Steps to File Form 10IE

What are the information to be furnished in Form 10IE?

The following details are required to be entered in Form 10IE:

- Name of the individual or HUF

- Address & PAN

- Date of Birth/ Date of Incorporation

- Confirmation as to whether the assessee is having any income under head “Profits & Gains from Business or profession”.

- Nature of business or profession

- Confirmation whether the taxpayer has any unit in International Financial Services Centre (IFSC)

- Details of previous form 10IE filed (if applicable)

- Declaration

Important Note:

- Form 10IE shall be signed by the Individual/Karta of the HUF or authorised representative

- Form 10IE is to be verified by digital signature or Electronic Verification Code (EVC)

Steps to file Form 10IE online on the new Income Tax Portal

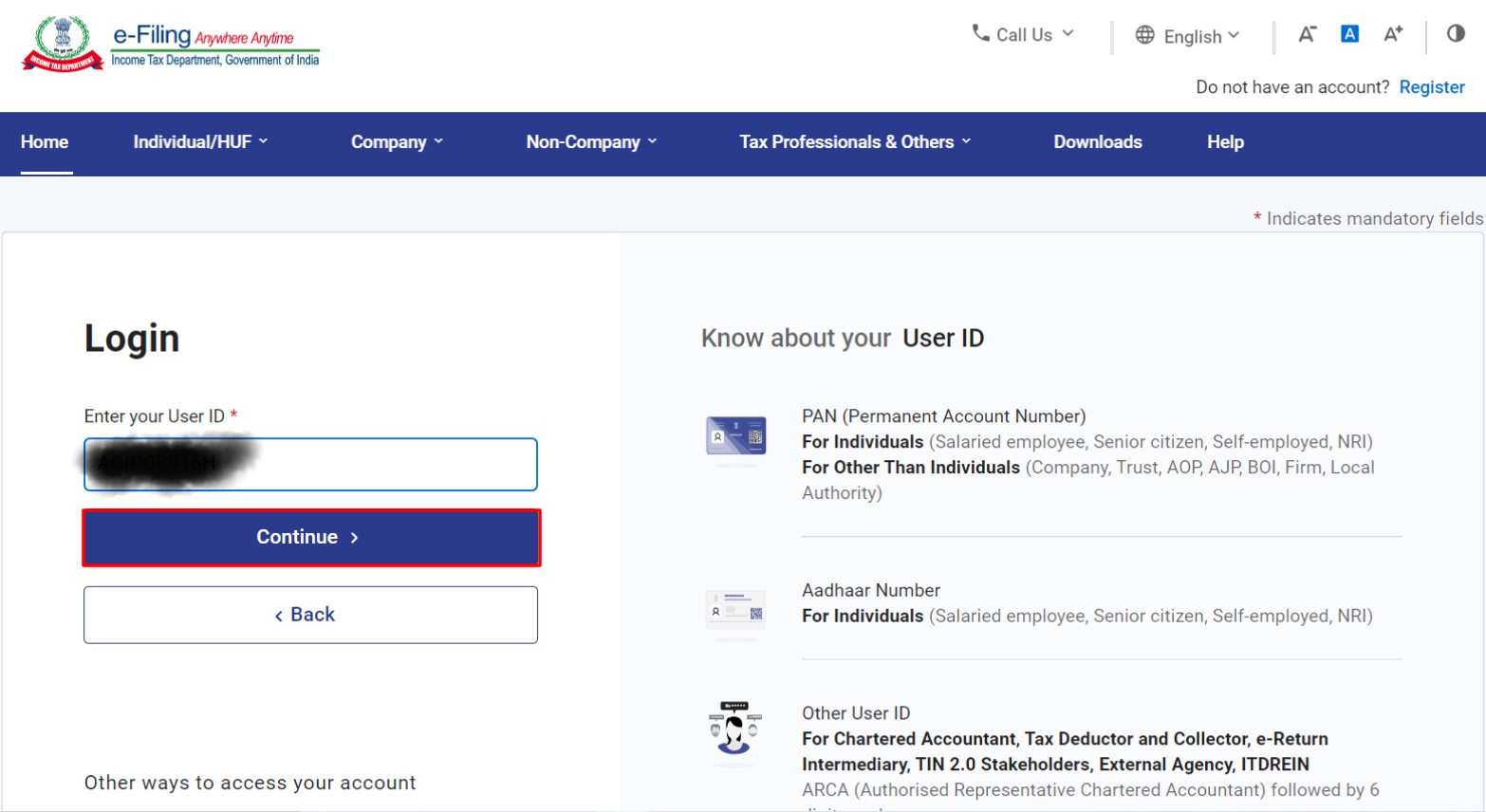

Step-I: Click on the following link to access Income Tax Login Account: https://eportal.incometax.gov.in/iec/foservices/#/login and enter your User Id (PAN) and click on ‘Continue’

