Conversion of Private Limited to Public Limited Company

Private limited companies are a dime a dozen, but every private limited company, at some point, wishes to turn public so as to increase scalability. The question generally put across is, “Why go public?” The answer lies in certain distinct differences that arise between private limited companies and public limited companies.

- Public companies offer the option of Initial Public Offering (IPO). Here, by going public, the company is offering its shares to the general public.

- The option of IPO thereby removes the restriction on the transferability of shares, which is a feature of private limited companies.

- There is no cap with regards to the maximum number of members in a public limited company, thereby allowing them to raise and gain easy access to funding. Therefore, growth and flexibility are ideally the reasons for the switch from private to public.

A Public Company has seven or more members and can invite public to subscribe to its shares. A subsidiary company of a Public company is deemed to be a Public company.

A Private company is an organization which limits its number of members to 200 and cannot invite public to subscribe to its shares. The Companies Act, 2013 provides for converting a Public Company to a Private Company by altering the MOA and AOA of the company.

The main advantage of Public Company is that it can raise reserves at a large scale without approaching banking system and reducing debt whereas Private Companies which are privately owned, all the reserves are raised by existing members, shareholders and promoters. If a Private company goes public then the risk is also shared among the shareholders. Public companies once recorded, get indirect promotions and support through stock exchange websites where their stocks are recorded.

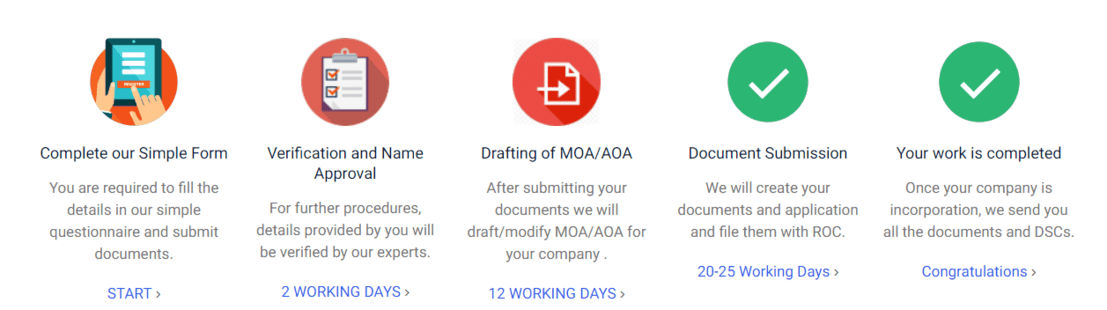

Conversion of Private Limited Company to Public Limited Company is done through TAXAJ for the peace of mind and fast processing.

Get your private limited company converted to public limited in the fastest possible manner.

It usually takes 20 to 25 working days.

- DSC (2 nos)

- Filing of SPICe+ Form

- Issue of Incorporation Certificate along with PAN and TAN

- Includes Govt Fees & Stamp duty for Authorised Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

- Excludes foreign national / Body Corporate as director or business needing RBI/SEBI approval

- Assistance in Opening Bank Account

- Businesses looking to expand or scale operations on higher level

- Startups looking to raise capital and issue ESOPs

- Businesses looking to convert their private limited company to public ltd company

- Businesses aiming to work globally or with reputed clients

DSC Application

Name approval form filing

Preparation of Incorporation Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Latest Month Personal Bank statement of all the Stakeholders.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Latest Electricity Bill/Landline Bill of Registered Office.

NOC from owner of registered office, If Owned. (Download Template)

Rent Agreement from Landlord, If Rented/Leased. (Download Template)

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Authorised & Paid Up Share Capital of the Company.

Everything about Conversion of Pvt Ltd to Public Ltd Explained here in this video!

What is a Private Limited Company and a Public Limited Company?

Let us have a brief understanding of what is private and public limited company.

A company that is privately held for small businesses. The liability of the members of a private limited company is restricted to the number of shares respectively held by them. The shares of a private limited company can’t be traded.

A company whose shares are traded on a stock exchange and can be purchased and traded by anyone. It is also called a publicly held company. As the name suggests, a public limited company is a company that offers company shares to the general public. The Company’s Act 2013 also defines a public limited company as one that has limited liability and offers company shares to the public. Anyone can acquire the stocks of such a company either through stock-market trading or via IPOs ( Initial Public Offerings).

Benefits of a Public Limited Company

Quick Share Transfer

Shareholders of a public limited company can transfer their shares with great ease. All they need to do is file the share transfer form and hand over the share certificate to the buyer. The process of transferring a share to another business structure is very tedious.

