Issue of Shares in a Company : Equity & Preference

The issue of shares is the procedure in which enterprises allocate new shares to the shareholders. Shareholders can be either corporates or individuals. The enterprise follows the rules stipulated by Companies Act 2013 while circulating the shares. The Issue of Prospectus, Receiving Applications, Allocation of Shares are 3 key fundamental steps of the process of issuing the shares.

A noticeable feature of the company’s capital is that the amount on its shares can be progressively collected in simple instalments that are spread over a time frame relying upon its enhancing financial obligation. The 1st instalment is collected with the application and is hence, called as application money, the 2nd is on allocation (termed as allocation or allotment of money), and the 3rd instalment is known as a 1st call, 2nd call and so on. The word-final is suffixed to the final instalment. This procedure, in no way, prevents an enterprise from calling the entire amount on shares during the period of application.

It Usually takes 3 to 5 working days (depends on MCA approval)

Every company in which share capital is involved.

- Purchase the plan

- Upload documents on vault

- Verifying your documents

- Preparing the share certificates

- Payment of Stamp Duty

- Filing of Forms with ROC

- Acknowledgement is generated

Name, Contact Number and Email Id of DIN Holder.

Directors Identification Number.

Self Attested PAN, Aadhar & Passport size photo of DIN Holder.

Share holding pattern

DSC of the Authorised Director. Buy here

Issue of Further Shares in a Company Explained

All About Right Issue of Shares

Bonus Equity Shares as per Companies Act 2013

What are the Steps involved in Issue of Shares?

What are the Steps involved in Issue of Shares?

The process of issues of shares is primarily divided into three significant steps, which are:

Prospectus Issue

This is the first step of the Issue of Shares wherein an enterprise releases a prospectus to the public. It contains the details that a new enterprise has come into being and that it would require funds from the public to operate, for which the public can purchase shares of that particular enterprise.

The prospectus has all the necessary details of that share issuing authority along with details pertaining to how they will collect money from investors.

Application Receipt

The second step in share issuing is the receipt of application as and when an investor wishes to purchase a share of that asset or enterprise. However, they have to follow the necessary rules and regulations as cited in the prospectus issued earlier.

They also have to deposit the amount against shares they are willing to purchase. The money has to be deposited to any scheduled bank along with the application.

Share Allocation

This is the last step in issues of shares wherein after completing the formalities from the investor’s side, the enterprise will issue the shares to the investors. As there is a minimum subscription limit, one has to wait till that quota is fulfilled.

Once that limit is fulfilled, the shares will be allocated to those investors who have subscribed for the capital shares. A letter of allotment is also sent out to those who have been allocated with shares.

Therefore, this process makes up for an authentic way of trading shares between investors and enterprises.

The main reason for issuing new shares by the company is to raise money to finance the business. The following are some of the examples where an Allotment of Shares may be considered.

A number of shares will usually be issued when the company is established. With the help of a share issue, the company will be able to trade, along with any money that the company may borrow.

Allotment of Shares is considered when the company requires new funds to grow the business organically. There are various factors that influence how many shares to issue.

In order to repay all or some of the company’s borrowing, shares can be issued.

Shares can be issued to fund the purchase of another company, which means raising cash from a share issue and using that cash to acquire the new business.

Shares can also be issued to continue trading after a particularly difficult period, to repair a damaged balance sheet or in case of problems across an industry or part of a wider downturn in the whole economy.

The company can make a capitalization Issue of Shares to existing shareholders. Rather than the shareholders needing to pay for the shares themselves, the company uses its own money to fund the allotment. This generally has the effect of reducing the value of the shares in issue, which may, in turn, make them more merchantable to investors.

If shareholders prefer not to receive a cash dividend, the company may offer them a ‘scrip’ dividend instead by allotting shares of the same value as the cash dividend. This is often popular among companies because issuing shares as a dividend does not impact cash flow in the way a cash dividend does.

In case a director or employee of the company takes on a share option after being permitted by the company, the company may acquire shares.

The company may consider allotting the shares in case a new director or senior employee joins the business or an existing employee becomes a director. This can demonstrate the commitment of an employee or a new director to the business, and they will have a clear interest in the company’s success. The shares would either be passed to the employee or new director through a transfer from existing shareholders or by a new Allotment of Shares.

What are the Different Classes of Shares?

What are the Different Classes of Shares?

The types of issues of shares are usually set by a company or enterprise that is issuing its share to the public. This division is generally set to keep a limitation to all rights being conferred to those shareholders. For instance, the right to vote and the amount of dividend they will receive when there is a profit incurred by an enterprise whose share is out for sale is decided on the basis of such divisions.

The division is made in the following two types -

Ordinary Share: This is the most common type of share issued by an enterprise that grants voting rights to the shareholders.

Deferred Share: These shares grant fewer rights than common shares, wherein dividends are paid only after a certain period of time and various other constraints.

Redeemable Share: As the name suggests, these shares might be bought back by an enterprise that sold them for the first time from the shareholders.

Non-voting Share: These shares do not permit any voting rights to their shareholders. Meaning that the shareholders are not able to partake in any executive decision regarding that organization. However, they are part owners of the enterprise.

Preference Share: These shares grant a prefixed amount of dividend to its shareholders. They do not enjoy voting rights, though they receive a dividend before any other shareholder.

