Compliances for a Business Entity Registered in India

For a business, whatever be its mode or constitution has to adhere with certain guidelines and tax laws as applicable to sustain and develop in India. We shall be discussing this from very scratch, i.e Incorporation and Confusion regarding the type of business entity to start with.

Compliance is not an event, it's a practice to be carried out round the clock, throughout the year & If you think Compliance is Costly, try Non-Compliance.

- Accounts Review

- GST Filing

- Income Tax Filing

- TDS Compliance

- ROC Annual Filing

- Dedicated Accounts Manager

- Reconciliation

- TDS Compliance

- ROC Filings

- Payroll (10 staff)

- Senior Compliance Manager

- Full Accounting

- GST + TDS Automation

- Contract Vetting

- MIS Reporting

- Dedicated Compliance Team

- Tax Representation

- Unlimited Drafting

- HR Compliance

Change the way of Tracking your Compliance Status

Things are going global; we all must come up with ideas and efforts to compete with better players. In order to control your business with precision reports and data that can help you track, govern and run the show with accurate reports and stay a step ahead of your competitors in every aspect of your bookkeeping & compliance.

Your TAXAJ Compliance Journey

A structured, step-by-step onboarding & filing workflow with automated progress milestones

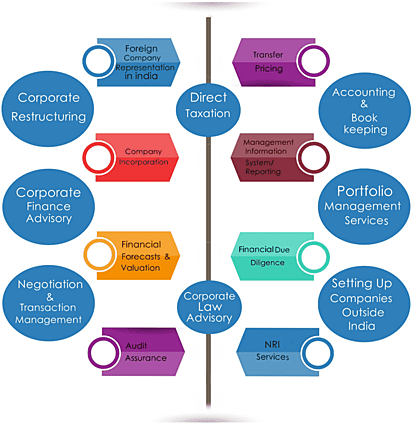

Avail All Corporate Services under One Roof

Avail All Corporate Services under One Roof

Business Compliance

Comply with all your Tax & Business Filings.

Licenses for Business

Get all the applicable licenses for your business.

Virtual Offices

Have a reputed business address for your business.

Secretarial Filings

Comply with all your MCA- ROC Corporate Filings.

Corporate Re-Structure

Comply with all your Restructuring Filings.

Closure of Business

Comply with all your Closure requirements legally.

Income Tax

Comply with all your Income Tax Filings.

Goods & Service Tax

Comply with all your GST Compliances & Filings.

Legal Services

Comply with all your Legal Support & Services.

Payroll Management

Comply with all your Payroll Filings.

Conversion of Company

Convert your company structure into another form.

Digital Services

Comply with all your Legal Support & Services.

Valuation of Business

Get Valuation for all your needs done.

Foreign & FDI Filings

Comply to all your Foreign Transactions

Intellectual Property Rights

Secure your Trade Name or Logo from Infringement

From Start Up to Scale Up — We Power Your Growth.

Maintenance of Books of Accounts Under Income Tax Act

Books of accounts including vouchers and receipts are required to be maintained under different statutory laws – Income Tax Act, Companies Act 2013 and GST Act. Books to be maintained, retention period and compulsion requirements are different under all the 3 laws. While running a business, maintaining books of accounts is essential. The Tax Department needs them, the bank or your investor might ask for them. Outsource your book keeping function and let professionals manage your business financial reporting.

Under Income Tax Act

- Legal

- Medical

- Engineering

- Architectural

- Accountancy

- Technical consultancy

- Interior decoration

- Authorised Representative (one who charges fees for representing someone before tribunal or any authority)

- Film artist (producer, editor, actor, director, music director, art director, dance director, cameraman, singer, lyricist, story writer, screenplay or dialogue writer and costume designers.

Under Companies Act

Every company has to maintain books of accounts, at the registered office or any office that board of directors may decide. If the company is maintaining books at an office other than the registered office, it has to intimate the same to RoC. The company can maintain the accounts electronically also.

- Cash flow statement

- Records of sales and purchases,

- Records of assets and liabilities

- Items of cost

- Deeds, vouchers, writing, documents, minutes, and registers whether in physical or electronic mode

Books should be maintained for a period of 8 years from the end of the relevant financial year.