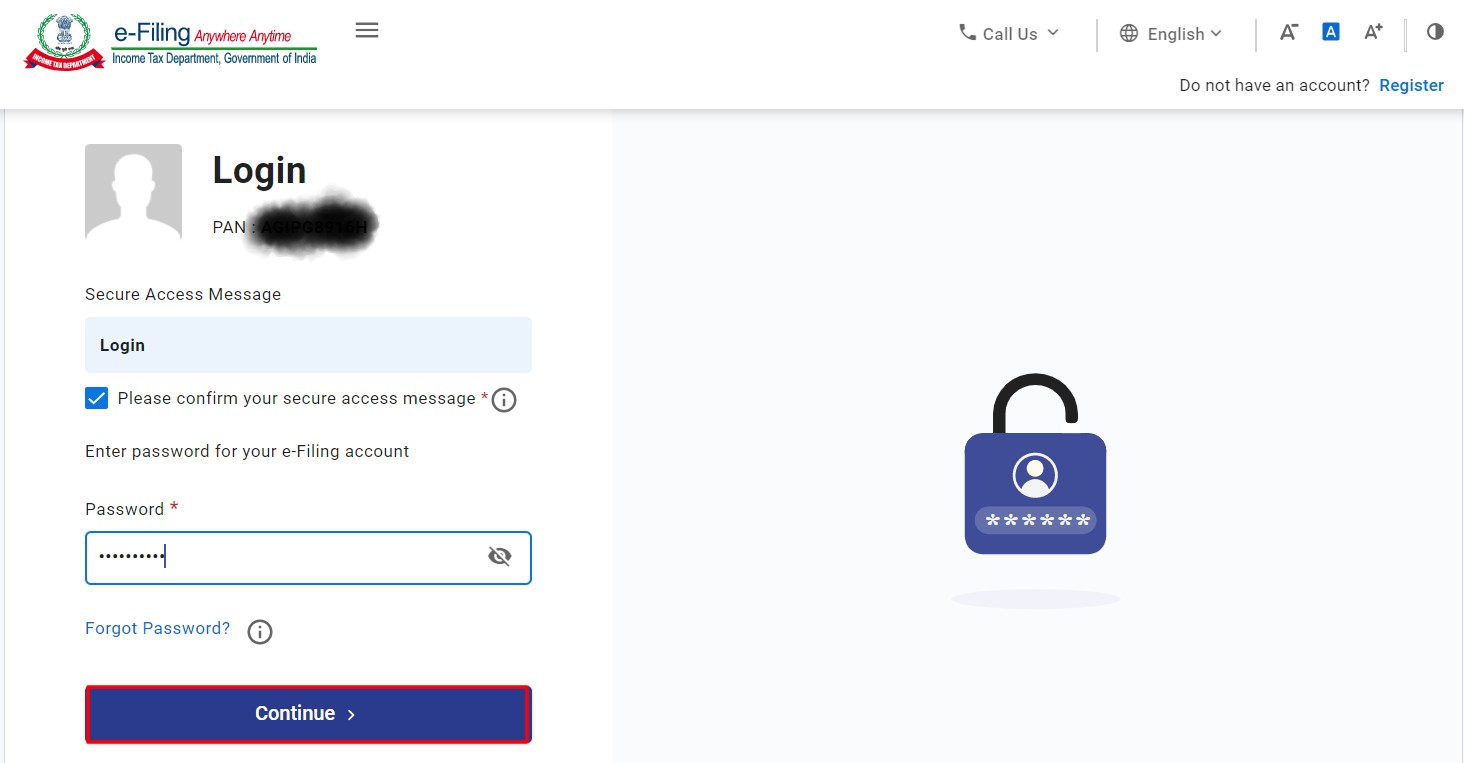

Step-II: Click on “Please confirm your secure access message” and enter login password and click on ‘Continue’ to enter Main Dashboard

