AD Code Registration on Ice-Gate for Export

In a world where the total number of online buyers globally has spiked through more than 2.14 billion, venturing into the global market and expanding business is every entrepreneur’s dream come true. But stepping into cross-border trade is no small feat. There are legal documentation processes and international compliance requirements one needs to be aware of.

To start with, an Import Export Code (IEC) is a prime requirement to get your goods shipped, whether you’re an exporter or importer. Think of it like the passport, but for your goods. Other than the IEC code, there are four other documentation requirements that are primary for customs clearance – Shipping Bill, Bill of Lading, Export General Manifest and AD Code.

Let’s delve into what is AD code and why one needs AD code for export.

Application & Generation of AD Code on Ice-Gate for Export through Customs

2-5 working days

- Generation of AD Code

- Business or Individual planning to export goods through customs port.

- Purchase of Plan

- Expert Assigned

- Share the details as requested

- Filing of Application

- Generation of AD Code

- AD Code (Request Letter to Bank in DGFT Format)

- Copy of IEC (Import Export Code) Code

- Copy of Pan Card

- GST Registration Certificate

- Export House Certificate (this is optional)

- Bank Statement of one year

- Aadhar, Voter ID/passport or IT returns of Export Partner.

AD Code Registration Process on Ice-Gate Portal for Export of Goods in Customs Port

Everything Needed for IceGate & ADCode Registration (Exhaustive Video)

Overview - What is ICE-GATE?

Overview - What is ICE-GATE?

Indian Customs Electronic Gateway (ICEGATE) is the name of the public portal operated by the Central Board of Indirect Taxes and Customs (CBIC). The customs office provides e-commerce services to importers, exporters, freight carriers, and other business partners via this website platform. This simplifies the customs agreement process and promotes EXIM business. Along with the website's services, ICEGATE offers information regarding exporter guidelines and import compliances. It offers a single window for the online submission of paperwork linked to commercial transactions as well as the payment of taxes and customs fees.

