USA Company Registration: LLC & C Corporation

Start your business in the United States from anywhere

Start your business in the United States from anywhere

USA Company registration is now easy as there is no need to travel to the USA or physically be present in the USA. As the process can be commenced and completed online in less than a week through TAXAJ.

Indian Companies looking to expand or have a non-resident Indian Customer base can enjoy several USA company registration advantages.

The United States being a developed nation, is an economic superpower because of its advanced infrastructure, technology, and abundant natural resources. The economy is service-oriented, contributing 80% of its GDP, whereas manufacturing contributes about 15% of its output.

With rapid development and globalization and a substantial English-speaking population, Indian businesses are unique to exploring the American market. With the lowest corporate taxes and well-established business laws and practices, most Indian companies with global ambition think that the USA is the right choice.

Get your private limited company registered in the fastest possible manner.

It normally takes us 20 business days to get everything done for you. If you have an SSN or a TIN, the process takes 2-4 business days.

1. State filing fees

2. Company formation

3. Obtaining EIN (Tax ID for the company)

4. Post-Incorporation set up

5. The first year of registered agent fees

6. Fees for the first month of a US-based address through our partner Anytime Mailbox

7. A business bank account with our partner, which is set up remotely so you do not need to visit US

8. One-time free tax consultation

9. Special offers and discounts from our partners

10. Lifetime support from us.

- Businesses looking to expand or scale operations on higher level

DSC Application

Name approval form filing

Preparation of Incorporation Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms

Receipt of Incorporation Certificate.

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Apostilled Passport, Mobile Bill and other KYC docs in case of NRI Stakeholder.

Latest Month Personal Bank statement of all the Stakeholders.

Specimen Signatures of all Stakeholders.

Few Proposed Business Names along with Objects.

Brief description of main business activities of the proposed Company.

Shareholding pattern (50:50 or 60:40) between the Stakeholders.

Authorised & Paid Up Share Capital of the Company.

Strategies for Launching your Business in USA:

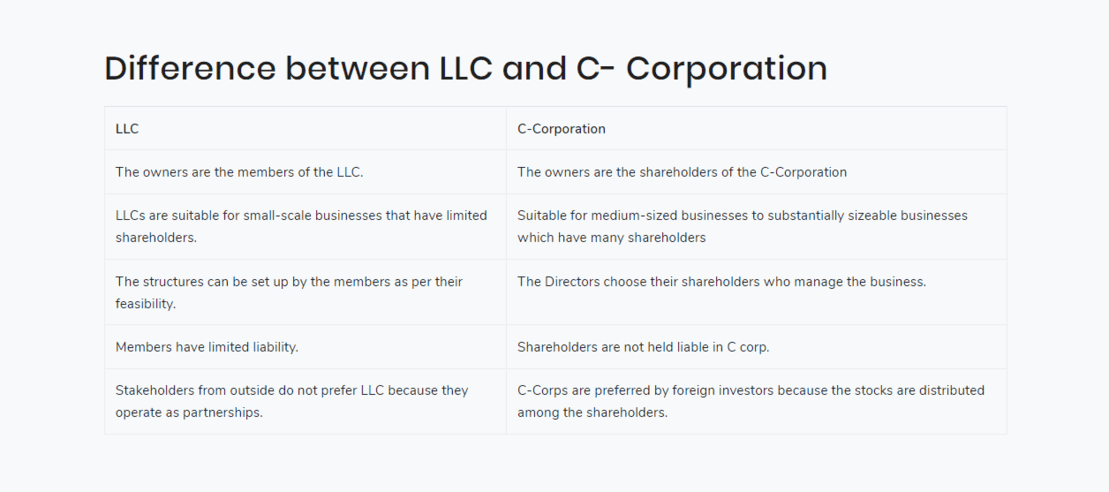

Business in the US can be set up in sole proprietorship, general partnership, LLC, or a Corporation. However, the entries for Indian companies are limited to an LLC or a C corporation in the USA.

In the USA, the laws and the regulations relevant to the Incorporation and management of LLC or corporation differ from one state to another. We incorporate all LLC or Corporations for Indian Nationals in Delaware as Company registration in Delaware has various benefits like low taxes, minimal maintenance fees, and excellent corporate laws.

