⚖️ Corporate Litigation Before NCLT

Expert Legal Support for Company Law Disputes, Insolvency Matters & More

Corporate disputes today require more than just courtroom presence—they demand strategic thinking, in-depth legal expertise, and deep knowledge of the Companies Act and the Insolvency and Bankruptcy Code. At TAXAJ, we provide robust legal representation and strategic counsel for corporate litigation before the National Company Law Tribunal (NCLT). As a dedicated forum for company-related disputes and insolvency proceedings, NCLT plays a pivotal role in ensuring lawful, transparent, and timely resolutions for corporate entities.

🔍 What is NCLT?

The National Company Law Tribunal (NCLT) is a quasi-judicial body in India established under the Companies Act, 2013. It serves as the principal forum for adjudicating corporate law disputes and other matters related to companies, including those formerly handled by the Company Law Board (CLB), the Board for Industrial and Financial Reconstruction (BIFR), and High Courts in company law matters.

NCLT has exclusive jurisdiction in many of these matters and functions under the principles of natural justice, while not being strictly bound by the Code of Civil Procedure. It has the authority to summon witnesses, examine evidence, and pass enforceable orders.

📌 In simple terms:

NCLT is the “corporate court” of India—a specialized tribunal that resolves company-related legal disputes quickly and effectively.

Would you like this adapted for infographic or blog format too?

📂 Types of Corporate Litigation Before NCLT

The National Company Law Tribunal (NCLT) handles a wide spectrum of disputes and proceedings that arise under the Companies Act, 2013 and the Insolvency and Bankruptcy Code, 2016. Below are the key types of corporate litigation that businesses and stakeholders may encounter before the NCLT:

🏛️ 1. Insolvency & Bankruptcy Cases (IBC, 2016)

Initiation of Corporate Insolvency Resolution Process (CIRP) by financial or operational creditors under Sections 7, 9, and 10

Appointment of Resolution Professional (RP)

Liquidation proceedings

Approval of resolution plans and settlement applications

💼 3. Mergers, Amalgamations & Demergers (S 230–232)

Approval of Schemes of Arrangement between companies and creditors or shareholders

Fast-track mergers of small companies or holding-subsidiary mergers

Protection of interests of minority shareholders

📑 4. Compounding of Offences (Section 441)

Regularization of non-compliance or technical defaults without criminal prosecution

Voluntary filings for compounding to avoid prolonged litigation

Common for delay in filings, non-holding of AGMs, etc.

📊 5. Restoration of Struck-off Companies (Section 252)

Filing petitions to restore companies struck off by the ROC due to non-compliance

Useful for reviving business operations or pursuing litigation

Requires evidence of genuine business activity and reason for default

📜 7. Share Transfer & Securities Disputes (Sections 58–59)

Appeals against wrongful refusal to register share transfers

Enforcement of shareholder rights in private companies

Can involve disputes over ownership, forged transfers, or deadlock resolution

🧾 9. Conversion of Companies

Applications for converting public companies into private and vice versa

Requires approval from NCLT along with ROC and shareholder consent

🧑⚖️ At TAXAJ:

We represent clients across all types of NCLT litigation, from IBC petitions to complex shareholder disputes. Our legal team ensures compliance, strategic representation, and protection of stakeholder interests throughout every stage of the litigation process.

🤝 2. Oppression & Mismanagement (Sections 241–242)

Petitions by minority shareholders against misuse of power or prejudicial conduct by majority stakeholders

Removal of directors, alteration of board structure

Court-appointed management in exceptional cases

📈 6. Reduction of Share Capital (Section 66)

Legal process to reduce share capital with NCLT’s approval

May involve extinguishing unpaid share capital or returning excess capital to shareholders

🚫 8. Investigation, Fraud & Freezing of Assets (S 221–222)

Freezing of company’s assets when fraud or unlawful conduct is alleged

Orders for investigation into affairs of the company by ROC or SFIO

Based on complaints by shareholders, creditors, or regulators

📘 10. Other Company Law Violations

Defaults in filing statutory returns

Disqualification of directors

Non-compliance with corporate governance standards

⚠️ Consequences of Ignoring NCLT Proceedings

Ignoring notices or failing to respond to litigation before the National Company Law Tribunal (NCLT) can lead to severe civil, financial, and reputational consequences for companies, promoters, and even individual directors. NCLT has wide-ranging powers to pass binding orders that can significantly alter the future of a business.

⚖️ 1. Ex-Parte Orders – No Second Chance

📌 Lesson: Delayed or no response can result in loss of opportunity to defend, pushing the company into insolvency resolution or liquidation.

