Form DPT-3 MCA - Return of Deposits

MCA vide its notification dated 22nd January 2019 notified that every company other than a government company must file a one time return in DPT 3. It is also required to be filed annually. Accordingly, a sub-rule (3) was inserted after sub-rule (2) in Rule 16A of the Companies (Acceptance of Deposits) Rules, 2014 which reads as follows:

Every company other than Government company shall file a onetime return of outstanding receipt of money or loan by a company but not considered as deposits, in terms of clause (c) of sub-rule 1 of rule 2 from the 01st April, 2014 to 31st March, 2019, as specified in Form DPT-3 within “ninety days from 31st March, 2019” along with a fee as provided in the Companies (Registration Offices and Fees) Rules, 2014.

*The said time period was then amended by issue of General Circular No.05/2019 which stated that the additional fee will be levied after 30 days from the deployment of the form DPT -3 on MCA 21 portal. Therefore, the revised due date was 31st of May 2019. Since then the form must be filed annually.

While filing Form DPT-3 for your company, you will need to adhere to a few procedures in accordance to the Government. TAXAJ experts will help you in the same.

It Usually takes 2 to 4 working days.

- Drafting of Documentation

- Filing of Form DPT-3 - Return of Deposits

- Companies that want to comply to law by filing Form DPT-3 - Return of Deposits

- Purchase the plan

- Provide details required for filing form such as Loan Details

- Get secretarial services to draft various documents such as disclosure, resolutions, etc

- TAXAJ files Form DPT-3 - Return of Deposits on your behalf

Statement & Proof of Loan Taken i.e Secured or Unsecured

Registration Certificate (Certificate of registration by RBI/ other regulators (applicable to NBFC)

Why should you not miss this compliance?

All About Form DPT-3 - Return of Deposits

Meaning of Form DPT-3

DPT–3 form is the statement return which is required to be filed by every company other than a government company which has accepted deposits as per the definition mentioned in section 73 and rules made thereunder. Generally, every amount accepted from public (including members) is treated as public deposits.

DPT–3 form is filed in terms of rule 16 of Companies (Acceptance of deposit) rules.

DPT 3 Applicability

All Public, Private Limited companies and One Person Company meeting any of the below criteria must file form DPT-3.

- Onetime Return for disclosure of details of outstanding money or loan received by a company but not considered as deposits in terms of rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014.

- Return of Deposit

- Particulars of transactions by a company not considered as deposit as per rule 2 (I) (c) of the Companies (Acceptance of Deposit) Rules, 2014.

- Return of Deposit and Particulars of transactions by a company not considered as deposit

One-time DPT–3 form - New

As said above, the DPT–3 form is only required to be filed by the companies who have accepted deposits. However, in January, 2019, the Ministry of Affairs (MCA) has issued a notification and inserted another rule, 16A.

As per the rule, 16A, every company (other than Government Company) has to file a ONE TIME RETURN for transactions which are not considered as deposits. Hence, doesn’t matter if you are a small company or one person company, filing of DPT 3 form is mandatory.

DPT-3 Annual Return / One Time Return

Amounts Received by Company considered as Outstanding Loan

(i) Amount Received from Central/ State Government

If the company receives any amount from the Central government or the state government during the financial year, the company must consider such amounts as outstanding loans and not deposits. Below are the different types of amount receipts (a)Any amount received from the Central Government or a State Government (b)Any amount received from any other source whose repayment is guaranteed by the Central Government or a State Government (c)Any amount received from a local authority (d)Any amount received from a statutory authority constituted under an Act of Parliament or a State Legislature.

(ii) Amount received from Foreign Governments

If a company receives any foreign amount, the company must consider such receipts as an outstanding loan. Listed below are the different types of foreign amounts

(a) Any amount received from foreign Governments.

(b) Any amount received from foreign or international banks, multilateral financial institutions.

(c) Any amount received from foreign Governments owned development financial institutions.

