🧾 SMF (Single Master Form) Compliances

RBI Reporting Made Simple

The Single Master Form (SMF) is a consolidated digital reporting form introduced by the Reserve Bank of India (RBI) for entities in India to report foreign investments in a structured and centralized manner. It was launched as part of the FIRMS (Foreign Investment Reporting and Management System) initiative to streamline the compliance framework for reporting foreign direct investment (FDI) under the Foreign Exchange Management Act (FEMA), 1999.

Previously, Indian companies and LLPs were required to submit multiple separate forms such as FC-GPR, FC-TRS, LLP-I, DRR, CN, etc., through different channels. This fragmented approach often led to errors, delays, and compliance issues. To simplify this, the RBI introduced the Single Master Form—an integrated platform that brings all reporting obligations for foreign investment under one roof.

🧾 Key Objectives of the SMF:

🏢 Who Must File the SMF?

Entities in India (including companies, LLPs, startups, etc.) that:

Receive FDI through issuance of equity instruments; or

Transfer shares to/from non-residents; or

Have foreign investors, whether active or dormant

are mandatorily required to report such transactions via the SMF on RBI’s FIRMS Portal.

The Single Master Form (SMF) is not just a form—it’s a digital compliance ecosystem for foreign investment in India. It ensures that all FDI-related inflows and transactions are accurately reported and tracked by RBI, enhancing regulatory oversight and easing the burden on businesses through a single-point reporting system.

✅ Who Needs to File SMF?

The Single Master Form (SMF) must be filed by any Indian entity that has received or facilitated foreign investment in any form. It is a mandatory compliance requirement under the Foreign Exchange Management Act (FEMA), 1999, and enforced by the Reserve Bank of India (RBI) via its FIRMS portal.

🏢 Entities Required to File SMF Include:

❗Note:

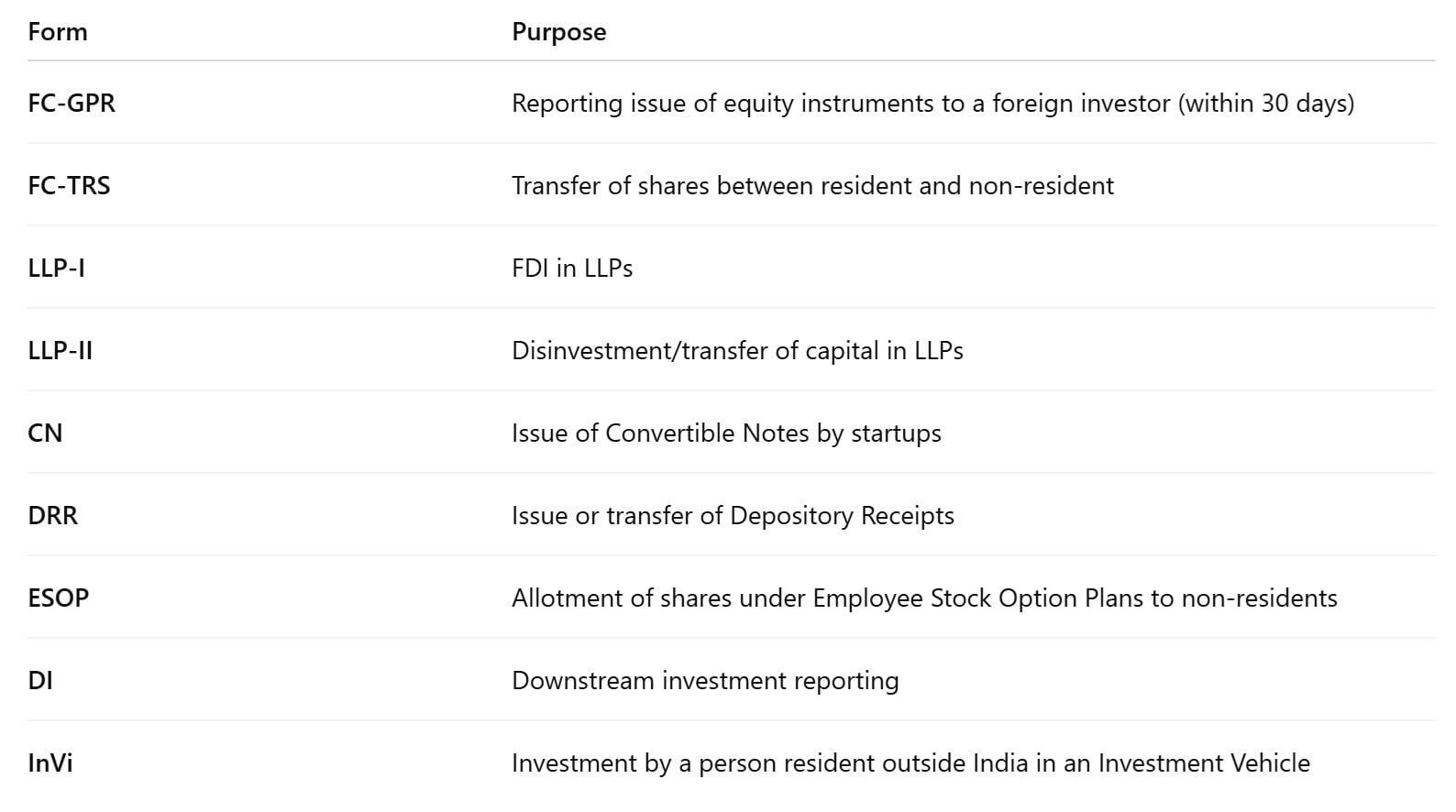

📋 Components of SMF Reporting

The SMF is used for filing the following forms:

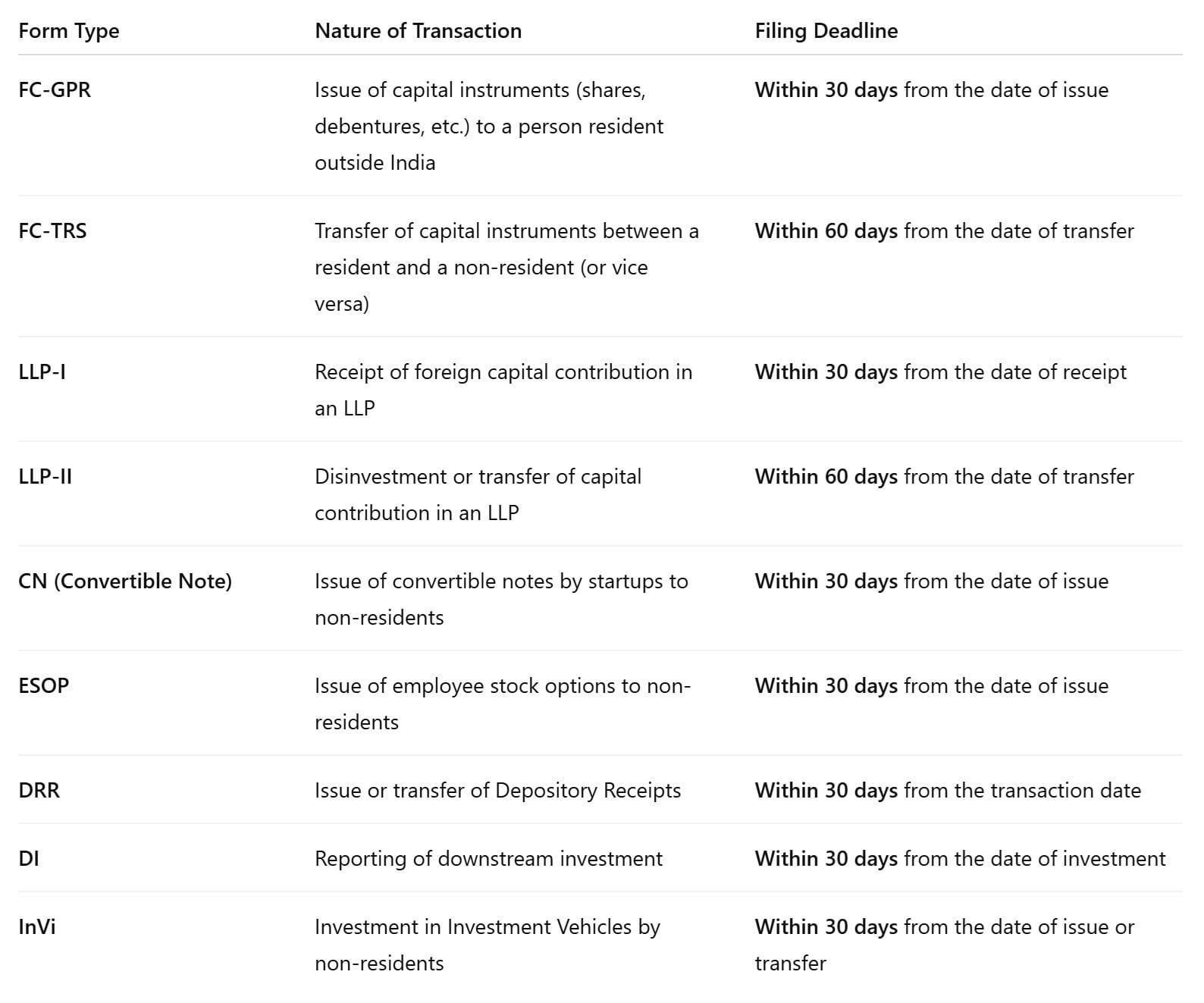

📅 Timelines for Filing – SMF Compliance

Timely filing of the Single Master Form (SMF) is critical for complying with the Foreign Exchange Management Act (FEMA), 1999 and the Reserve Bank of India (RBI) regulations. Each type of transaction involving foreign investment has a specific reporting deadline through the SMF module on the FIRMS Portal.

⏰ Key Reporting Timelines:

⚠️ Late Filing Consequences

🧑💼 TAXAJ’s Role in SMF Compliance

At TAXAJ, we understand that regulatory compliance with the RBI's SMF (Single Master Form) framework is critical for companies receiving or handling foreign investments. Our experienced professionals ensure you stay compliant with FEMA regulations, avoid penalties, and maintain investor confidence through timely and error-free reporting.

💼 How TAXAJ Assists You with SMF Compliance:

✅ Why Choose TAXAJ?

⚠️ Non-Compliance Risks – SMF Filing Under FEMA

Failure to file the Single Master Form (SMF) or any related foreign investment reporting with the Reserve Bank of India (RBI) is treated as a serious violation under FEMA, 1999. Ignoring or delaying this mandatory compliance can lead to monetary penalties, reputational damage, and business disruptions.

🔻 Key Risks of SMF Non-Compliance:

🛡️ TAXAJ Helps You Avoid These Risks

📣 Avoid Penalties. Stay Compliant.

🎯 Stay RBI-Compliant with Confidence.

Whether it’s your first FDI or a complex restructuring, TAXAJ ensures timely, accurate, and hassle-free SMF filings.

For any type of filing with RBI