⚖️ 3. Initiation of Liquidation Due to Silence

Case:Innoventive Industries Ltd. v. ICICI Bank (SC, 2017)

Facts: Innoventive did not contest the CIRP petition effectively.

Held: The Supreme Court confirmed NCLT's order to admit insolvency and initiate liquidation proceedings.

📌 Lesson: Failure to raise a timely defence or settlement proposal before NCLT can lead to loss of business control and irreversible liquidation.

⚖️ 4. Criminal Proceedings Triggered

Case:Registrar of Companies v. Gagan Deep Singh (NCLT Delhi, 2022)

Facts: The company did not respond to ROC’s petition and failed to appear.

Held: The tribunal directed initiation of criminal action under Section 447 (fraud) and Section 448 (false statements) of the Companies Act.

📌 Lesson: If a company ignores regulatory notices or misleads the tribunal, criminal liability may be imposed.

🧑⚖️ How TAXAJ Protects You

With constant tracking of tribunal dates, proper filings, and strategic legal arguments, TAXAJ ensures you never miss a hearing or face adverse orders. We handle all communication, documentation, and defence proactively — from first notice to final order.

👉 Don’t wait for a legal shock—

respond strategically with expert legal help.

⚖️ 2. Freezing of Assets & Disqualification

📌 Lesson: Ignoring proceedings in matters of oppression/ mismanagement can lead to severe restrictions and personal liability.

⚖️ 5. Revival Petition Dismissed Due to Non-Appearance

Case:Pooja Steel Pvt. Ltd. v. ROC (NCLT Kolkata, 2021)

Facts: Company filed for revival after being struck off but failed to appear in hearings.

Held: NCLT dismissed the petition and refused restoration, citing lack of seriousness.

📌 Lesson: Ignoring NCLT even in revival matters can permanently extinguish the company’s existence.

🧑⚖️ NCLT Bench Jurisdiction Across India

The National Company Law Tribunal (NCLT) operates through multiple regional benches across India, ensuring that corporate disputes and company law matters can be heard locally and efficiently. Each bench exercises jurisdiction over specific geographical regions and is empowered to hear matters filed within those territories.

🏛️ Key NCLT Benches and Their Jurisdictions:

| Bench | Jurisdiction |

|---|---|

| NCLT New Delhi | Delhi, Haryana, Rajasthan |

| NCLT Mumbai | Maharashtra, Goa |

| NCLT Kolkata | West Bengal, Sikkim, Bihar, Jharkhand |

| NCLT Chennai | Tamil Nadu, Kerala, Puducherry, Lakshadweep |

| NCLT Bengaluru | Karnataka |

| NCLT Hyderabad | Andhra Pradesh, Telangana |

| NCLT Ahmedabad | Gujarat, Dadra & Nagar Haveli, Daman & Diu |

| NCLT Cuttack | Odisha, Chhattisgarh |

| NCLT Allahabad | Uttar Pradesh, Uttarakhand |

| NCLT Chandigarh | Punjab, Himachal Pradesh, Jammu & Kashmir, Chandigarh |

| NCLT Guwahati | Assam, Manipur, Meghalaya, Mizoram, Arunachal Pradesh, Nagaland, Tripura, Sikkim |

📌 Note: Jurisdiction is based on the registered office location of the company involved in the dispute.

🔄 How Jurisdiction Affects Your Litigation Strategy

Filing Accuracy: Petitions must be filed at the correct bench based on jurisdiction to avoid dismissal or delays.

Local Expertise: Legal counsel familiar with regional NCLT practice and procedures is critical.

Transfer Petitions: In rare cases, matters can be transferred between benches, subject to NCLT/NCLAT approval.

Efficient Hearings: Bench-specific listing and timelines can vary; some benches have faster turnaround based on volume.

🧑⚖️ At TAXAJ:

We offer pan-India legal support across all NCLT benches, with dedicated associates and local counsels available for representation and documentation in:

Insolvency & Bankruptcy Cases

Oppression & Mismanagement

Company Strike-Off & Revival

Merger/Demerger Schemes

Director Disqualifications and more

Let TAXAJ help you determine correct jurisdiction, file precisely, and represent you strategically.

📋 Step-by-Step Process of NCLT Litigation

Your Guide to Navigating Corporate Disputes & Proceedings Before the Tribunal

Legal proceedings before the National Company Law Tribunal (NCLT) follow a well-defined process that ensures fair hearing and resolution of disputes under the Companies Act, 2013 and Insolvency & Bankruptcy Code (IBC), 2016. Whether you’re filing a case or defending one, understanding the stages is essential for effective litigation strategy.