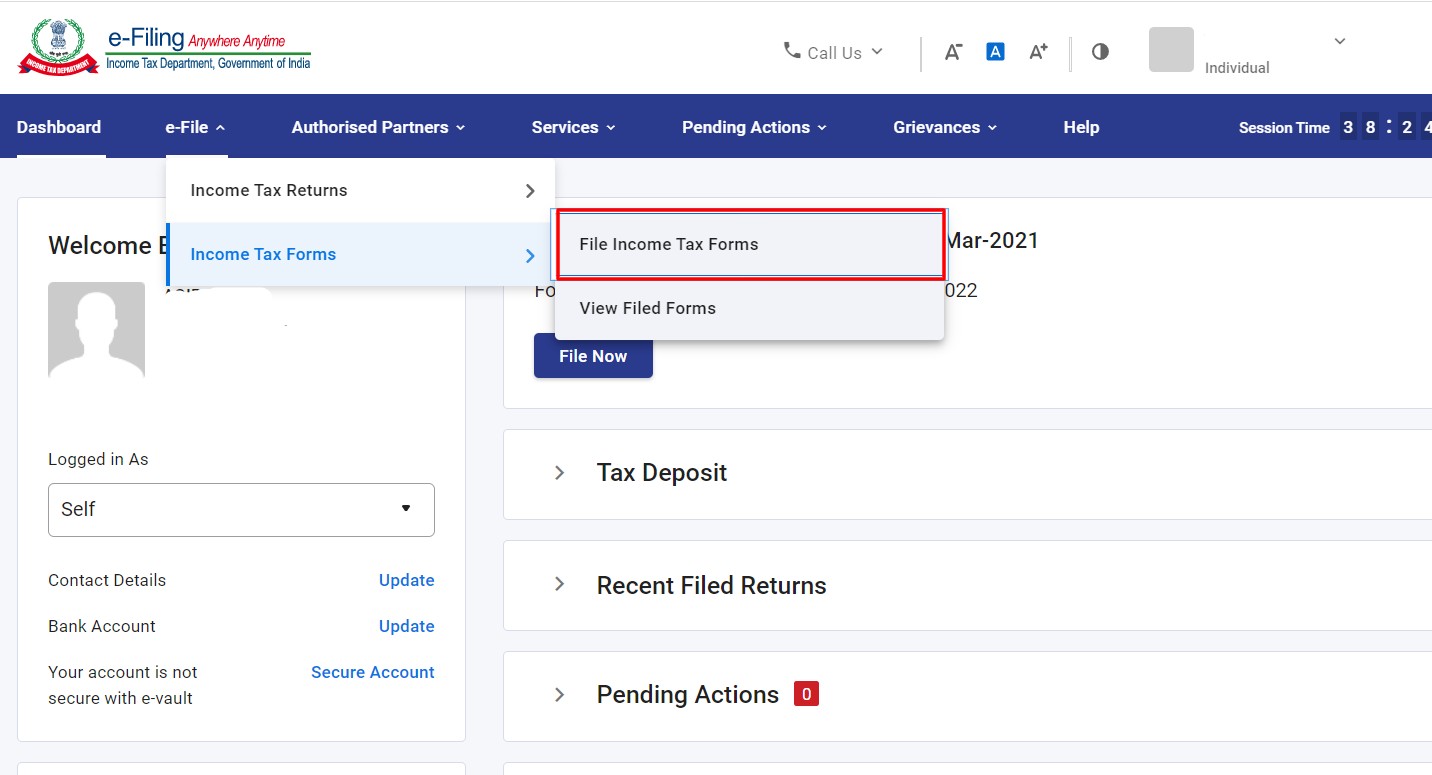

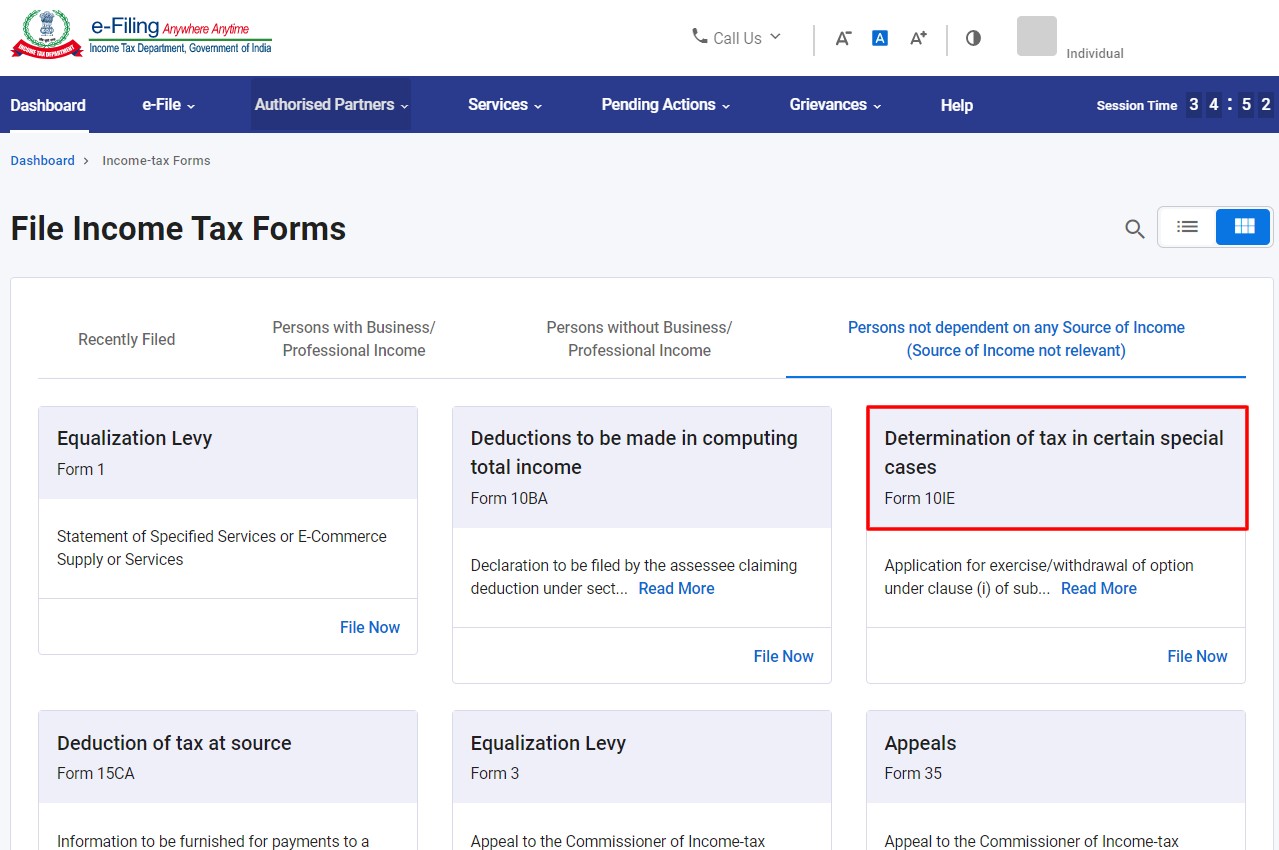

