Transfer of Shares in Company

It's a pretty regular phenomenon that shares are either transferred internally or externally in a private limited company. Share transfer facility is the sole reason people prefer Private Limited companies in place of other options. Transferring shares here is quite an easy procedure in comparison to other forms of company. Here you can find all the Procedures for share transfer in a private limited company only after verifying the AOA of the Company by executing a share transfer deed.

It Usually takes 1 to 2 working days (depends on MCA approval)

Every company in which there is a change in stake holding.

- Purchase the plan

- Upload documents on vault

- Verifying your documents

- Preparing the share certificates

- Payment of Stamp Duty

- Filing of Forms with ROC

- Acknowledgement is generated

Name, Contact Number and Email Id of DIN Holder.

Directors Identification Number.

Self Attested PAN, Aadhar & Passport size photo of DIN Holder.

New Share holding pattern

DSC of the Authorised Director. Buy here

This is a Heading

Meaning of Share Transfer

Meaning of Share Transfer

Transfer of shares means the voluntary handing over of the rights and possibly, the duties of a company member (as represented in a share of the company). The rights and duties of the share transfer happen from a shareholder who wishes to not be a member of the company any more to a person who wishes of becoming a member.

Thus, shares in a company are transferable like any other movable property in the absence of any expressed restrictions under the articles of the company.

Persons involved in Share Transfer

Persons involved in Share Transfer

- Subscribers to the memorandum.

- Legal Representative, in case of a deceased.

- Transferor.

- Transferee.

- Company (whether listed/ unlisted).

Procedure for Transfer of Shares under the Companies Act, 2013

Procedure for Transfer of Shares under the Companies Act, 2013

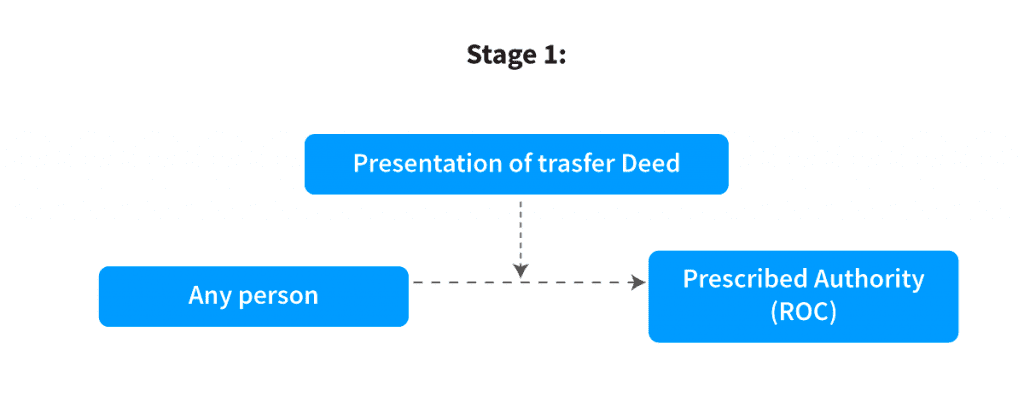

- Firstly, the transfer deed needs to be obtained in the prescribed form i.e. Form SH-4, endorsed by the prescribed authority.

- The instrument of transfer may not be in the prescribed form (Form SH-4) in the following cases:

- Where a director or nominee transfers shares on behalf of another body corporate under section 187 of the Companies Act, 2013;

- Where a director or nominee transfers shares on behalf of a corporation owned or controlled by the central or state Government;

- Shares transferred by way of deposit as a security for repayment of any loan or advance If they are made with any of the following:

- State Bank of India; or

- Any scheduled bank; or

- Any other banking company; or

- Financial Institution; or

- Central Government; or

- State Government; or

- Any corporation held by the Central or State Government; or

- Trustees who have filed the declarations.

- For transferring debentures, a standard format can be used as the instrument of transfer.

