How to use the Digital Signature Certificate (DSC) for e-filing Income Tax Returns/ Online Filing of Income Tax Returns

A digital signature is an electronic form of a signature that can be used to authenticate the signatory of a document. It is used to sign the documents digitally and to authenticate the electronic documents. A Digital Signature Certificate (DSC) is the electronic format of physical or paper certificate that serves as a proof of identity of an individual.

DSC comes in the form of USB token, generally has a validity of 1 or 2 years and is renewable on expiry. It is an easy and hassle-free process to file the IT return using the Digital Signature. This is also considered a secure way to file the Income-Tax Return (ITR).

It is mandatory for an individual, HUF, firm, LLP (if their accounts are required to be audited under the provisions of Section 44AB), political parties and companies to file the ITR using the DSC (Class 2). Other taxpayers can also voluntarily use the DSC to file the income-tax return. If the return is signed digitally, then it is neither required to verify the return using Aadhaar-based OTP, nor to send the signed hard copy of ITR-V to the CPC Bengaluru. The taxpayer just needs to affix the DSC to the tax return to authenticate it. Before verifying the ITR using DSC, it is mandatory to register the DSC on the income-tax e-filing website.

How to Register a Digital Signature with the Department of Income Tax:

The Digital Signature Certificate is to be registered on the website of the Income-Tax Department. This is necessary to ensure that the authorized person and DSC verify the tax return. DSC can be registered in the following steps:

Step 1: Visit https://www.incometax.gov.in/iec/foportal/ and login with registered PAN and Password.

Step 2: After log-in, from main menu go to Profile Settings > Register Digital Signature Certificate.

Step 3: From the landing page, download DSC Management Utility from the link given on that page. Extract the ZIP folder and open the DSC management utility.

Step 4: Go to the second tab Register/Reset Password using DSC in DSC Management Utility.

Step 5: Insert the DSC USB token in USB port of Computer/Laptop.

Step 6: Enter the E-Filing User ID and PAN of the DSC (Registered in E-Filing).

Step 7: Select the type of DSC (USB Token) and generate the signature file.

Step 8: Go back again to the e-filing portal and attach the Signature File (generated in Step 7) on the page of Register Digital Signature Certificate and submit.

On successful registration of DSC, a confirmation email shall be sent on the registered Email ID.

Registration of DSC is the first step in the process of verification of the Income-Tax Return with DSC. Once it is registered, the next step is to verify the ITR, which can be done with the following process.

How to Upload Income Tax Return Online using a Digital Signature:

Step-1: Prepare your Income Tax Return and Generate XML.

Step-2: Save XML file in your favorite location [Say Desktop].

Step-3: Login to Income Tax e-filing website.

Step-4: Click on” e-file -> Income Tax returns”. Next, Select the proper ITR, Assessment Year.

Step-5: Select the Submission Mode as “Upload XML”.

Step-6: Enable the relevant check boxes shown i.e., If you are audited u/s 44AB and If you are audited u/s 92E.

Step-7: Download the DSC Utility and generate the Signature file.

Step-8: Now, upload the signature file and the XML.

Step-9: On click of Submit” button, verification of the signature file and the XML takes place and the return filing acknowledgement will be given.

Steps to Generate signature file using DSC Management Utility:

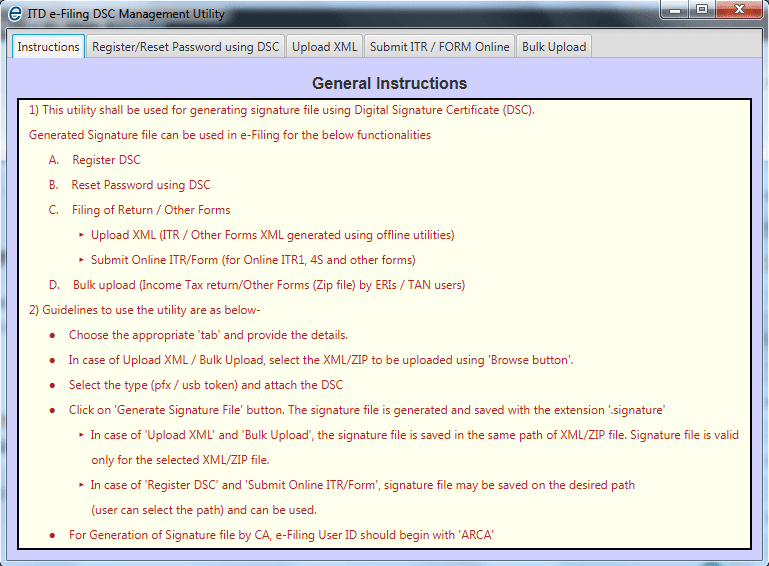

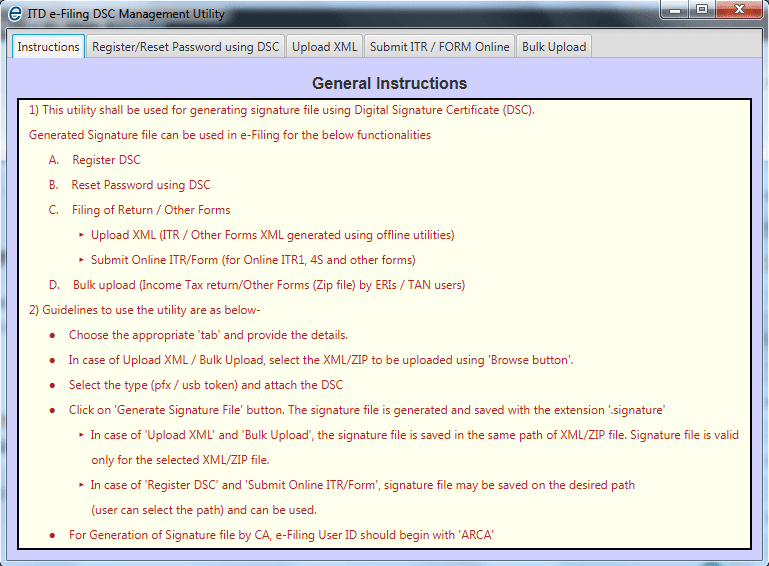

Step 1: Download ‘ITD e-filing DSC Management Utility’ from the given link.

Step 2: Extract zip folder and open the utility (DSC_MGMT_UTILITY.jar).

Step 3: The utility will be opened as below

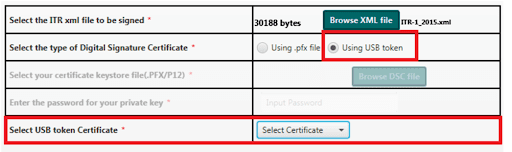

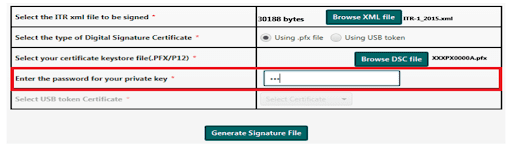

Step 4: Click on "Upload XML" tab and Use the ‘Browse’ button to select your valid XML file for e-filing.

Step 5: Select the type of Digital Signature Certificate

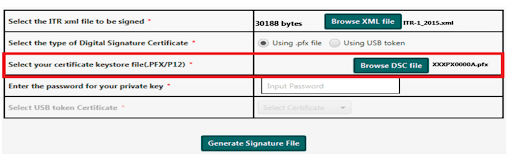

Step 5(1): Using .pfx file

- Step a: Click on ‘Browse’ button to select a valid ‘.pfx’ file

- Step b: Enter password for the selected ‘.pfx’ file

- Step c: Click on ‘Generate Signature file’ button.

- Step d: Upload the XML along with the generated signature file in eFiling portal to complete filing with DSC.

- Step d: Upload the XML along with the generated signature file in eFiling portal to complete filing with DSC.

Using a digital signature and e-filing the income tax return has a number of benefits, not limited to streamlining the efficiency of the entire process. It ensures a reduced amount of fraud and misrepresentation and ensures that individual taxpayers take individual responsibility for managing their own finances in terms of filing income tax returns.