Well, incorporating in Delaware is not only a good option for Indian Nationals and companies, but even American Companies as more than half of the companies are publicly traded, and fortune 500 companies in the USA are incorporated in Delaware.

LLC (Limited Liability Company)

LLC (Limited Liability Company)

LLC is a type of entity that has features of both corporation and a partnership. LLC provides the owners limited liability protection in case of a lawsuit and even bankruptcy. LLCs are more flexible, and the compliance requirements for LLC are simple.

A corporation requires resolutions and shareholders meetings and the recording and filing of forms showing meetings that were held and votes. On the contrary, LLCs do not require annual shareholders' meetings.

C-Corporation

C-Corporation

If the goal is to seek funding from the VCs and angel investors, it is better to seek a C corporation in the USA. The bankers, investors, customers, suppliers, and employees consider corporations ideal for most businesses.

C-Corporations independent legal entities that are separate from the people who own, control, and manage. Due to this, it is viewed as a regular person in tax laws and can thus be engaged in business, and contracts can initiate lawsuits and be sued.

How To Incorporate In USA From India

Brief Introduction

For the last several years our company was specializing in helping international clients to register their businesses in the US. As such, we helped thousands of entrepreneurs from India to register their US companies and guiding them on how to further develop and expand their business into American and international markets.

This article reflects our experience accumulated over years of assisting Indian clients, and we update it periodically to present the most relevant information.

What we cover here:

- What kind of money are we talking about?

- What does it take to form a US company?

- What about banking?

- What about accepting credit cards?

- What about taxation?

- What state should I register my company in?

- Should I register LLC or Corporation?

- What about licensing?

- If I have a US company, can I move to the US?

- If I have a US company, can I get Social Security Number?

What kind of money are we talking about?

We touch this question first, because many of the prospects looking for US company registration are vaguely aware of the costs involved in launching a US business.

Initial Investment

It is crucial to understand that formal company registration is only a small part of the budget needed for launching your US business. Depending on the state of registration, entity type, and specific business needs, registration costs can run from as little as $300 to as high as $1000 and over. On average our Indian clients spend between $600 and $700 on registration formalities.

Then there is a question of banking, and for many entrepreneurs also the question of merchant account (what many confusingly refer to as “payment gateway”). We discuss both further in this article, but if we consider the option of traveling to the US in order to open the bank account, or using a managed service , you should prepare an additional budget of $2000 minimum, with about half or it to be spent on the fees, and the rest to be kept as balance in the account.

To summarize, for proper company registration only, without opening a US bank account, prepare a budget of $600-$700. With banking your budget needs to be between $2,600 and $3,000. Keep in mind – this is just the initial investment needed to properly set up the company. Your business would need more money for the actual business activity, so make sure to take that into consideration when preparing your startup budget.

Running Costs

Beside initial investment, you would have monthly and annual costs, related specifically to maintaining your company. If you plan to lease a US address expect to pay between $20 and $99 each month (we offer our own professional solution called MyUSAOffice that offers addresses for as low as $299/year). Another recurring cost is the cost of Registered Agent service (we provide it for a competitive $99 a year). Banking would cost you another $20-$100 a month in bank fees and management fees if you opt for managed bank account services.

Most states have recurring maintenance fees, taxes and reports. For example, Wyoming has Annual Report of $52, while Delaware has franchise tax for LLCs ($300 a year) and both annual report and franchise tax for corporations, calculated based on some formula. Some states have no annual fees, but its rare.

And finally, depending on your company structure and activity, you might be required to file annual tax return (and in some cases – pay taxes), which means you need to hire the services of CPA (certified public accountant) and maybe even a bookkeeper. Filing simple tax returns should not cost more than $300-$500, however more complex cases would result in higher costs. Keep in mind, in some cases you as the owner would need to obtain Individual Tax ID Number (ITIN), adding another $300-$400 per partner, but it’s a one time cost.

Conclusion

Before launching your business you should plan your budget carefully. Many clients make the mistake of hoping that some of the initial and running costs will be offset by the first clients they are counting on acquiring, but you should never build your business on hope – cold blooded calculations prove to be a more reliable tool in business.

We recommend preparing a setting aside a specific sum that would keep your business running for a year without any income whatsoever. In case of US business setting aside $4,000–$8,000 would go a long way to ensure your business is properly set up and funded for a year, giving you the necessary peace of mind to develop your product and customer base.