Raise Capital

The advantage of the public limited structure is that you can leverage it to raise capital from the general public through shares. This would, however, require listing on a stock exchange. All public limited companies can issue fixed deposits, debentures, convertible debentures to the general public.

Greater Credibility

Public limited companies need to disclose their audited statement of accounts, inform the regulatory bodies of any structural change, and hold annual general body meetings for all shareholders. These compliance procedures bring a great deal of credibility to the organization.

Increase in Reputation

Conversion of private limited to public limited company would increase the reputation of the company. A public limited company is allowed to list its shares in the public stock exchange. Automatically this process of listing the shares in the public stock exchange would increase the reputation of the company.

Acceptance of Deposits

Any public company is allowed to accept deposits under section 76 of the Companies Act, 2013.

Procedure for Conversion into a Public Limited Company

Procedure for Conversion into a Public Limited Company (pursuant to applicable provisions of the Companies Act, 2013 and the Companies (Incorporation) Rules, 2014):

Board Meeting:

The Directors are to be issued a notice regarding the agenda of the Board Meeting. This notice has to be issued to their respective registered addresses at least 7 days prior to the date on which the Board Meeting is to be held. The following matters have to be included in the agenda of the Board Meeting for discussion: – Approval of the shareholders regarding –

- Adoption of a new/amended Memorandum of Association (MOA).

- Adoption of a new/amended Articles of Association (AOA).

- Conversion of the private limited company into a public limited company.

– Approval for conducting an EGM and the subsequent authorization of a person to be in charge of circulation of the notice regarding the EGM.

– The date, time and place for the EGM has to be fixed as well.

– Passing of a Board Resolution for the increase in the number of directors, as a public limited company would mandate a minimum of 3 directors as per the provisions under Section 149(1)(a) of the Companies Act 2013.

Issuance of a notice regarding EGM and holding the EGM:

Once the Board Meeting has taken place, the Director/Company Secretary so appointed to circulate the notice regarding the EGM may issue to the notice to all of the following:

– Directors

– Shareholders

– Auditors

The notice of the EGM has to be given not less than 21 days prior to the date on which the EGM is to be held. However, a shorter notice period can be given if and only if the consent is given by not less than 95% of the members who are entitled to vote at the meeting. The consent has to be obtained either through:-

– Writing

– Electronic mode At the EGM, the resolutions will be passed subject to the approval of the shareholders.

Filing of the form with RoC:

Once the resolutions are passed in the EGM, the formalities with regard to form filing with the Registrar of Companies has to be completed within the stipulated time frame.

a)E-Form MGT – 14: This form has to be filed with the RoC within 30 days of passing the respective resolutions along with the prescribed fees. The form is be filed on the MCA portal, with the following attachments:

- Notice of the EGM along with the Explanatory Statement as per Section 102 of the Act.

- Certified copies of the resolutions which are passed in the EGM. – Copy of the new MOA.

- Copy of the new AOA.

b)E-Form INC – 27: This form is specifically for the application for conversion of a private limited company into a public limited company. This form has to be filed with the RoC within 15 days after passing of the resolutions in the EGM. The following documents are to be enclosed along with the form:

- Minutes of the meeting.

- Copy of the new AOA.

- Copy of the new MOA.

- Copy of the resolution(s) passed at the EGM.