(d) Any amount received from foreign export credit agencies, foreign collaborators, foreign bodies, corporate and foreign citizens,

(e) Any amount received from foreign authorities or a person resident outside India subject to the provisions of the Foreign Exchange Management Act, 1999.

(iii) Amount Received from Bank

If a company receives an amount as a loan from the bank, the company must consider such amounts as an outstanding loan. Below is a list of different receipts from banks (a)Any amount received as a loan or facility from any banking company (b)Amount received from the State Bank of India or any of its subsidiary banks. (c)Amount received from a banking institution. (d)Amount received from a corresponding new bank. (e)Amount received from a co-operative bank.

(iv) Amount received from Public Financial Institutions

If a company receives a loan from Public Financial Institutions during the financial year, the company must consider such amounts as an outstanding loan. Below we shall see in detail the type of amounts received from Public Financial Institutions (a)Any amount received as a loan or financial assistance from Public Financial Institutions notified by the Central Government on this behalf in consultation with the Reserve Bank of India (b)Any amount received from regional financial institutions (c)Any amount received from Insurance Companies (d)Any amount received from Scheduled Banks.

(v) Amount received against the issue of commercial paper

Following are the different types of amounts that a company has to consider as an outstanding loan.

(a) Any amount received against the issue of commercial paper

(b) Any amount received against any other instruments issued under the guidelines or notification issued by the Reserve Bank of India.

(vi) Amount received from other company

If a company has received any amount from some other company in the financial year, such amounts are outstanding loans.

(vii) Amount received towards a subscription to any securities

If a company receives any amount towards share application money or other securities, such amounts are outstanding loans. Below are different types of amounts receipts for securities

(a)Any amount received towards a subscription to any securities inclusive of share application money. (b)Advance towards allotment of securities pending allotment

(viii) Amount received from the director of the Private company

A company may receive an amount from the company director, in which case such an amount is considered an outstanding loan. Therefore, the company must disclose such amounts in the board’s report. However, there is a condition for this amount to be considered an outstanding loan. The condition is that the director of the private company or relative of the director furnishes a declaration in writing that the amount is not given out of funds acquired by him by borrowing or accepting loans or deposits from others. Also, he has to furnish this declaration at the time of giving money to the company.

(ix) Amount raised by the issue of bonds or debentures

Any amount raised by the issue of bonds or debentures secured by a first charge or a charge ranking pari passu with the first charge on any assets referred to in Schedule III of the Act excluding intangible assets of the company or bonds or debentures compulsorily convertible into shares of the company within 6[Ten years]: Provided that if such bonds or debentures are secured by the charge of any assets referred to in Schedule III of the Act, excluding intangible assets, the amount of such bonds or debentures shall not exceed the market value of such assets as assessed by a registered valuer.

(x) Amount received from an employee of the company

If the company receives any amount from an employee of the company, it must satisfy the following conditions to consider it an outstanding amount. (a) The amount must not exceed his annual salary (b)Amount is like a non-interest bearing security deposit.

(xi) Non-interest bearing amount received & held in trust

If a company receives any non-interest bearing amount and holds it in the trust, it must consider such amounts as an outstanding loan.

(xii) Amount received as advance for the supply of goods and services

During business, a company receives different amounts in advance for the supply of goods and services. Below are certain conditions when a company must consider the amount as an outstanding loan.

Any amount received as advance for the business of the company

(a) The Supplier or Seller must appropriate the supply of goods or services against the supply of goods or provision of services within 365 days from the advance receipt date.

(b) For the supply of goods or services must be appropriated against the supply of goods or provision of services concerning legal proceedings, the time limit of 365 days is not applicable.

(c) In consideration for an immovable property under an agreement or arrangement is adjusted against such property.

(d)As a security deposit for the performance of the contract for the supply of goods or provision of services.

(e) For long-term projects for the supply of capital goods.

(f) In consideration for providing future services in the form of a warranty or maintenance contract such that services do not exceed five years from the date of receipt of the amount.