What does it take to form a US company?

The actual process of registering a U.S. company is rather simple, and involves filing certain applications with various government authorities and drafting some internal company documents. Our company provides full service in company registration for a very competitive cost, so we make it easier on our clients to get this part of the plan done with.

Before registering your company two decisions need to be made: first you need to choose what state you want your company registered in, and second you need to decide on what type of legal entity this company will be organized as (typically a choice between a corporation and an LLC – limited liability company). We discuss both questions later in this article.

What about banking?

Banking is crucial for running your business. Most of our Indian clients are looking to form a U.S. company and have a U.S. bank account opened, among other things. After 9/11 U.S. government made it harder for banks to offer remote account opening for non-U.S. individuals, however it is still possible to open such accounts when visiting the bank in person. We have an entire article dedicated to banking in the U.S., including various alternatives, which we invite you to read.

In brief, if you can visit the U.S. in person, or have a U.S.-based partner or just someone (friend/family) willing to help you by acting as the “Signer” on the account, you might want to explore these options. Those who want to use a managed service can opt for one remotely, however such service comes with both initial and monthly cost, and includes certain restrictions.

Why not start with bank account in India?

It might be a good idea to consider opening a bank account in India for your U.S.-based business, until such time other options would become available to you. All you would need in that case is to order Apostille for your company’s certified copy of articles of incorporation (or organization), a service you can order form us at the same time when you are ordering your company registration.

Once you establish your first U.S. clients who are willing to make overseas payments via wire transfers to your Indian bank account, you will be in a position to expand further by using those funds to open a U.S. bank account, either by traveling to the U.S. or by hiring a management company to act as the local signer.

What about accepting credit cards?

Another challenge is to arrange a payment processing facility for your business. Technically, there are many ways your clients can pay you for your services or the products you sell that does not involve the use of credit cards – think of such solutions as:

- wire transfers,

- ACH payment services,

- Western Union and similar services,

- PayPal and its equivalents,

- Bitcoin and other virtual currencies,

- e-checks,

- checks (which can be deposited online), and

- money orders & cash.

Depending on what you sell you might want to explore all those and other payment methods while looking for credit card processing solutions.

That being said, credit and debit card processing capabilities are crucial for the growth of your U.S. business. First, let’s understand how credit card processing works.

Payment Gateway

A payment gateway is an e-commerce service that authorizes payments for e-businesses and online retailers. Payment gateways are provided by payment processors, such as Authorize.net. You can learn more about payment gateways here, and about payment processors here.

It’s not difficult to create an account with a payment processor, however the real challenge is to open a merchant account.

Merchant Account

A merchant account is a type of bank account that allows businesses to accept payments by payment cards, typically debit or credit cards. Those accounts are provided by merchant account providers. Funds processed through payment gateways are deposited in merchant accounts, which in turn deposit them in your company checking account, minus fees.

The challenge with opening a merchant account lies in the fact that merchant account providers are exposed to the financial risk as a result of their clients’ business activity, and this risk is mitigated by rigorous underwriting process and elimination of certain countries and specific types of businesses considered “high-risk” businesses. You can learn more about merchant accounts here.

U.S. businesses owned by Indian clients, who don’t have Social Security number or any merchant history in the U.S, would fall under “high-risk” category. There are merchant account providers that serve the high-risk niche, and they are called high-risk merchant account providers. Typically a U.S. bank account is required, but some of those providers would even offer services to clients with a bank account in India or other countries. Also, to offset the risk, those providers charge higher fees and have longer settlement times.

KEEP IN MIND: certain types of business activity, popular among our clients from India, fall under “high-risk” profile. Typical examples are remote IT services, staffing, etc.

We suggest clients falling in this category to consider expanding their business services to include less risky categories, such as software development and IT services, and to use every precaution and best customer service practices in order to create solid merchant history with the merchant account provider.

Good merchant history is key to opening a low-risk account in the future, which would result in reduced merchant fees and settlement times.

Online Payment Service Providers

Payment service providers (PSP) offer online services for accepting electronic payments by a variety of payment methods such credit cards, direct debit, and more. By using the services of a PSP you can circumvent the need to open a merchant account and sign up for payment gateway, since you get all those services under one roof.

