FFMC License - Full Fledged Money Changer

FFMC is an abbreviation for fully fledged money changer. A company which intends to carry out the activities of forex currency exchange after obtaining the prior approval of Reserve Bank of India shall be regarded as Full Fledged Money Changers (FFMC). Under Section 10 of the Foreign Exchange Management Act, 1999, the Reserve Bank of India authorizes entities to deal in foreign exchange for specific purposes. These entities are called as Authorized Money Changers (AMCs).

All the Individuals or Business Entities who want to deal in Foreign Currencies need to obtain FFMC License from the Apex Bank, i.e., RBI. Such a license gives the holders the authority to purchase foreign exchange from NRIs (Non Resident Indians) and sell the same for business and travel purposes to the Indians visiting abroad.

Based on the provisions and stipulations of Section 10 of the FEMA 1999, it shall be noted that only an AMC (Authorised Money Changer) is eligible to deal in the activities concerning Money Changing and Foreign Exchange. Some of the firms and hotels have also been provided Full Fledged Money Changer License by the RBI to deal in Foreign Currency, Traveller’s Cheques, and Coins. The same is done to avoid the difficulties faced by the foreign tourists and visitors.

Get your FFMC License in the fastest possible manner.

It usually takes 50 to 60 working days, depending upon government approval.

FFMC License

- Businesses looking to get FFMC License.

Preparation of Documents and filing with department

- Copy of the certificate of registration of the company (Certificate of Incorporation and Certificate of Commencement of Business).

- Copy of Memorandum of Association with a letter mentioning the clause related to money changing activity.

- A confidential report from the bank.

- Copy of the latest audited balance sheet of the company along with a certificate from the Statutory Auditors of net owned funds. Also, audited accounts for the last 3 years need to be submitted.

- Declaration to the effect that the company or its Directors are not being investigated by DOE or DRI.

- Details of the nature of the business.

- Details of a previous application for FFMC/RMC license by the applicant

- A Board Resolution for applying to the Full Fledged Money Changers license and undertaking money changing activity.

All you need to know about FFMC License

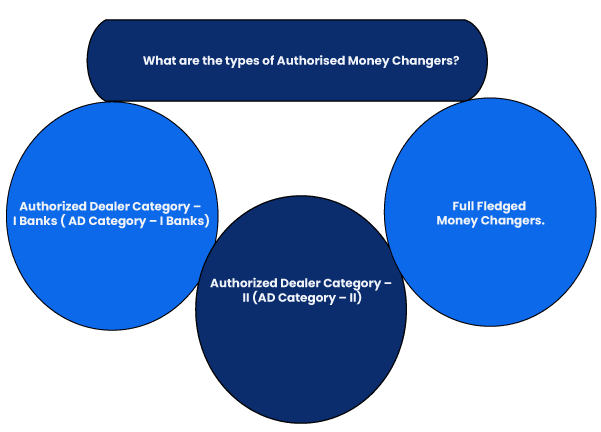

What are the types of Authorised Money Changers?

What are the types of Authorised Money Changers?

The following are the types of authorised money changers:

The purpose of the above mentioned three types of Authorized Money Changers is to enable residents and tourists to have wider access to foreign exchange facilities. The objective is also to ensure that customers get the best and the most efficient service, with increased competition.

Role of Authorised Money Changers in Forex Transactions

Role of Authorised Money Changers in Forex Transactions

Authorised Money Changers play a pivotal role in the transactions concerning Foreign Exchange. The Reserve Bank of India grants approval to the banks in the form of Licenses to deal in activities of foreign exchanges. The said license is granted to only those banks which are well equipped to carry out foreign exchange transactions in India.

Also, it shall be noted that other than banks, certain financial institutions are granted authorisation by the apex bank to undertake prescribed types of foreign exchange transactions that are incidental to their main business.