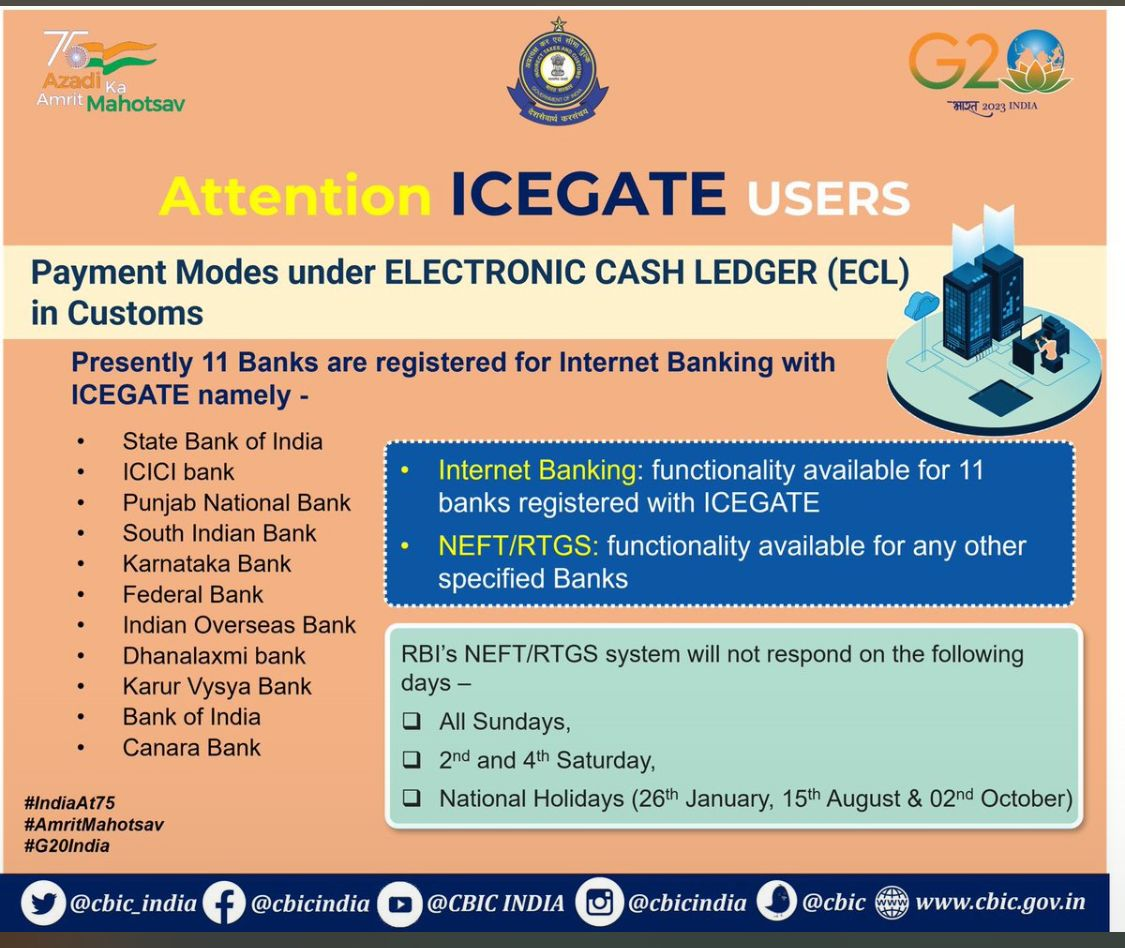

More efficient Customs clearance has been made possible by ICEGATE's internal connections to multiple partner agencies, including the RBI, banks, DGFT, Directorate General of Commercial Intelligence and Statistics(DGCIS), the Ministry of Steel, the Directorate of Valuation, and other partner governmental organisations involved with EXIM trade. All electronic documents/messages handled by the ICEGATE are processed at the Customs level by the Indian Customs EDI System (ICES), which is operational at over 250 Customs ports.

For Indian importers and exporters, the tool is designed to speed up and ease the customs permission procedure. It makes it simple to track goods in actual time by offering a secure and effective location for electronic forms of bills of entry, cargo bills, and other customs-related documentation. Both Indian importers and exporters have to submit their customs documentation electronically with ICE-GATE.

What are the services offered by ICE-GATE?

What are the services offered by ICE-GATE?

Importers, exporters, freight carriers, and other business partners can electronically file documents with the Customs department. The ICE-GATE website allows the Customs department to allow exporters and importers in getting shipping bills, bills of entry, and other documents required for the import & export processes. Among the most important services provided are:

- Electronic filing of the Bill of Entry (Import goods declaration)

- IE code status

- Shipping Bills (Export goods declaration)

- e-Payment of Customs Import Duty

- A free-of-cost web-based Common Signer utility for signing all the Customs Documents

- Facility to file online supporting documents through e Sanchit

- End-to-end electronic IGST Refund etc.

- 24X7 helpdesk facility

- Document Tracking status at Customs EDI

- Online verification of DEPB/DES/EPCG licenses

- PAN-based CHA data

- IGST Refund & DBK Status.

- Filing of RoDTEP & RoSCTL

Advantages of ICEGATE Registration

Advantages of ICEGATE Registration

The ICEGATE Portal allows for the computerised filing of both import and export confirmations from you. Using the Portal, Customs can reply to exporters and importers after reviewing shipping bills and bills of entry. The Customs Department has become more responsible after the implementation of ICEGATE. Additionally, it helped the government in reducing complaints from importers and exporters about delays in cargo delivery.

The following are a few of ICEGATE's important advantages: –

- The service allows users to submit export and import declarations electronically.

- After reviewing Bills of Entry and Shipping Bills, customs can respond to importers and exporters.

- This allows importers and exporters to track and monitor the status of their online documentation.

