Change in Authorised & Paid Up Capital/Contribution in Company/LLP

Every Public or Private company 'limited by shares' must have a share capital. Share capital refers to the amount invested in the company to carry out its day to day operations or business activities. The company's share capital can be altered or increased, subject to certain conditions as prescribed in law. A company cannot issue share capital over the limit specified in the capital clause without changing the capital clause of the memorandum of association.

While changing capital for your company/LLP, you will need to adhere to a few procedures in accordance to the Government. TAXAJ experts will help you in the same.

It Usually takes 2 to 4 working days.

- Drafting of Documentation , Disclosure of interest, Board Resolution

- Filing of SH-7 & related forms

- Companies/LLP that want to change the capital in the company/llp

- Companies that need assistance in quickly completing the capital change process with perfection

- Purchase the plan

- Provide details required for changing the capital

- Get secretarial services to draft various documents such as disclosure, resolutions, etc

- TAXAJ files SH-7 & related on your behalf

Name, Contact Number and Email Id of all the Stakeholders.

Directors Identification Number, if already.

Self Attested PAN, Aadhar & Passport size photo of all the Stakeholders.

Capital Change details along with stamp duty

Authorised Capital of Private & Public Limited Company in India Unleashed!

Paid Up Capital of Private & Public Limited Company in India Unleashed!

Detailed Analysis of Law as per Companies Act

A limited company having a shares capital can alter the capital clause of the memorandum of association in its member meeting, and such alteration may include the following:

- Increase its authorised share capital by such amount as it thinks fit so;

- all or any of its share capital can be consolidated and divided into shares of a larger amount than its existing shares;

- all or some of its fully paid-up shares can be converted into stock, and again reconvert that stock into fully paid-up shares capital of any denomination;

- Sub-divide the shares into shares of smaller amount than is fixed by the memorandum; and

- Cancel the shares on the date of passing of the resolution, which has not been or agreed to be taken by any individual and diminish the amount of its share capital by the amount of the shares so cancelled.

