GST Letter of Undertaking (LUT)

All GST registered goods and service exporters are eligible to submit LUT except the exporters who have been prosecuted for any offence, and the amount of tax evasion exceeds Rs. Two hundred fifty lakhs under the CGST Act or the Integrated Goods and Services Tax Act, 2017 or any existing laws. In such cases, where the exporter is not eligible to file LUT, they would have to furnish an export bond.

TAXAJ can help you with GST LUT filing or export bond filing. Get in touch with our GST Experts to know more about exporting under LUT or export bond.

Letter of Undertaking (LUT) is required in case of export without payment of IGST. A LUT has a validity of one financial year.

It usually takes 1 to 2 working days.

- Eligibility Consultation

- LUT certificate (online)

- Business Hour CA Support

- Individuals and companies engaged in export of goods or services

- Purchase of Plan

- Submission of LUT form in GST portal

- Receipt of ARN number

- LUT certificate

- The documents needed shall depend on the service you need at a particular point of time. The same shall be communicated to you by our experts based on your requirements.

- Name and Address of 2 witness

Letter of Undertaking in GST Explained in easy language.

What is LUT and why is it used?

What is LUT and why is it used?

All registered taxpayers who export the goods or services will have to furnish Letter of Undertaking (LUT) in GST RFD-11 form on the GST portal in order to make exports without payment of IGST.

When to apply/file an LUT and what was the scenario before GST?

When to apply/file an LUT and what was the scenario before GST?

Letter of undertaking has to be filed /submitted online before exporting the goods/services. Prior to this, exporters had to manually submit the filled and signed RFD-11 on Business letterhead in duplicate –

- One to the Jurisdictional Deputy/Assistant Commissioner having jurisdiction over their principal place of business where the verification with the Export documents happens through ICEGATE medium

- Another along with the Export documents to the Customs clearing authority.

Just like the earlier excise regime, this led to exporters losing considerable time and operating expense on this compliance. Eventually, this process has now been rationalized and made simple & quick, giving transparency in the entire process of exports by an exporter to all the stakeholders involved. Note that the furnishing of Bond has to be on a non-judicial stamp paper and so needs a manual submission.

What are the eligibility criteria to apply for LUT?

What are the eligibility criteria to apply for LUT?

A person intending to supply goods/services

- To or outside India or

- Places covered under Special Economic Zone

- Without paying integrated tax and

- Is also registered under goods and services tax

- There has never been the prosecution of the person under the Central Goods and Services Tax Act (CGST) or the Integrated Goods and Services Act (IGST) 2017 or any other existing laws. Where, the amount of tax levied exceeds Rs. 250 lakhs.

- The LUT shall be provided on the letterhead of the person registered under goods and services tax. It should be furnished in duplicate for a financial year. LUT is presented in the annexure to form GST RFD-11 and can be issued by the partner, MD, Company Secretary or by the person duly signed by the company or the proprietor.

- If a person fails to pay the tax within the stipulated time as mentioned under the Central Goods and Services Act, the facility of exporting without payment of IGST is withdrawn till it is paid.

Steps to furnish LUT on the GST portal

Steps to furnish LUT on the GST portal

Here are the steps to be followed on GST portal/GSTN to furnish LUT:

