Payroll Outsourcing & Management Services

Payroll compliance is in actual a legal framework to which companies or organisations must adhere. Statutory compliance means the treatment of workers or employees. Most of the company's money and time goes into safeguarding compliance with these laws. Everything from being compliant to the minimum wages paid to maternity benefits to provident funds needs a lot of time and experts who can advise on all of these compliance measures. Therefore, the companies dealing with payroll compliance need to be well-versed with India's different labour laws or labour regulations.

Choose among our Payroll Offerings:

Payroll explained like Chapter 101

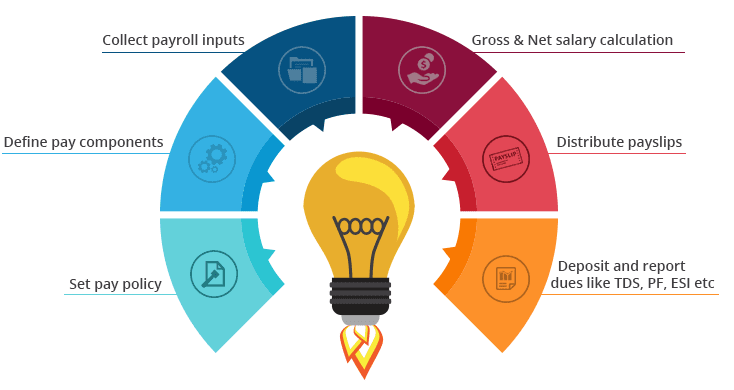

Payroll is the list of employees who works for the company either in their own office or in someone else's office. But they get paid by the company, for example. Paul is on the payroll of Apple, but if Facebook needs few IT Experts, Apple can send their employee to Facebook's office to work for a contract period. Payroll is the total of money the employer pays to the employees. As a business function, it involves:

- Developing organization pay policy including flexible benefits, leave encashment policy, etc.

- Defining payslip components like basic, variable pay, HRA, and LTA

- Gathering other payroll inputs (e.g., the organization's food vendor may supply information about the amount to be recovered from the employees for meals consumed)

- The actual calculation of gross salary, statutory as well as non-statutory deductions, and arriving at the net pay

- Releasing employee salary

- Depositing dues like TDS, PF, ESI etc. with appropriate authorities and filing returns

In short, we can say that the payroll process involves arriving at what is due to the employees, also called 'net pay', after deducting taxes.

Net pay = Income- Deduction,

Income = All regular income + allowances

What are Statutory Compliances related to Payroll | Best Payroll Management Outsourcing Services

What are Statutory Compliances related to Payroll | Best Payroll Management Outsourcing Services

What are the various Stages in Payroll ?

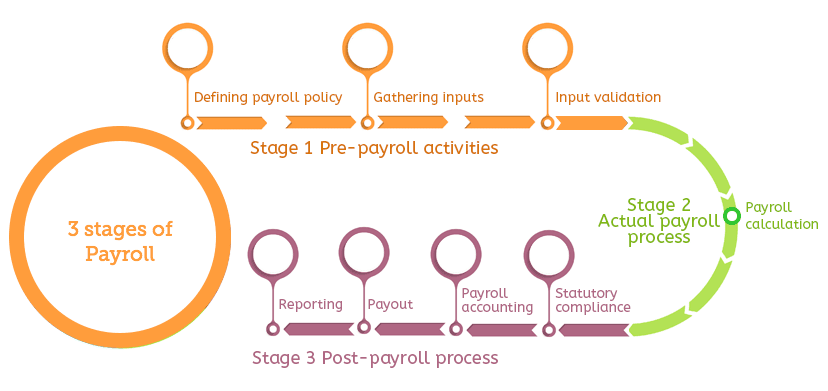

Pre-Payroll Activities

Defining payroll policy

The net amount to be paid to any employee is calculated after considering the company's various policies, such as HR Allowance, Dearness Allowance, Travelling Allowance, Casual leave and sick leave benefits, attendance policy, etc., play at that time. As a first step, such policies need to be well defined and approved by the management to ensure standard payroll processing.