Benefits of FFMC License

Benefits of FFMC License

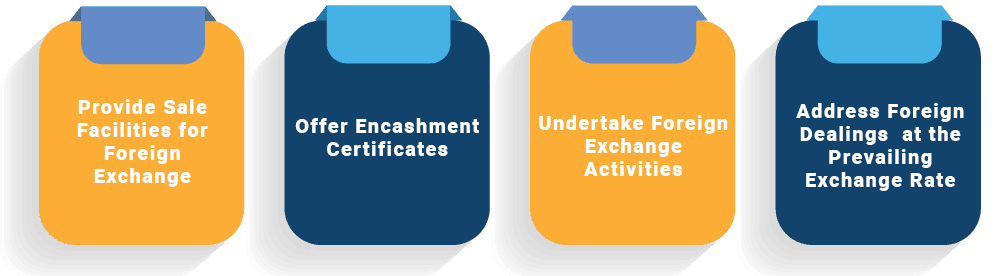

The key benefits of the Full Fledged Money Changer License are as follows:

- An AMC License Holder has the Capability to provide sale facilities and services for foreign exchange;

- FFMC license holder can offer encashment certificates in case of the Travellers Cheques, Foreign Currency Notes from the Non Residents and Residents;

- An FFMC License Holder can undertake foreign exchange activities for the foreign tourists visiting India;

- An AMC License Holder is able to address dealings in coins, travellers’ cheques, foreign currency, at the prevailing exchange rate;

Fully Fledged Money Changer License in India

Fully Fledged Money Changer License in India

In order to work as an authorized money changer in India, one needs to apply for a valid fully fledged money changer license which is issued by the Reserve Bank of India and if any person or organization found to be operating money changing activities without the appropriate license will be liable to be penalized as per the laws. For obtaining this license in India, it is mandatory that the company is registered under the Companies Act, 2013.

The RBI annually publishes the applicable guidelines for Fully Fledged Money Changer in the form of a master circular called the Memorandum of Instruction on Money Changing Activities. Every entity intending to enter or already involved in the money changing activities in India need to follow these guidelines as well as the provisions mentioned in the Foreign Exchange Management Act, 1999.

Eligibility criterion for Fully Fledged Money Changer License in India

Eligibility criterion for Fully Fledged Money Changer License in India

The eligibility criteria for companies to obtain the Fully Fledged Money Changer license are:-

- The company has to be registered with the Registrar of Companies under the Companies Act, 2013.

- The minimum net owned fund (NOF) of the company need to be Rs. 25 lakh for a single branch license. For a multiple branch license, the minimum net owned fund of the company needs to be Rs. 50 lakh. It is essential that the FFMC maintains this minimum NOF on a continuous basis. Apart from this for the fully fledged money changer the requirements related amount required for the particular branch also have to be satisfied.

Single Branch Rs. 25 lakhs

Multiple Branch Rs. 50 lakhs

Note: The Net Owned Fund (NOF) is calculated by subtracting the investments of the company from the owned funds. Investments can include a share of its subsidiaries, the book value of debentures, bonds, outstanding loans and even advances made to and deposits with its subsidiaries and companies in the same group in excess of 10% of the owned funds. Owned funds, on the other hand, is derived by subtracting accumulated balance of loss, deferred revenue expenditure and other tangible assets from the sum of paid-up equity share capital, free reserves and credit balance in P&L Account.

- It is also essential that the main activity which is mentioned in the object clause of the company needs to be money changing activity.

- Finally, there should be no ongoing case against the company with the Department of Enforcement or Department of Revenue Intelligence.

Basic requirements for Fully Fledged Money License

Basic requirements for Fully Fledged Money License

- The Fully Fledged Money license needs to be renewed on annual basis.

- The company is required to start operations within six months from the date of issue of the fully fledged money license.

- Using a Franchise Agreement, all the three categories of AMC:– AD Category – I Bank, AD Category – II and FFMC appoint their franchises to widen the network for providing money changing facilities such as conversion of foreign currency, notes, coins and traveler's cheque into Indian currency to travelers, tourists, NRIs etc.

- To be appointed as a franchise, the proposed company needs to have a minimum net owned fund of Rs. 10 lakh and its main object must be money changing activity.

- The franchisee’s books need to be annually inspected to ensure that its activities comply with laid terms and conditions of RBI.

Main Regulatory Authority for Fully Fledged Money Changer License

Main Regulatory Authority for Fully Fledged Money Changer License

In India, the framework for Fully Fledged Money Changer is regulated by the Reserve Bank of India as per Section 10 of the Foreign exchange Management Act, 1999. It is mandatory for a license holder to comply with the directions & guidelines issued by the RBI. The fully fledged money lender License holder shall not engage in any transaction which is not in conformity with the authorization terms. RBI may at any time revoke the FFMC license if it is in the public interest.