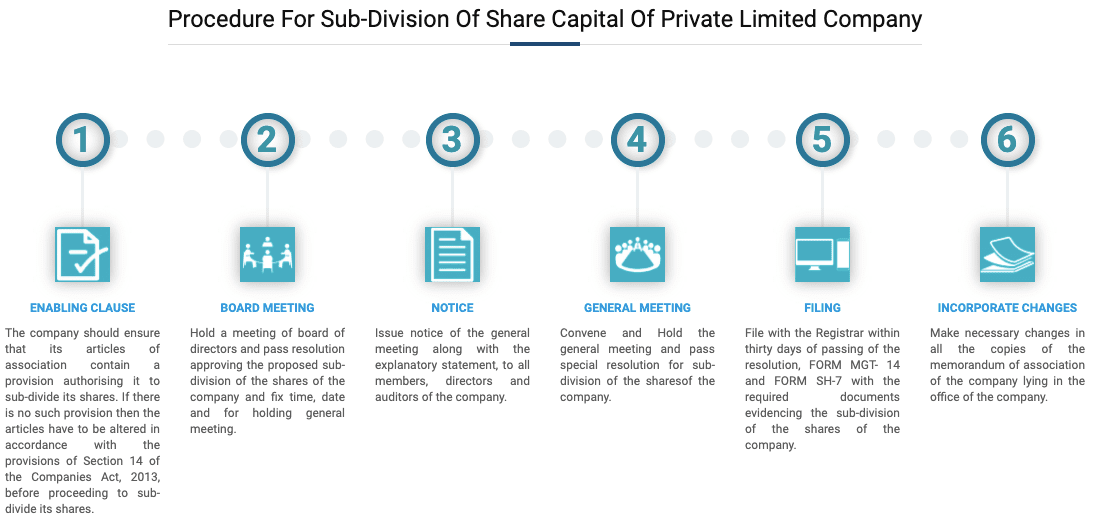

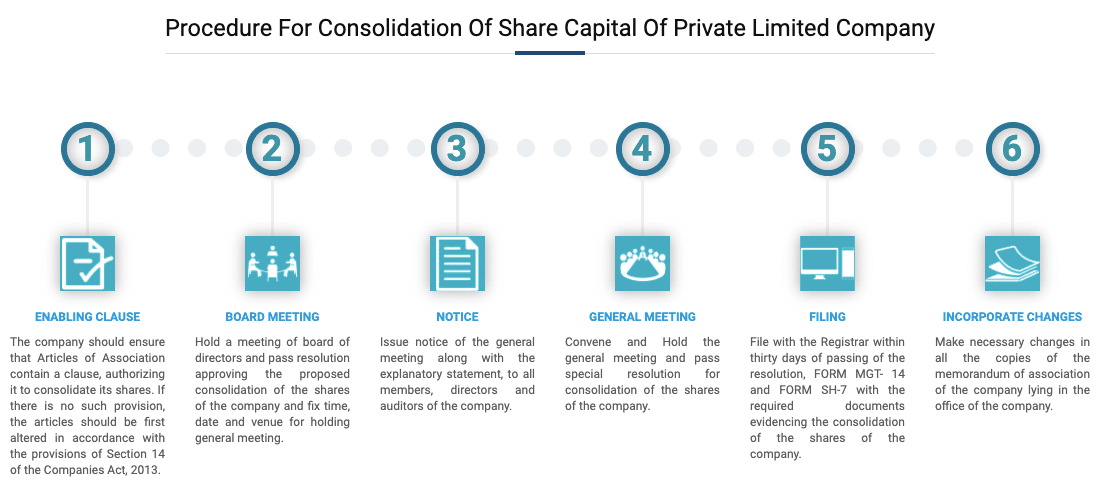

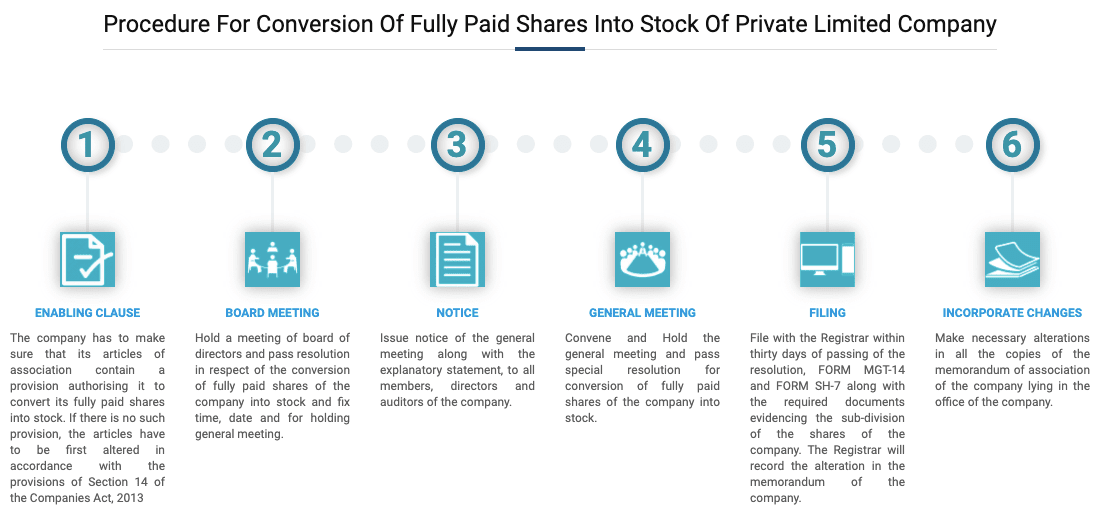

The Companies Act, 2013, provides the power to alter the share capital of the company. Any modes of alteration of share capital must be authorised by the article of the company. In the absence of an express provision in the article, no alteration of the capital can be done. Therefore, before commencing upon the passing of a resolution to change the share capital of the company, it has to be ensured that there is an express provision in the articles authorising the company to alter its share capital.

Any resolution passed at the general meeting approving the alteration of the share capital of the company must be filed with the Registrar of Companies within 30 days from the date of passing such resolution.

