Apply Digital Signature Tokens Now

Documentation are getting digital today i.e. in electronic format, and Digital Signatures help establish the sender's identity. Online transactions such as Income Tax E-Filing, Company or LLP Incorporation etc., are validated using DSC. Obtain your DSC along with an e-token without any hassles under the plan.

A Digital Signature Certificate (DSC) certifies the holder's identity, issued by a Certifying Authority (CA) is a secure digital key. It contains various critical information related to your identity (name, email, country, APNIC account name and your public key). Digital Certificates use Public Key Infrastructure, meaning its corresponding public key can only decrypt data that has been authorised by digitally signing or encrypted by a private key. A digital certificate is a type of electronic "credit card" that establishes your credentials when doing business or other transactions on the Web.

Apply Digital Signature (D.S.C.)

Get Approval within 15 minutes

What Is Individual DSC? Uses of Digital Signature & How It Works

What Is Individual DSC? Uses of Digital Signature & How It Works

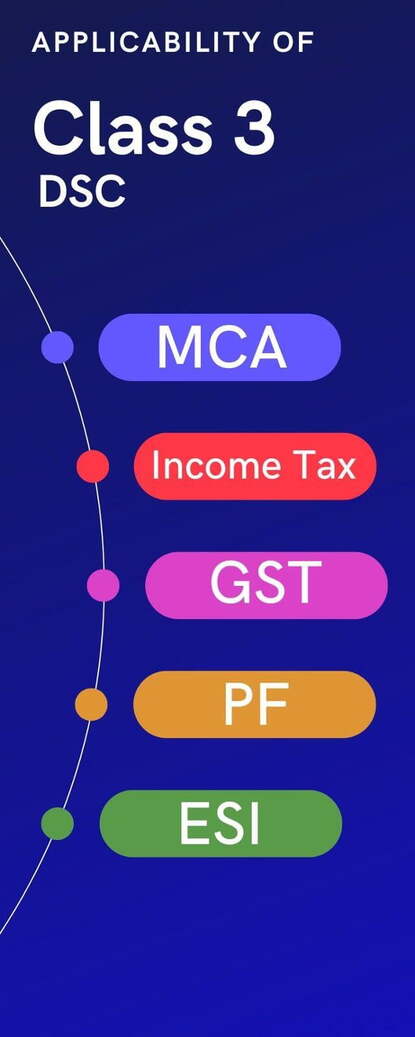

Digital certificates play an important role in securing our personal records from any cyber hazard or forgery, data stealing, or alteration.Several professionals including CA/CS, Advocates, Lawyers, Doctors or Employed Persons, or any authorized entity use a Digital Signing Certificate to perform safe and secure signing of electronic documents with their Individual DSC. Let us further discuss the utilities and applications of Class 3 Digital Signature for an Individual.

Which Class of DSC to Buy?

Which Class of DSC to Buy?

There is only one class of DSC to buy now after 2021. Only Class-3 DSC is available to purchase for both individuals and organisations. Renewals or new sales of Class 2 is discontinued.

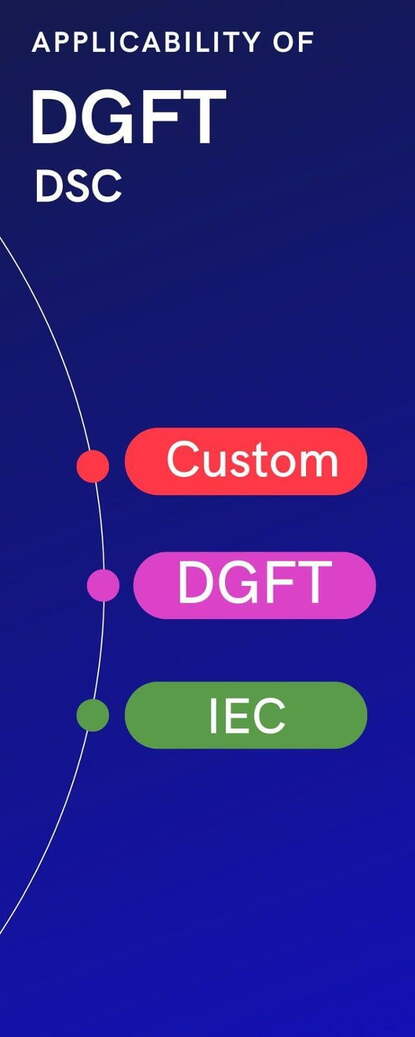

Class-3 DSC (Only Signing) is widely accepted for most purposes like Income Tax, GST, Ministry of Corporate Affairs, EPFO, Director's eKYC, register new business on MCA portal, Import Export Code, Sign invoices (Tally or Zoho Books), EPFO, etc.

To Submit Tenders Online, Government eProcurement or IceGate/AD Code Registration applicants have to use Class-3 with Signing & Encryption (Combo) for submitting bids to tender portal if TIA requires so.

