Approval to Establish a Liaison Office in India

This approval is required for a person resident outside India who wants to establish a liaison office in India but it is not required for any banking company which has obtained necessary approvals under the Banking Regulation Act, 1949 or any insurance company which has obtained approval from the IRDAI.

Liaison offices are a popular option for foreign investors seeking to explore and understand the business environment of the country. This entity type is also beneficial for promoting the parent’s company business and act only as a communication channel between the foreign parent company and Indian companies.

Approval to Start Liaison Office in India

Depends upon case to case basis

Approval to Start Liaison Office in India

- Companies incorporated outside India and engaged in manufacturing or trading activities are allowed to set up Branch Offices in India with specific approval of the Reserve Bank.

- Reserve Bank has given general permission to foreign companies for establishing branch/unit in Special Economic Zones (SEZs) to undertake manufacturing and service activities.

- Purchase of Plan

- Expert Assigned

- Share the details as requested

- Filing of Application with Department

- Copy of the Certificate of Incorporation / Registration; Memorandum of Association and Articles of Association attested by the Notary Public in the country of registration. [If the original Certificate is in a language other than in English, the same may be translated into English and notarized as above and cross verified/attested by the Indian Embassy/ Consulate in the home country]

- Audited Balance sheet of the applicant company for the last three/ five years in case of branch office/liaison office respectively. [If the applicants’ home country laws/regulations do not insist on auditing of accounts, an Account Statement certified by a Certified Public Accountant (CPA) or any Registered Accounts Practitioner by any name, clearly showing the net worth may be submitted]

- Bankers' Report from the applicant’s banker in the host country / country of registration showing the number of years the applicant has had banking relations with that bank.

- Power of Attorney in favour of signatory of Form FNC in case the Head of the overseas entity is not signing the Form FNC.

What are the eligibility criteria for establishing a Liaison office in India?

A liaison office can be established after seeking permission from RBI under the provisions of Foreign Exchange Management Regulations (FEMA), 1999. Following are the requirements for opening an LO:

- Three-year record of profitable operations during the immediately preceding three financial years in the home country

- Minimum net worth of USD 50,000 verified by the most recent audited balance sheet or account statement.

If a company does not meet these requirements, but is a subsidiary of a company that does, the parent company may submit a Letter of Comfort on the subsidiary’s behalf.

What are the Permitted Activities of Liaison Office in India?

- Establish healthy communication between the foreign head company and the parties in India with a motive to create market opportunities

- Promotion of import/export relationship between countries

- Form a financial and technical collaboration between Indian and overseas companies

- Represent the foreign parent company in India

As India is among rapidly growing and progressing economies globally, many multinational companies are willing to invest in the Indian market. Therefore, they are always looking forward to establishing their liaison office in India.

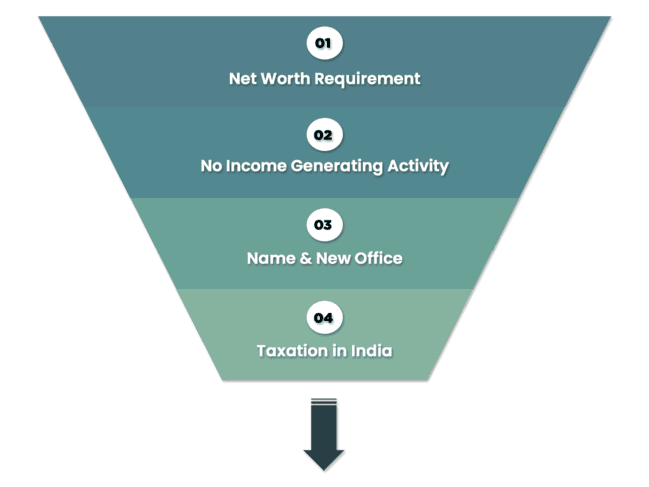

Important points to consider before registering Liaison office in India

- Net Worth Requirement

A parent company must have a beneficial track record of the past three years in a row, and they should own a net worth of more than $50,000 attested by their auditors.

- No Income Generating Activity

The parent company provides financial aid to all the operations of the liaison office since the liaison office is not allowed to earn any income in India.

- Name & New Additional Liaison Office

The name must be similar to that of the foreign parent company. In addition, a new approval is needed for each new liaison office from the Reserve Bank of India with complete justification.

- Taxation in India

Income tax authorities have the right to impose income tax on a liaison office.

What are the documents required for registration of an LO?

To begin the process of setting up a liaison office in India, the foreign company should submit the following documents:

- A notarized and apostilled copy of the liaison office charter or Memorandum and Articles of Association in English;

- Certificate of incorporation or registration of the parent company

- Name and address of the liaison office in India;

- List of directors;

- Details of activities to be undertaken in India

- Name and address of the company’s official representative based in India;

- Financial Statement of the previous three years of the parent company duly attested by its auditors;

- Certificate from the auditors of the parent company that the net worth of the parent company is more than USD 50,000 or its equivalent

The liaison office should also obtain a Permanent Account Number (PAN) from the income tax department and a Unique Identification Number (UIN) from the RBI. The application for registration should be forwarded to the RBI by a designated AD Category – I Bank.

Can an LO maintain more than one bank account in India?

If an LO wants to open more than one account, it has to obtain prior permission of the Reserve Bank of India (RBI) through its Authorized Dealer (AD) bank justifying the reason for the additional account.

If at a later stage, a Liaison office is upgraded to a Branch office (BO), will it be required to open a bank account again?