✅ Step 1: Identification of Cause of Action

Before initiating any proceeding, a detailed assessment is conducted to:

Identify the nature of the dispute (e.g. IBC, oppression, share transfer, etc.)

Determine whether NCLT has exclusive jurisdiction

Collate facts, legal provisions, and supporting documents

🔍 Example: A creditor seeks recovery of dues under Section 9 of IBC due to prolonged default in payment.

✅ Step 3: Scrutiny & Admission

Upon filing, the NCLT Registry:

Scrutinizes the petition for procedural compliance

May raise defects or request clarifications

The Tribunal may pass an admission order if the case is found prima facie valid

🧾 In insolvency cases, admission triggers the appointment of an Interim Resolution Professional (IRP).

✅ Step 4: Issuance of Notice to Opposite Party

Once the matter is admitted:

NCLT issues notice to the respondent, giving them an opportunity to file a reply

Respondent can also file interlocutory applications, preliminary objections, or counterclaims

📎 Filing of rejoinder by the petitioner may follow, if needed.

✅ Step 5: Hearing Before the Bench

The matter is listed for hearing where both parties present:

Legal arguments

Documentary evidence

Precedents and case law

Tribunal may hear interim relief applications, including injunctions or stay orders, at this stage.

✅ Step 7: Final Arguments & Order

Once hearings conclude:

Tribunal reserves the matter for final order/judgment

Orders can include reliefs, penalties, directions to ROC/NCLAT, or CIRP initiation

🧾 Certified copies of orders can be requested and are binding unless appealed.

✅ Step 2: Drafting & Filing of Petition

The applicant (petitioner or creditor) prepares a petition/application using the relevant NCLT Rules and prescribed format. This includes:

Application form (e.g., Form NCLT-1 or IBC Forms)

Affidavits, resolutions, invoices, or balance sheets

Court fee payment and digital submission via the NCLT e-filing portal

📌 Pro Tip: Precision and legal accuracy in drafting can significantly affect the outcome.

✅ Step 6: Evidence and Affidavit Stage (If Required)

In complex matters (like oppression/mismanagement), NCLT may direct:

Filing of affidavit of evidence

Cross-examination of witnesses

Submission of expert opinions or forensic audit reports

✅ Step 8: Appeal or Execution (If Applicable)

Parties aggrieved by NCLT’s order can appeal before the National Company Law Appellate Tribunal (NCLAT) within 30 days.

In some cases, appeals lie with the Supreme Court thereafter.

NCLT orders can be enforced like civil court decrees.

🛠 How TAXAJ Assists at Each Stage of NCLT Litigation

End-to-End Legal Support Tailored for Corporate Disputes & Compliance

At TAXAJ, we provide comprehensive legal representation and corporate advisory throughout the lifecycle of NCLT proceedings. Whether you are filing a petition, defending a claim, or navigating complex insolvency or shareholder disputes, we stand by your side at every stage to ensure legal clarity, procedural compliance, and strategic advocacy.

✅ 1. Pre-Litigation Assessment & Strategy

Before initiating or responding to a legal proceeding, we:

Conduct a thorough legal diagnosis of your case

Identify the applicable sections under the Companies Act or IBC

Examine whether NCLT is the proper forum for your matter

Assess risks, available remedies, and possible defences

Advise on alternate dispute resolution options if appropriate

📌 Outcome: A clear go/no-go decision with litigation roadmap

✅ 3. Petition Drafting & Filing

Our legal team prepares and files:

Precise and persuasive petitions or replies

Interlocutory applications (e.g., for injunctions or relief)

Rejoinders, affidavits, compounding requests, and scheme applications

All forms and annexures in accordance with NCLT Rules and IBC provisions

🧾 We manage filing through the NCLT e-portal and physical submissions where required.

✅ 4. Representation Before NCLT Benches

Our experienced advocates represent you before:

NCLT benches across India for hearings and evidence stages

Committee of Creditors (CoC) meetings in IBC matters

Appear for cross-examinations, oral arguments, and final orders

🎤 We present your case effectively—factually, legally, and strategically.

✅ 6. Post-Order Compliance & Execution

Once orders are passed, we:

Ensure implementation of NCLT’s directives

Coordinate with the ROC, MCA, banks, and statutory bodies

Draft and file compliance affidavits or closure reports

Enforce or challenge the order, if required

📋 You stay compliant without worrying about paperwork or follow-ups.

✅ 2. Documentation & Evidence Compilation

We assist in gathering all necessary corporate and financial records such as:

MOA/AOA, board resolutions, shareholder agreements

Financial statements, loan agreements, invoices, correspondences

ROC filings and compliance reports

Minutes of meetings, emails, notices, and witness statements

📎 TAXAJ ensures your petition or defence is fully backed by evidence.

