Conversion of Private Limited into Section 8 Company

The concept of a Non-Profit Company is quite old in our country India. The Companies Act, 2013 provides for the Registration of Non-Profit Companies in India. Any person intending to form a Company with a non-profit object can register in India. Section 8 of Companies Act, 2013. read with the Companies (Incorporation) Rules, 2014, provides for the incorporation of a Non-Profit Companies under the Act. Under Companies Act, 2013, the Non-Profit Company is also known as Section 8 Company. In the article, we will discuss the procedure for Conversion of Private Company into Section 8 Company.

Get your private limited company converted into section 8 company in the fastest possible manner.

It usually takes 30 to 40 working days.

- DSC (2 nos)

- Filing of SPICe+ Form

- Issue of Incorporation Certificate along with PAN and TAN

- Includes Govt Fees & Stamp duty for Authorised Capital upto Rs. 1 Lakh except for the states of Punjab, Madhya Pradesh and Kerala

- Excludes foreign national / Body Corporate as director or business needing RBI/SEBI approval

- Assistance in Opening Bank Account

- Businesses looking to work in social sector for social welfare

- Businesses looking to convert their existing firm structure into ngo

DSC Application

Name approval form filing

Preparation of Incorporation Documents

Getting those docs signed by the respective stakeholders

Filing of e-Forms with ROC

Receipt of Incorporation Certificate with PAN, TAN, GST, EPF, ESI & Bank Account.

- Draft of MOA (Memorandum of Association);

- Draft of AOA (Articles of Association);

- A Declaration in Form INC 14 by Chartered Accountant

- Statement showing the information about the Assets or Liabilities of the Company (As on the Date of Application);

- An Audit Report of the existing Private Company;

- A copy of the Board Report of the existing Private Company;

- A Statement regarding the estimation of the “Future Expenditure” and “Annual Income” of the proposed Company for the next 3 Financial Years;

- Details regarding the Income Sources;

- Details regarding the Objects of Expenditure;

- A True and Certified copy of the Board Resolution passed by the Board of Directors in the meeting for approving the “Company Registration” under Section 8 Company;

- Declaration filed in Form INC 15 by each person who is making an application for the “Conversion of Private Company into Section 8 Company”

Concept of Private Limited Company

The term “Private Limited Company” denotes a business format, which is privately held by a group of people known as Shareholders. Further, this business format is chosen by all the start-ups and the business with high growth potential.

Section 2 (68) of the Companies Act 2013 defines the term “Private Limited Company”. In this format, the Articles of Association restricts the shareholders of the company from transferring their shares.

As per the Companies (Amendment) Act 2015, the requirement of having the minimum paid up capital for the Private Limited Company Registration has now been removed.

Further, for incorporating a Private Limited Company in India, a minimum of 2 and a maximum of 200 members are required. However, the term “member” does not include both former and present employee.

Concept of Section 8 Company

The term “Section 8 Company” denotes an NPO (Non Profit Organization) which promotes Arts, Education, Charitable Purpose, Protection of Environment, Science, Sports, Research, Religion and Social Welfare.

Further, the income earned by an NPO cannot be utilized for paying out dividends to the member of the company. Moreover, the same should be used only for the promotion of charitable objectives.

Furthermore, such companies need to obtain a certificate of section 8 company registration from the central government and are liable to comply with the rules specified by the government as well.

Benefits of Conversion into Section 8 Company?

- Privilege and exemption under the provisions of Companies Act 2013

- No stamp Duty for Registration

- Tax deduction under Section 12A and Section 80G of income tax to the organization’s income and to the donors.

What are the forms required for Conversion?

| Form No | Purpose of the Form |

| RUN Form | For applying name with MCA (Ministry of Corporate Affairs) |

| Form RD 1 | Application for the Process of Conversion |

| Form INC 14 | Declaration From the Practising Advocate, Chartered Accountant, and Company Secretary |

| Form INC 15 | Declaration by each person who is making an application for the “Conversion of Private Company into Section 8 Company” |

| Form INC 26 | For filing the copies of Publication with the Registrar of Companies |

| Form INC 16 or Form INC 17 | Grant of License by the Registrar |

Procedure for converting a Private Limited Company into Section 8 Company?

Whenever there is a Conversion of Private Company into Section 8 Company, the Private Company needs the approval of its Board Members through a special resolution passed in Annual General Meeting or Extraordinary General Meeting. After the passing of the special resolution, Form MGT-14 is to be filed with the Registrar of companies (RoC). The MGT-14 should be filed within 30 days of passing of the special resolution by the Board.

