Steps to Generate ICAI UDIN

The attestation of a Chartered Accountant on a certificate or any such document is of immense value since it usually signifies that the Chartered Accountant, in his professional opinion, has ensured that there is no misrepresentation by the entity issuing/submitting such a document.

A prime example of this being an audit report issued by the auditor in respect of the financial statements of an entity stating the financial statements reflect a true and fair view of the state of affairs of the entity. It is because of this attestation or signature made by the Chartered Accountant that the investors and other stakeholders can rely on the performance of an entity.

Introduction

It is being observed that certain unscrupulous individuals are forging signatures while posing as Chartered Accountants to issue certificates and other such documents with the intent of misleading the authorities.

In view of the above, the Institute of Chartered Accountants of India (ICAI), has developed a method of securing the documents issued by a Chartered Accountant by issuing a Unique Document Identification Number (UDIN). The official announcement is available on the ICAI website.

How to generate UDIN for a document?

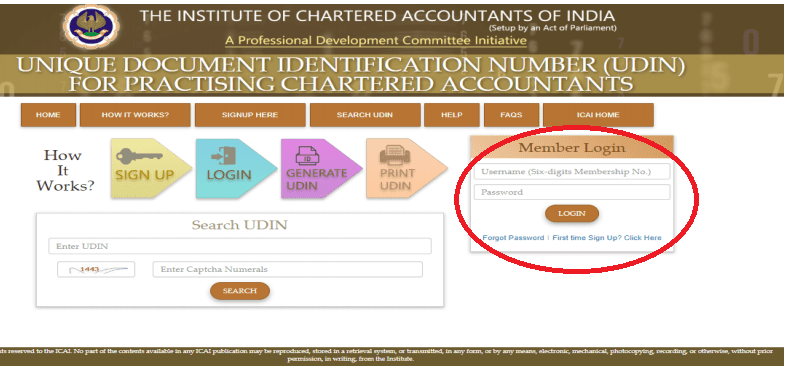

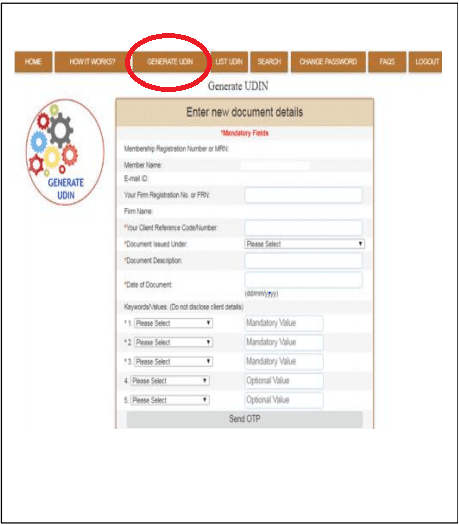

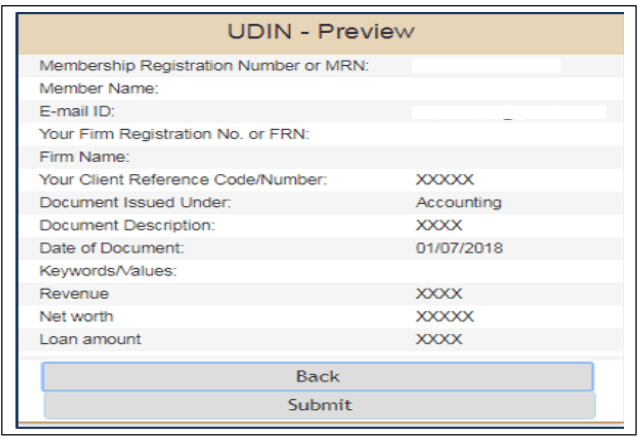

The following steps need to be followed after registering on the UDIN portal:

Note: The password for the UDIN portal can be changed at any time. It is recommended to do so after the first login.

Note that at least 3 keywords and their corresponding values need to be provided for a document. The maximum number of keywords that can be given are 5.

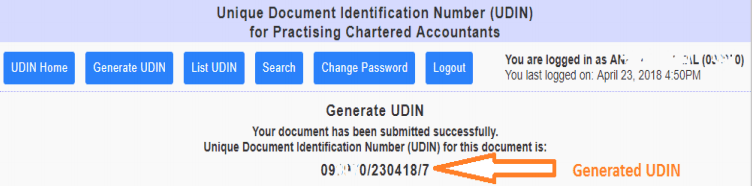

Step 5: The UDIN will now be generated. Such UDIN may be used on the document by mentioning it using a pen or as a watermark on the document.

Verification of Documents using UDIN