(g) as an advance received and as allowed by any sectoral regulator or following Central or State Government;

(h)For subscription towards publication in print or in electronic mode to be adjusted against receipt of such publications.

(xiii) Amount brought in by the promoters of the company by way of an unsecured loan

Any amount brought in by the promoters of the company by way of an unsecured loan is subject to fulfilment of the following conditions, namely: (a) the loan is brought in pursuance of the stipulation imposed by the lending institutions on the promoters to contribute such finance; (b) the promoters or their relatives or both providing loan (c) the exemption under this sub-clause shall be available only till the loans of the financial institution or a bank are repaid and not after that;

(xiv) Amount accepted by a Nidhi company

If you are a Nidhi company whose core business is borrowing and lending money between its members, then any amount accepted by you is an outstanding loan. Now, you know what the amounts that a company has to consider as an outstanding loan are.

Companies NOT required filing the form DPT–3

There are certain companies which are not required to file the Form DPT–3. The list of the companies is as follows;

- Banking companies;

- Non-Banking Finance Companies (NBFC)

- A housing finance company

- Others as notified.

The above companies are not required to file because the new rule gets power from section 73, and the above exemptions are provided in section 73 itself.

Due Date of filing the form DPT-3

The due date for filing of form DPT–3 has been extended to 30th June Every Year. However, it is advised to file the form well before it to avoid the high-pressure time.

Whether companies with zero transaction are required to file the DPT-3 form?

Ideally, the answer is no. The companies with zero transactions are not required to file the form DPT–3 because the rule 16A applies to companies which have received the money not recognised as deposits.

However, to be on a safer side, it is advised to file the form with zero figures.

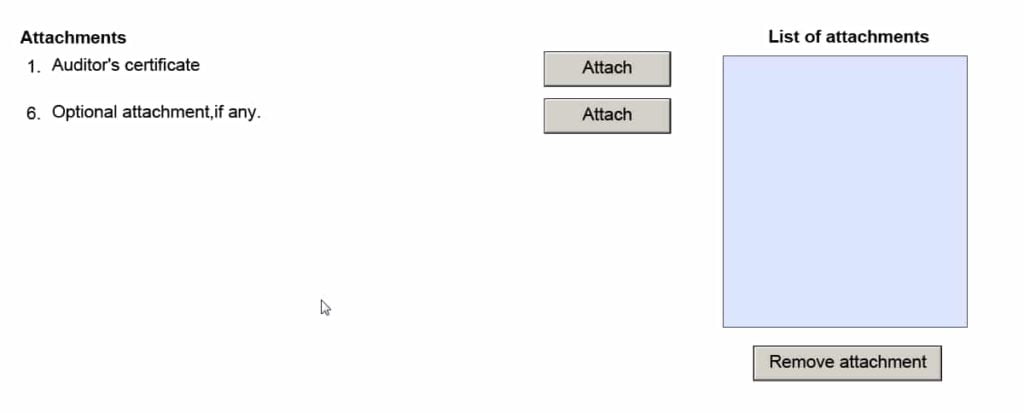

Documents to be submitted with Form DPT-3

Here are the following attachments required with the DPT–3 form;

- Auditors certificate

- Copy of Trust deed

- Deposit Insurance contract, wherever applicable and mentioned in the form

- Copy of instrument creating the charge

- List of depositors – List of deposits matured and cheque issued but not yet cleared to be shown separately

- Details of liquid assets

- Optional attachment

Procedure for Filing the One-Time DPT–3 Form

You can download the DPT3 form from the MCA website via DPT-3 download

After downloading the form, you may follow the below steps on how to fill DPT 3 form.