- List of the members of the company along with the essential details

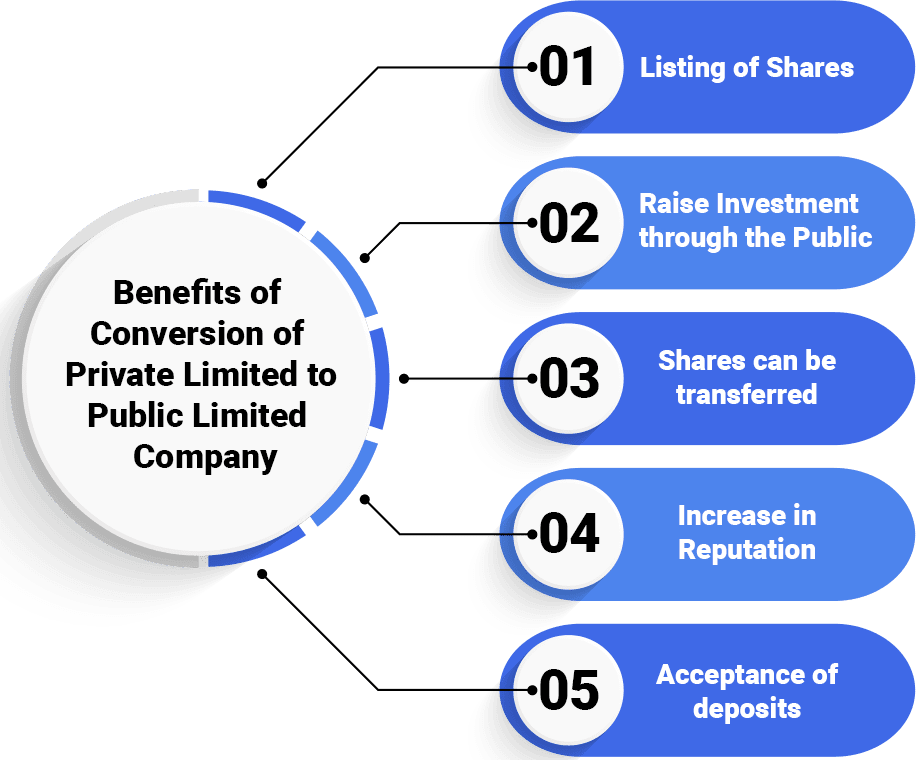

Benefits of Conversion of Private Limited to Public Limited

In India, the benefits of conversion of Private Limited to Public Limited are as follows:

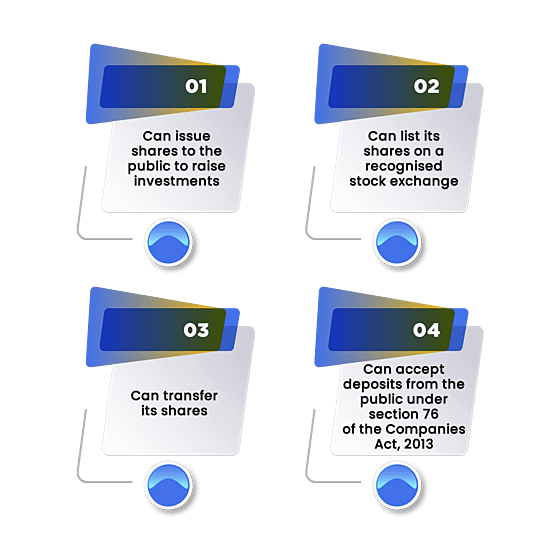

- A Public Company can issue shares to the public to raise investments;

- A Public Company can list its shares on a recognized stock exchange. It means that more people will get information about its functions, thereby increasing brand recognition.

- A Public limited company can transfer its shares in comparison to a private limited company. It means that a shareholder is not bound to be with the company forever and can easily sell shares for a profit.

- A Public Company can accept deposits from the public under section 76 of the Companies Act, 2013.

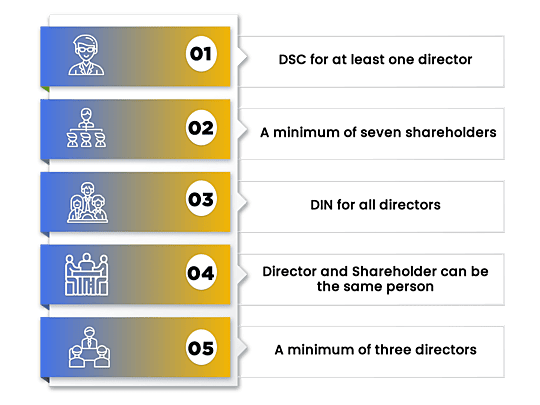

Minimum Requirements for Conversion of Private Company to Public Company

- Digital Signature Certificate (DSC) - A digital signature certificate has to be created for at least one director.

- Seven members as Shareholders- Seven members have to be appointed as shareholders of the company to be a public limited company.

- Director Identification Number for all the Directors- All the directors need a director identification number (DIN).

- Shareholder and Director- An individual can be appointed as a shareholder and a director.

- Three Directors- Apart from this to operate, the public company has to have minimum of three directors.

Regulatory Framework for Conversion of Private Company to Public Company

The primary regulatory authority for conversion of private limited to public limited company is the Registrar of Companies and the Ministry of Corporate Affairs.

Apart from the above regulatory bodies, the Companies Act, 2013 and respective rules would apply for conversion of private limited to public limited company.

