Demat Account: Meaning | Facilities | How to open | Benefit

A demat account allows investors to hold their shares in an electronic form. It is a replacement for holding and trading in physical share certificates, which involved a lot of paperwork. As most of the transactions are now online, an investor can trade conveniently with demat account. Stocks in demat account remains in dematerialized form, where all your stocks are converted from physical to electronic form to increase accessibility. Apart from shares, the demat account can also hold bonds, ETFs, mutual funds, gold bonds, and other similar assets with a unique ISIN number. Demat Account has become the necessary thing in case you want to invest in stock markets. It makes the entire process of share trading secure and speedy.

For Opening a Demat Account:

We recommend:

Amongst all the Discount Brokers available in the market we find www.5Paisa.com to be the best performing & Affordable at the same time with no hidden fee. With over 3 years of use we are confident enough to refer you:

USE REFERRAL CODE: BSHIV1611

Get Rs.500 Bonus with your First Transaction.

All you need to know about Dematerialization of Shares

1. What is a Dematerialisation (Demat) Account?

You need a Demat Account number to settle trades electronically. Having a Demat Account allows you to buy shares and store them safely. It is similar to a bank account in which you hold deposits with the bank, and the record of debit/credit balances are maintained in a bank passbook. In the same way, when you purchase or sell shares, they will be credited or debited to/from your Demat Account, respectively. You can hold various investments like equity shares, exchange-traded funds, mutual funds, bonds, and government securities in a Demat account. You can open a Demat Account without possessing any shares and maintain a zero balance in your account.

2. What are the facilities offered by a Demat Account?

Transfer of Shares

A Demat Account is used to transfer the shareholdings of an investor, and it can be done by using a Delivery Instruction Slip (DIS) to conduct share trading. You can provide all the relevant details in this slip for the smooth execution of a transaction.

Multiple Access Options

Owing to electronic operation, a Demat Account can be accessed using numerous media. You can conduct investing, trading, monitoring and other security-related operations using the Internet facility on a computer, smartphone, or other handheld devices.

Loan Facility

The securities held in your Demat Account can give you access to various loans from the bank. You can pledge these securities as collateral to secure a loan from your bank.

De-materialization & Re-materialization

If you have a Demat Account, then converting the securities into different forms becomes a simple task. You can give your depository participant (DP) the necessary instructions to dematerialise physical share certificates converted into electronic form. Conversely, you can get the electronic securities converted back to the physical form as per your requirements.

Freezing Demat Accounts

Demat account holders have the option to freeze their accounts for a specific duration, as per the requirement. It is done to avoid any unpredicted debit/credit into the Demat Account. To avail of the freezing option, the account holder needs to hold a specific quantity of securities in their account.

Speed E-Facility

The National Securities Depository Limited (NSDL) keeps extending various facilities for the Demat account holders. Instead of physically submitting the slip, the account holder may send instruction slips electronically to the depository participant. It is done to make the process faster and less cumbersome.

Corporate Actions

Having a Demat Account can help you avail of benefits associated with owning securities. Whenever a company provides dividends, interest or refunds to its investors, all the Demat account holders automatically get access to these benefits. Additionally, corporate actions related to equity shares like stock split, right shares or bonus issue is updated in the shareholders’ Demat Accounts.

Q. What are the Documents required for a Demat Account?

You may perceive a Demat account just like a bank account that hold securities instead of money. The Demat account opening procedure and the mandatory documents required are similar across organisations.

Here is the detailed list of documents that you need for opening a Demat Account.

Proof of Income

You may submit any one of these as a proof of income:

Proof of Identity

👉 PAN card.

👉 Aadhar card/ Driving license/ Passport.

Proof of Address

You may submit any one of these as a proof of address:

👉 Passport/Voters Identity Card/Ration Card/Registered Lease or Sale Agreement of Residence/Insurance Copy.

👉 Utility bills like landline telephone bill, electricity/gas bill which is not more than 3 months old.

👉 Bank Passbook.

👉 Self-declaration of new address given by judges of High Court and Supreme Court.

👉 Address proof in the name of the spouse

4. How to open a Demat Account?

You can open a Demat Account by following these easy steps:

- Firstly choose a Depository Participant (DP) with whom you would like to open a Demat Account.

- Afterwards, fill an account opening form and attach a passport-sized photograph along with photocopies of the required documents stating proof of address and identity. You should have a PAN card unless otherwise exempted. Remember to carry the original documents along for verification.

- The DP will give you a copy of the rules and regulations, the terms of the agreement and necessary charges that you need to pay.

- During an In-Person Verification, a representative of the DP would contact you to verify the details provided in the account opening form.

- After processing of the application, you will get an account number/ client ID from the DP. These details will be required to access Demat Account online.

- When you become a demat account holder, you would be required to pay an annual maintenance fee for maintenance of your account. Additionally, you would be charged a transaction fee for conducting buying/selling transaction via the Demat Account. In case your shares are in physical form, the DP may charge you a separate fee for dematerialisation of the shares.

- You can open a Demat Account without having any shareholdings. Moreover, there’s no mandate to maintain a minimum balance.

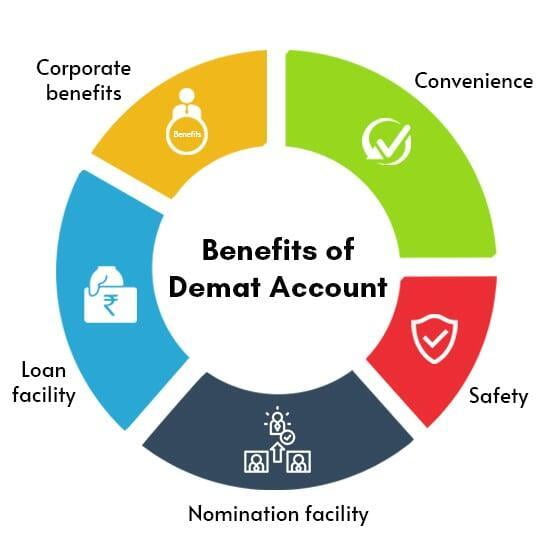

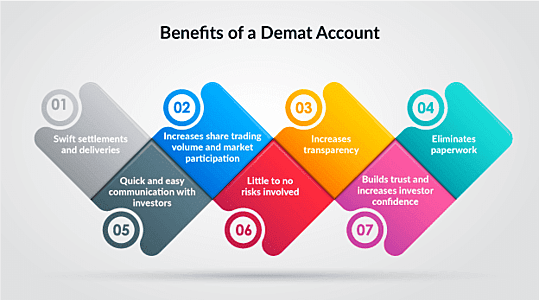

5. What are the benefits of Demat Account?

Less Paperwork

All your investments are held in an electronic form, which eliminates a major part of documentation and reduces paperwork.

Safe & Secure

A demat account eliminates all the risks associated in dealing with physical shares like physical damage or misplacement. Opening a demat account will eliminate all these risks.

Reduces Cost

Trading in physical entities can entail higher transactional costs with extra expenses of handling charges and stamp duty. A demat account eliminates all these extra charges.

Instant Transactions

Being in the electronic form, a demat account allows faster transaction, resulting in quick credit for investors.