Gathering inputs

The payroll process involves interaction with Finance departments, accounts department, so that alteration in wages and salary are taken into consideration immediately

In smaller organizations, we receive inputs from small teams. In larger companies, the data amount looks overwhelming. If you use intelligent payroll software with integrated features like leave and attendance management, employee self-service portal, etc., the inputs collection process does not remain a problem.

Once the payroll calculation is complete for a month, you must get it approved from either C.F.O. or C.E.O. Try tp make report in detailed format such as department wise employee cost, location wise employee cost, etc. As a payroll officer, it becomes your responsibility to dig into the data, extract the required information, and share the reports.

Post-Payroll Process

Statutory compliance

Each Company keeps a record of all its financial transactions. Salary paid is one of the highest operational expense which is reported in the books of accounts. Therefore, it is essential to check that all wage and reimbursement data is fed accurately into the accounting/ERP system as part of payroll management.

Salary payments are done mostly by account transfers such as either NEFT or RTGS. Few of the organizations also issue cheques. While wages to labor are mainly done by cash payments. Large Companies provide better facilities as provide their employees with salary account in some leading banks. Once the calculation are done, you can make the payment of salary by a single click now. This statement consists of particulars like employee id, bank account number, amount of wages, etc. If you opt for payroll software with an employee self-service portal, you can easily publish the payslips and have your account and access the payslips.

Payroll Deliverables:

Monthly:

- Pay Sheet

- Tax Computation Sheet

- Salary Master / Employee Master

- Headcount Reconciliation

- Reimbursement Eligibility Master

- Bank File (Salary transfer)

- Pay Slips & Tax Slips

- Client Specific Reports (GL, Cost Center, etc,)

Quarterly:

- Base file (Working File)

- Form-27A

- Form-24Q (Acknowledgement copy)

Yearly:

- Form 16

- ITR Filing

- Provident Fund

- Employee State Insurance

- TDS Report

- Professional Tax

- Labour welfare Fund

- Challan generation for all statutory remittance

- Monthly / Quarterly / Half Yearly / Yearly return filing

What is the statutory compliance in payroll?

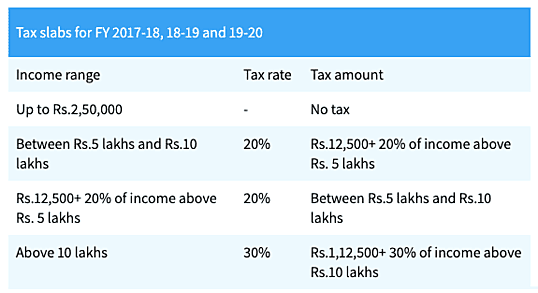

When you prepare payroll, being statutory compliant means paying as per the applicable employment norms set by the central and state legislation. Provision for minimum wages, payment of overtime wages to workers, TDS deduction, Provident fund, ESI are some statutory requirements that apply to Indian businesses.

While computing salary, you need to consider all these deductions and contributions. Income tax is one such deduction. Therefore, at the beginning of the year, the employee should make a declaration about his additional incomes, tax-saving investments, etc., called an ‘income tax declaration.’ Accordingly, We calculate an employee’s tax liability and deduct his TDS.

Based on the above tax slabs, you can calculate monthly tax liability and deduct TDS. The TDS is then deposited monthly with the government, and a quarterly report of all deductions are filed. Once you complete TDS returns for the fourth quarter, you can issue form 16 to employees. The employees use this form 16 as proof of tax deducted when filing their individual income tax return.

Non-adherence to the statutory law can lead to hefty fines and penalties. That is why you need to be up to date on all tax and payroll statutory changes.

In India, we have mainly four tax slabs with an increasing tax rate. The following chart will help you understand better

What are the challenges in handling Payroll management process?

The payroll process becomes challenging due to two main reasons.

The requirement to stay statutory complaint

We have already discussed about non-adherence to statutory laws can lead to a levy of fines and penalties. There are cases, which may even threaten the existence of the business. However, today there is some advanced payroll management software that automatically processes payroll according to statutory laws.

