Temporary or Casual Taxable Person GST

Casual taxable persons have got a legitimate position in GST Act. They have been provided special treatment under GST. The GST Act defines a simple taxable person as someone who occasionally undertakes transactions involving the supply of goods or services in his business schedule. As an Occasional businessman in a random territory with no fixed place of business, he is known as a temporary or casual business person. Hence, persons running temporary businesses in fairs, exhibitions, or seasonal companies would fall under casual taxable persons under GST.

Casual taxable person GST registration procedure and documents required. Temporary and seasonal traders supplying goods or services must obtain GST registration.

It usually takes 5 to 7 working days.

- Session with TAXAJ Expert

- Filing of Application for Registration

- Follow up till you secure GST Identification Number

- Vendors selling or conducting business for a limited period of time such as a Trade Fair in another state or Project wise venture

- Someone who supplies taxable goods or services occasionally in a taxable Territory where he does not have a fixed place of business. The person can act as a Principal or agent or in any other capacity supply goods or services for the furtherance of business

- Purchase of Plan

- Expert Assigned

- Upload documents on vault

- Registration Form Submission on GST portal

- ARN Number Generated which can be used temporarily to issue invoices

- GSTIN Received (5-7 working days subject to Govt. approval)

- PAN card of the applicant (Indian National) or Passport (for Foreign Nationals and NRIs)

- Proof of Business Registration or Incorporation Document

- Proof of Identity of the Applicant and Authorized Signatory (such as Voter's Id, Passport, Driver's license, Aadhar card, etc.)

- Photographs of the applicant and authorized signatory (in JPEG format, maximum size – 100 KB)

- Address proof of the applicant and principal place of business (such as electricity bill, rent agreement, property tax receipt, etc.)

- Bank account details or statements

- Proof of appointment of authorized signatory (such as a letter of authorization, board resolution, etc.)

- Existing registration of the applicant, if any (such as GSTIN, MCA registration, etc.)

Who is Casual Taxable Person?

Who is Casual Taxable Person?

The GST Act accords special treatment to casual taxable individuals. According to the provisions of the GST act, a casual taxable person is someone who occasionally engages in transactions involving the supply of goods, services, or both, with the aim of facilitating business operations. The act specifies that the business activities may take place in a state or union territory where the individual lacks a permanent business location.

What is the difference between a Regular and a Casual Taxable Person?

What is the difference between a Regular and a Casual Taxable Person?

The typical taxable individual is one who must undergo registration under the GST Act and cannot be categorised as a casual taxable person. Consequently, a typical taxable person may operate their business anywhere in India. Conversely, a casual taxable person may find it challenging to establish a fixed business location, necessitating temporary GST registration. Special provisions under the GST registration act are essential to accommodate the unique requirements of taxpayers, such as regular business operations for typical taxpayers and the transient nature of business for casual taxpayers. Unless a typical taxpayer opts for enrolment under the GST composition scheme, they must adhere to filing monthly GST returns and maintaining accounts in accordance with the GST Act.

What is the Process of Temporary GST Registration?

What is the Process of Temporary GST Registration?

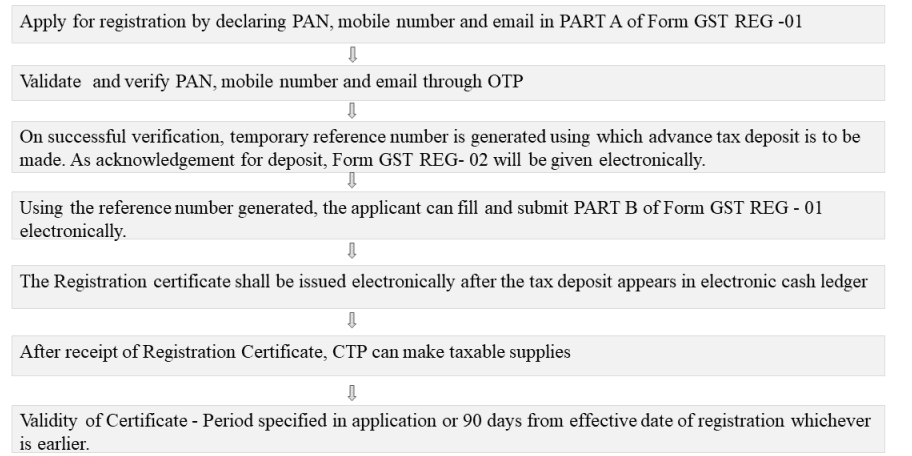

The process of temporary GST registration for casual taxable persons is as follows:

- To initiate the registration process as a Casual Taxable Person, the applicant is required to submit Form GST REG-01 on the GST portal, specifying the option 'For Casual Taxable Person' in Part A. Essential details such as PAN, mobile number, email address, state or union territory, and the anticipated period of activity must be provided.

- Upon successful verification of PAN, mobile number, and email address, the applicant will be assigned a temporary reference number (TRN). Subsequently, the applicant should log in using the TRN and complete Part B of Form GST REG-01, furnishing necessary information and supporting documents including address proof, bank account details, nature of business, estimated turnover, etc.

- An advance tax payment, based on the estimated turnover for the registration period, is required. This payment can be made either online or offline through a challan.

- Following the submission of the application and tax payment, the applicant will receive an acknowledgment in Form GST REG-02. The application will be processed by the designated officer within three working days. In the absence of any queries or deficiencies raised by the officer, the registration certificate in Form GST REG-06 will be issued.

- If the officer identifies any queries or deficiencies, the applicant will be notified through Form GST REG-03 and is required to respond within seven working days using Form GST REG-04. If the officer finds the reply satisfactory, the registration certificate will be issued. In the event of an unsatisfactory reply or non-receipt within the stipulated timeframe, the application will be rejected, and the applicant will be notified through Form GST REG-05.

What is the validity of Temporary GST Registration?

What is the validity of Temporary GST Registration?

The temporary GST registration is valid for 90 days or for the period specified in the application, whichever is earlier. The registration can be extended for another 90 days by filing Form GST REG-11 and paying additional tax before the expiry of the original period.

Casual Taxable Person or Temporary GST Registration

All About Casual Taxable Person

1. INTRODUCTION

Casual taxable person means a person who supplies taxable goods or services occasionally in a Taxable Territory where he does not have a fixed place of business. The person can act as a Principal or agent or in any other capacity supply goods or services for the furtherance of business

Example:

Mr.Ravi having the place of business in Bangalore providing Management consultancy services in Hyderabad where he has no place of business. Hence Mr.Ravi has to register as a Casual Taxable Person in Hyderabad before providing such services.

Note-

a. Person includes individuals, Hindu Undivided Family, company including government company, firm, limited liability partnership, an association of persons, a body of individuals, co-operative society, local authority, government including a corporation.

b. Principal place of business means the place of business specified as the principal place of business in the certificate of registration

2. REGISTRATION

The liability to register under GST arises when the person is a supplier and the aggregate turnover in the financial year is above the threshold limit of 20 lac rupees. However, there are certain categories of suppliers who are required to get compulsory registration irrespective of their turnover. The threshold limit of 20 lac rupees is not applicable to them. One such supplier would be a Casual Taxable Person (hereafter referred as CTP). A Casual Taxable person cannot opt for Composition Scheme.

A CTP has to obtain a Temporary Registration which is valid for a maximum period of 90 days in the State from where he seeks to supply as a Casual taxable person. A CTP is required to make the advance deposit of GST (based on an estimation of tax liability).

Let’s take our previous example,

Say Mr.Ravi estimates his taxable services at Rs. 100000. He is required to make an advance deposit of Rs.18000 (18% of Rs.100000) to obtain temporary registration.

3. REGISTRATION PROCESS

4.EXTENSION OF PERIOD OF REGISTRATION

Apply in FORM GST REG-11 before the end of validity of registration. An extension can be made for a further period not extending 90 days. The extension will be allowed only on deposit of additional tax liability for the extended period.

