Goods & Service Tax

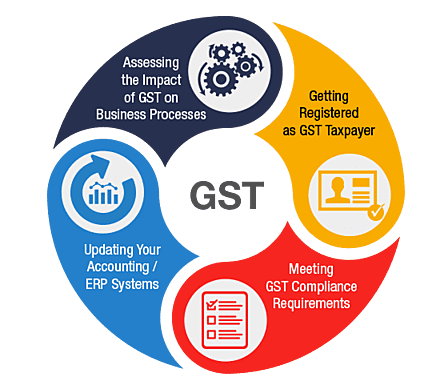

GST is the most significant tax reform in India, tremendously improving ease of doing business and increasing the taxpayer base in India by bringing in millions of small businesses in India. Abolishing and subsuming multiple taxes into a single system would reduce tax complexities while increasing the tax base. Under the new GST regime, all entities involved in buying or selling goods or providing services or both are required to register for GST. Entities without GST registration would not be allowed to collect GST from a customer or claim an input tax credit of GST paid and could be penalized. Further, registration under GST is mandatory once an entity crosses the minimum threshold turnover of starts a new business that is expected to cross the prescribed turnover.

GST registration usually takes between 2-6 working days. We’ll help you to register for GST in 3 easy steps.

GST Services that we offer:

GST HSN & SAC Code Search with Rates

Search GST HSN (Goods) and SAC (Services) codes with applicable GST rates as notified by CBIC.

| HSN / SAC | Description of Goods / Services | CGST (%) | SGST (%) | IGST (%) |

|---|---|---|---|---|

| Start typing to view results | ||||

Evaluate Your Business.

Know your Business Health & Status for Free!

Let the epicenter of our effort be “Creating an Entrepreneur“ and then working on that business just to make sure the world recognises him. Help us to build your Business, grow exponentially & simplify the taxation for you.

All About Goods & Services Tax

Understanding the Goods and Services Tax (GST)

The goods and services tax (GST) is an indirect federal sales tax that is applied to the cost of certain goods and services. The business adds the GST to the price of the product, and a customer who buys the product pays the sales price inclusive of the GST. The GST portion is collected by the business or seller and forwarded to the government. It is also referred to as Value-Added Tax (VAT) in some countries.

How the Goods and Services Tax (GST) System Works

Most countries with a GST have a single unified GST system, which means that a single tax rate is applied throughout the country. A country with a unified GST platform merges central taxes (e.g., sales tax, excise duty tax, and service tax) with state-level taxes (e.g., entertainment tax, entry tax, transfer tax, sin tax, and luxury tax) and collects them as one single tax. These countries tax virtually everything at a single rate.

Dual Goods and Services Tax (GST) Structures

Only a handful of countries, such as Canada and Brazil, have a dual GST structure. Compared to a unified GST economy where tax is collected by the federal government and then distributed to the states, in a dual system, the federal GST is applied in addition to the state sales tax. In Canada, for example, the federal government levies a 5% tax and some provinces/states also levy a provincial state tax (PST), which varies from 7% to 10%. In this case, a consumer's receipt will clearly have the GST and PST rate that was applied to their purchase value.

History Of GST

On July 1st 2017, the Goods and Services Tax implemented in India. But, the process of implementing the new tax regime commenced a long time ago. In 2000, Atal Bihari Vajpayee, then Prime Minister of India, set up a committee to draft the GST law. In 2004, a task force concluded that the new tax structure should put in place to enhance the tax regime at the time.

In 2006, Finance Minister proposed the introduction of GST from 1st April 2010 and in 2011 the Constitution Amendment Bill passed to enable the introduction of the GST law. In 2012, the Standing Committee started discussions about GST, and tabled its report on GST a year later. In 2014, the new Finance Minister at the time, Arun Jaitley, reintroduced the GST bill in Parliament and passed the bill in Lok Sabha in 2015. Yet, the implementation of the law delayed as it was not passed in Rajya Sabha.

GST went live in 2016, and the amended model GST law passed in both the house. The President of India also gave assent. In 2017 the passing of 4 supplementary GST Bills in Lok Sabha as well as the approval of the same by the Cabinet. Rajya Sabha then passed 4 supplementary GST Bills and the new tax regime implemented on 1st July 2017.

