Step By Step Procedure For E-Filing Of Tax Audit Report

As we all know, from assessment year 2013-2014 onwards, tax audit report as required under section 44AB is required to be filled electronically.Before we start the process or procedure of e-filing tax audit report, please remember that only a chartered accountant having a certificate of practice can only do tax audit as required under section 44AB of income tax act. Other professionals like company secretary, advocate and cost accountants are not allowed to do section 44AB tax audit.

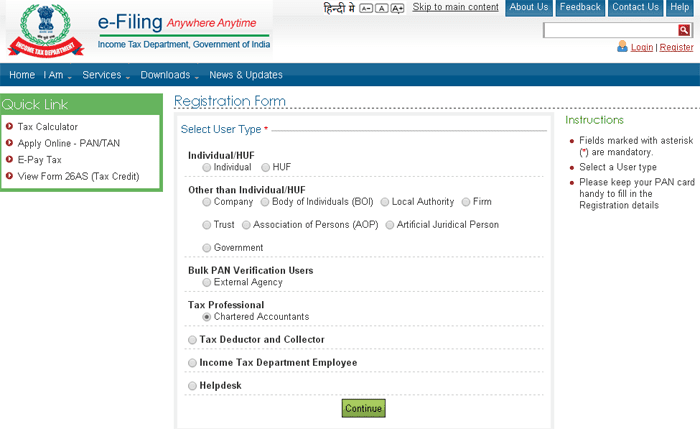

To file these tax audit reports, the chartered accountant in practice is required to get himself registered first as a chartered accountant with the income tax efilling site.

In the process of registration, the chartered account is required to provide his or her membership number, enrollment date and other details like PAN number, DSC and email ID.

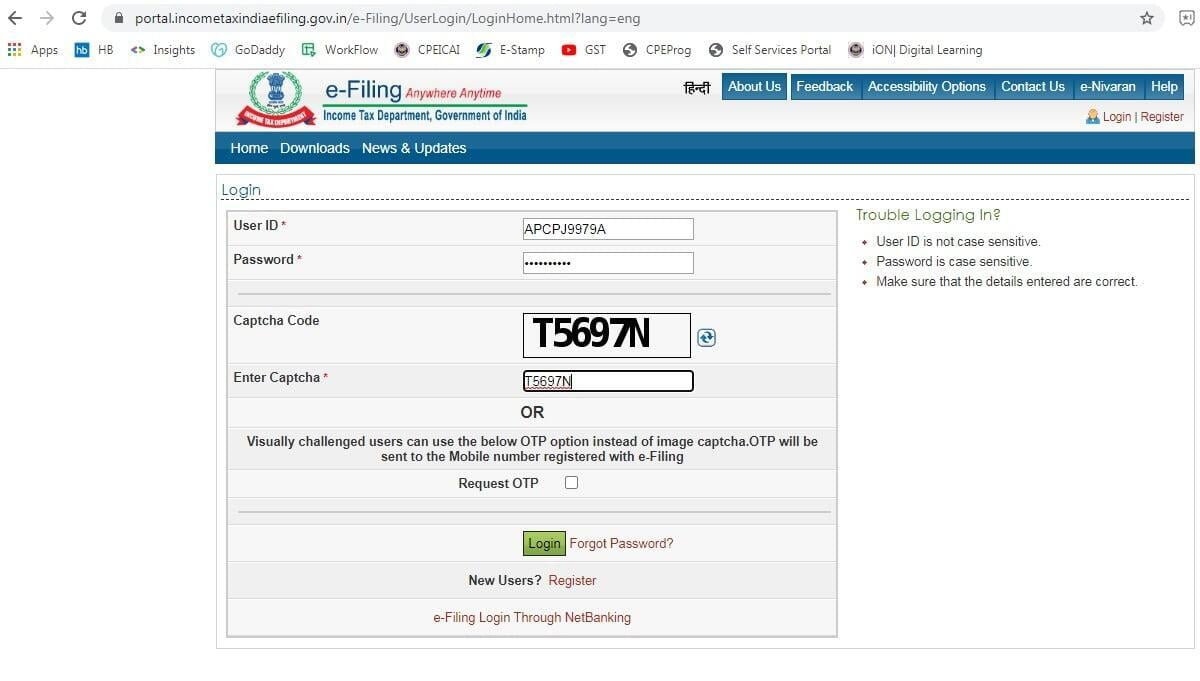

After completion of registration, an activation link will be delivered to the chartered accountant’s email ID. After activation user ID will be generated and activated with the password that is selected at the time of registration.

Now, below are the steps to for e-filing of Tax Audit report:

1. Login with CA ID

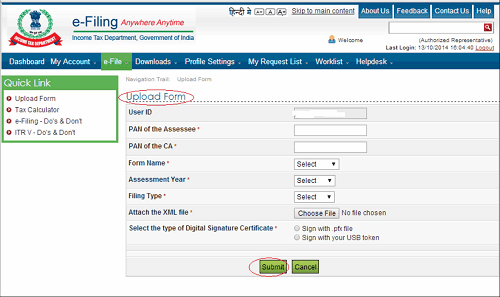

2. Go to e-file and click Upload Form

3. Fill all details and choose XML file then Submit

- Enter the PAN of Assessee and PAN of Chartered Accountant.

- Select form name and Assessment Year.

- Attach XML file of Form 3CA-3CD/3CB-3CD. Auditor is required to submit Balance Sheet and Profit & Loss Account along with Audit report on new e-filing portal.

The form once uploaded by the auditor would be reflected in the work list of the auditee. The auditee then would be required to login to e-filing portal, go to his work-list and accept/reject the form. Once the form has been accepted by the auditee, it would be successfully submitted and auditee will get an acknowledgement number. The e-filing procedure ends here and no further action is required to be taken.