Generation of E-Way Bill in GST

Under GST, transporters should carry an eWay Bill when moving goods from one place to another when certain conditions are satisfied.

Table of Contents

What are the modes of e-way bill generation?

The e-way bill can be generated by using following methods:

1. Web based system

2. SMS based facility

3. Android App

4. Bulk generation facility

5. Site-to-Site integration and

6. GSP (Goods and Services Tax Suvidha Provider).

Can the e-way bill be modified or edited?

The e-way bill once generated, cannot be edited or modified. Only Part-B can be updated to it. However, if e-way bill is generated with wrong information, it can be cancelled and generated freshly again. The cancellation is required to be done within twenty four hours from the time of generation.

Is there any validity period for e-way bill?

Yes. Validity of the e-way bill or consolidated e-way bill depends upon the distance the goods have to be transported. The validity is one day upto 100 km and for every 100 km or part thereafter it is one additional day.

What is the Part A Slip?

Part A Slip is a temporary number generated after entering all the details in Part A. This can be shared or used by transporter or yourself later to enter the Part B and generate the E-way Bill. This will be useful, when you have prepared invoice relating to your business transaction, but don't have the transportation details. You can enter invoice details and keep it ready for transportation, once the transportation is ready.

Whether Part-B is must for e-way bill?

E-Way bill is complete only when Part-B is entered. Part-B is a must for the e-way bill for movement purpose. Otherwise printout of EWB says it is invalid for movement of goods.

What are the documents to be carried with the goods being transported?

The person in charge of a conveyance shall carry the tax invoice or bill of supply or delivery challan, bill of entry as the case may be; and a copy of the e-way bill or the e-way bill number generated from the common portal.

1. What is an e-Way Bill?

2.When Should eWay Bill be issued?

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment)In simpler terms, the term ‘supply’ usually means a:

- Sale – sale of goods and payment made

- Transfer – branch transfers for instance

- Barter/Exchange – where the payment is by goods instead of in money

- Inter-State movement of Goods by the Principal to the Job-worker by Principal/ registered Job-worker***,

- Inter-State Transport of Handicraft goods by a dealer exempted from GST registration

3. Who Should generate eWay Bill?

4. Cases when eWay Bill is not required?

- In the following cases it is not necessary to generate e-Way Bill:

- The mode of transport is non-motor vehicle

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

- Goods transported under Customs supervision or under customs seal

- Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

- Transit cargo transported to or from Nepal or Bhutan

- Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

- Empty Cargo containers are being transported

- Consignor transporting goods to or from between place of business and a weigh-bridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

- Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

5. What is the Status of E way Bill?

Inter-State movement of goods has seen rise in numbers of generation of eway bills ever since its implementation began from 1st April 2018. State-wise implementation of e-way bill system has seen a good response with all the States and Union Territories joining the league in the generation of eway bills for movement of goods within the State/UT. However, reliefs have been provided to people of few States by way of exempting them from eway bill generation in case of monetary limits falling below threshold amount or certain specified items. For Instance, Tamil Nadu has exempted people of its State from the generation of eway bill if the monetary limit of the items falls below Rs. One Lakh. To know more of such reliefs for other States/UTs, visit commercial tax websites for each of such States/UTs.

6. How to Generate E way Bills on eway bill Portal?

The e-waybill (EWB) portal provides a seamless gateway to generate eWay bills (single and consolidated options), change vehicle number on the already generated EWB , cancel generated EWBs and many more…

E-way bills in EWB-01 can be generated by either of two methods-

- On the Web

- Via SMS

This topic covers the step-by-step process of generating the e-way bills on the E way bill portal (web-based).

Prerequisites for e-Way Bill Generation

There are some pre-requisites for generating an e-way bill (for any method of generation):

- Registration on the EWB portal

- The Invoice/ Bill/ Challan related to the consignment of goods must be in hand.

- If transport is by road – Transporter ID or the Vehicle number.

- If transport is by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

Steps to generate e-Way Bill on the e-Way Bill portal

Here is a step by step Guide to Generate EWay Bill (EWB-01) online:

Step 1: Login to e-way bill system.

Enter the Username, password and Captcha code, Click on ‘Login’

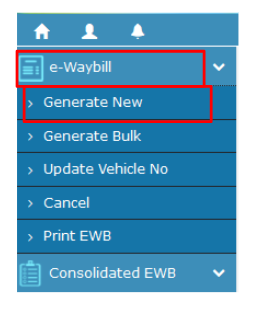

Step 2: Click on ‘Generate new’ under ‘E-waybill’ option appearing on the left-hand side of the dashboard.

