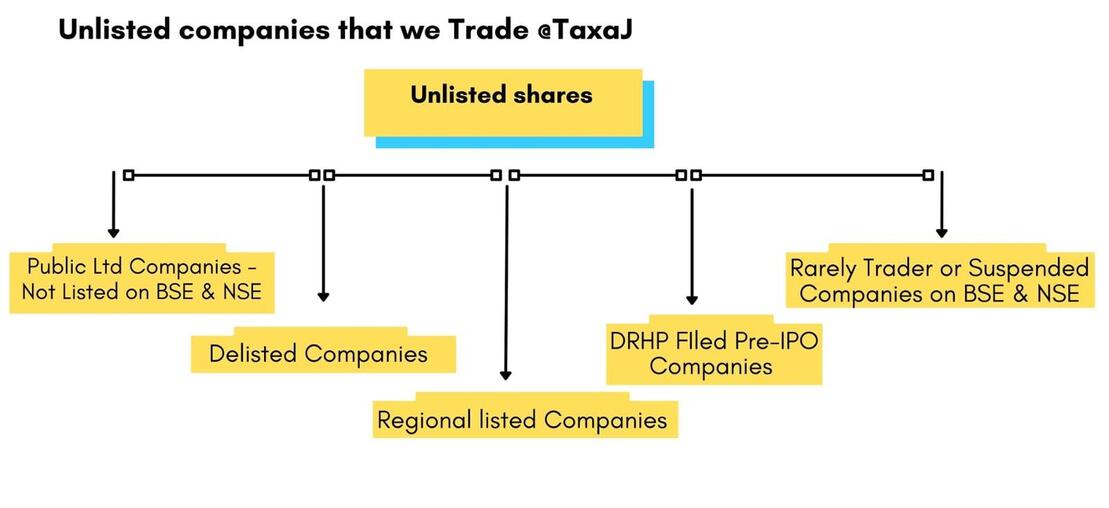

These include equity shares of a company not listed on BSE/NSE; these shares are traded over the counter (OTC) and are often called OTC securities. These companies can be privately held, formerly public companies taken private in management buyouts, and public companies waiting to be listed on a recognised Indian stock exchange like BSE or NSE.

These companies often enjoy a healthy growth rate and have industry-leading prospects. Most of them never try to move towards public borrowing even after qualifying by all means. Moreover, they are eligible for public trust also as their name is well established in the customers' minds. These unlisted shares, especially at a pre-IPO stage, provide an excellent investment opportunity mainly focusing on long-term wealth creation. The returns can potentially beat returns by listed equities

Q. What are Unlisted Shares?

Most of the people are unaware about the true meaning of Unlisted Shares.

👉Unlisted shares, in simple terms are those shares which are not traded on NSE and BSE

👉Unlisted Share are traded via a broker-dealer network.

1. Public Companies that are not traded on BSE & NSE:

✔ Subsidiaries of well-known publicly traded companies, such as Reliance Retail, HDFC Securities, Chennai Super Kings Ltd as well as Tata Technologies

✓ Start-ups & Unicorns such as Five Star Business Finance Itd, Cochin International Airport.

Key Benefits of investing in Companies not traded on BSE & NSE

👉 Access to new-age companies that are high on innovation,

👉 Unlisted Stocks provide an opportunity to invest in a firm that is still in its early stages of growth and yield high returns.

👉 Unlisted equity shares are a distinct asset class, and as a result, they provide some risk diversification for investors who invest primarily in listed equity markets.

2. Delisted Companies

These are those company shares that were once listed on the stock exchanges but got delisted due to various reasons either via voluntary delisting process or compulsory delisting process

Key Benefits of investing in Delisted Shares:

✓ One can get better exit opportunities in Unlisted Markets. Hexaware Technologies Ltd, and Otis Elevator Company (India) Itd are good examples of Delisted Shares

→ Hexaware Technologies Limited got delisted at 480/- and now trades at 630-700 levels in Unlisted Market.

→ Otis Elevator Company India Limited got delisted at 320/- and now trades at 4100-4500 per share in the Unlisted Market.

✔Companies that have voluntary delisted may relist within three years in accordance with the new Sebi Guidelines published. The previous period was five years.

✔ Shareholders can create wealth from companies that were previously delisted but are now back on the market (relisted). Mideast Integrated Steel Limited, for example.

3. Regional Listed Companies

These are shares that aren't traded on the NSE or BSE, but rather on stock exchanges such as the Metropolitan Stock Exchange of India or the Calcutta Stock Exchange, where trading is either non-existent or very infrequent.

Examples include-Premier Cryogenics Itd, Mohindra Fasteners Ltd, India Carbon Itd. Some of the market leaders like Dalmia Refractories Itd. Mohan Meakin Ltd etc.

Key Benefits of investing in Regionally Listed Shares:

✓ Regionally listed companies can list directly on BSE or NSE without going through IPO process

✓ For instance, Lux Industries Ltd, which significantly increased shareholders' wealth

✓ Also, since these companies do not need to go through the IPO process, there will be no 6-month lock-in period for shareholders.

4. DRHP filed - Pre-IPO companies

These are the companies that has filed DRHP and will get listed in NSE or BSE after the approval of SEBI.

Examples include-One Mobikwik Systems Ltd, Tamilnad Mercantile Bank Ltd, Le Travenues Technology Ltd (ixigo), etc

Key Benefits of investing in DRHP filed companies:

• You can get a pre access to those shares in the Unlisted Markets that are difficult to be allotted in an IPO, as there is no certainty that you will be allotted an IPO.

• As per the new SEBI rule, the lock-in period in Pre-IPO shares held by individuals is reduced to 6 months from 1 year.

5.Rarely Traded or Suspended Companies

There are some companies that are rarely traded or suspended on NSE or BSE due to a combination of reasons, including circuit filters mechanism

Among the best examples are -

→ It is possible for suspended companies to relist, providing opportunity for shareholders who bought stocks off-market to improve their wealth.

➜A good example is Coffee Day Enterprises Ltd- While it was suspended from BSE, it was traded in Unlisted Market, but it got relisted and has created wealth for shareholders