There are over 900 PSPs in the world, with more than 300 offering services in the U.S. Most of those PSPs don’t offer services in India, however since you are establishing a U.S. company, preferably with U.S. business address and U.S. bank account, your business might qualify. Click here to see .

So how do I establish credit card processing facilities for my U.S. business?

Take it one step at a time. Each step brings you closer to accepting credit cards, but you must invest time and money first to prepare the foundation of your merchant application regardless of what service you will use:

- STEP 1: Register your U.S. company;

- STEP 2: Lease a U.S. address with mail forwarding;

- STEP 3: Open a U.S. bank account (unless you can’t, in which case you would be limited to certain high-risk merchant account providers);

- STEP 4: Build a professional website for your business, clearly showcasing your business;

- STEP 5: Research the , and try applying for an account with each one in turn, until you find one that will accept your application.

- STEP 6: If that fails or you are not interested in this kind of service then run a search for “high-risk merchant account providers” and try applying for an account with them. You will be required to provide additional documentation, in which case work on providing whatever is necessary to be accepted as a client.

- STEP 7: If all fails, look to partner with a U.S. citizen or permanent resident with good credit history, in order to open a regular (non-high-risk) merchant account with one of the large domestic providers.

What about taxation?

U.S. taxation is a confusing topic, so let’s try to simplify it as much as possible. You should be concerned about the following types of taxes:

- Income tax,

- Sales tax,

- Payroll tax,

- Franchise tax,

- Gross receipt tax,

- Various specialty taxes.

Income and Sales Taxes:

We cover the questions of income and sales taxes in detailed manner in our article U.S. Taxation for Foreign Entrepreneurs. The short version is, sales tax is charged on specific products, and its rate depends on the state where your business is registered or has significant presence. Income tax depends on your company type (LLC or corporation), state(s) of registration, number and domicile of partners, etc.

Make sure to read the full article for a better understanding of how sales and income taxes work. It is recommended to hire CPA to handle the question of taxation.

Payroll Taxes:

Payroll taxes become relevant if your company starts hiring regular employees in the U.S. Keep in mind, contractors are a different kind of employees, who file their own income and self employment taxes. So unless you plan to open a physical office and hire employees who will be working regular hours in that office, you will not need to worry about payroll taxes.

Franchise Tax:

Franchise tax is another way for the state to cash in on the fact that your company is registered there. Only few states have franchise taxes, and in a way they are just another way you maintain your company in good standing, similar to annual reports and such.

Two most notable states that levy franchise tax are Delaware (as of this writing it’s $300 a year for LLC, for corporations it’s calculated based on number of shares and par value) and California (as of this writing it’s minimum $800 a year for LLC and corporations). Typically, the state and/or your Registered Agent will remind you when this tax is due.

Gross Receipts Tax:

Gross receipts tax is levied in a few states and on some entity types. For example, Texas has annual gross receipts tax. Your CPA will be able to assist you with the calculation of this tax, if your entity is required to file one.

Various Specialty Taxes:

For most part you wouldn’t worry about those, as they are specific to certain activities, and often are related to companies with physical presence in the state. Some taxes you should be aware of are taxes levied on products containing tobacco or alcohol, in which case they require licensing and compliance.

What state should I register my company in?

U.S. companies are registered by states and territories, not by the federal government. That means theoretically you have 50 states, DC and several U.S. territories to choose from.

Each state is different – different laws, registration fees, processing times, and renewal rules and costs. When making the choice of state you need to answer a few questions first.

Are you launching a technology startup with the goal of raising investment from angels/VCs?

If the answer to this question is “yes” then you probably should consider registering a Delaware C-Corporation specifically, since this is the most popular tool for companies with this profile.

Will you have a real office/store/warehouse in a specific state?

If the answer to this question is “yes” then you should consider registering your company in this state, even if it’s not the friendliest or cheapest of all states.

The reason is simple – having real presence in a given state creates what is called “strong nexus”, requiring your company to be registered in that state. That means if you register in one state but have real physical presence in another you would be forced to register a foreign entity in that state, which means the whole thing will cost you double or more.

Incorporation-friendly states

If your business is conducted online and/or run remotely from India, without any physical presence in the U.S. (having clients doesn’t make your business U.S.-based) then you should consider registering in one of the incorporation-friendly states.

