Turnover Certificate from Chartered Accountant

A turnover certificate is a factual statement that certifies the turnover of the entity based on the requirements. The turnover certificate in India assures the users that the turnover generated by the business entity during a specific period. A turnover certificate is issued by the Chartered Accountant. This certificate certifies the total turnover of the applicant’s organization.

The turnover can be for 1 or more years depending on the requirements. This turnover is in the name of the organization’s applicant and not that of a group or sister organization.

Get the Turnover Certificate easily with TAXAJ

It usually takes 1 to 2 working days.

- Discussion about the matter with an Expert

- Preparation & Filing of Certificate

- Resident & Non Resident Individuals

- Submit the documents as per the Checklist

- Documents are verified by the CA

- A Draft copy of the turnover certificate is shared

- Once the draft is approved a final certified copy is issued by the Chartered Accountant

- Name and details of the business entity

- Registration details

- Period for which the turnover is stated

- Purpose of the turnover certificate

- Any other information as required.

Know Everything About Turnover Certificate

Apply for the Turnover Certificate Now and get it same day

What information will be included in the turnover certificate?

What information will be included in the turnover certificate?

The contents of the turnover certificate in India will depend on the requirements and the purpose for which the turnover certificate is being produced. A basic turnover certificate includes the following information:

- Name and details of the business entity

- Registration details

- Period for which the turnover is stated

- Purpose of the turnover certificate

- Details of the practicing professional

- UDIN

- Any other information as required.

What is the process to obtain a turnover certificate?

What is the process to obtain a turnover certificate?

The process to obtain a turnover certificate in India is very simple :

- Submit the documents as per the Checklist

- Documents are verified by the CA

- A Draft copy of the turnover certificate is shared

- Once the draft is approved a final certified copy is issued by the Chartered Accountant

Where is the turnover certificate required?

Where is the turnover certificate required?

A turnover certificate is required by anybody willing to get an assurance on the turnover of the entity in speculation. Here are some cases where the turnover certificate might be required.

- For participating in tenders issued by the various companies, local authorities, and also institutes.

- It is also required in the banks and the financial institution for loan purposes.

- Also required by investors to fund an existing or new project/business.

Who can issue a turnover certificate in India?

Who can issue a turnover certificate in India?

The turnover certificate in India is a certificate that provides an assurance certificate to the user about the turnover of a business entity. It is issued by a practicing Chartered Accountant who is specializing in issuing the turnover certificate.

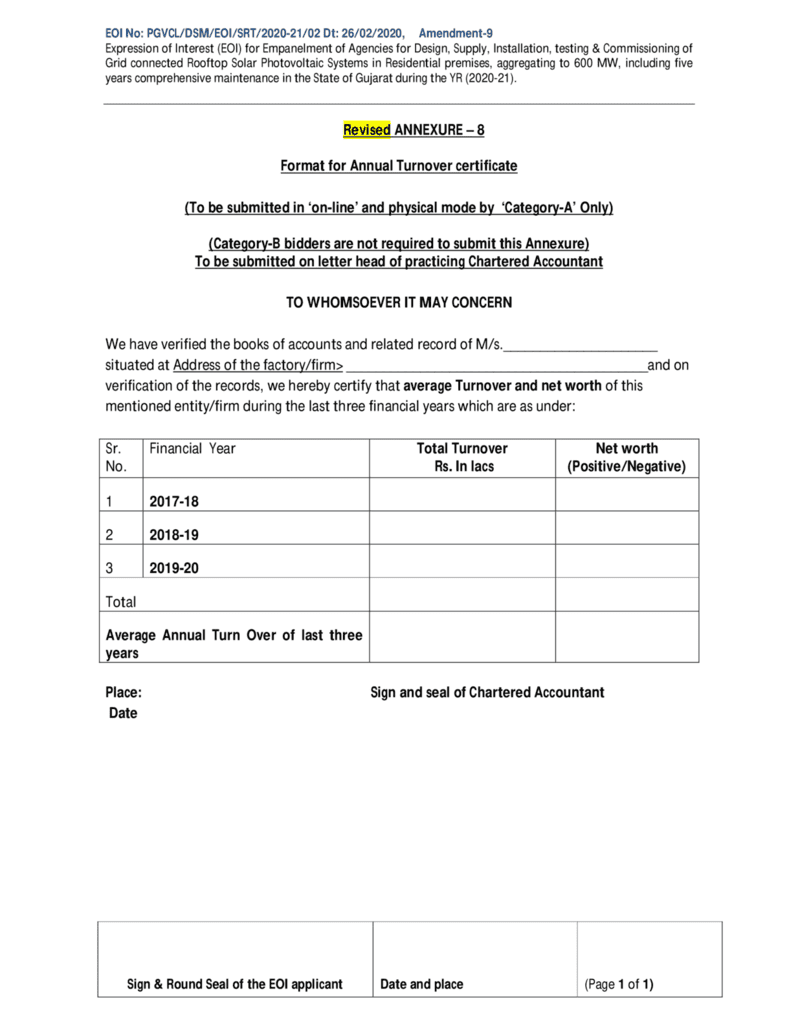

Here's a Sample Draft of Turnover Certificate