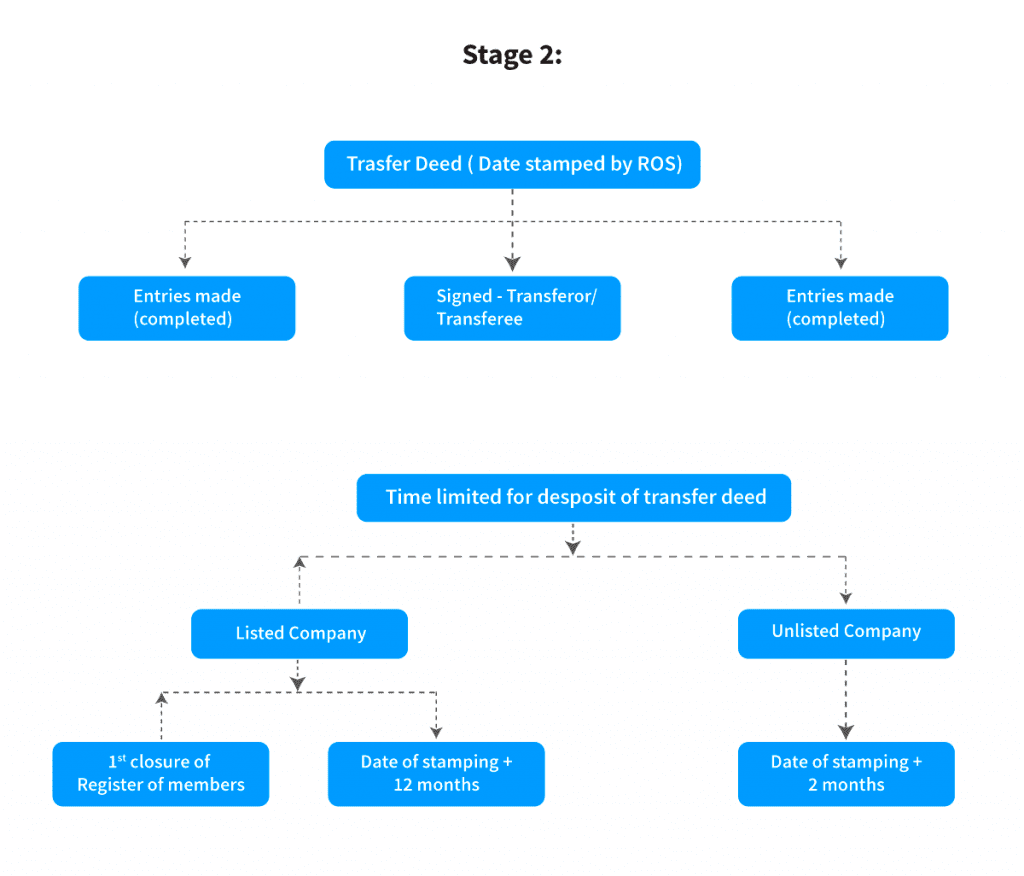

- Get the Articles of Association in case of shares, trust deed in the case of debentures and transfer deed registered either by the transferor and the transferee or on their behalf in accordance with the provisions of the Companies Act, 2013.

- According to the Indian Stamp Act and stamp duty notification in force in the state concerned, the transfer deed should need to have stamps. The present stamp duty rate for transfer of share is 25 paise for every one hundred rupees of the value of the share or part thereof. That means for shares valued Rs. 1,050, the stamp duty will be Rs. 2.75.

- Check that the stamp affixed on the transfer deed is cancelled at the time of or before the signing of the transfer deed.

- A person who gives his signature, name and address as approval for transfer must see the transferor and the transferee sign the share/debentures transfer deed in person.