✅ 5. Interim Relief & Emergency Filings

In urgent matters (like injunctions, asset freezing, or stay), we:

Move interim applications with priority listing

Secure ex-parte orders, if justified

Coordinate with forensic auditors, resolution professionals, and ROC for compliance

🛡️ TAXAJ helps protect your business during ongoing proceedings.

✅ 7. Appeals Before NCLAT

If needed, TAXAJ handles:

Appeal drafting and filing within limitation period

Grounds of appeal and stay applications

Representation before National Company Law Appellate Tribunal (NCLAT) or the Supreme Court (in appropriate cases)

🧑⚖️ We provide continuity of representation through higher forums.

📝 Checklist Before Filing a Case with NCLT

Ensure Your Case is Legally Sound and Procedurally Ready

Filing a petition before the National Company Law Tribunal (NCLT) requires strategic preparation, accurate documentation, and legal clarity. A well-prepared case avoids delays, objections, or outright dismissal. This checklist will help you ensure that you're ready to initiate proceedings with full confidence and procedural compliance.

✅ 1. Identify the Correct Jurisdiction

Confirm the registered office address of the company or parties involved

Choose the appropriate NCLT bench (e.g., Delhi, Mumbai, Kolkata, etc.)

📌 Why It Matters: Filing in the wrong jurisdiction will delay your case and may lead to dismissal on procedural grounds.

✅ 3. Board Resolution / Authorization Letter

If you're filing on behalf of a company, secure a Board Resolution authorizing the filing

If you're an individual (e.g., shareholder, creditor), retain a Letter of Authority if you're being represented by counsel or agent

✅ 4. Key Legal Documents & Evidence

Depending on the nature of your case, ensure you have:

MOA/AOA of the company

Financial statements, ledgers, and audit reports

Bank statements, invoices, and contracts

Shareholding patterns or registers

ROC filings (e.g., MGT-7, AOC-4, DIR-12)

Email correspondence or notices exchanged

Affidavits and verification statements

📎 These form the backbone of your claim or defence.

✅ 5. Application Forms & Supporting Annexures

Prepare the correct forms prescribed under NCLT Rules:

For general petitions – Form NCLT-1

For IBC cases – Form 1, 5, or 6 (as applicable)

Include a detailed index, list of dates/events, and list of documents

✅ 7. Digital & Physical Filing

File the petition via the NCLT e-filing portal

Submit physical copies where mandated by specific benches

Serve notices to respondents and maintain proof of service

📌 TAXAJ ensures all your filings meet technical and legal standards.

✅ 9. Statement of Facts & Legal Grounds

Draft a concise statement of material facts, supported by:

Legal grounds

Statutory provisions

Judicial precedents (if applicable)

📄 This is your legal narrative – it must be convincing and structured.

✅ 2. Establish Legal Grounds for the Petition

Ensure your issue is within NCLT’s purview (e.g., insolvency, shareholder disputes, oppression, mismanagement, merger/demerger, strike-off, etc.)

Refer to the relevant sections under the Companies Act, 2013 or IBC, 2016

📌 Tip: Vague or unsupported claims are often rejected at the admission stage.

✅ 6. Court Fee Payment

Ensure applicable tribunal fees are paid via demand draft or online modes

Fees vary depending on the type of petition (e.g., IBC vs. Company Law matters)

✅ 8. Affidavit in Support of Petition

Every petition must be supported by a sworn affidavit affirming the truth and accuracy of statements made.

✅ 10. Prepare for Hearing

Have your legal arguments ready

Ensure your counsel is briefed on technical and factual matters

Keep additional copies of documents for bench and opposite party

🧑💼 At TAXAJ, We Help You Tick Every Box

With a trained legal team and compliance experts, we:

Vet your case's viability

Compile documentation

Draft precise petitions

File & serve as per NCLT procedure

Represent you until final disposal or appeal

🔁 Appeals & Remedies – NCLT to NCLAT

Understanding the Hierarchy of Redressal in Corporate Litigation

The National Company Law Tribunal (NCLT) plays a central role in resolving disputes under the Companies Act, 2013 and the Insolvency & Bankruptcy Code (IBC), 2016. However, if any party is aggrieved by an order passed by the NCLT, they are entitled to seek a remedy by filing an appeal before the National Company Law Appellate Tribunal (NCLAT).

This system ensures that parties have a hierarchical legal pathway to challenge or correct errors in judgment, ensuring fairness and adherence to legal principles.