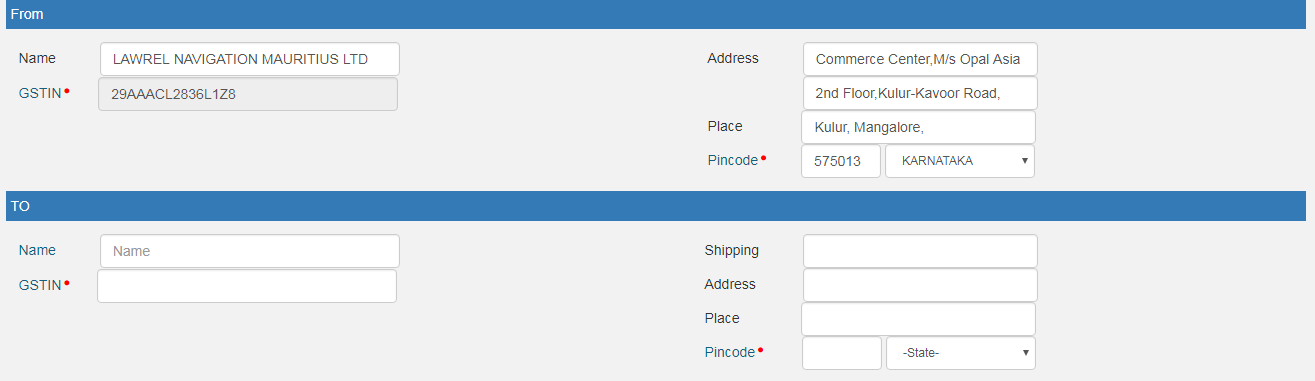

Step 3: Enter the following fields on the screen that appears:

1) Transaction Type:

Select ‘Outward’ if you are a supplier of consignment

Select ‘Inward’ if you are a recipient of consignment.

2) Sub-type: Select the relevant sub-type applicable to you:

If transaction type selected is Outward, following subtypes appear:

![]()

If transaction type selected is Inward, following subtypes appear:

Note: SKD/CKD- Semi knocked down condition/ Complete knocked down condition

3) Document type: Select either of Invoice / Bill/ challan/ credit note/ Bill of entry or others if not Listed

4) Document No. : Enter the document/invoice number

5) Document Date: Select the date of Invoice or challan or Document.

Note: The system will not allow the user to enter the future date.

6) From/ To Depending on whether you are a supplier or a recipient, enter the To / From section details.

Note: If the supplier/client is unregistered, then mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’.

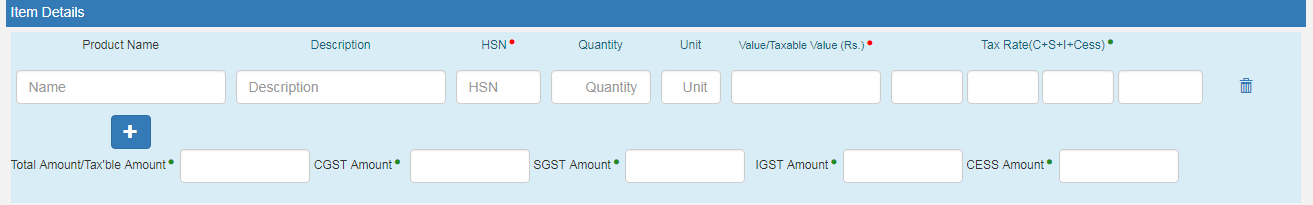

7) Item Details: Add the details of the consignment (HSN code-wise) in this section:

- Product name

- Description

- HSN Code

- Quantity,

- Unit,

- Value/Taxable value

- Tax rates of CGST and SGST or IGST (in %)

- Tax rate of Cess, if any charged (in %)

Note: On the implementation of Eway bills, Based on the details entered here, corresponding entries can also be auto-populated in the respective GST Return while filing on GST portal.

8) Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, Either of the details can be mentioned:

- Transporter name, transporter ID, transporter Doc. No. & Date.

OR

- Vehicle number in which consignment is being transported.

Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234

Note: For products, clients/customers, suppliers, and transporters that are used regularly, first update the ‘My masters’ section also available on the login dashboard and then proceed.

Step 4: Click on ‘Submit’. The system validates data entered and throws up an error if any.