A Liaison office can be upgraded to a Branch office and can continue with the same bank account provided that the bank account is re-designated as a BO account.

Is it mandatory for an LO to register with police authorities?

Only applicants from Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong, Kong, Macau, and Pakistan have to get registered with the State Police authorities. Copy of the approval letter for persons from these countries shall be marked by the AD Category I bank to the Internal Security Division – I, Ministry of Home Affairs, Government of India for necessary action and record.

Can a foreign company set up more than one liaison office in India?

All requests for establishing additional Liaison offices can be submitted to the AD Category-I bank in a fresh FNC form. However, the documents mentioned in form FNC need not be submitted again, if there are no changes to the documents submitted earlier.

- If the number of offices exceeds 4 (one LO in each zone - East, West, North and South), the applicant has to justify the need for additional office/s and prior approval of RBI is required.

- The applicant may identify one of its offices in India as the Nodal Office, which shall coordinate the activities of all its offices in India.

- In case the existing LO is shifting to another city in India, prior approval from the AD Category-I bank is required. However, no permission is required if the LO is shifted to another place in the same city subject to the condition that the new address is intimated to the designated AD Category-I bank

Route of RBI Approval

Automatic Route

In the automatic route, the proposed entity applicants do not require prior approval from RBI or the government of India. So these are the sectors where 100% FDI is allowed.

Also, such applicants belong to countries with whom India does not share land borders.

Approval Route

The approval route applies in the following circumstances;

1. The applicant company is headquartered at, or an applicant is a citizen of Pakistan, China, Sri Lanka, Iran, Afghanistan, Bangladesh, Hong Kong, or Macau, and the application is for opening a BO/LO/PO in Jammu and Kashmir, Andaman and Nicobar Islands; and North East region.

2. The principal business activity falls in the four sectors, namely Private Security, Telecom, Defence and Information, and Broadcasting.

3. The applicant is an NGO

Drafting of Government Forms and Documents

On receiving the complete set of documents, the next step is to draft the following documents for the signature purpose by the applicant company and from the authorized signatory.

- Approval from the Board Resolution for opening the liaison office in India.

- A declaration from the applicant regarding the FDI eligibility and source of fund

- A declaration stating the nature of the activity, location of the activity of the proposed Liaison office

- A declaration stating the nature of the activity and the location of activity of the applicant company

- Form FNC

- A letter of comfort from the holding company

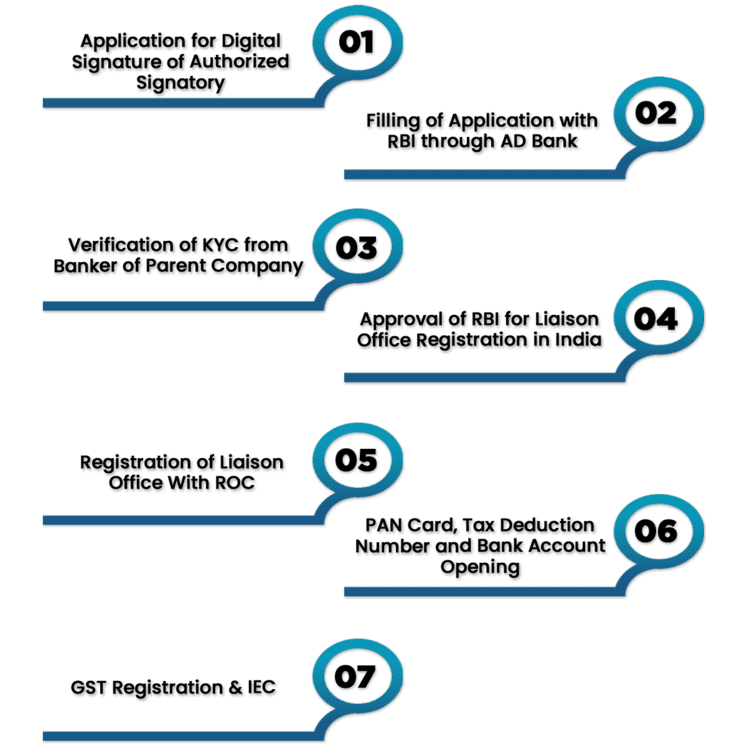

Liaison Office Registration Process in India

- Filling of Application with RBI through AD Bank

A foreign company's liaison office application is filed with the FNC. The application is submitted through AD Bank to the Reserve Bank of India (Authorised Dealer). The AD bank plays a crucial function since it is through them that all contact with the RBI is routed.

- Verification Of KYC From Banker Of Parent Company

A request for document examination is issued to the banker of the foreign firm. The process of sending requests for verification purposes is called swift-based verification.

Once the foreign lender has validated the documentation, the application is sent to the RBI for approval. The RBI may also request other documentation, depending on the circumstances.

- Approval of RBI for Liaison Office Registration in India

A particular policy is followed for approving the liaison office in India by the AD Banker. Priority is given to the cases where the automatic route is not available.

- Registration of Liaison Office with ROC

Once the company is formed, its bank account is opened, wherein the FDI should reach within 180 days of forming the company with an advance announcement to the banker.

- PAN Card, Tax Deduction Number, and Bank Account Opening

The income tax department of India issues a unique 10 digit number, known as PAN number. Once the PAN number is obtained, the liaison office is eligible to open its bank account. And every taxpayer must obtain a Tax Deduction Account Number to obey all the TDS norms.

- GST Registration & IEC

On obtaining Bank Account and cheque book, a copy of the check is needed to apply GST registration and Import Export Code