Dependence on multiple payroll inputs sources

Before you process the payroll, you need to get all the data together from sources such as attendance register, conveyance facility availed record, data from HR team like salary revision information, etc., making it a complicated process. For many years HR and payroll officers were managing payroll on excel sheets. Still, excel sheets have problems like dependency on excel formulas for salary calculation, complexity in adding and removing employees and other limitations like manual data entry, difficulty in extracting information, etc.

What are the methods available for Payroll management?

Excel based Payroll management

Many businesses that are at an initial stage of operations and have a handful of employees go for excel based payroll management. Excel-based payroll management involves doing payroll calculation on excel sheets using a standard payroll calculation template. The mathematical formulas concepts used by the payroll officer for computation. Just because this method does not involve any cost, but it has its inherent limitations like

👉 High chances of clerical and mathematical with manual data entry.

👉 Managing payroll of list of employee is a tough task here, mainly adding and removing of employees from the list

👉 Cases of duplicate data entry or omission of value/entry is common.

👉 Updation of tax and other norms is often neglected or delayed.

Outsourcing payroll is the best option that an organization have. Outsourcing means you want an external expert agency to take care of your day-to-day payroll function. Many organizations that need an error-free solution for payroll go for this option. Based on their pay cycle, every month, they provide employee salary information and other data such as attendance, leaves, reimbursement details, etc., to the payroll service provider. The service provider then computes payroll and also takes care of statutory compliance. However, since payroll is a crucial function and businesses want full transparency and control over it, they often hesitate to outsource payroll.

As discussed above, you need to ensure that payroll inputs are coming from every source in a timely and seamless manner for running successful payroll. The intent of using software is to reduce the friction in getting the inputs. There is advanced payroll management software available in the market that automates payroll computation and serves as a holistic leave and attendance management, HR management, and employee self-service portal. Depending on your business size and use cases, you can opt for appropriate payroll software for your business.

Integration with time, attendance and leave management system

Time Management

Typically this module is used to track time spent on projects or specific activities. Consulting firms such as audit firms, specialist doctors, etc., who manage critical projects require a robust time management module for tracking time, and at times this data may also be used for billing clients.

Integration with the accounting system

Your accounting/ERP system needs to record every financial transaction, including payroll information like department wise employee cost, individual payroll components like reimbursements, tax due and paid, etc. Some payroll software integrates with accounting software via API( a way to push data directly from one software to another).

If the integration is not proper, the payroll officer needs to provide all transaction details to the accounts department. The accountant then manually posts it in journal entries in accounting/ERP software like Tally ERP, SAP, Quickbooks, etc. These integrations can help the finance and payroll team work together and avoid any manual entry of data.

Attendance

While most small organisation go for a manual attendance system, medium and large organisations have started using intelligent, automated tools such as biometric method, auto-tracking via system log-in, access cards, iris capture, etc. The data stored in a system linked to the payroll software that uses this data to calculate attendance days, overtime, etc. For seamless payroll processing, check that software supports attendance management and is configurable with access control machines.

Leave Management

Employees take a certain number of leaves in every organization, such as privilege or annual leave, casual leave, sick leave, holiday, etc. Employees are entitled to this leave in almost every organization.

If the software has leave management feature such as casual leave, sick leave, HR can credit these leaves to eligible employee account. So, the employee can apply for leave through the system. A sound plan should also define a workflow to notify the employee’s manager for either approval or rejection. Robust payroll software with a built-in leave management feature can help attain accurate payroll.

Tax Registrations for Above

According to this act, the employer is responsible for paying wages at least every month on a timely basis. The wage period is fixed according to the employer's convenience on a daily, weekly or monthly basis.

So, if the company falls under the ESIC Act compliance, then the Employees CTC needs to be updated, including the ESIC employer and employee contribution.

According to EPFO (Employee Provident Fund Organisation) rules and regulations, any company with 20 or more employees should register for Provident Fund. If the company fails to comply with EPFO rules and regulations, it is heavily penalised.