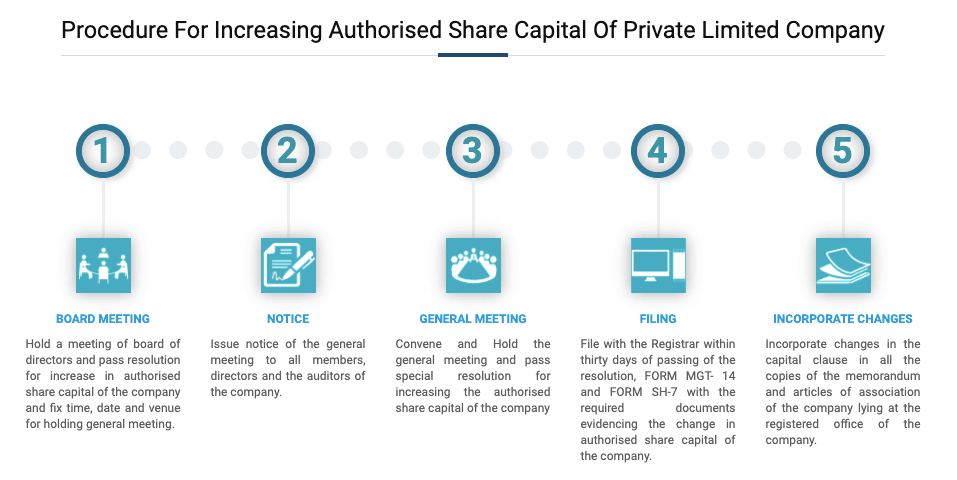

Authorised Share Capital Increase

There must be an increase in the company's authorised share capital before issuing further new equity shares and increasing its paid-up share capital. Authorised share capital means the total value of shares a company can issue, while paid-up capital is the total value of shares the company has issued. Paid-up capital can never exceed authorised capital. Hence, if a company having an authorised capital of Rs.10 lakhs and paid-up capital of Rs.10 lakhs would like to induct new shareholders, it can do so either by:

- Increasing an authorised share capital by issuing new shares. (or)

- Transfer the shares from existing shareholders to the new shareholders of a company.

In most cases, authorised capital is increased by issuing new shares

Verify AOA of the Company

Before commencing the procedures for increasing authorised share capital, verify the AOA to ensure there is enabling provision in the Articles of Association (AOA) particularly with reference to increase authorised share capital. If there are no provisions for increasing authorised share capital, the company must first make changes to the AOA of the company.

Note: Most of the AOA’s will have enabling provisions for increasing authorised share capital

Convene Board Meeting

First, to increase the authorised share capital, convene a Board Meeting by providing notice to the Director. At the Board Meeting, obtain approval from the Board of Directors for increasing authorised share capital. Then fix a date, time, and place for conducting an Extra-Ordinary General meeting to obtain approval of shareholders to increase authorised share capital and make changes to the MOA of the company.

First, obtain the approval of the Directors of Company present at the meeting to present the notice of Extra-Ordinary General Meeting to the shareholders. Then, based on the approval, present the Notice of Extra-Ordinary General Meeting to all shareholders, Directors and Auditor of the Company.

Extra-Ordinary General Meeting

On time, date and place mentioned on the Notice of Extra-Ordinary General Meeting, conduct the Extra-Ordinary General Meeting and obtain shareholders approval for increase of authorised capital. The approval of shareholders for increasing authorised share capital must be in the form of an ordinary resolution.

File ROC forms

Once the ordinary resolution is passed at the Member General Meeting, then eform SH-7 must be filed by the company within 30 days of passing of the ordinary resolution. Along with Form SH-7, prescribed government fee for authorised capital must be paid, and the following documents must be attached:

- Notice related to EGM.

- Authorised True copy of Ordinary Resolution.

- Changed Memorandum of Association. (Showing higher authorised capital)

If the procedures for increasing authorised capital are followed as mentioned in the Companies Act and Companies Rules, then the Registrar would approve the filing and increase the authorised share capital of the company. The new authorised share capital of the company would be reflected on the MCA portal.

Allotment of shares

After increasing authorised share capital, the company's paid-up share capital can be increased by issuing new equity shares.

Highlights of Change in Share Capital

Increase in Share Capital

The need for an increase in the company's authorised share capital may arise when the company plans to enlarge its business operations by the new issue of capital. If the increase in authorised share capital results in alteration of articles of association, a special resolution is required; otherwise, an ordinary resolution is to be passed.

Consolidation of Share Capital

A company may alter its existing paid-up share capital by consolidating or dividing all of its shares into shares of larger denominations than its existing shares. To consolidates means to bring together (separate parts) into a single or unified whole.

Conversion of Shares into Stock

A company limited by shares may alter its capital clause of memorandum for converting any of its fully paid-up shares into stock or vice-versa. When a number of shares are converted into a single holding with a nominal value equal to that of the total value of the shares, it is called conversion of shares into stock. Stock is the aggregate of the fully paid-up shares legally consolidated and portions of which aggregate may be transferred or split up into fractions of any amount without regard to the original nominal value of shares.

Where a company having a share capital has converted any of its shares into stock, and given notice of the conversion to the Registrar, all the provisions of this Act which are applicable to shares only, shall cease to apply on so much of the share capital as is converted into stock.

Sub-Division of Share Capital

A company may sub-divide its share capital if so authorised by articles of association. It is done by an ordinary resolution passed at a general meeting. Sub-division is the method by which the nominal value of each share is reduced to a smaller amount.