- Inspection of Documents

Reserve Bank of India is empowered to inspect the books of accounts and other documents of the fully fledged money changer as per FEMA, 1999. For carrying out the inspection, full assistance and co-operation shall be provided to the investigating authority. However, if the entity fails to produce books of accounts, or any other document or fails to answer any question asked by the authority then it shall be considered a contravention of the provisions.

Procedure of obtaining Fully Fledged Money Changer License

Procedure of obtaining Fully Fledged Money Changer License

The application form for the Fully Fledged Money Changer license needs to be downloaded from the website of RBI. Along with the required supporting documents, the application form needs to be submitted to the Foreign Exchange Department of the Reserve Bank of India at the regional center under the purview of which the registered office of the applicant falls.

- First and foremost, a company has to be formed as per the requirements of the Companies Act, 2013.

- Documentation & Arrangement of the entire necessary documents for filing of Fully Fledged Money Changer license application as per RBI guidelines;

- Submission of FFMC license application along with the necessary documents with the concerned department of RBI;

- Reply in case of resubmission;

- Liaison with the RBI until the license is obtained;

- After the vigilant inspection by the RBI, Fully Fledged Money Lender License is obtained.

What are the requirements for the Fully Fledged Money Changer License?

What are the requirements for the Fully Fledged Money Changer License?

There are certain requirements which need to be fulfilled in order to obtain Fully Fledged Money Changer license in India-

- Application for license shall not be considered if DoE (Directorate of Enforcement) /DRI (Directorate of Revenue Intelligence) had initiated any case against the applicant company or its directors/promoters;

- The decision of the Reserve Bank of India shall be binding on the applicant company in relation to the approval of the FFMC license;

- After obtaining the Fully Fledged Money Changer license from the Reserve Bank of India, a copy of registration under Shop and Establishment, rent receipt or any other documentary evidence shall be submitted by the applicant;

- Once the license is obtained by the Reserve Bank of India, business should be commenced within a period of six (6) months and such commencement of business shall be informed to the concerned Regional Office of the RBI.

Rules related to Fully Fledged Money Changer License Renewal

Rules related to Fully Fledged Money Changer License Renewal

The license holder has to file a renewal application every year along with the applicable documents with the Reserve Bank of India. The renewal application shall be filed at least one month prior to the expiry of the license. Once an application is made for FFMC license renewal, it shall be valid until the expiry date or rejection date as the case may be. If the license is expired, no renewal application can be made.

What are the guidelines regarding the maintenance of books of accounts by the Fully Fledged Money Changer?

What are the guidelines regarding the maintenance of books of accounts by the Fully Fledged Money Changer?

For these entities in India, it is required to maintain following registers in respect of the money changing activities:

Forms | Description |

FLM 1 | Daily Summary and Balance Book (Foreign currency notes/coins) |

FLM 2 | Daily Summary and Balance Book (Travellers' cheques) |

FLM 3 | Register of purchases of foreign currencies from the public |

FLM 4 | Register of purchases of foreign currency notes/coins from authorized dealers and authorized money changers |

FLM 5 | Register of sales of foreign currency notes/coins and foreign currency travelers' cheques to the public |

FLM 6 | Register of sales of foreign currency notes/coins to authorized dealers / Full Fledged Money Changers / overseas banks |

FLM 7 | Register of travelers' cheques surrendered to authorized dealers / authorized money changers / exported |

These documents need to be kept up-to-date, cross-checked and the balances shall be verified on a daily basis whereas transactions which are outside the purview of money changing activities shall not be blend together. Separate registers need to be maintained in case of more than one establishment.

What are the circumstances under which an License can be revoked by RBI?

What are the circumstances under which an License can be revoked by RBI?

The Reserve Bank reserves the right to revoke the license granted to an AMC at any time if it is in the opinion of the Reserve Bank of India that:

- It is in public interest to do so or;

- The AMC has failed to comply with any condition subject to which the authorization is granted or has contravened any of the provisions of the Foreign Exchange Management Act, 1999 or any rule, regulation, notification, direction or order made there under.

- The Reserve Bank also reserves the right to revoke the authorization of any of the offices for infringement of any statutory or regulatory provision.

- The Reserve Bank may at any time revoke any of the existing conditions of a money changer's license or impose new conditions.

Who can obtain a Franchise License from the existing Fully Fledged Money Changer?

Who can obtain a Franchise License from the existing Fully Fledged Money Changer?