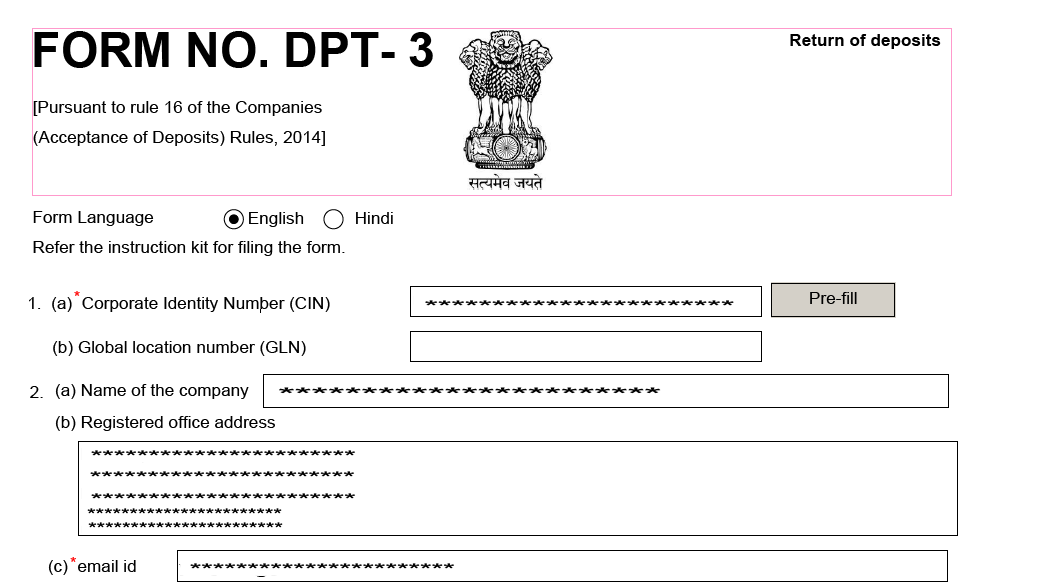

(1) Firstly, enter the Valid CIN of the company. You may find CIN by entering the company’s existing registration number or name on the MCA website. (www.mca.gov.in )

(2) Click on Pre-fill to auto-populate the other details of the company.