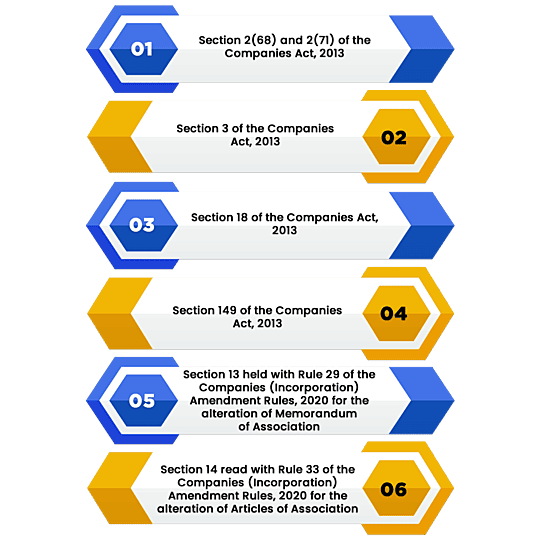

- Section 2(68) defines the meaning of private companies under the Companies Act, 2013. These companies are not allowed to transfer their shares as per the articles of association of the company. Section 2(71) provides the meaning of public limited companies under the companies act, 2013. These companies are allowed to transfer their shares and also list shares as per the requirements of the stock exchange.

- Section 3 of the Companies Act- Such section would relate to the objects of the company. The objects clause is present in the Memorandum of Association (MOA). The company has to change the objects clause for converting into a public limited company.

- Section 18 of the Companies Act- This section provides that the company can go for the process of conversion of private limited to public limited company. Alteration of the MOA and AOA has to be carried out as per the requirements of the companies act, 2013.

- Section 149 of the Companies Act- Such section relates to the appointment of directors of the company. A public limited company has more directors that a private limited company.

- Section 13 along with Rule 29 of the Companies (Incorporation) Amendment Rules, 2020- When going for conversion of private limited to public limited company, the MOA has to be altered.

- Section 14 along with Rule 33 of the Companies (Incorporation) Amendment Rules, 2020- This provision and section relates to alteration of the AOA of the Company.

Post-Compliance requirements for Conversion of Private Limited to Public Limited Company

Post-Compliance requirements for Conversion of Private Limited to Public Limited Company

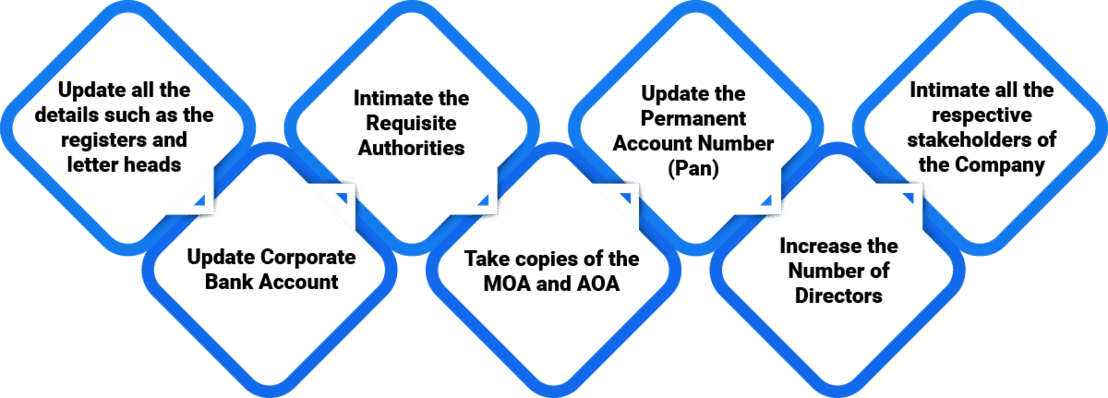

The following post-compliance requirements have to be carried out by the company in order to comply with the requirements of the Companies Act, 2013:

Frequently Asked Questions:

One of the most important compliance requirements after converting a private limited company to a public limited company is to change the name of the company.

A public limited company has a minimum of seven shareholders and three directors.

First the board meeting has to be held. For this a notice must be provided to all the directors. Once the board meeting is held, the agendas and various resolutions must be discussed. Apart from this the amendments of the MOA and AOA should take place. The schedule to holding the EGM must be considered in the board meeting. In the EGM a special resolution must be passed by the majority regarding the conversion of private limited to public limited. After this is considered the same must be filed with the ROC along with MGT-14 and INC-27. If the ROC considers that all requirements have been fulfilled, then the certificate of incorporation would be provided for the new company.

Usually the process to convert a private limited company to a public limited company would take a period of 30 days.

Clear days would include just the days which it takes for a particular transaction or process to occur. For example, if the filing is done on Thursday evening, then for the purpose of calculating the amount of clear days the time from Friday is only taken. However, for business days the time from Thursday would be taken for calculation.

The main individuals having authority over the public limited company are the directors and shareholders of the public limited company.

No, any additional fee should not be provided for the process of conversion of private limited to public limited company. A fee should not be paid even when the registrar issues the certificate of incorporation for the public limited company.