Conversion of LLP (Limited Liability Partnership) into Partnership Firm

LLP, which is the recognized form of business organization, was introduced in India through the Limited Liability Partnership Act, 2008 and the LLP Rules, 2009. A limited liability partnership (LLP) is a partnership in which all the partners have limited liabilities. It is an alternative corporate form of business organization that gives the benefits of limited liability of a company and the flexibility of a partnership. Its existence continues irrespective of the changes in the partners and owners. It is also capable of entering into the contracts and holding property in its name. LLP is a separate legal entity fully liable for its assets, whereas the partner's liability is limited to their agreed contribution in the LLP. In an LLP, either partner is indemnified for another partner's misconduct or for negligence. The Partnership deed governs all the mutual rights and the duties of the partners.

Now you know how this actually works!

What is a LLP (Limited Liability Partnership) ?

LLP, which is the recognized form of business organization was introduced in India by the way of the Limited Liability Partnership Act, 2008, and the LLP Rules, 2009. A limited liability partnership (LLP) is a kind of partnership in which all the partners have limited liabilities. It is an alternative corporate form of business organization which gives the benefits of limited liability of a company and the flexibility of a partnership. Its existence continues irrespective of the changes in the partners and owners. It is also capable of entering into the contracts and holding of property in its own name.

It is a separate legal entity, and it is liable to the full extent of its assets but the liability of the partners is limited to their agreed contribution in the LLP. In an LLP, one partner is not responsible or is not liable for another partner’s misconduct or negligence. In an LLP, all the mutual rights and the duties of the partners within the LLP are governed by an agreement between the partners or between the partners and the LLP as the case may be. However in the absence of such agreement, the LLP would be governed by the framework which is provided in Schedule I of the Limited Liability Partnership Act, 2008, which describes the matters relating to the mutual rights and the duties of the partners of the LLP.

Further any other form of business such as a partnership which is set up under the provisions of the Indian Partnership Act, 1932, a private limited company and an unlisted public limited company can convert itself into LLP by the provisions of the LLP Act, 2008 and by following the due procedure of law. Following is the Conversion of LLP into a Partnership firm :

What is a Partnership Firm ?

A Partnership firm is governed by the principles of the Indian Partnership Act, 1932. The following are the essentials features of a Partnership Firm:

👉 An association or agreement between two or more individuals to share the profits and losses of a particular business or a venture.

👉 There is a separate legal document known as a partnership deed where the profit sharing ratios of the partners are specified.

👉 There is no form of limited liability status enjoyed by the partners of a partnership firm. Hence conversion of partnership to LLP would be an ideal choice, if the partners want limited liability status and more flexibility.

Related Topics

Can a LLP be converted into Partnership Firm?

No, An existing LLP cannot be converted in a Partnership Firm. There is no provision for such conversion in Limited Liability Partnership Rules, 2009. The Limited Liability Partnership is a modification of the Partnership concept. It is introduced by rectifying the conventional bottlenecks in the Partnership form of business structure. The lawmakers removed the privilege of converting themselves into Partnership firms.

Why should I choose LLP over Partnership Firm?

An LLP is usually opted by such entrepreneurs, who prefer to carry out their business in a conventional style. In an LLP, partners have a privilege of a limited liability, to the extent of their capital contribution in the business. Moreover, exclusivity of name is available.

Why should I choose Partnership Firm over LLP?

Registering a Partnership Firm is opted by such entrepreneurs, who prefers simplified annual compliance requirements. Though an LLP is the up-gradation of Partnership firm, it has stringent annual compliances, compared to that of a Partnership firm

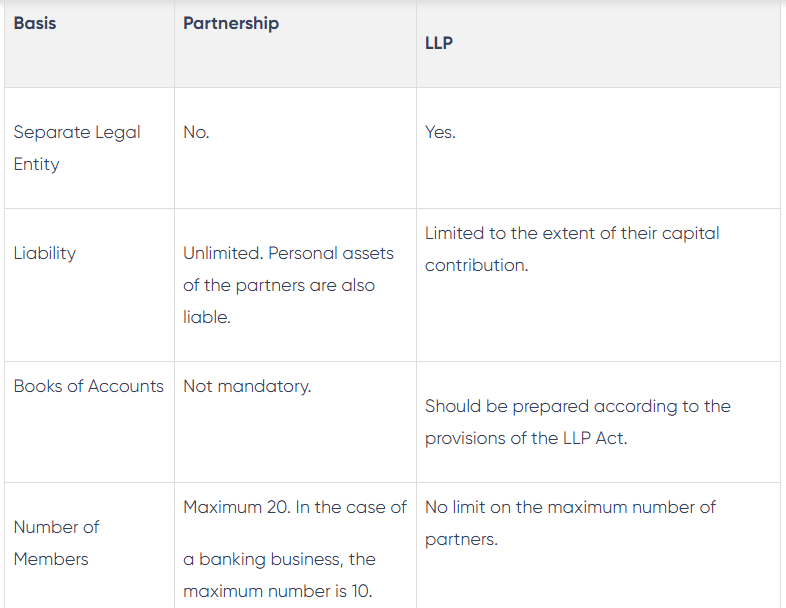

Key Differences Between a Partnership and an LLP

Key Differences Between a Partnership and an LLP