⏱️ Time Limit for Filing Appeal:

| Type of Order | Appeal To | Time Limit | Extension Possible |

|---|---|---|---|

| NCLT Order under Companies Act | NCLAT | 45 days | Up to 45 days (if sufficient cause is shown) |

| NCLT Order under IBC (Section 61) | NCLAT | 30 days | Up to 15 days (only if sufficient cause is shown) |

📋 Who Can File an Appeal?

Any:

Corporate Debtor

Creditor (Financial or Operational)

Shareholder/Member/Director

Resolution Professional (RP)/Liquidator

Government Authority or Regulator (like ROC, SEBI)

...may appeal an order of the NCLT if they are directly aggrieved by it.

⚖️ Scope of NCLAT Powers:

NCLAT can:

Reverse, modify, or set aside NCLT’s order

Remand the case back to NCLT for reconsideration

Grant interim relief (stay, injunctions, etc.)

Hear fresh arguments on points of law

🏛️ Further Remedy – Appeal to the Supreme Court:

🧑💼 How TAXAJ Assists You in the Appellate Process

Our appellate legal services include:

Evaluating the viability of your appeal

Drafting precise and persuasive appeal petitions

Filing all documents and satisfying procedural requirements

Obtaining stay of NCLT orders, if required

Representing you before NCLAT benches (New Delhi and others)

Liaising with legal counsel for Supreme Court appeals (if needed)

📑 Grounds for Appeal to NCLAT

Violation of principles of natural justice

Misinterpretation or incorrect application of law

Procedural irregularity or arbitrariness in the decision

Perverse findings not based on evidence

NCLT exceeding its jurisdiction

🧾 An appeal is not a fresh trial — it focuses on errors in the NCLT’s findings.

🚨 Important Note:

📩 Disagree with an NCLT Order?

Let TAXAJ handle your appeal with legal expertise and procedural precision — from NCLT to NCLAT and beyond.

💼 Industries Most Impacted by NCLT Proceedings.

Sectors Where Corporate Disputes, Insolvency, and Regulatory Actions Are Most Common

The National Company Law Tribunal (NCLT) plays a critical role in resolving disputes and insolvency matters that affect a wide range of industries in India. While NCLT has jurisdiction over all companies registered under the Companies Act, some sectors see disproportionately higher litigation, restructuring, and compliance activity due to their scale, regulatory complexity, or financial exposure.

🔍 1. Banking & Financial Services

Frequent involvement in Insolvency & Bankruptcy proceedings (as financial creditors)

Commonly initiate actions under Section 7 of IBC for recovery of defaulted loans

Face litigation related to shareholding, mergers, and NBFC compliance

📌 Example: Banks filing insolvency proceedings against defaulters like Jet Airways or DHFL

🔍 3. Telecommunications

Highly regulated and capital-intensive sector facing NCLT cases for:

License compliance issues

Debt defaults and spectrum-related financial disputes

M&A and demerger schemes

📌 Example: RCom's insolvency and restructuring proceedings before NCLT

🔍 4. Pharmaceuticals & Healthcare

Disputes related to mergers, licensing, foreign investment, and patent-linked agreements

Companies facing compliance scrutiny under FEMA, MCA, or SEBI

Promoter and shareholder litigation is not uncommon

🔍 6. Manufacturing & Heavy Industries

Involved in large debt-financed projects leading to insolvency if not viable

Industrial disputes under IBC or for revival through Section 230-232 schemes

Labour law disputes sometimes escalate with ROC or Tribunal involvement

🔍 8. Logistics, Aviation & Transportation

Capital-heavy and debt-laden industries

Common subjects of IBC proceedings, NCLT-led asset transfers, or management change orders

Also impacted by cross-border compliance and FDI regulations

📌 At TAXAJ:

We specialize in NCLT representation across all these sectors, offering:

Sector-specific litigation strategies

In-depth documentation & compliance

Timely resolution or restructuring options

🔍 2. Real Estate & Infrastructure

Heavy exposure to IBC matters, especially under Section 9 by homebuyers or contractors

Frequent issues of project delays, mismanagement, and unfulfilled promises

Subject to oppression & mismanagement petitions and regulatory restructuring

📌 Example: Amrapali and Unitech insolvency cases affecting thousands of buyers

🔍 5. Information Technology & Start-ups

Frequent internal disputes among co-founders and investors

Shareholder oppression, ESOP disagreements, or exit terms

Involved in funding-related compliance, including filings before NCLT for share allotments, restructuring

📌 Example: Co-founder disputes in startups often lead to Section 241-242 filings

🔍 7. Retail, Hospitality & Food Services

Business downturns can result in winding up petitions or IBC filings

Franchisor-franchisee disputes over brand control or agreement breaches

Vendor disputes involving unpaid dues or shareholding claims

🧠 Why These Sectors?