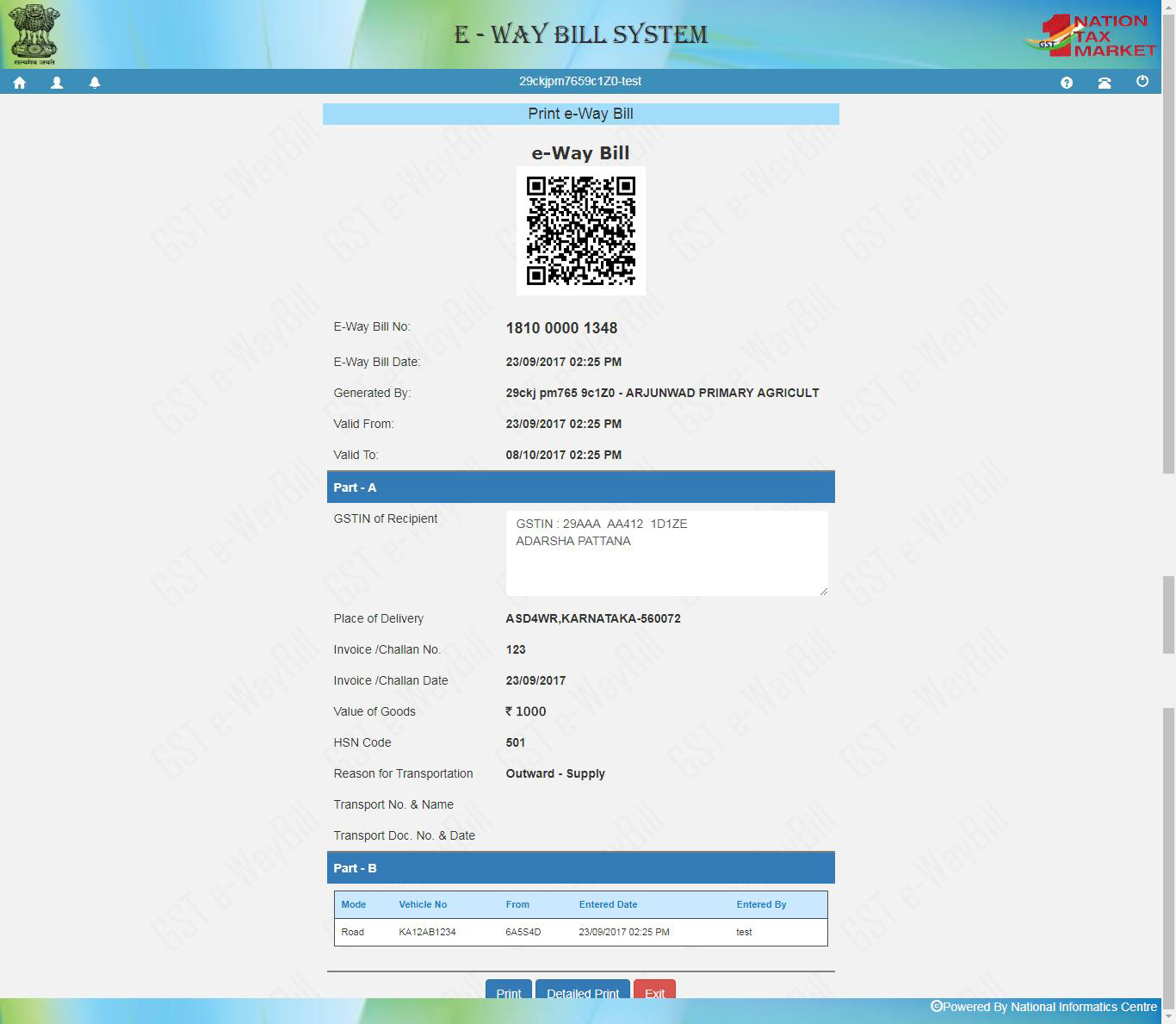

Otherwise, your request is processed and the eway bill in Form EWB-01 form with a unique 12 digit number is generated.

The eway bill generated looks like this:

Print and carry the eway bill for transporting the goods in the selected mode of transport and the selected conveyance.

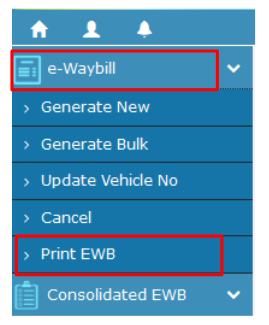

You can print the eway bill anytime as follows:

Step-1: Click on ‘Print EWB’ sub-option under ‘e-Waybill’ option

Step-2: Enter the relevant eway bill number -12 digit number and click on ‘Go’

Step-3: Click on ‘Print’ or ‘detailed print’ button on the EWB that appears:

Bogged down by Eway bills? Use TAXAJ EWayBill, a simple and intelligent solution to your Eway bill woes!