Tax Laws Before the Implementation of GST

- The Centre and the State used to collect tax separately. Depending on the state, the tax regimes were different.

- Even though import tax was levied on one individual, the burden was levied on another individual. In the cases of direct tax, the taxpayer must pay the tax.

- Prior to the introduction of GST, direct and indirect taxes were present in India.

Types of GST

The four different types of GST are given below:

- Central Goods and Services Tax : CGST is charged on the intra state supply of products and services.

- State Goods and Services Tax : SGST, like CGST, is charged on the sale of products or services within a state.

- Integrated Goods and Services Tax : IGST is charged on inter-state transactions of products and services.

- Union Territory Goods and Services Tax : UTGST is levied on the supply of products and services in any of the Union Territories in the country, viz. Andaman and Nicobar Islands, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Chandigarh. UTGST is levied along with CGST.

Who is Eligible for GST?

The below mentioned entities and individuals must register for Goods And Services Tax:

- E-commerce aggregators

- Individuals who supply through e-commerce aggregators

- Individuals who pay tax as per the reverse change mechanism

- Agents of input service distributors and suppliers

- Non-Resident individuals who pay tax

- Businesses that have a turnover that is more than the threshold limit

- Individuals who have registered before the GST law was introduced

Registration of GST

Any company that is eligible under GST must register itself in the GST portal created by the Government of India. The registered entities will get a unique registration number called GSTIN.

It is mandatory for all Service providers, buyers, and sellers to register. A business that makes a total income of Rs.20 lakhs and more in a financial year must be required to do GST registration. It takes 2-6 working days to process.

Know the GSTIN – GST Identification Number

A 15-digit distinctive code that is provided to every taxpayer is the GSTIN. The GSTIN will be provided based on the state you live at and the PAN. Some of the main uses of GSTIN are mentioned below:

- Loans can be availed with the help of the number.

- Refunds can be claimed with the GSTIN.

- The verification process is easy with the help of the GSTIN.

- Corrections can be made.

Verify GST Number Online by visiting https://services.gst.gov.in/services/searchtp. Enter the GSTIN mentioned on the invoice in the search box and followed by captcha, Final click "enter" to view the details.

GST Certificate

A GST Certificate is an official document that is issued by the concerned authorities for a business that has been enrolled under the GST system. Any business with an annual turnover of Rs. 20 lakh or more and certain special businesses are required to be registered under this system. The GST registration certificate is issued in Form GST REG-06. If you are a registered taxpayer under this system, you can download the GST Certificate from the official GST Portal. The certificate is not issued physically. It is available in digital format only. GST Certificate contains GSTIN, Legal Name, Trade Name, Constitution of Business, Address, Date of liability, Period of Validity, Types of Registration, Particulars of Approving Authority, Signature, Details of the Approving GST officer, and Date of issue of a certificate.

GST Returns

A GST Returns is a document that contains information about the income that a taxpayer must file with the authorities. This information used to compute the taxpayer’s tax liability. Under the Goods and Services Tax, registered dealers must file their GST returns with details regarding their purchases, sales, input tax credit, and output GST. Businesses are expected to file 2 monthly returns as well as an annual return.

GST Rates

The GST Council has assigned GST rates to different goods and services. While some products can be purchased without any GST, there are others that come at 5% GST, 12% GST, 18% GST, and 28% GST. GST rates for goods and services have been changed a few time since the new tax regime was implemented in July 2017.

How do I calculate GST?

Calculating the amount that needs to be paid as GST when filing your returns can be quite tedious. Several aspects and factors must be taken into consideration, such as ITC, exempted supplies, reverse charge, etc. Failure to pay the entire GST amount can see you slapped with an 18% interest on the shortfall, thereby making it necessary to ensure that you pay the right amount towards GST.

The GST Calculator makes it simple for taxpayers to calculate the amount that needs to paid as GST. You will have to enter all the required details such as the month for which you are calculating GST, the due date for filing returns for the particular month, the actual date on which the returns are filed, the tax liability for the month, the purchases that attract Reverse Charge Mechanism, the opening balance of your cash ledger as well as your credit ledger and the eligible ITC.