High financial exposure

Multiple stakeholders (lenders, investors, regulators, employees, etc.)

Rapid expansion leading to governance or compliance failures

📚 Real Case Studies & Success Stories

How TAXAJ Delivered Results in Complex NCLT Matters

At TAXAJ, we believe in combining legal precision with strategic insight to achieve successful outcomes for our clients before the National Company Law Tribunal (NCLT) and Appellate Tribunal (NCLAT). Here are real-world examples where our team made a measurable difference—demonstrating not only our expertise but also our client-centric approach to corporate litigation and insolvency matters.

✅ Case Study 1:

Successful Revival of a Distressed Manufacturing Company

Challenge: The company faced insolvency proceedings initiated by an operational creditor due to alleged default on supplies.

Our Intervention:

Conducted a thorough review of the purchase orders and payment trail

Filed a reply under Section 9 of IBC, establishing the existence of a pre-existing dispute

Assisted the client in amicable settlement through mediation before admission

Ensured the petition was dismissed and business operations resumed smoothly

📌 Outcome: Proceedings withdrawn before admission. Company avoided insolvency and reputation damage.

✅ Case Study 3:

Speedy Approval of Scheme of Merger

Client: Two group companies in the logistics sector

Challenge: Needed a fast-track merger approval to streamline operations and reduce overhead

Our Intervention:

Advised on structuring the scheme under Sections 230-232 of the Companies Act

Ensured compliance with all procedural steps—board resolutions, shareholder notices, valuation reports

Coordinated with ROC, RD, and Official Liquidator for NCLT clearance

Represented the client during NCLT hearings and responded to regulatory queries

📌 Outcome: Scheme approved within statutory timelines. No objections raised. Business integration completed smoothly.

🏆 Why These Cases Stand Out

✅ Complex fact patterns resolved with clarity and speed✅ Strategic use of legal provisions and evidence✅ Balanced approach between litigation and resolution✅ Ensured compliance, continuity, and cost-effectiveness for clients

✅ Case Study 2:

Minority Shareholder Oppression Successfully Defended

Client: Director and majority shareholder of a Delhi-based tech company

Challenge: A disgruntled investor filed a Section 241–242 petition alleging oppression and mismanagement

Our Intervention:

Gathered documentary proof showing fair conduct, valid board decisions, and investor consent

Demonstrated that claims were motivated and lacked substance

Filed a detailed counter affidavit and rejoinder, dismantling the petitioner’s case

Successfully obtained an order dismissing interim relief sought by the minority shareholder

📌 Outcome: NCLT declined to grant any interim order. The petition was ultimately withdrawn.

✅ Case Study 4:

Recovery Through CIRP Filing

Client: Financial Creditor (NBFC)

Challenge: Recovery of ₹2.8 Crores stuck with a defaulter company for 18 months

Our Intervention:

Drafted and filed a Section 7 IBC petition

Provided proof of default and bank statements showing non-payment

Helped client nominate a Resolution Professional (RP)

Facilitated CoC formation and CIRP admission

📌 Outcome: CIRP admitted. Defaulter offered a one-time settlement within 60 days. Recovery completed.

✅ Case Study 5:

Compounding of ROC Default Avoiding Prosecution

Client: A foreign-invested private limited company

Challenge: Missed filings for issue of shares and delay in allotment of ESOPs

Our Intervention:

Analyzed the default and filed compounding applications under Section 441

Prepared comprehensive representations for ROC and NCLT

Negotiated to minimize penalty and avoid criminal proceedings

📌 Outcome: Compounding approved. Nominal fine imposed. No further prosecution initiated.