Step-III: Go to “E-file” tab<< Income Tax Forms<< File Income Tax Forms

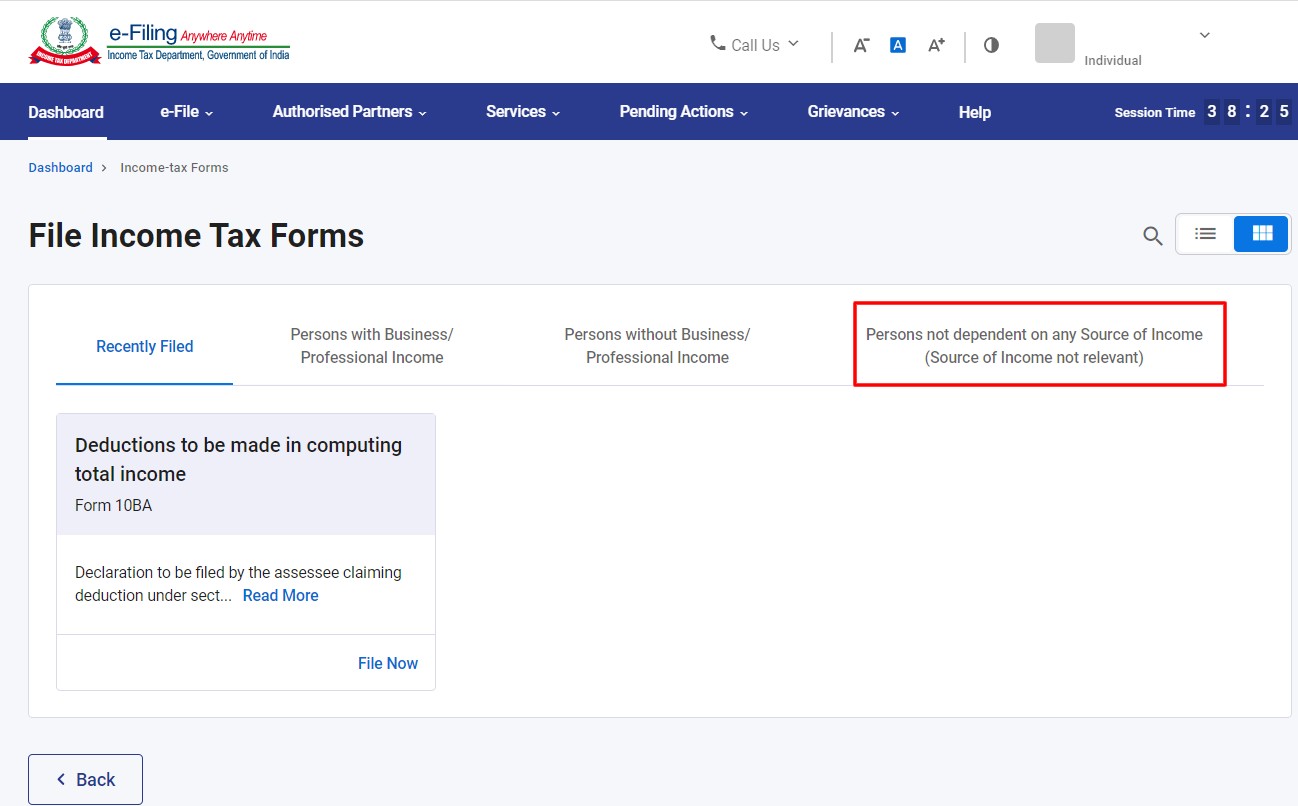

Step-IV: Under “File Income Tax Forms” select “Persons not dependent on any source of Income”