ICEGATE( Indian Customs Electronic Commerce / Electronic Data Interchange Gateway) is an e-commerce gate for Indian customs.

Types of ICEGATE Registrations

Types of ICEGATE Registrations

There are 2 types of registration modules i.e. simplified(old) & New version.

In the Simplified Registration Module, users can generate the shipping bill, and bill of entry and also can apply for AD code & IFSC registration. But they can not apply for an incentive scheme application like RoDTEP & RoSCTL. The simplified Registration Module in ICEGATE is designed to register at ICEGATE without the need to upload the Digital Signature Certificate (DSC), PAN verification, document upload to ICEGATE, and approval procedure.

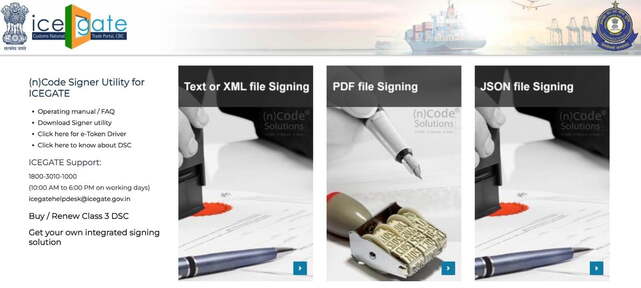

In the New Version of Registration, it is compulsory to use Class 3 DSC for Icegate Registration. Also, users can apply for all sorts of services i.e. shipping bill generation, bill of supply, incentive scheme application & can do the online payment of bill of entry. Therefore as the Simplified version is no longer available now we will explain the step-by-step process with screenshots of the new Icegate registration process. And also explain how you can migrate from old simplified registration to new icegate registration.

Documents Checklist for Icegate Registration

1. Class 3 Digital Signature (Combo)

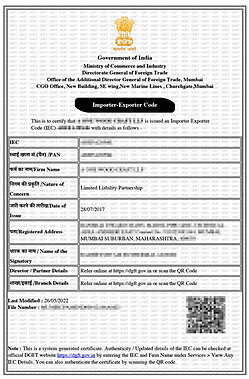

2. Self Attested & Stamped Proof of Business/Trade (IEC Code Original Downloaded from Portal).

3. Self Attested & Stamped Colour Photo Aadhar Card of Authorised Signatory

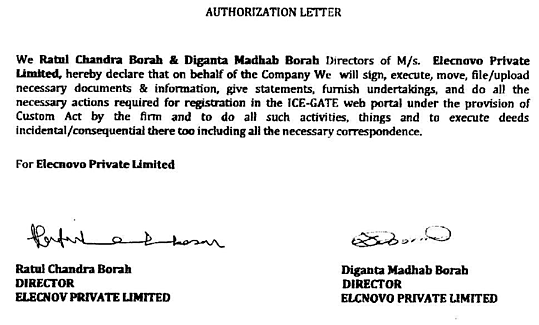

4. Self Attested & Stamped Authorisation Letter on the Letter Head of the Company

5. Contact Number & Email ID used in DGFT or GST

Important Points To Check Before Applying

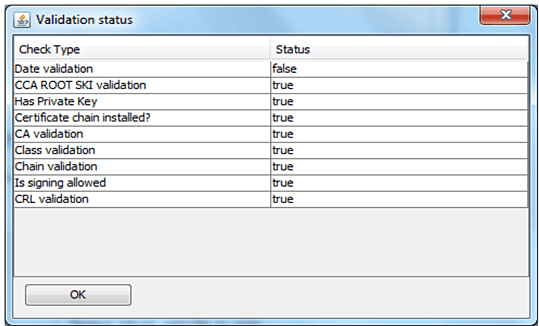

Digital Signature Token (Class 3 Combo)

The DSC Token required for IceGate has to be with Signing & Encryption which is different from Normal DSC Token which has Only Signing that we use for normal GST, Income Tax or ROC Forms Filing.