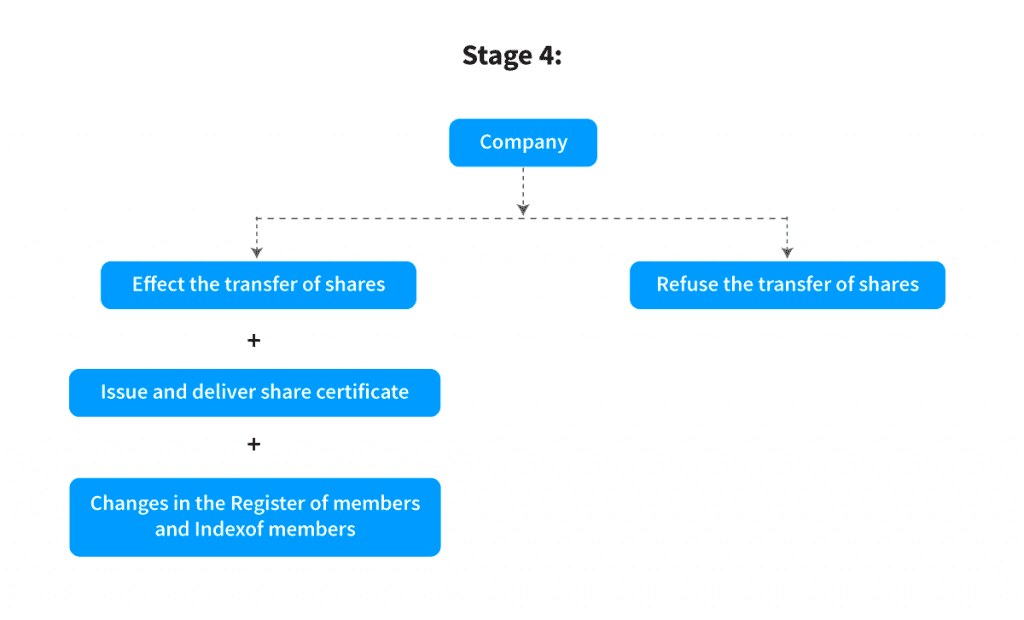

- The relevant share/debenture certificate or allotment letter with the transfer deed must be attached and sent to the company.

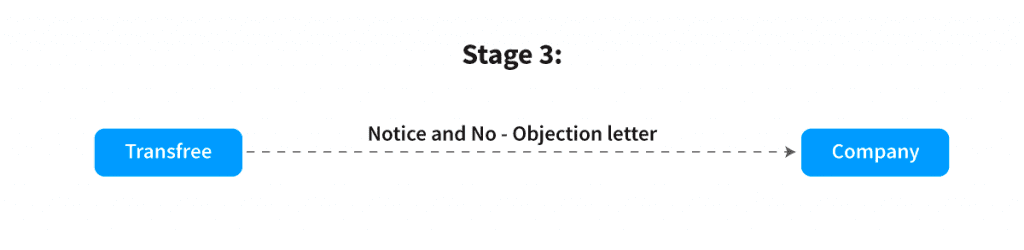

- In case the application made by the transferor is for partly paid shares, the company has to duly notify the amount due on shares/debentures to the transferee. Also, a no objection from the transferee is required within two weeks from the date of receipt of the said notice.

- Affix the same value stamp on a written application if the signed transfer deed has been lost. In this case, the board may register the transfer on specific terms of indemnity as it thinks fit.

- If the shares of the company are listed in a recognized stock exchange, then the company cannot charge any fee for the registration of transfers of shares and debentures.

- The company has given a notice in Form No. SH.5 to the transferee.

- Till the transferee has given a no objection certificate to the transfer within two (2) weeks from the date he received the notice from the company.

Note: A company shall not register a transfer of partly paid shares in these two cases:

Flowchart – Procedure for Share transfer

Flowchart – Procedure for Share transfer

Time Limit

- A Company having share capital: The Company shall not register transfer of securities of the Company or member’s interest in the Company other than beneficial owners without a proper instrument of transfer within a period of 60 days from the date of execution.

- Application by transferor alone: The transfer shall not be registered until and unless the company gives notice of the application to transferor and transferee gives no objection certificate within 2 weeks from receipt of the notice.

- Company shall deliver certificates of all securities allotted/ transferred/ transmitted in the following cases and within the following mentioned time limits:-

- In case of subscribers to memorandum – within a period of 2 months from the date of incorporation.

- In case of allotment of any of its shares – within a period of 2 months from allotment date.

- Receipt by the company of the instrument of transfer/ intimation of transmission – within a period of 1 month from the date of receipt.

- Allotment of debenture – within a period of 6 months from the date of allotment.

Penalties

- For Company – Minimum is Rs. 25,000 and maximum is Rs. 5,00,000.

- For an officer In default – Minimum is Rs. 10,000 and maximum is Rs. 1,00,000.

What are the steps to transfer shares physically?

Delivery of possession is a method to transfer ownership of shares and stock., but there is a contractual relationship between the members and the company. share transfers to the transferee, assigns Contractual relationship which needs an instrument of transfer. Transferring a share involves a series of steps, first an agreement to sell (Share Transfer Deed), then executing a deed of transfer, and finally registering the transfer.