5. RETURNS TO BE FURNISHED

The casual taxable person is required to furnish the following returns

| FORM | DUE DATE |

| FORM GSTR-1 ( Details of outward supplies of goods or services) | On or before the 10th of the following month |

| FORM GSTR-2 ( Details of inward supplies) | After 10th but before the 15th of the following month |

| FORM GSTR-3 | After 15th but before the 20th of the following month |

A casual tax person is not required to file an annual return as required by a normally registered taxpayer.

Note –

All Forms can be submitted at the common portal, either directly or through a Facilitation Centre notified by the Commissioner.

6. REFUND BY CASUAL TAXABLE PERSONCTP is eligible for the refund of any amount deposited in excess of tax liability which will be refunded after all the necessary returns have been furnished for the Registration period.

Application for Refund of balance in excess of tax liability in the electronic cash ledger has to be made in serial no. 14 of the last FORM GSTR-3 return

What is the difference between Casual Taxable person & Regular Taxable person ?

A regular taxable person would be someone who is required to be registered under GST and not classifiable as a casual taxable person or non-resident taxable person. Hence, regular taxable persons would be someone with a fixed place of business located within India.

Unless a regular taxpayer is enrolled under the GST composition scheme, the taxpayer would be required to file monthly GST returns, maintain accounts as per GST Act, maintain a fixed place of business and comply with GST regulations.

Casual taxable persons would find it hard to maintain a fixed place of business or file monthly GST returns continuously, as their business would be seasonal in nature with no fixed place of business. To accommodate the unique requirements of such taxpayers special provisions have been provided under the GST Act for registration of casual taxable persons.

How long is this Registration for Casual taxable person valid ?

The validity of GST registration for a casual taxable person is the validity period specified in the GST registration application or 90 days from the date of registration, whichever is earlier. The sample GST registration certificate below shows validity period being specified only for casual taxable persons and non-resident taxable persons under GST.

Q. Can this GST Registration of Casual Taxable person be extended ?

In case a casual taxable person needs an extension of the validity period mentioned in the GST registration certificate, then FORM GST REG-11 must be submitted. Along with the request for extension of the validity period, advance GST deposit must also be made by the taxpayer based on the expected tax liability. If the officer verifying the application is satisfied and advance GST deposit is made, the GST registration can be extended by up to another 90 days.

How can I avail these exemptions ?

The exemption is available only if the person is availing the benefit of notification no. 03/2018 – integrated tax dated 22nd October 2018;

The total aggregate value of such supplies, to be computed on all India basis, should not be more than the amount of aggregate turnover above which the supplier is liable to be registered in the State or Union Territory; and

A person is required to obtain PAN (i.e. Permanent Account Number) and it also required to generate an E-way bill in accordance with rule 138 of the Central Goods and Service Tax Rules, 2017.

Is there a timeline or limit to apply the Registration under casual person scheme ?

All persons who are classified as casual taxable persons are mandatorily required to obtain GST registration, irrespective of annual aggregate turnover. Further, the application for GST registration for a casual taxable person must be made at least 5 days prior to the commencement of business. GST registration application for casual taxable persons can be made using FORM GST REG-01.

Is there any deposit or advance payment under this scheme ?

What are the exemptions to this scheme ?

A certain casual taxable person is exempted from obtaining the GST Registration. Exemption from GST registration, for a casual taxable person, has been provided vide notification no. 56/2018 – Central tax dated 23rd October 2018. The below-mentioned list provides the special category of casual taxable person who is being exempted from obtaining the GST registration –

A casual taxable person who is being engaged in making inter-state supplies of handicraft goods. However, the basic condition for claiming the exemption is that the handicraft goods should have been made by hand (even though some tools or machinery may also have been used in the process). Further such handicraft goods should be graced with visual appeal in the nature of ornamentation or in-lay work or some similar work of a substantial nature, possess distinctive features, which can be aesthetic, artistic, ethnic or culturally attached and are amply different from mechanically produced goods of similar utility; and

A casual taxable person who is engaged in making inter-state supplies of specified items, when such items are made by the craftsmen largely by hand even though some machinery may be used in the process.