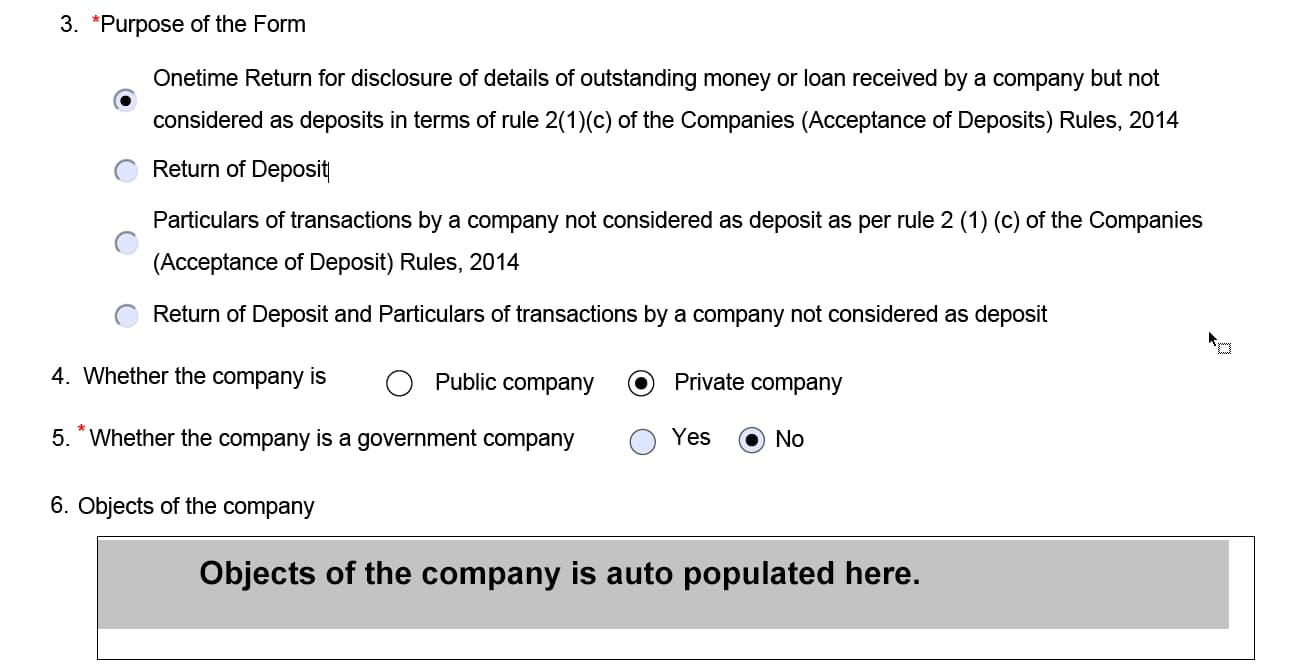

(3)(a)If you are filing DPT 3 Annual Return for an outstanding loan, click on the 3rd option- Particulars of transactions by a company not considered as deposit as per rule 2(1) (c). And disclose the outstanding loan to date.

OR

If you are filing the DPT 3 One Time Return, click on the 1st option, Onetime Return, as the purpose of the form and disclose the outstanding loan to date.

(4)Select the type of company as shown below.

(5)Confirm if you are a government company or not.

(6)The company’s Objects is auto-populated in the box as per the details given by you to ROC at the time of incorporating a company.

(8) Net worth of the company as of 31st Mar 2021 while filing DPT 3 for FY 2020-21.

DPT-3 Net worth Calculation

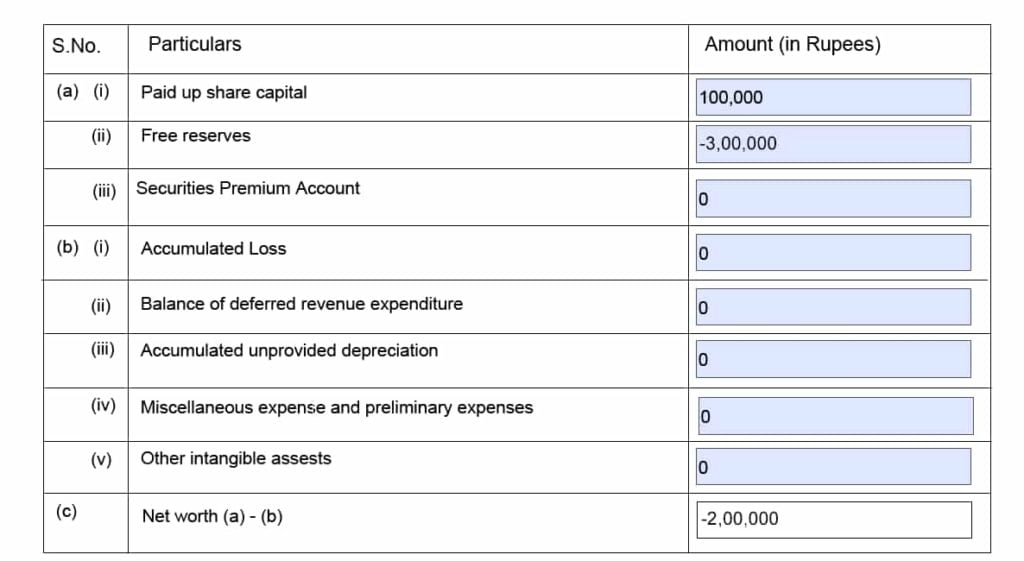

You may provide the Net worth amount as per the latest audited balance sheet prior to the filing of DPT-3.

Let’s assume we are calculating the DPT3 net worth for FY 2021-22. If the latest audited balance sheet is for FY 2020-21 then you can consider the net worth amount of FY 2020-21.

However, to calculate the outstanding loan amount for FY 2021-22, you must consider the company’s outstanding amount as on 31st March 2022.