There are 3 states that are traditionally considered to be incorporation-friendly: Delaware, Wyoming and Nevada. Of the three we typically recommend Wyoming, because Nevada is quite expensive to register and to maintain your company in, while Delaware comes with high franchise tax, steep penalties for late fees and relatively high maintenance fees. Wyoming easily compares to the other two states, while being relatively cheap and easy to work with.

You can learn more about the difference between the three and see why we recommend Wyoming for most business types by checking the comparison between Delaware, Wyoming and Nevada.

If I register in one state, can I do business in another?

Per U.S. constitution, company registered in any U.S. state or territory is immediately recognized by all other states and territories, so for example you can take your Wyoming company formation documents and go to New York to open a bank account. Also, your clients can be anywhere in the U.S. or the world for that matter.

That being said, there are at least two cases in which additional registration might be required:

1. If your business sells tangible goods that are typically taxed (sales tax) and it uses distributors in states other than the state of registration, then it might be creating “soft nexus”, meaning you would need to register for sales tax collection in those states.

2. If your business establishes physical presence in another state, such as opening an office, hiring full time employees, opening a store, or leasing a warehouse, among other activities, you might be creating “hard nexus”, which would require you to register your company in that state as “foreign entity”.

Consulting an attorney

If you are still not sure where to register your company it’s always a good idea to consult a corporate attorney. Though it might be a bit expensive, there are plenty of online resources allowing you to ask for a free consultation, or free answering service that you could use for that purpose.

Should I register LLC or Corporation?

Question of “LLC vs. Corp” is one dealing primarily with taxation and with formation and maintenance costs. We will consider several points on interest and show you how those two entity types compare to each other.

Limited Liability Protection

Both entities provide limited liability protection to the owners, so in that regard there is probably not much meaningful difference between the entities.

Formalities

As far as formalities go, corporations require somewhat more formalities, while LLCs go easier on formalities.

Corporations have three levels of ownership and management – shareholders own the corporation through holding of shares, and they elect directors who manage the affairs and decide on the general business strategy of the corporation. Board of directors in turn appoints officers, who run the day to day operations of the corporation. All that is governed by the corporate bylaws, and the ownership and management of the corporation is defined through series of meetings, for which minutes must be created and maintained in company records.

LLC has two levels of ownership/management – members of the LLC are the owners, and managers manage the LLC. LLCs can be memeber-managed, which means all managers are also members (but not necessarily all members are also managers), and manager-managed, meaning some or all managers are NOT members of the LLC. LLC typically would need an Operating Agreement to govern its structure and operation, and in which membership and management are defined, among other things. LLCs also need to have meetings of members, which should be recorded via minutes, however this requirement is less strict for LLCs compared to corporations.

Cost of Registration and Maintenance.

For many clients costs or registration and consequent maintenance of an entity plays critical role in choice of state and entity. In that sense most states have similar costs for LLCs and corporations, with a few notable exceptions:

New York LLC: though the cost of NY corporation is relatively low, cost of LLC is unproportionally high, due to bigger state fees and especially due to the publication requirement, which only applies to LLCs and some other entity types, but not corporations.

Illinois LLC: another state where cost of LLC is significantly higher than the cost of corporation, primarily due to state fee differences.

Tax Related Differences

The most crucial difference between LLC and Corporation are tax related. First, its important to understand that the only type of corporation available for foreigners who are not U.S. citizens or permanent residents is C-Corporation. Perhaps you heard about S-Corporation, but this is irrelevant for non-U.S. persons so we will skip discussing it.

LLC is a pass-through entity, which means the profit and loss passes through the company to the owners, who pay their personal taxes on that profit. C-Corporation is a double taxation entity, which means net corporate profit is taxed first (both on federal level and on state level, if the state has income tax), and then dividends are distributed to shareholders, who in turn pay their income tax on those dividends.

Does that mean corporation is necessarily bad, and LLC is necessarily good? Nope, it only means that corporation permits some wiggle room for creative tax planning, while LLCs are pretty much straight forward entities. Curious fact, one of the reasons we love LLCs so much is the fact an LLC is a flexible entity, that can elect to be taxed as C-Corporation, if the management deems it more beneficial from tax point of view.