So make sure the DSC you are using is Correct before starting.

If any of these options show "False" while signing on IceGate then reach out to your DSC Provider to get this resolved. This is not a Site Error but DSC Issue.

Import Export Code Certificate

The DSC Token required for IceGate has to be with Signing & Encryption which is different from Normal DSC Token which has Only Signing that we use for normal GST, Income Tax or ROC Forms Filing.

So make sure the DSC you are using is Correct before starting.

If any of these options show "False" while signing on IceGate then reach out to your DSC Provider to get this resolved. This is not a Site Error but DSC Issue.

Make Sure its Self Attested & Stamped

Colour Copy of Aadhar Card of Authorised Signatory

- Make Sure Signatory whose DSC is being used should be same as mentioned in IEC & Aadhar.

- Photograph of the Authorised Signatory should be clearly visible on Scanned Copy of Aadhar.

- Do Not Use Masked Aadhar

- Make sure its Self Attested & Stamped

Authorisation Letter for Authorised Signatory

- Make Sure Signatory whose DSC is being used should be same as mentioned in IEC & Aadhar & Authorisation Letter.

- Should Specifically Mention that he is authorised for Icegate & AD Code Registration

- Not Required for Proprietorship Firm, provided Proprietor Name is mentioned on IEC Certificate

- Make sure its Self Attested & Stamped

Contact Details in Application

- Email ID & Mobile Number used for applying Icegate Registration has to be the same in DGFT/IEC/GST

- Atleast with IEC it should match to avoid rejection

- If its not the same, first update it in your IEC Code then Apply Ice Gate

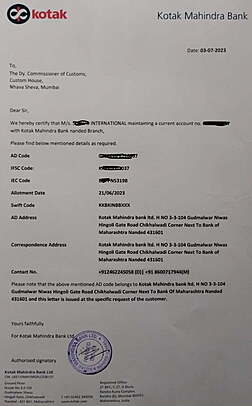

Bank AD Code Letter

- There's no specific format for the same but has to be on Bank's Letter Head & Preferably Signed & Stamped by Bank.

- Must Contain Bank Name, Address, Branch, Account Number, AD Code, IFSC Code

Bank Details

- Signed & Stamped Cheque for Bank Account whose AD Code Letter is attached

- This will be the same bank linked to AD Code and also for Export Promotion Scheme

Ice-Gate Portal Application Process & Timeline

- Icegate Registration can be applied at www.icegate.gov.in, Old or New Site Doesn't Matters, Both will give same result.

- If you go for Simplified Registration (Without DSC) you won't be able to access most of the features and will be useless and you will have to follow the same steps again for converting it to Normal DSC User from the Old Website Login

- You may face techical issue while signing with DSC on Icegate, for which we have made separate video on our Channel which is already ranking 1/2 so you can watch that to sort that issue, if it doesn't helps (which is rare) reach out to us via WhatsApp at 8961228919 for the Paid Support since every system has their own set of configurations and will take time and effort but shall be solved for sure.

- It may take somewhere around 2 to 10 working days for the approval/rejection of your Application.

- If its rejected, there will be reason mentioned, Re-Apply After Correction

- Once Approved, Lets move towards AD Code Linking

All About AD Code Linking in Ice-Gate Portal

What is AD Code?

Authorised Dealer Code, or commonly known as AD code, is a 14-digit (sometimes 8 digits) numerical code a seller receives from the bank with which they have account for their international business. AD code is obtained after IEC code registration and is mandatory for export customs clearance.

Why is AD Code Registration required?

AD Code Registration is a must for many reasons in carrying out export business. The significant reasons are as follows:-

1. Exporters who want to export goods from India must register the AD Code.

2. A Shipping Bill is one of three documents that must be submitted for export customs clearance. Without an AD Code registration, you cannot produce a Shipping Bill on Icegate, Indian Customs' electronic data exchange platform.