In the below eform, Fill in the fields that apply to your company. For example, we have taken Paid up share capital as 1,00,000 and Free reserves -3,00,0000 (Reserves & Surplus amount in balance sheet). Net worth="-2,00,0000

Note: Net worth & Free Reserves amount shows a negative figure because the company has taken a loan.

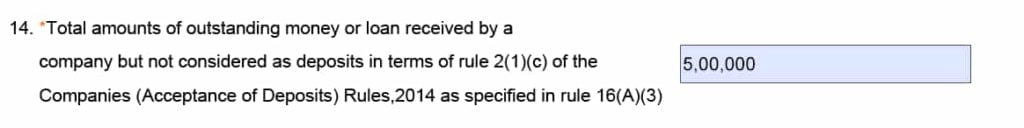

(14) Enter the total amount of secured and unsecured loans in this field

Attachments In DPT 3

It is not mandatory to attach Auditor’s report for a company having only an outstanding loan or money.

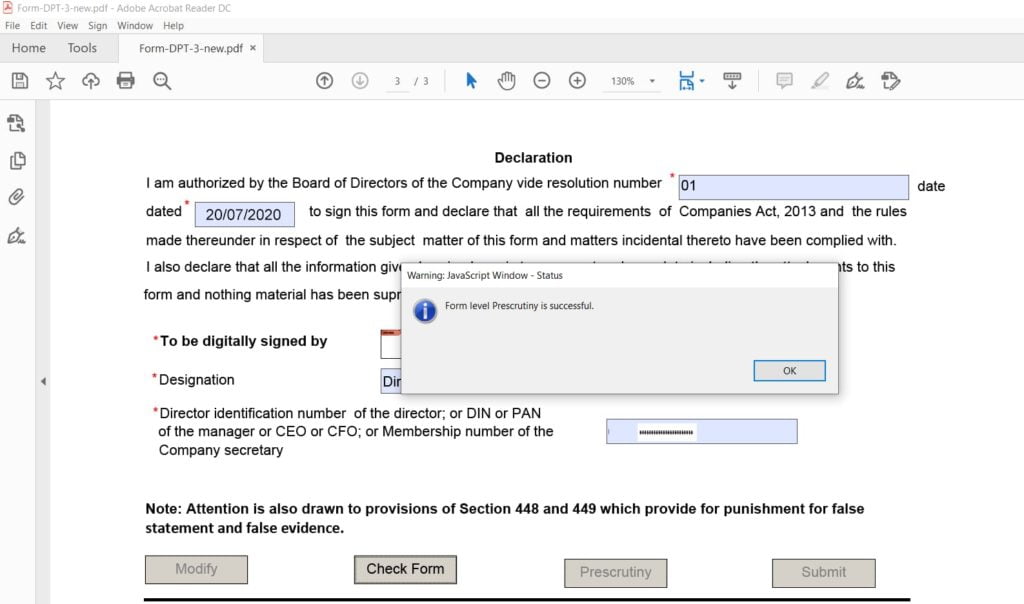

Declaration

(1) Mention the board resolution number and date of resolution authorising the person who can file DPT 3 on behalf of the company. [ See the sample Board Resolution for filing DPT 3 in the link]

Board Resolution For Filing DPT-3

(IN COMPANY LETTERHEAD)

EXTRACT OF THE RESOLUTION PASSED IN THE MEETING OF THE BOARD OF DIRECTORS OF ABC PRIVATE LIMITED HELD ON MONDAY, THE 20TH JULY 2021 AT 11.00 AM AT OFFICE OF THE COMPANY AT * (enter the address of the company)

BOARD RESOLUTION FOR FILING FORM DPT-3

“RESOLVED THAT approval of the Board be and is hereby accorded to severally authorise the (Designation of authorised person) to digitally sign and file the form DPT-3 as per the requirements of the Companies Act, 2013.