We have the entire section of this article dedicated to taxation, as well as an entire article dedicated to taxation of foreign-owned U.S. companies, so we recommend you to study those. Also, it is always a good idea to consult with a CPA (accountant) before making your final decision on what type of entity to register. Remember, LLCs are flexible, so chances are you won’t go too wrong by choosing an LLC as your entity type.

Conclusion

We often suggest LLC as the entity of choice, due to it being a less formal entity to maintain, and due to its flexible taxation. Some cases would justify going with corporation, so before making this decision make sure you fully understand what having a corporation in the particular state of your choice would mean and cost. And of course – consult a CPA and an attorney if you are not confident enough with your choice.

What about licensing?

First of all, it’s important to understand that “getting a license” is not the same as “registering a company”. Companies such as LLCs or corporations are legal entities, formed by the state, and essentially are separate from their owners. License is a permit allowing a business to conduct certain business activity, while at the same time requiring the business to comply with laws and rules that the license is governed by, and in some cases pay related taxes.

Most U.S. businesses formed by our Indian clients don’t require any licensing whatsoever. However we do offer a license research service to make sure your business either doesn’t need any licensing, or needs some specific licensing, in which case we will let you know what it is and how to obtain it.

General Business License

A few states require all businesses formed in that state to obtain general business license (like Nevada, which is one of the reasons we don’t recommend this state). This is just another way for the state to cash in on the fact that companies want to or have to be registered there. Also in some states local authorities require businesses domiciled within the borders of the local jurisdiction (e.g. California cities and towns) to obtain local general business license.

Typically this license is obtained at the same time or right after the company is registered, and it is renewed together with company renewal.

Specialty Licenses

Certain activities require specific license. The most common type of licensing we handle on steady basis is tobacco-related licensing. Other examples are alcohol licenses, professional licenses, gambling licenses, firearms licenses, dealerships etc.

Unless your business trades in regulated merchandise, products containing one of the regulated substances, or deals in regulated activity, it will not need any specialty license.

If I have a US company, can I move to the US?

Perhaps, but not right away. Typically, the more successful your business becomes, the better is your chance to obtain legal status in the U.S., even, eventually, obtain permanent resident status (“green card”).

U.S. immigration laws are changing constantly, so you should be on top of the most recent updates, which can be done by periodically reviewing news on USCIS website and similar sites dedicated to immigration to the U.S. In general, certain visas exist today that allow foreign businessmen entry to the U.S. for such purposes as business trips, visas for investors, and visas for company executives.

Following numerous requests by our clients to provide assistance with U.S. business visas we have partnered with VisaPlace.com, a leading U.S. & Canada immigration service to provide free Immigration Assessment for potential visa applicants. We invite you to use this form to assess your visa eligibility.

If I have a US company, can I get Social Security Number?

No. Social Security number is given to individuals who satisfy certain immigration requirements, and most non-immigrant visas that justify obtaining Social Security number will restrict it to specific uses and activities. Having a U.S. company could be the first step in obtaining a legal status in the U.S., as explained above, however by itself if gives no right to Social Security number.

That being said, having a U.S. company in some cases requires you as the owner to file a personal tax return with the IRS. For that purpose you will be required to obtain an ITIN (individual tax identification number) from the IRS, which can be done with the help of your CPA (we also provide this service through our CPA). ITIN is a number that resembles SSN (9 digits), however it is only used for payment of taxes (though you might be able to use it for additional purposes, such as opening a bank account).

Ready To Start?

We hope this not-so-short article gave you plenty of information to chew on and would make it easier for you to take the next step in registering your U.S. business. If you have some questions that we haven’t covered in this article you are welcome to leave them in a comment below, and we will consider expanding this article to include those questions and answers. Otherwise we will reply to you in private.

Remember, just as we already helped thousands of Indian clients with their U.S. company registration, we are here to help you as well. You are welcome to contact us via chat, call us (our number is +91 8961-228-919), email us, or schedule skype consultations with one of our incorporation specialists.

Will I need to travel to the USA for Incorporation?

Will I need to travel to the USA for Incorporation?

No, you need not travel to the USA for incorporation. It can be completed without leaving India.

Will I need a passport of visa to Incorporate a US LLC or Corporation?

Will I need a passport of visa to Incorporate a US LLC or Corporation?

No, any foreign national can incorporate a US LLC or Corporation without having a passport or US visa.

How many persons are required to open a US LLC or Corporation?