3. AD Code Registration allows you to transfer credit to the trader's current account directly.

4. Any Government advantages you want to avail of, for example, duty rebates and exemptions, GST (Goods and Services Tax) refunds, and so on, are credited straight to your current account if you have an AD Code registered with customs.

5. Registering or submitting the AD code in each & every port from where you want to export shipment is a mandatory requirement.

6. When exporting goods, exporters must provide the IE Code as well as the AD Code.

7. Furthermore, while receiving money from Abroad, Banks can demand the AD code of the business/individual.

What are the Documents required for AD Code Registration?

1. Class 3 Digital Signature (Combo)

2. Self Attested & Stamped PAN Card of Organisation (Proprietor's PAN in Case of Proprietorship Firm)

3. Self Attested & Stamped Proof of Business/Trade (IEC Code Original Downloaded from Portal).

4. Self Attested & Stamped Canceled Cheque or Bank Statement

5. Self Attested & Stamped Colour Photo Aadhar Card of Authorised Signatory

6. Self Attested & Stamped Authorisation Letter on the Letter Head of the Company

7. Bank AD Code Number on Bank’s Letter Head

8. Contact Number & Email ID used in DGFT or GST

To Be Merged in One Single PDF File and Size Should be Less than 800 Kb

How to Apply for AD Code?

Exporters are required to register AD code with the airport or port from which they plan to ship their goods across borders. In case an exporter ships packages from more than one port, they must register an AD Code for each of the ports, irrespective of whether the ports are in the same states or different states.

AD Code Registration Process for Customs

Sign the Merged PDF File at E-Sanchit

- Sign the Single Merged File with DSC at www.filesign.icegate.gov.in

- Preferably in Microsoft Edge, in case DSC Issues in Signing

- Takes 1-2 Days for Approval, No Emails Sent for this, Check on Portal

Post Signing the PDF File Upload it to e-Sanchit and Generate the IRN Number

Following are the steps to register AD Code on ICEGATE:

- Log on to the ICEGATE Website.

- Click on the left panel >> Bank Account Management.

- Click on AD Code Registration on the Export Promotion Bank Account Management page.

- Select AD Code Registration and then Submit for AD Code Bank Account Registration.

- Fill required details – Bank Name, Port Location, AD Code, and upload documents as requested.

- Save all details once they’re feeded. A 6-digit OTP is sent to your registered mobile number and email id.

- Bank Account Modification is then submitted to ICEGATE after the mobile number & email ID is verified.

- Once ICEGATE approves the request, bank account details start showing on the AD code dashboard.

Benefits of AD Code Registration

There are multiple benefits of AD Code Registration which are listed below.

1. AD Code Registration will assist you in developing your business and reaching out to a broader market on a worldwide scale, allowing your company to flourish at a rapid pace.

2. Registering an AD Code is the one-time process. It means you won't have to submit any returns. Once the code is assigned to you, you will not be required to complete any more steps or return filing.

3. An AD Code is valid for as long as the entity survives. In other words, the AD Code has life-long validity. As a result, if you register for AD Code, you will never have to worry about renewing it.

4. Based on their AD Code registration, the companies may receive various incentives for their imports/exports from the DGFT, Export Promotion Council, Customs, and several other Government schemes.

How can we help in AD Code Registration?

We have a top-notch professional team providing a hassle-free and error-free Online AD Code Registration Service in India. Our experts have been completing 1000+ AD Code Registration and staying up to date with DGFT's new registration procedures every day since 2014. So, we render you the best AD Code Registration that is DGFT compliant.

Chartered Accountants, Lawyers, and Company Secretaries make up our diverse teams of specialists. Over the years, we have been dealing with a wide variety of financial services, including export-import, business compliances, taxation, and accounting issues in India. Also, Our service is affordable.

It's your turn to kick start your import-export business with entire legal formalities. Our team is always here to guide you with your export import business at every step while you grow.