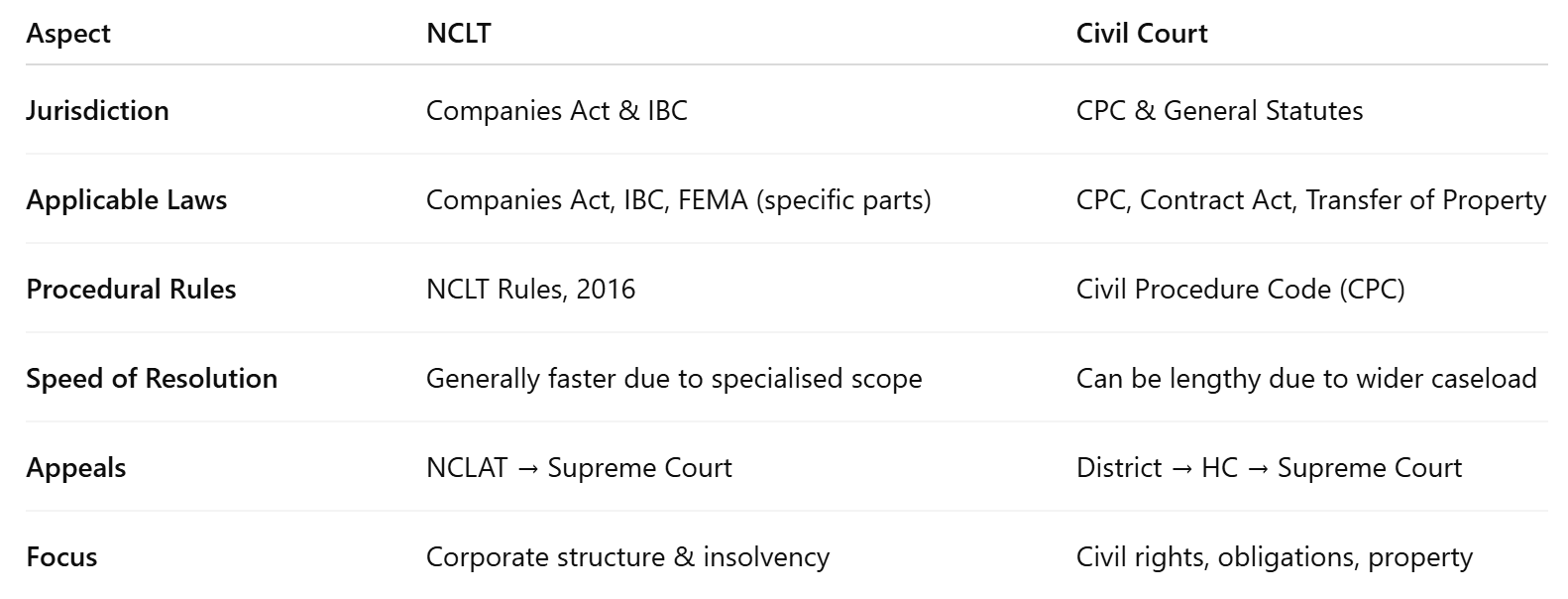

🔍 NCLT vs. Civil Court – When & Why?

Understanding the Jurisdictional Divide in Corporate Disputes

As a business or individual navigating the legal system, choosing the right forum for your corporate dispute is crucial. In India, NCLT (National Company Law Tribunal) and Civil Courts have distinct powers, and selecting the correct one depends on the nature of the dispute, applicable laws, and reliefs sought.

Here’s an in-depth look at when and why a matter should be taken to NCLT vs. Civil Court.

🧾 NCLT: Specialized Tribunal for Company Law & IBC Matters

📌 Matters Handled by NCLT:

Company Law Disputes under the Companies Act, 2013

Insolvency & Bankruptcy cases under IBC, 2016

Oppression & Mismanagement (Sections 241–242)

Class action suits by shareholders or depositors

Winding up & amalgamation schemes (Section 230–232)

Revocation of incorporation, strike-off petitions

Share transfer and transmission disputes (Sections 58–59)

Compounding of offences under the Companies Act

Nidhi Company & Producer Company issues

Appeals from orders of the Registrar of Companies (ROC)

✅ Why Choose NCLT:

Specialized expertise in company and insolvency matters

Faster resolution compared to general civil courts

NCLT follows less rigid procedural laws, making litigation more efficient

Appeals can be directly taken to NCLAT and then Supreme Court

⚖️ Civil Courts:

Traditional Forum for General Contractual & Tort Disputes

📌 Matters Handled by Civil Courts:

Contractual breaches not related to corporate governance

Damages for personal loss or injury

Property disputes, landlord-tenant issues

Tort-based claims like defamation, negligence

Commercial disputes not covered under Companies Act or IBC

Matters involving partnership firms (non-incorporated)

✅ Why Choose Civil Court:

Suitable when corporate structure is not central to the dispute

Broader remedies available including injunctions, damages, and declarations

Jurisdiction exists even against non-corporate entities or individuals

⚠️ Key Differences Between NCLT & Civil Court:

🧠 When to Approach Which?

| Scenario | Go To |

|---|---|

| Company director/shareholder disputes | NCLT |

| Non-payment of dues under a commercial agreement | Civil Court (or NCLT if debtor is a company and default meets IBC threshold) |

| Insolvency resolution or liquidation | NCLT |

| Injunction against breach of contract by individual | Civil Court |

| Share transfer refusal by a company | NCLT |

| Defamation by a business partner | Civil Court |

| Mergers, amalgamations, demergers | NCLT |

| Vendor disputes or property issues | Civil Court |

🚫 Misfiling May Lead to Dismissal

Filing a matter before the wrong forum can result in:

Jurisdictional objections

Delay in obtaining relief

Increased legal costs

Adverse orders and limitation risks

🧑💼 How TAXAJ Helps:

We evaluate the correct forum before taking legal action

Ensure compliance with jurisdictional rules

Prepare and file well-drafted petitions

Represent clients before both NCLT and Civil Courts

Provide end-to-end litigation strategy

⚠️ Common Mistakes to Avoid in NCLT Litigation

Safeguard Your Corporate Case by Steering Clear of These Pitfalls

Appearing before the National Company Law Tribunal (NCLT) requires a deep understanding of procedural compliance, documentary evidence, and applicable corporate laws. Even strong cases can falter due to avoidable legal missteps. Whether you’re filing a petition, defending one, or navigating insolvency or company law matters, here are the most common mistakes to avoid:

1. ❌ Filing Before the Wrong Jurisdiction

Each NCLT bench has territorial limits.

Filing before the wrong bench may result in immediate rejection or delay.

Always verify the registered office location of the company to identify the correct bench.

🔎 Tip: Consult the NCLT Jurisdiction Rules or let legal experts like TAXAJ assist in forum selection.

3. ❌ Incomplete or Inadequate Documentation

NCLT proceedings are document-heavy.

Submitting petitions without:

Proper board resolutions

Financial statements

Contracts or loan agreements

Notices, correspondences, or ledgers

...can weaken or stall your case.

📑 Ensure every claim is backed by verifiable documents.

4. ❌ Improperly Drafted Petitions

Petitions not conforming to NCLT Rules, 2016 (Forms NCLT-1 to NCLT-9) may be returned or rejected.

Common errors include:

Missing cause titles

Unsupported prayers

Inaccurate facts or vague allegations

✍️ TAXAJ ensures your petitions are legally sound and well-structured.

6. ❌ Underestimating the Need for Interim Relief

Not applying for interim relief (stay, injunction) can lead to:

Loss of control over assets

Shareholder dilution

Destruction of financial records

⚖️ TAXAJ helps file urgent interim applications for protection during trial.

8. ❌ Overlooking Appeal Deadlines

Appeals to NCLAT or Supreme Court have strict timelines (30–45 days).

Missing deadlines may leave you without recourse.

⏳ Always monitor important dates and seek legal assistance for appeals.

10. ❌ Assuming NCLT Is Like Civil Court

NCLT is not a trial court. It is a quasi-judicial body with a unique procedural framework.

Misapplying CPC rules or relying on irrelevant legal doctrines can backfire.

📘 Get advice from specialists in company law and NCLT practice.

2. ❌ Missing Limitation Periods

Each type of petition (e.g., IBC, Oppression & Mismanagement, Share Transfer) has a statutory deadline.

Late filings without valid justification are often dismissed on limitation grounds.

📌 Example: IBC Section 7 and 9 petitions must be filed within 3 years of default.

5. ❌ Failure to Serve Proper Notices

Procedural fairness demands advance notice to respondents.

Improper or unserved notices can delay proceedings and show bad faith.

📬 Use speed post/hand delivery/courier and retain proofs of dispatch.

7. ❌ Ignoring Pre-Existing Dispute in IBC Matters

In IBC proceedings, especially under Section 9 (operational creditor), the presence of a pre-existing dispute can lead to rejection.

Submitting without addressing such disputes signals poor preparation.

🧠 Conduct a legal audit before filing any insolvency application.

9. ❌ Non-Appearance or Poor Representation

Absence or casual representation during hearings can lead to:

Ex-parte orders

Striking off the matter

Adverse costs

👨⚖️ TAXAJ ensures committed representation at every hearing stage.

🚨 Bottom Line:

Corporate litigation is won not just on facts but on flawless procedure.

Avoiding these common mistakes could save you from costly delays, dismissals, and legal liabilities.

Why Choose Us?

At TAXAJ, we approach Litigative matters with a unique blend of legal expertise, emotional intelligence, and procedural precision. Such matters are highly sensitive and complex, requiring not just legal capability but also deep empathy, discretion, and smart advocacy. Here's why clients trust TAXAJ:

Consult us today to protect your legal rights and move forward with confidence.

✅ Protect Your Rights, Claim What's Rightfully Yours

TAXAJ’s legal experts are experienced in navigating NCLT proceedings from start to finish — ensuring your case is presented with maximum legal accuracy and strategic strength.

💬 Schedule a consultation today to discuss your damages or breach claim.