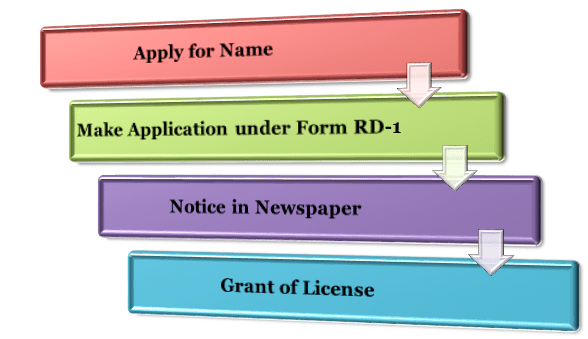

The procedure for Conversion of Private Company into Section 8 Company is as follows:

Apply for Name Approval

The members should apply for the name in the (Reserve Unique Name) RUN Form. The Run form is submitted electronically on the official website of the Ministry of Corporate Affairs (MCA). The Form should be submitted with the fees as prescribed by the MCA.

Make Application Under Form RD-1

An application in Form RD-1 will be made to the Registrar of the Companies with the prescribed fees for the incorporation of Section 8 Company. The following documents should be attached with RD-1 Form:

- Form INC-12 should be attached with the application.

- Draft of MoA for proposed Section 8 Company.

- Draft of AoA for proposed Section 8 Company.

- Declaration by Advocate, Chartered Accountant, or Company Secretary in practice as per INC-14.

- Statement showing the details of the Assets Liabilities of the Company as on the date of application

- The Audit Report of the existing Private Company

- The Board Report of the existing Private Company

- Statement of estimation of future expenditure and annual income of the proposed Company for the next 3 years.

- The sources of income and the objects of expenditure should be mentioned.

- A true certified copy of the resolution passed by the Board in the meeting approving the Company Registration under Section 8 Company

- Declaration of each person making an application for the Conversion of Private Company into Section 8 Company as per INC-15.

Publish of Notice in NewsPaper

A notice should be published in the newspaper (one in the vernacular language newspaper and one in English newspaper) by the Private Company of the application made for Conversion of Private Company into Section 8 Company. The Private Company should bear the expenses of the publication of notice in the newspaper. The notice should be published within a week from the date on which the application is made to the Registrar for the Conversion of Private Company into Section 8 Company. The Registrar should be given the copy of these publications as per Form INC-26 immediately after their publication in the newspaper.

Grant of License

The Registrar should consider the objections raised against the Conversion of Private Company into Section 8 Company after the publication of notice is made in the newspaper. The Objections should be raised within 30 days from the date of publication of notice in the newspaper. After considering the objections Registrar of Companies (RoC), after consulting with the other authority or regulatory body, or Department of Central Government (CG) or State Government (SG), in his/her discretion, should decide whether the license for Conversion of Private Company into Section 8 Company should be granted or not. The Registrar should grant the license in Form INC-16 or INC-17 as prescribed by the MCA.

After granting the license, the Registrar can direct the Company to insert certain conditions in the Memorandum of Association (MoA) or in the Articles of Association (AoA).

| Form No | Purpose of the Form |

| RUN Form | For applying name with MCA (Ministry of Corporate Affairs) |

| Form RD 1 | Application for the Process of Conversion |

| Form INC 14 | Declaration From the Practising Advocate, Chartered Accountant, and Company Secretary |

| Form INC 15 | Declaration by each person who is making an application for the “Conversion of Private Company into Section 8 Company” |

| Form INC 26 | For filing the copies of Publication with the Registrar of Companies |

| Form INC 16 or Form INC 17 | Grant of License by the Registrar |

Conclusion

Section 8 Company is formed with a primary objective of charity. These Companies enjoy all the privileges and exemptions as provided in the Companies Act, 2013. To avail such privileges and exemptions, the Private Company goes for Conversion. The Conversion of Private Company into Section 8 Company is a lengthy and long-lasting task. We at TAXAJ have skilful and competent professionals to assist you in the process of Conversion of Private Company into Section 8 Company. Our professionals will help and assist you in getting through the process of Conversion. Our professionals will plan correctly and assure the successful completion of the process. TAXAJ have skilful and competent professionals to assist you in the process of Conversion of Private Company into Section 8 Company. Our professionals will help and assist you in getting through the process of Conversion. Our professionals will plan correctly and assure the successful completion of the process.