Paperless Steps to Buy DSC Online

Step 1: Enter applicant name, phone, email, and make payment.

Step 2: Receive automatic e-mail with link to open CA Portal (eMudhra or Capricorn).

Step 3: Create KYC ID / PIN or use existing KYC ID.

Step 4: Upload PAN Card, Proof of Address, and a passport size photo. For Class-3, additional documents must be uploaded.

Step 5: Record Video using phone or laptop. Read statement shown on screen.

Step 6: Certifying Authority will approve and issue Digital Signature Certificate (eMudhra or Capricorn).

Step 7: Download DSC and store on USB cryptographic token such as ePass2003-Auto.

How to Record Video for DSC?

How to Record Video for DSC?

- Record video using camera on smartphone or computer.

- Read the statement shown on screen - loud and clear.

- Show documents to camera - original PAN Card and Address Proof for Normal DSC (Authority Letter Also in Encrypted/Organisation DSC)

- Applicant face must be visible

- Duration of video will be for 30 seconds

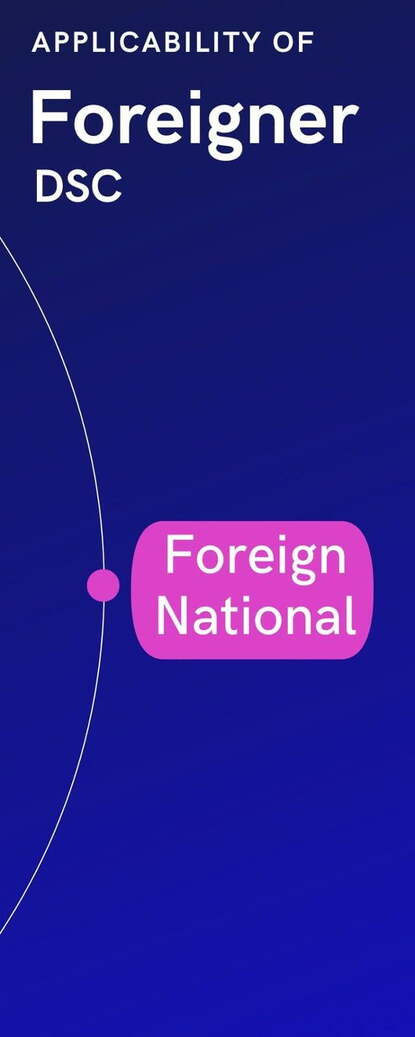

List of Documents Required for Foreign Individuals

List of Documents Required for Foreign Individuals

1. Scanned copy of ID Proof issued by the local government.

2. Scanned copy of a valid Address Proof.

3. Personal Contact Details of the applicant.

4. E-Mail, Mobile, and Video Verification of the applicant.

List of Documents Required for Foreign Individuals

List of Documents Required for Foreign Individuals

1. Scanned copy of employee ID proof of the applicant or authorized signatory.

2. Scanned copy of Organization Address Proof.

3. Scanned copy of Organization Authorization Letter.

4. Scanned copy of Registration/Incorporation Document.

5. Applicant and Organization details.

6. E-Mail, Mobile, & Video Verification of the Applicant.

Advantages of Applying Class 3 DSC for Foreign Individuals & Organisations

Advantages of Applying Class 3 DSC for Foreign Individuals & Organisations

Several benefits can be derived from using a Class 3 DSC, Some benefits related to its usage are mentioned below :

DSC ensures a high level of security and safety to your data.

It digitally affirms your identity at any government portal.

It facilitates the processes of filing income tax returns, e-tenders, and participating in e-auctions and other services.

DSC can digitally sign any documents/forms in bulk numbers from anywhere and anytime while saving time, cost, and effort.

It helps you to establish the ownership of a domain.

The foreign DSC safeguards entities against cyber threats.

F.A.Q.

Digital Signature is essential in India to sign documents electronically. Paper less process is faster and truly online to buy DSC. No paper documents need to be submitted. Applicants record 30 seconds video using smart phone or laptop USB eToken is used to store Digital Signature Certificates. DSC is issued with validity of 2 years. After expiry of validity period, applicants need to buy new DSC.

What is Aadhar e-KYC XML?

It is a secure sharable document which can be used by Aadhar number holder for offline verification of Identity. Service Providers like telecom mobile companies, Digital Signature Providers, and others can establish identify of an individual using Aadhaar eKYC XML. The XML file contains Name, Address, Photo, Gender, DOB, registered Mobile Number, Email address of resident among other details.

What is ePass2003 Auto token?

ePass2003 Token is widely used in India to store Digital Signature. It is a type of secure USB token designed to provide strong authentication and identification and to support network login, secure online transactions, digital signatures and sensitive data protection. The FIPS 140-2 security levels for the Module are available on the website of Feitian Technologies. Competitor products include ProxKey, TrustKey, and Alladin tokens. The retail price of the USB token varies between Rs. 350 to Rs. 650 depending on the demand.

What are the uses of Digital Signature Certificates?