To obtain the franchise license from the existing FFMC there is a requirement of two things such as:

- An entity with the physical place of business and

- Minimum Net Owned Funds of 10 lakhs INR;

If the above-mentioned requirements are fulfilled, the Franchise agreement will be executed. Franchisee agreement will describe the tenure which shall be decided by the FFMC and the commission and fees payable to the franchise as mutually decided between the parties.

Features of the Franchise Agreement

Features of the Franchise Agreement

- The name of the Franchisers and the exchange rates shall be primarily displayed by the Franchisees and the exchange rates shall be in coordination with the daily exchange rates as charged by FFMC and their branches;

- The purchased foreign currency shall be surrendered by the franchisee to the franchiser within the period of 7 working days from the date of purchase;

- The proper records of all transactions shall be maintained by the franchisees;

- The Franchiser shall conduct the onsite inspection of the Franchisee at least once a year;

How to obtain a franchise license from the existing FFMC?

How to obtain a franchise license from the existing FFMC?

For obtaining a franchise license, an application shall be made in Form RMC-F accompanied by a declaration that adequate due diligence of the entity has been carried out prior to the entering into the Franchise Agreement.

How to conduct Due Diligence of Franchisees?

How to conduct Due Diligence of Franchisees?

While conducting the due-diligence of the Franchisees, following things must be considered:

- Description of the Franchisee along with its existing business activities;

- Check on minimum Net Owned Funds (NOF) requirements as prescribed;

- Municipal certification including registration under Shop and Establishment act, in the favour of Franchisees;

- Verification of the physical office of the Franchisee from where the restricted money changing activities will be carried on;

- Certificate from the local police authorities in the favor of the Franchisee to carry out the activities;

- Declaration regarding non-involvement in any criminal case;

- Copy of PAN of the Franchisee, its directors, its shareholders;

- Passport size Photographs of the Directors, shareholders and other KMP of the franchisee;

- Personal visit at least once a year.

What are the reporting requirements for Fully Fledged Money Changer?

What are the reporting requirements for Fully Fledged Money Changer?

- A monthly consolidated statement of all offices for all sale and purchase of foreign currency notes shall be submitted by the entity in form FLM 8 to the concerned department of the RBI not later than the 10th of the succeeding month;

- A monthly statement indicating details of receipt/purchase of US $ 10,000 (or its equivalent) and above shall be submitted to the regional office of the RBI, within 10 days of the end of the month;

- A quarterly statement regarding Foreign Currency Account/s maintained in India in their names with AD Category-I Banks shall be submitted to the regional office of the RBI;

- An Annual Statement giving the details of the amount written off during the financial year should be submitted by all the AMC to the respective Regional Offices of the Foreign Exchange Department, RBI within one month of the financial year-end.

What are the guidelines regarding grant of license for setting up an additional branch?

What are the guidelines regarding grant of license for setting up an additional branch?

For setting up an additional branch to carry out the money changing activity prior approval of RBI is required. For this purpose, a written application shall be submitted to the regional office of the RBI where the registered office of the company is situated. The main purpose of setting up an additional branch is that adequate money exchange facilities shall be provided in the remote areas of tourist attraction.

For setting up additional branch following documents are required:

- Copy of latest audited accounts accompanied by a certificate from Statutory Auditor, clearly specifying the position of Net Owned Funds(NOF) as on date;

- Bankers Report;

- A declaration specifying non-pendency of any proceedings with the Directorate of Enforcement (DoE)/ Directorate of Revenue Intelligence (DRI) or any other enforcement authorities against the applicant company or its directors;

- Declaration confirming the effectiveness of the proper policy framework on KYC/AML/ CMT;

- Declarations regarding internal control systems including internal/external audit;

- A copy of registration under Shop and Establishment, rent receipt or any other documentary evidence of the place of business of additional branch.

Revocation of Authorised Money Changer License

Revocation of Authorised Money Changer License

In India, the utmost authority to revoke/ suspend/ or cancel an issued Authorised Money Changer License is with the Reserve Bank of India. The same is possible in the situations as follows:

- In the interest and benefit of the General Public;

- If in case an Authorised Money Changer is unable to successfully comply with the statutory provisions of the FEMA Act 1999 and the circulars, guidelines, and directions issued by the RBI;

Further, it shall be noted that the Apex bank reserves the right to modify/ change/ or revoke any of the prevailing terms, conditions, or regulations concerning AMC License in India.