TAXAJ offers a wide range of services in GST compliances such as Invoicing, Preparation and filing of returns and the latest addition to this list is preparing and generating ‘E-Way Bill’.

TAXAJ E-WayBill helps you:

- Avoid multiple login for separate States & Branch level Access control by providing users with a centralised login for EWB generation

- Accurately estimate distance for e-way bill validity via inbuilt distance calculator with an option to edit also

- Bulk update Transporter details for the documents issued without punching data again

- Avoid errors through in-built validations, improved User experience and Intelligent Reports

How to generate e way bill without Transport ID or Vehicle Number?

No. One needs to transport the goods with a e-way bill specifying the vehicle number, which is a carrying the goods. However, where the goods are transported for a distance of less than ten kilometers within the State from the place of business of consignor to the place of transporter for further transportation, then the vehicle number is a not mandatory.

It is not possible to generate E-way bill without vehicle number or transporter id. You have to give either a valid transporter id or valid vehicle number to generate E-way bill.

Whether the e-way bill can be cancelled? if yes, under what circumstances ?

Yes. e-way bill can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill. e-way bill can be cancelled within 24 hours from the time of generation.

If the vehicle in which goods are being transported with e-way bill is changed, then what has to be done?

The e-way bill for transportation of goods always should have the vehicle number that is actually carrying the goods. There may be requirement to change the vehicle number after generating the e-way bill or after commencement of movement of goods due to transshipment or due to breakdown of vehicle. In such cases, the transporter or generator of the e-way bill can update the changed vehicle number.

Why the transporter needs to enroll on the e-Way Bill system?

There may be some transporters, who are not registered under the Goods and Services Tax Act and if such transporters cause the movement of goods for their clients, they are required to generate the e-way bill on behalf of their clients or update the vehicle number for e-way bill. Hence, they need to enroll on the e-way bill portal and generate the 15 digits Unique Transporter Id.

Can I transport the goods with the e-way bill without vehicle details in it?

No. One needs to transport the goods with a e-way bill specifying the vehicle number, which is a carrying the goods. However, where the goods are transported for a distance of less than ten kilometers within the State from the place of business of consignor to the place of transporter for further transportation, then the vehicle number is a not mandatory.

What is consolidated e-Way Bill?

Consolidated e-way bill is a document containing the multiple e-way bills for multiple consignments being carried in one conveyance (goods vehicle). That is, the transporter, carrying the multiple consignments of various consignors and consignees in one vehicle is required to carry one consolidated e-way bill instead of carrying multiple e-way bills for those consignments

Can the e-way bill be deleted or cancelled?

The e-way bill once generated cannot be deleted. However, it can be cancelled by the generator within 24 hours of generation. If it has been verified by any empowered officer, then it cannot be cancelled. e-way bill can be cancelled if either goods are not transported or are not transported as per the details furnished in the e-way bill.

Who can reject the e-Way Bill and Why?

The person who causes transport of goods shall generate the e-way bill specifying the details of other person as a recipient of goods. There is a provision in the common portal for the other party to see the e-way bill generated against his/her GSTIN. As the other party, one can communicate the acceptance or rejection of such consignment specified in the e-way bill. If the acceptance or rejection is not communicated within 72 hours from the time of generation of e-way Bill, it is deemed that he has accepted the details.

How to generate e-way bill, if the goods of one invoice is being moved in multiple vehicles simultaneously?

Where the goods are being transported in a semi knocked down or completely knocked down condition the EWB shall be generated for each of such vehicles based on the delivery challans issued for that portion of the consignment and;

(a) the supplier shall issue the complete invoice before dispatch of the first consignment;

(b) the supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice;

(c) each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

(d) the original copy of the invoice shall be sent along with the last consignment

Please note that multiple EWBs have to generate under this circumstance. That is, the EWB has to be generated for each consignment based on the delivery challan details along with the corresponding vehicle number.

How does the tax payer or recipient come to know about the e-way bills generated on his GSTIN by other person/party?

As per rules, the tax payer or recipient can reject the e-way bill generated on his GSTIN by other parties. The following options are available for him to see the list of e-way bills.

• He can see on the dashboard, once he logs into the system.

• He will get one SMS everyday indicating the total e-way bill activities on his GSTIN.

• He can go to reject option and select date and see the e-way bills. Here, system shows the list of e-way bills generated on his GSTIN by others.

• He can go to report and see the ‘EWBs by other parties’.