Pre-requisite for Individuals to Register on Income Tax Portal

Prior to registering on the income tax portal, one must ensure they have following details:

- Valid PAN

- Valid Mobile Number

- Valid Current Address

- Valid Email Address, preferably your own

Minor, lunatic or idiot and those who are barred by Indian Contract Act, 1872 are incompetent to register on the income tax portal.

Step-by-Step Process on Registering on the Income Tax Department Website

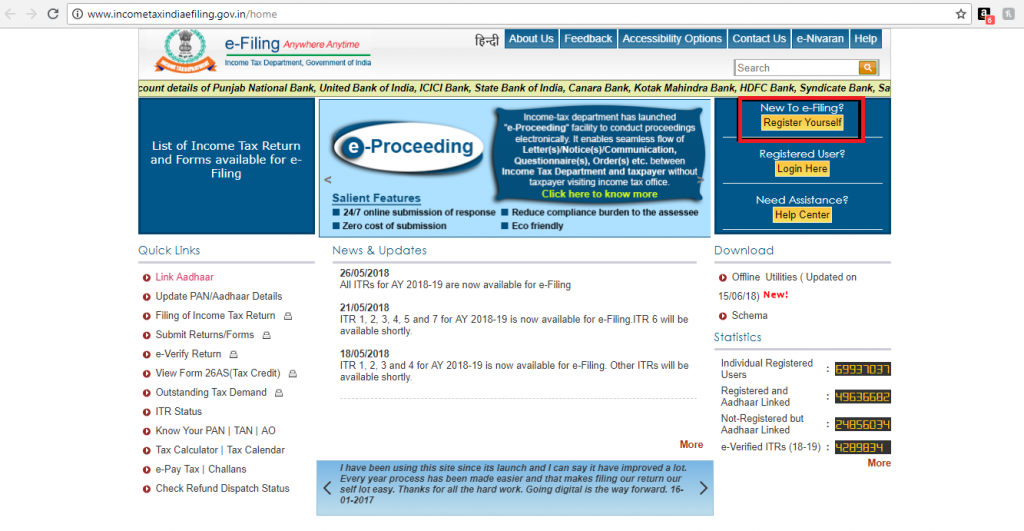

Step 1: Visit the income tax department portal

On the homepage of the government portal, click on ‘Register Yourself’ on the right hand side of the page.

Step 2: Select the User Type

Once you have clicked on that button, you will be taken to a registration form that will ask you to select your user type.

Step 3: Enter the Basic Details

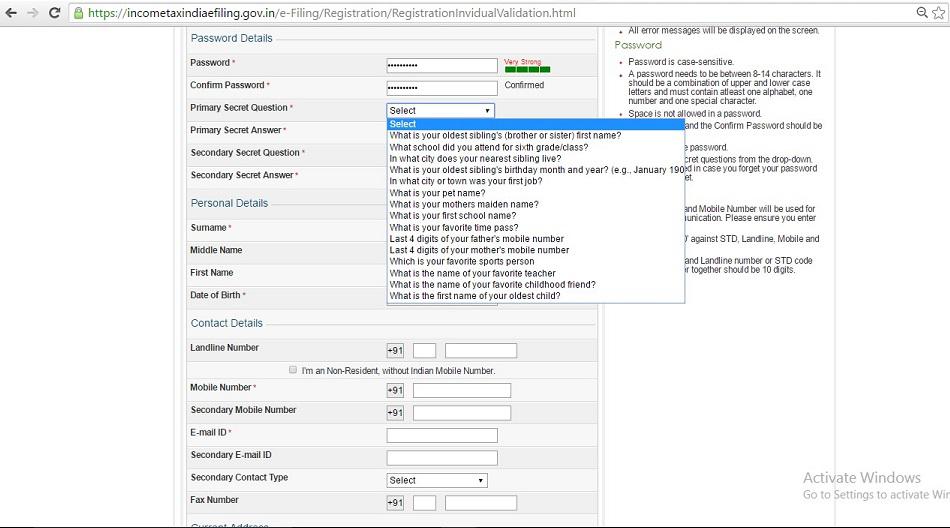

Step 4: Fill in the Registration Form

The following details in the registration form are mandatory:

- Password details

- Contact details

- Current address

After correctly entering all the details, click on submit.

Step 5: Verification

On submitting the duly filled form, a six digit One Time Password (OTP) is sent to your mobile number and the email ID provided. Enter this OTP correctly to successfully verify the details. Please note that in case of non-residents the OTP is only sent on the registered email address.

The OTP will expire after 24 hours from the actual time of receipt. In case one fails to complete the registration process within the given 24 hours, the entire registration must be initiated again.

3. Income Tax Department E-filing Login

Step 1: Visit the income tax department homepage

To access the Indian income tax login page, visit the homepage of government portal. Here, you will see a box on the right side that has a ‘Login Here’ button for registered users.

Step 2: Enter the Details

Once you have clicked on that button, you will be taken to the login page where you have to enter your income tax login username and password.

Please note, for Income Tax Login, the User ID is your PAN Card Number.