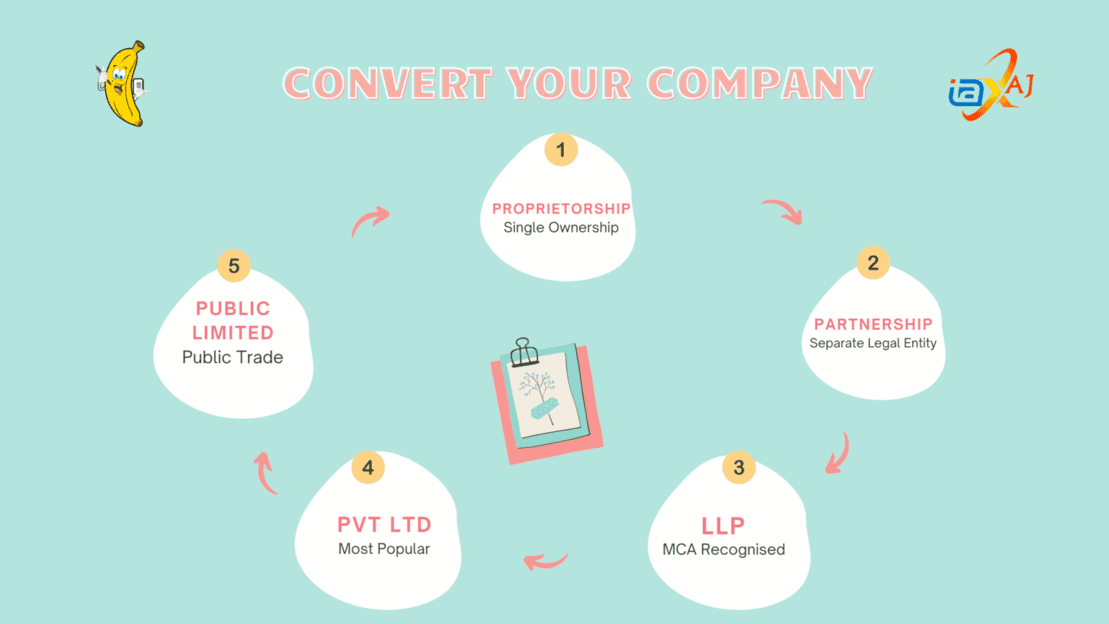

Conversion of Company from One Form to Another

In the modern days the need & speed for expansion has been growing tremendously which leads to fast evolving change in the nature of company status to adapt the required needs and move ahead of the constraints in existing one. So here we shall be knowing about the types of conversion possibilities currently as per the Indian Taxation and Government Laws for the time being.

Therefore let us now discuss the types of conversions possible as per Indian Law:

Partnership Firm to L.L.P.

After introducing the LLP Act in 2008, many Partnership Firms have started to convert their Partnership Firm to LLP. The reasons for conversion are self-evident, such as the ability to take an unlimited number of partners, separate legal entities, limited liability and easy process of ownership transfer by simply filling a form. Due to all of these advantages of LLP over Partnership, LLP has become very popular amongst small and medium-sized businesses.

The Partnership Firm that is willing to convert itself to LLP must be registered under the Indian Partnership Act, 1932. Unlike these, Unregistered Firms can’t be converted to an LLP. All converted LLP from Partnership Firm must have same partners as in earlier entity Partnership Firm. So we at Taxaj suggest our clients retire Partners who do not wish to be a part of LLP, and if new partners are to be added, they should be added after the incorporation of LLP.

Proprietorship to Pvt Ltd Company

The most popular form of business entity that most Indians launch their business with is Sole Proprietorship due to the minimal compliance requirements & documentations. As the business and the incomes grow, you need to open a business with current accounts and income tax filings of the Proprietor. Once you know you are booming and there is only an uphill to go, then you can convert Sole Proprietorship into a Private Limited Company to accomplish this separation.

To convert a Sole Proprietorship into a Private Limited Company, an agreement is generally drafted between the Proprietorship and the Private Limited Company (once it is incorporated) to sell the business. Further, such Private Limited Company so incorporated should takeover the Sole Proprietorship Concern” as one of the objectives in its Memorandum of Association.