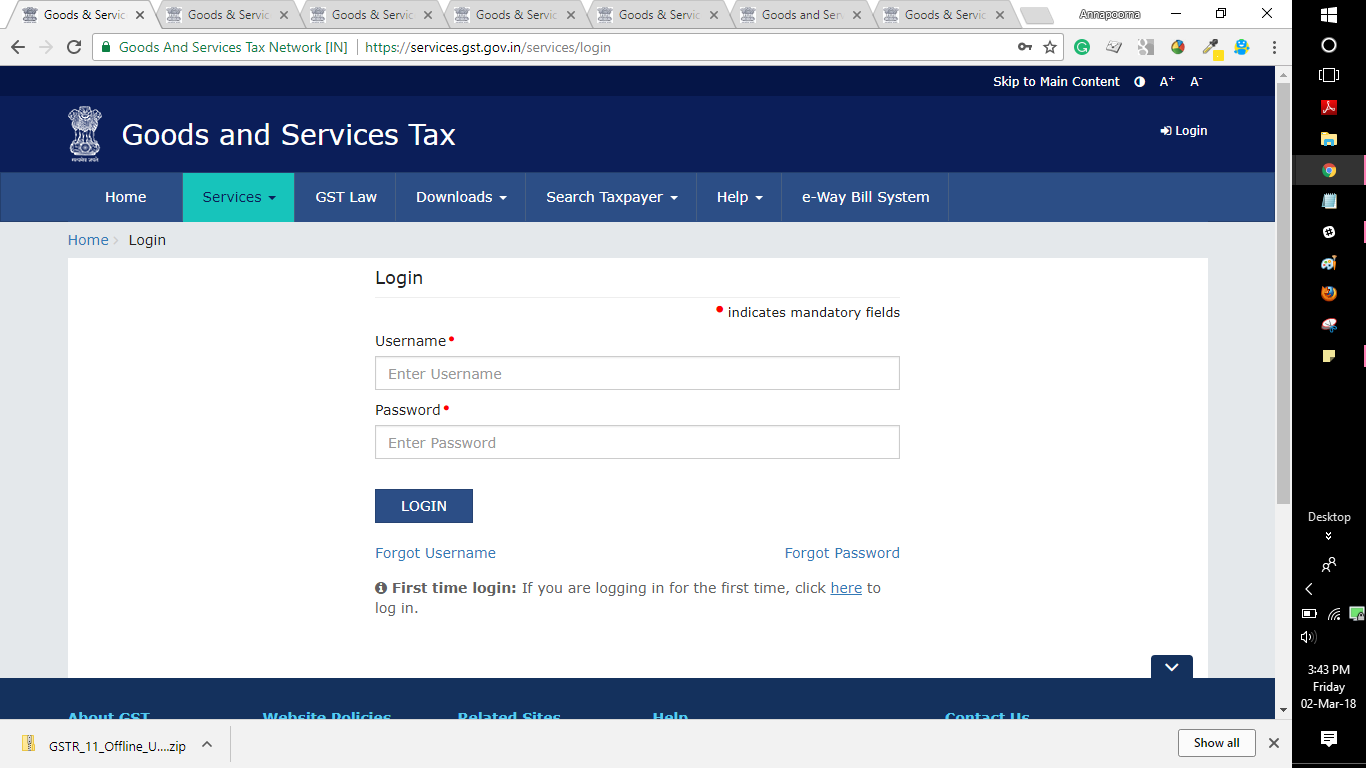

Step 1: Login to GST Portal.

Step 2: Go to ‘SERVICES’ Tab > ‘User Services’ > Select ‘Furnish Letter of Undertaking(LUT)’

Step 3: Select the financial year for which Letter of Undertaking is applied for from the ‘LUT Applied for Financial Year’ drop-down list. Eg: 2021-22.

Note: If Letter of undertaking has been already furnished manually for any of the previous periods, then please upload the same by Clicking on ‘Choose File’ option on the same window.

Ensure the following:

- Only PDF or JPEG file formats are allowed.

- Maximum file size for upload is 2 MB

Step 4: Fill up the necessary details on the Letter of Undertaking Form/ GST RFD-11 that appears on the screen The following needs to be done on the form:

(a) Self-Declaration: Tick mark by clicking against each of the three boxes

By doing this, Exporter undertakes the following :

- Export of goods/services will be completed within a period of three months from the date of issue of Export invoice or further period allowed by the Commissioner if any.

- To abide by GST law in respect of exports

- To pay IGST along with Interest* if failed to Export

*Interest must be paid at the rate of 18% per annum for the period From date of issue of export invoice upto date of Payment of IGST.

(b) Give Independent Witnesses Information: Mention the Name, Occupation and Address of two independent witnesses in the boxes highlighted in red color mandatorily.

