Certificate issued under RERA |

| 32 | Others |