OPC to Pvt Ltd Company

Section 18 of the Companies Act, 2013 & Provisions of Companies (Incorporation) Rules of 2014 discharges the rules and guidelines for converting an OPC into a Private Limited Company. It will not affect the assets, liabilities, debts, obligations or any running contracts of the OPC. You can convert an OPC into a private limited company in two ways, either voluntarily or mandatorily. Here, the MOA and AOA of the OPC should be altered as per new standards.

You must obtain NOC from the concerned members and creditors in written form; passing a resolution in support of conversion; must satisfy the minimum number of members and directors, i.e. two members and two directors at a minimum.

L.L.P. to Pvt Ltd Company

A lot of businesses started in India as Limited Liability Partnership (LLP) are now willing to convert into a private limited company for certain more advantages that a Pvt Ltd company enjoys. Most prominent among them being the ease of infusing equity capital. An LLP can be converted into a Pvt. Ltd. company as per the provisions contained in Section 366 of the Companies Act, 2013 and Company (Authorised to Register) Rules, 2014.

However, various requirements need to be satisfied for converting an LLP into a Private Limited Company. Partners approval is required. Advertisement in a newspaper is to be done in a local and a national newspaper. A No Objection Certificate (NOC) is required from the ROC where such LLP is registered. Then all the incorporation process has to be undertaken which includes:

Private Ltd to Public Limited Company

Private limited companies are a dime a dozen, but every private limited company, at some point, wishes to turn public so as to increase scalability. The question generally put across is, “Why go public?” The answer lies in certain distinct differences that arise between private limited companies and public limited companies.

- Public companies offer the option of Initial Public Offering (IPO). Here, by going public, the company is offering its shares to the general public.

- The option of IPO thereby removes the restriction on the transferability of shares, which is a feature of private limited companies.

- There is no cap with regards to the maximum number of members in a public limited company, thereby allowing them to raise and gain easy access to funding. Therefore, growth and flexibility are ideally the reasons for the switch from private to public.

Public Limited to Private Limited Company

Ministry of Corporate Affairs by its notification dated 18th December 2018 has amended the Companies (Incorporation) Rules, 2014 by making Companies (Incorporation) Fourth Amendment Rules, 2018. Rule 41 has been inserted in the said rules which provides for the regulations for making application for conversion of public limited company into private limited company. Earlier the application for conversion was made with NCLT Benches having jurisdiction over companies and the same is very time consuming process. Thereby to free the tribunals with the cases of conversion, power of approval of conversion has been transferred to Central Government. Thereafter the Central Government has delegated his powers to Regional Director vide notification S.O. 6225 (E) dated 18th December 2018 for approval of conversion of public limited company into private limited company.

LLP to Partnership Firm

LLP is a separate legal entity, and it is liable to the full extent of its assets but the liability of the partners is limited to their agreed contribution in the LLP. In an LLP, one partner is not responsible or is not liable for another partner’s misconduct or negligence. In an LLP, all the mutual rights and the duties of the partners within the LLP are governed by an agreement between the partners or between the partners and the LLP as the case may be. However in the absence of such agreement, the LLP would be governed by the framework which is provided in Schedule I of the Limited Liability Partnership Act, 2008, which describes the matters relating to the mutual rights and the duties of the partners of the LLP.

Further any other form of business such as a partnership which is set up under the provisions of the Indian Partnership Act, 1932, a private limited company and an unlisted public limited company can convert itself into LLP by the provisions of the LLP Act, 2008 and by following the due procedure of law. Following is the Conversion of LLP into a Partnership firm

Private Limited to One Person Company

The conversion of PLC (Private limited company) into an OPC (One Person Company) is provided as per the Companies Act, 2013, which implements a mechanism to convert one class of company into another. Section 18 of the Act, explicitly grants the conversion of an already registered private limited company starting from 1 April 2014.

The conversion of PLC to OPC would not affect the responsibilities and contractual obligations of the company before conversion, and such claims, liabilities, obligations shall be enforceable by law, and the resulting OPC shall be liable for them.

Private Limited to LLP

Limited Liability Partnerships are popular due to the multiple advantages as they are a mixture of both Company and Partnership firms. LLP offers the benefits of a Company and the flexibility of Partnerships.

The Limited Liability Partnership is a legal entity where the liability of the partners is limited. The LLPs can enter into contracts and holding properties in their own name

This article covers the concept of conversion of Private Limited Companies into an LLP. Each shareholder of the private limited company must submit a statement and consent for the conversion of a company into LLP along with the application.