Note that the Witnesses declared in the Letter of Undertaking (LUT) are the ones declared on the running Bond/ Bank guarantee.

Step 5: Enter the Place of filing > Click on ‘SAVE’ > click on ‘PREVIEW’ to verify the correctness of the form before submission Note that currently, the revision of a signed/submitted form is not possible.

Step 6: Sign and file the form using either of the below options:

The Primary authorised signatory/ any other authorised signatory can sign the Letter of Undertaking. Authorised signatory can be the working partner, the Managing Director or the Company Secretary or the proprietor or by a person duly authorised by such working partner or Board of Directors of such company or proprietor to execute the form.

- Submit with DSC: Sign the application using the registered Digital Signature Certificate of the selected authorized signatory.

To use this option, Click on ‘SIGN AND FILE WITH DSC’ > Warning message box appears > Click ‘PROCEED’> System generates a unique ARN (Application reference number)**

OR

- Submit with EVC: To use this option, Click on ‘SIGN AND FILE WITH EVC’ > The system will trigger an OTP to the registered mobile phone number and e-mail address of the authorized signatory. Enter that OTP in the pop-up to sign the application > Warning message box for submission appears > Click ‘PROCEED’> System generates a unique ARN (Application reference number)**

Note: Companies and LLPs can file only using DSC

** A confirmation message appears. GST Portal sends this ARN at registered email and mobile of the Taxpayer by e-mail and SMS.

You can click on the DOWNLOAD button to download the acknowledgement. You may also check out the Letter of Undertakings previously furnished on the GST portal.

On the home page, Go to ‘SERVICES’ > ‘ User Services’ > ‘View my Submitted LUTs’ > Select period > Check out the list of LUTs furnished during the selected period > Click ‘VIEW’ against the particular Letter of Undertaking to view the detail.

Document of LUT (Letter of Undertaking)

Self-declaration that the conditions of the Letter of Undertaking shall be accepted unless there is specific permission granted. In such cases, a self-declaration is required by the exporter to the effect that he has not been prosecuted should serve the purpose of notification- 37/2017- Central Tax on 4th October 2017. Verification if required may be carried out on a post-facto basis.

Time for acceptance of LUT/Bond-

As LUT or Bond is mandatory for export business, including exports to an SEZ unit, so it should be on the top priority list. The LUT/ Bond should be accepted within three working days after it has been received along with the self-declaration by the exporter as mentioned above. Failing to process the LUT within three working days, it shall be considered to be accepted.

Bank guarantee-

In all cases, bonds shall be accompanied by a bank guarantee amounting to 15% of the bond amount.

Sealing by officers-

In case of self-sealing, sealing of containers, is to be exercised under the supervision of the central excise officer having jurisdiction over the place of business. A copy of the report is to be submitted to the Deputy/ Assistant Commissioner having jurisdiction over the place of business.

Purchases from Manufacturer-

There are no provisions for issuance of CT-1 form which allows exporters to purchase goods from manufacturers without paying tax under the GST regime. The transaction between the manufacturer and the exporter is like supply, and the same would be subject to GST.

Transactions with EOUs (Export Oriented Units)-

Zero rating does not apply to supplies to EOUs, and there is no special exemption for them under the GST regime. Therefore they are taxable similar to any other taxable supplies. To the extent of exports, EOUs are eligible for zero-rating.

Q. What is Validity of LUT?

Ans. A LUT is valid for One Financial Year.

Q. What is the benefit of LUT?

Ans. If u furnish LUT, then you can export goods and services without payment of IGST

I want to know more about Letter of Undertaking (LUT) for Exports.

According to the CGST Rules, 2017, any registered person exporting goods without payment of integrated tax must furnish LUT in FORM GST RFD-11. All GST registered exporters are eligible to submit LUT except the exporters who have been prosecuted for any offence. The Tax evasion exceeds Rs.250 lakhs under the CGST/IGST Act,2017 or any of the existing laws.