Step-V: Select “Determination of tax in certain special cases- Form 10IE”

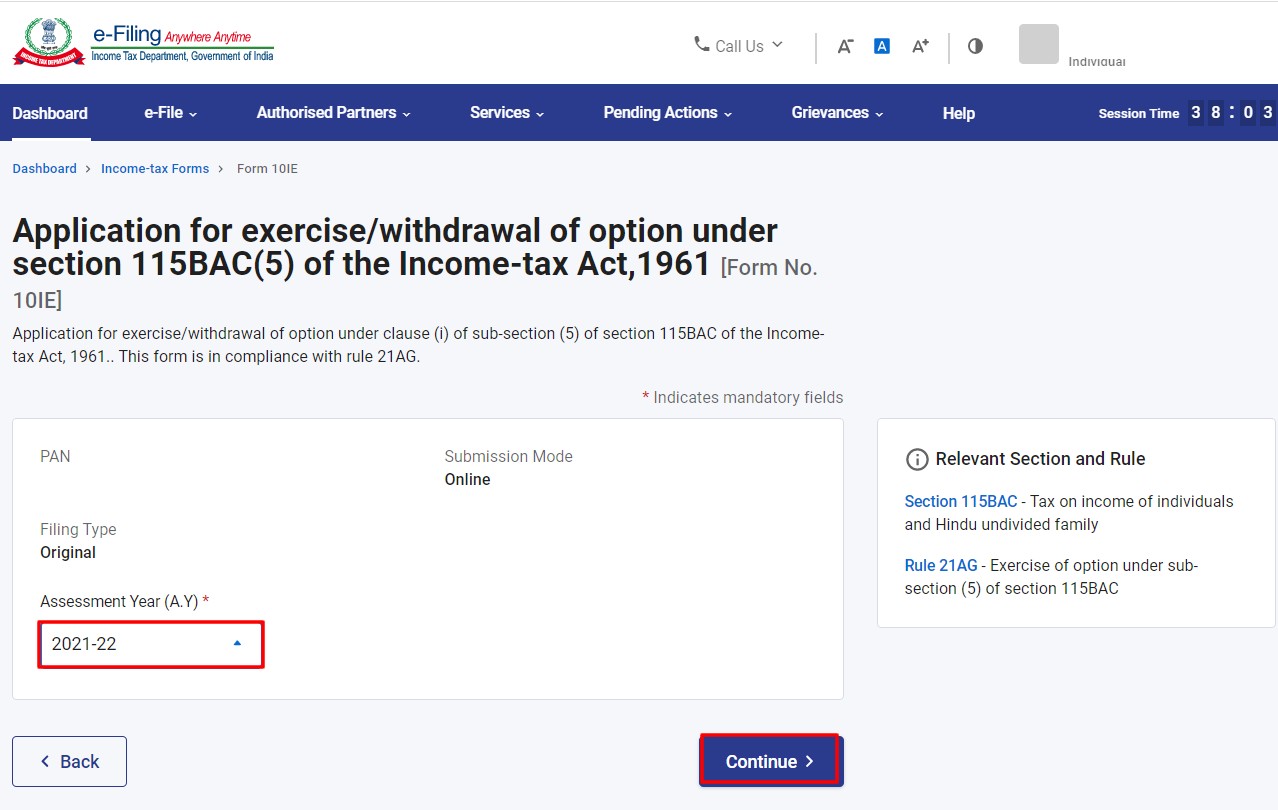

Step-VI: Under “Application for exercise/withdrawal of option under section 115BAC (5) of the Income Tax Act, 1961” select “Assessment Year” and click on “Continue”

Step-VII: Click on “Lets get started”. On clicking “Lets get started”, Form 10IE will open where you are required to submit the required information (also discussed above)

Step-VIII: After filling the form, ‘Submit’ the form using digital signature or electronic verification code.