Here is an example showing how you can calculate your GST liability:

| Particulars | Amount |

|---|---|

| Overall value of interstate sales | Rs.20 lakh |

| Overall value of intrastate sales | Rs.25 lakh |

| Advance received | Rs.8 lakh |

| SGST | Rs.25 lakh x 9% = Rs.2.25 lakh |

| CGST | Rs.25 lakh x 9% = Rs.2.25 lakh |

| IGST | Rs.20 lakh x 18% = Rs.3.6 lakh Rs.8 lakh x 18% = Rs.1.44 lakh Total = Rs.5.04 lakh |

GST Payments

Currently, the GST must be paid every month. The GSTR-1 and GSTR-3B must be filed. In the case of refunds, the relevant forms must be submitted as well. GST payments can be made both online and offline. Once the payment has made, a challan must be generated.

GST E-Way Bill

An electronic document that is generated to show proof of goods movement is the E-Way bill. You can generate the bill from the GST portal.

Benefits and Purpose of GST

The following are the advantages of goods and services tax in India

- Regulation of the unorganised sector

- E-commerce operators no longer suffer from differential treatment

- Fewer complications

- Composition scheme

- Registration process and filing of returns are simple

- Higher threshold

- Elimination of the cascading tax effect

GST Council

Any recommendations that are made to the State and Union Government regarding any issues that are related to GST is done by the GST Council. The chairman of gst council is Union Finance Minister of India. The other members of the GST Council are the Union State Minister of Revenue or Finance of all the states.

GSTN - Goods and Service Tax Network

The GSTN is the Goods and Services Tax Network which is responsible for managing the IT system concerning the GST Portal. It is a non-profit, non-government organization and is the database for the official GST Portal.

The current structure of the GST Network can be summed up as follows:

- Central Government – 24.5%

- State Governments and EC – 24.5%

- LIC Housing Finance Ltd. - 11%

- ICICI Bank, HDFC, NSE Strategic Investment Co., and HDFC Bank – 10% each.

Features of GSTN

The salient features of the GST Network can be listed as follows:

- Keeping the information of all the taxpayers safe and secure.

- Maintaining confidentiality of the taxpayers’ information.

- It is a trusted National Information Utility (NIU).

Functions of GSTN

The main functions of the GST Network or GSTN can be summed up as follows:

- It is responsible for handling the invoices

- It is responsible for handling the registrations

- It is responsible for handling the payments and refunds (if any)

- It is responsible for handling different types of returns.

GST Helpline

Taxpayers who have any confusions or doubts in regard to their GST filing can get in touch with the concerned authority through the GST Helpline. Earlier, taxpayers could get in touch through the helpdesk email ID – helpdesk@gst.gov.in. However, it should be noted that this email ID has been discontinued.

The GST Helpline details are as follows:

| Toll Free Phone Number | 1800 1200 232 |

|---|---|

| Self Help Portal | https://selfservice.gstsystem.in/ |

GST App

There are a handful of GST applications which have been designed to run on smartphones. Out of all the apps, there is a Government-issued application as well which is called the CBEC GST. It can be downloaded from the Google Play Store for your Android smartphone.

In addition to that, there are a host of third-party applications as well. The main aim of these applications is to help taxpayers familiarize themselves with the idea of GST and in turn, ensure that they smoothly transit to the new taxation system.

- Is it necessary for all traders to register under the GST?

- Do small traders have a separate scheme to pay taxes?

- What are the states with a turnover limit at Rs.50 lakh for composition levy?

- What is the composition levy tax rate?

- Who is not eligible for the composition scheme?

- Establishment that supply services, apart from restaurants.

- Those involved with making inter-state outward supplies of products.

- Those involved in making supply of products that are not chargeable to GST.

- Suppliers who make supply of products via e-commerce operators and are mandated to collect tax at source.

All traders who earn turnovers in excess of Rs.20 lakh in a financial year will have to register under the Goods and Services Tax.

Yes, small traders can make the most of the composition levy in case their turnover is less than Rs.75 lakh. For certain special states, this limit is Rs.50 lakh.

Arunachal Pradesh, Tripura, Manipur, Nagaland, Meghalaya, Assam, Himachal Pradesh, Sikkim and Mizoram.

The rate of tax applicable under the composition levy is 1% of the turnover earned in the state, with 0.5% going towards Central Goods and Services Tax and 0.5% going towards State Goods and Services Tax.