Management Share: The shareholders are granted special voting rights when they hold management shares. Herein, for every share that a shareholder holds, they are permitted to exercise two votes.

Alphabet Share: These types of shares are a subcategory of common shares, wherein management divides the shareholders into multiple classes, all these classes are granted different voting rights.

What are Equity Shares?

What are Equity Shares?

Equity shares are issues of shares that are purely meant for ownership. It is entirely opposite to preference shares and does not provide any preference rights to shareholders during the distribution of dividends. However, these shareholders have voting rights.

The Process for Issue and Allotment of Shares

The following steps are involved in the process for the issue and Allotment of Shares.

Step 1: Board resolution

Step 2: Passing of special or ordinary resolution

Step 3: Filing of necessary forms

Step 4: Approval of the ROC

For more information on shares and their types, check out our online learning programmes. There are several high-quality study materials for your understanding. All of the study materials are prepared by subject experts to provide you with a clear understanding of every concept. So, avail of them now and ace your exam preparation.

Nature and Classes of Shares

Nature and Classes of Shares

A share of a company is one of the units into which the capital of a company is divided. So if the total capital of a company is 5 lakhs, and such capital is divided into 5000 units of Rs 100/- each, then this one unit of amount 100 is a share of the company.

Thus a share is the basis of ownership of the company. And the person who holds such shares and is thus a member of the company is known as a shareholder.

Now the Articles of Association will contain some essential information about shares and share capital, like the classes of shares to be prescribed. In all, there are two types of shares a company can allot according to the Companies Act 2013. They have different natures, rights, and obligations.

What is Minimum Subscription?

This is a minimum amount that must be raised when the shares are offered to the public during the issue of shares. This minimum subscription is generally set by the Board of directors, but it cannot be less than 90% of the issued capital.

So at least 90% of the issued capital must receive subscriptions or the offer will be said to have failed. In such a case the application money received thus far must be returned within the prescribed time limit.

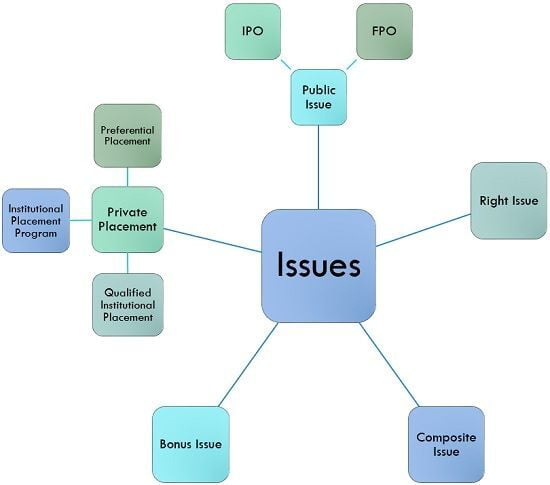

What are the different options to Issue Shares?

Public Issuance of Shares

Public issue is an issue where shares or convertible securities are issued by company in primary market with the help of its promoters. Under this type of issue, shares are offered to general public for raising the needed funds by enterprise. Companies issues a prospectus for attracting investors and those who are willing to subscribe for shares are required to make an application to company. Company after receiving applications then finally issues shares to public.

Public issue is of 2 kinds: Initial public offer (IPO) and Further public offer. Initial public offer is one where company sale its shares to general public for the first time by listing them at recognized stock exchange. Whereas, when listed companies after going for IPO issues additional shares to peoples, such issue is termed as further public offer. Such issue is done for expansion of equity base or pay back of debts by companies.

Right Issue of Shares

Right issue refers to selling of shares or convertible securities to present shareholders by companies. This issue is made at a concessional rate on specified time set by company itself. Right issue is done for raising additional amount of funds via issuing shares to existing equity shareholders in proportion of their shareholdings in place of doing a fresh issue.

Bonus Issue of Shares

Bonus issue refer to offering of free shares by company to current shareholders in addition to shares held by them. These shares are issued in proportion to fully-paid up equity shares held by shareholders. Bonus shares are issued free of any cost and are made out of free reserves or securities premium account of company.

Composite Issue

A composite issue is made by previously registered company. Under this type of issue, company issues share on public-cum-rights basis and make shares allotment on concurrent basis.

Private Placement

Private placement is such issue of shares under which company offers its share to selected group of investors that can be banks, pension funds, insurance companies, mutual funds and so forth in order to acquire the required funds. Various kinds of private placement are Preferential issue, Institutional Placement Program (IPP) and Qualified Institutional Placement (QIP).

Preferential Issue: When a public listed company issues its shares to a selected group of investors like venture capitalists, individuals and companies on preferential basis is termed as a Preferential Issue.

Qualified Institutional Placement (QIP): It is an issue in which a company that is publicly listed offers its equity shares or convertible securities to a qualified group of institution buyers for sale to acquire needed funds. Qualified institutional buyers consists of venture capital funds, mutual fund, insurance funds, pension funds, scheduled commercial banks, public financial institutions etc.

Institutional Placement Programme (IPP): It is when a public listed company makes a follow on offer of equity shares or shares are offered for sale by promoter. Shares are issues to QIBs only under it with the aim of attaining minimum shareholding of public.