RESOLVED FURTHER THAT(enter authorised person name), (Designation of authorised person) of the company, be and is hereby authorised and shall always be deemed to have been authorised to undertake all such acts and deeds, including but not limited to the signing of Application, Forms, Resolutions, Deeds etc. in this regard and also issue of power of attorney in favour of any other person enabling such other person to appear before the various authorities under the aforesaid law in the matters of registration and the matters incidental thereto.”

CERTIFIED TRUE COPY

FOR ABC PRIVATE LIMITED

******************************

(Enter Director Name)

MANAGING DIRECTOR

******************************

(Enter Director Name)

WHOLE-TIME DIRECTOR

DATE: 19/11/2020

PLACE : *********

(2)Digitally sign the DPT 3 e-form. Director/ Manager/ CEO/ CFO/ Company Secretary can digitally sign this form.

(3)Update the DIN of Director/ PAN of manager/ CEO/ CFO/ Membership number of the company secretary.

(4)Pre-scrutiny Click on Check Form. If any fields are incomplete in the form, it will show an error message. If you do not get any error messages, then click on Pre-scrutiny. You must get the message Pre-scrutiny Successful.

(5) Once Prescrutiny is successful, your eform is ready to upload.

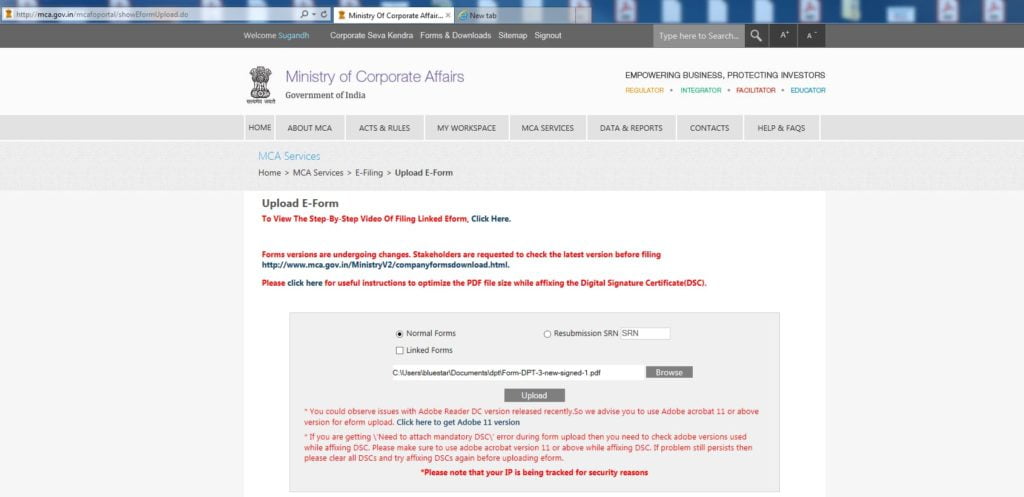

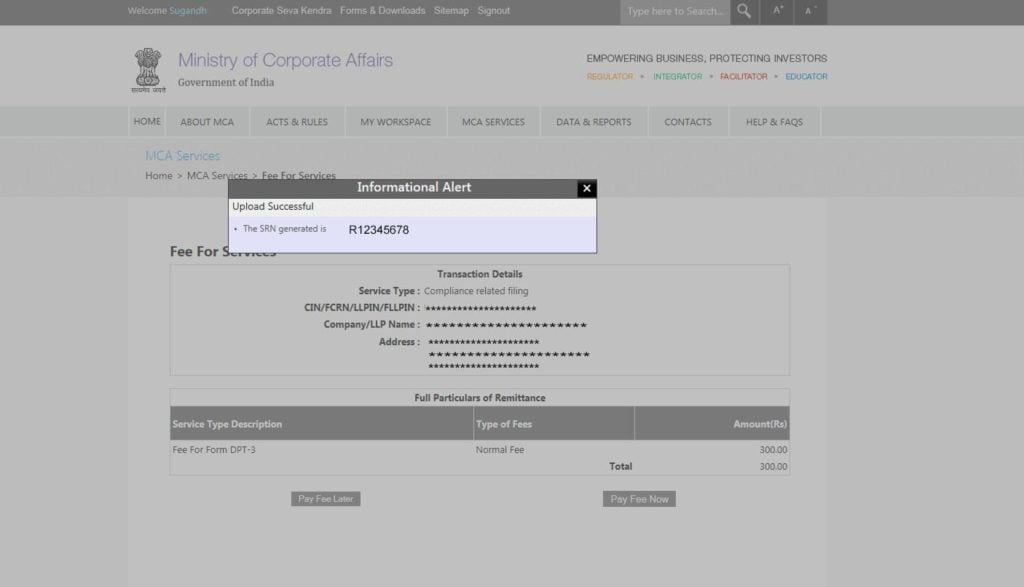

(6) DPT 3 E-Form MCA Upload

(1) Log in to the MCA website. Then Go to the E form upload and upload the eform.

(2)SRN generation After uploading successfully, SRN generates. Take note of the SRN.

(3) Click on Pay later / Pay Now option to pay the government fees.

Tip: We suggest using the Pay Later option to retry payments if there is an error while paying the fees. Furthermore, we have noticed that usually, on the last date of filing, the online payment is not successful when we use the Pay Now option.

Transactions not considered as deposits

- Any amount received from the government or guaranteed by the government, foreign government/foreign Bank.

- Any amount received as a loan or facility from any Public Financial Institutions, Insurance Companies or Banks

- Any amount received from a company by a company.

- Subscription to securities and call in advance.

- Any amount received from the director of the company or a relative of the director of the Private company, who held the positions at the time of lending.

- Any amount received by the company from an employee.