How many persons are required to open a US LLC or Corporation?

Just one person is sufficient to incorporate a US LLC or Corporation.

What is the Process of Incorporation of USA Company Registration?

What is the Process of Incorporation of USA Company Registration?

The first step begins for USA Company registration starts with uploading the required documents on the ICFO portal. Our business consultant will then verify the details and the documents. Simultaneously, we try to register the name for which we check the name availability. Once the name is registered, we begin with the third next step.

Once the name gets registered, the process for preparing the AOA begins. This is to be signed by the company directors, shareholders, and secretary before registering a USA company. Throughout the process, our business consultant will keep you updated with the process of company registration. Once the AOA is prepared, the company gets incorporated, and the next step is to apply for an Employer Identification Number (EIN) from the USA.

The process for registration varies slightly from state to state, and is somewhat dependent on whether you’re forming an LLC or a C-Corp. Here are some of the basic steps and requirements:

1. Choose a unique name as a trademark

You will need to choose a unique name that has not been previously registered in the United States. The US Patent and Trademark Office has a trademark database you can search.

2. Register with state agencies

You’ll likely need to register with any state where you will conduct business activities. This involves;

- Having a physical presence in the state

- Frequent in-person client meetings in the state

- A significant amount of your company’s revenue comes from that state

- If any of your employees work in the state

3. Get a registered agent

A registered agent is a business or individual who receives official papers and legal documents on behalf of your company.

4. File for Foreign Qualification

You’ll need to file for a foreign qualification in other states where you also conduct business activities.

5. File state documents and fees

The documents you’ll need will vary according to your business structure and the where you register the business. You’ll typically need the following information:

- Business name

- Business location

- Ownership, management structure, or directors

- Registered agent information

- Number and value of shares (for corporations)

The total cost to register your business in the US is usually less than $300 but this can vary from state-to-state and your business structure.

6. Register with local agencies

You might need to file for licenses and permits from the county or city for LLC, corporation, partnership, or nonprofit corporation business types. If you’re using a trade name or a fictitious name, you might also have to register them in the local county or city.

7. Open a Business bank account

If you don’t have an existing business account, you’re required to get one to carry out business financial transactions in the US especially for LLC and corporation types. There are a lot of options to choose from but it's worth putting some effort into research as some banks/providers can be a lot cheaper than the other for the same types of services. If you’re looking for a more flexible and quick to open business account, check out Wise for Business without borders - it's specially designed to cut the cost on international payments.

What is Registered Agent?

All Delaware LLCs or Corporations are required to maintain a registered agent in the State of Delaware who would be responsible for receiving and processing all official mail on behalf of the Delaware company. Our USA registration package includes Delaware Registered Agent service for one year.

What are the Corporate Tax Rates for Company in USA?

The USA has two corporate income tax levels levied on LLCs and Corporations - Federal Corporate Tax and State Corporate Tax. The Federal corporate income tax rate has recently been reduced from 35% to 21% by The Tax Cuts and Jobs Act (TCJA).

State corporate income tax rate in the US differs from one state to another. The lowest being 3% in North Carolina to 12% in Iowa. Delaware corporate taxes are levied at 8.7% of net income. However, if a business is incorporated in Delaware but does not transact business in the State of Delaware, then state corporate tax would not be levied. Thus, a Delaware incorporation would be most advantageous for foreign nationals and entities seeking to do business in the USA through Delaware.

Why is USA Company registration beneficial for Indian businesses?

Why is USA Company registration beneficial for Indian businesses?

We can trace the first benefit as the business laws and regulations are well-formed as well as the corporate income tax rates are meager, which is extremely favorable for the foreign business to dive in.

However, it is to be noted that every state in the USA is governed by its state and laws and regulations that differ from each other vastly. States like Delaware, Wyoming, Nevada provide the most complimenting business and taxation laws, which makes it better for companies to incorporate.

Specifically, Delaware has no state sales tax, and the state's franchise tax or small US businesses is also meager. In addition to this, there is no need for non-residents to pay separate corporate income tax in Delaware.

Besides this here are the other advantages.

- The laws and regulations are business-friendly.

- As there is limited liability, personal assets such as houses and savings are safe from liabilities.

- The corporate income tax rates are low.

- The laws do not require the disclosure of the names of the company shareholders and directors.