- Any amount received in the course of, or for the purposes of, the business of the company as an advance for the supply of goods or provision of services or as a security deposit for the performance of the contract for the supply of goods or provision of services.

- Unsecured loans from promoters.

- Any other amount which is not considered as a deposit under Rule 2(1)(c).

Hence any amount whether secured or unsecured and which is outstanding money or loan not considered as deposits must be reported.

DPT 3 Notification

Every company must file DPT 3 Annual Return or One Time Return annually. As per MCA DPT 3 Notification on 22nd Jan 2019, every company must file One Time Return for outstanding loans as of Mar 2019. Before this notification, only companies who accept deposits were to file deposits in eform DPT3 annually. However, as per the Companies (Acceptance of Deposits) Amendment Rules, 2019, Every company must file DPT 3 for outstanding loans annually. Accordingly, the due date to file DPT 3 Annual return is June 30th of every year. But, this year, due to the COVID-19 pandemic, the MCA has provided relaxation concerning compliance by companies. DPT 3 Form Last date is 31st Aug 2021. So, the companies need not pay any penalty if they file DPT 3 before 31st Aug 2021.

DPT 3 Rules MCA Extract

As per rule 16(A)Companies (Acceptance of Deposits) Rules, 2014, “Every company other than Government company shall file a onetime return of outstanding receipt of money or loan by a company but not considered as deposits, in terms of clause (c) of sub-rule 1 of rule 2 from the 01st April 2014 to the date of publication of this notification in the Official Gazette, as specified in DPT 3 Form within ninety days from the date of said publication of this notification along with fee as provided in the Companies (Registration Offices and Fees) Rules, 2014”.

Consequences of Non-Filing

If the company does not adhere to the requirements of DPT 3 and keeps accepting deposits then it will face the following consequences

Under Section 73

A penalty of minimum 1 crore or twice the amount of deposits whichever is lower, which may extend to Rs. 10 crore

For every officer who is in default imprisonment up to 7 years and with a fine not less than Rs. 25 lakhs which may extend to Rs. 2 crores.

Under Rule 21

On the company and every officer in default a fine which may extend up to Rs. 5000, and where the contravention is a continuing one, a fine of Rs. 500 for every day since the default.