EPF Certificate of Coverage for Working Abroad

If you are going to a foreign country from your company for a short duration (onsite) then what should you do with EPF account?

Do you withdraw from EPF account?

Secondly, when you work in a foreign country you might be required to contribute to their social security scheme. But if you work for a short duration, it may not be beneficial for you to contribute to their social security scheme as you can not reap its benefit during your short stay.

In this case, you need to obtain Certificate of Coverage (CoC) from the EPFO to claim exemption from the foreign country’s social security. The Government of India has social security agreements with several countries like Belgium, Germany, Switzerland, France, Denmark, Canada, Japan, Austria among others.

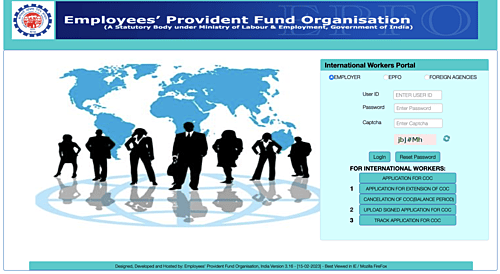

The Government of India, in July 2017, launched a new website for the online generation of CoC, https://iwu.epfindia.gov.in/iwu/.

This article talks about What is a Certificate of Coverage?

How to apply for it online?

What should an employer do?

What if your organisation is not covered by EPFO?

What is a Certificate of Coverage?

Whenever an employee works for an employer, they are required to make a contribution to the Social Security scheme of the country they are working in for example in India employee needs to contribute to EPF. However, in the cases where an employee is working in a foreign country, they have to contribute to the Social Security of that country. In cases where the term of employment is short, the employee won’t be able to reap its benefits. In this case, the employees can ask to claim exemption from the foreign country’s social security as long as he or she is contributing to their home social security system or EPFO. This is done by getting a Certificate of Coverage(CoC) from EPFO. CoC is also called adetachment certificate.

For example, an Indian employee, who is on assignment to Japan, may obtain a Certificate of Coverage in India and claim exemption from Japanese social security.

The term ‘detached worker’, refers to an outbound mobile worker who is posted by his/her employer to work in another country for a limited, temporary and short period of time for the same company or for an affiliate company and contributes to his/her home country and is exempted from social security contributions in that country Provided

- he/she is complying under the social security system of the home country

- Period of detachment is stipulated in a specific SocialSecurity Agreement.

Please note, if you are relocating or settling abroad then you are eligible to withdraw the complete amount. Your account will get interest until 58 years. but that interest would be taxable. Such workers are called International workers.

The CoC is issued for a period specified in the Social Security Agreements(SSA) between the relevant home and the host social security authorities and is valid for the period specified in the certificate. Social Security Agreements specify the period for which a Certificate of Coverage may be obtained such as 60 months, 48 months, 24 months, etc.

This exemption benefits the employee by allowing them to avoid the dual contribution of a social security scheme in India and the other country they had worked with. This is possible with 18 countries from which India has its operational Security System Agreement. The countries included in the list are Canada, Australia, Germany, Denmark, Switzerland, Belgium, South Korea, France, Hungary, Finland, Luxembourg, Czech Republic, Netherlands, Japan, Portugal, Sweden, Austria, Norway.

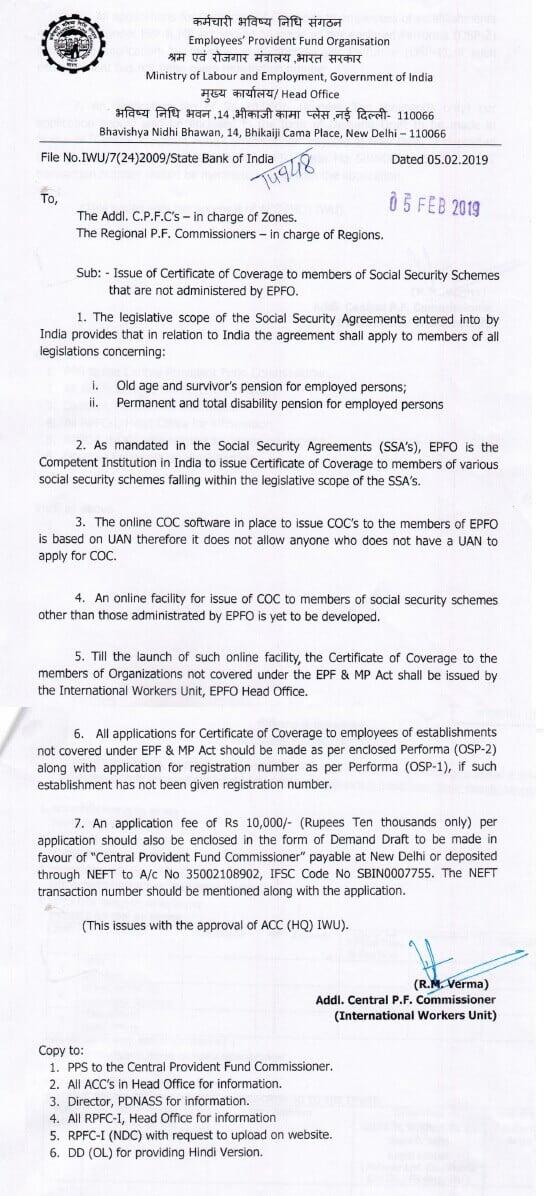

On 5 Feb 2019, EPFO has allowed Certificate of Coverage to be issued to members of Social Security Schemes that are not administered by EPFO. But this process is offline and costs Rs 10,000. This is discussed in detail later in the article here.

How the submission of Certificate of Coverage has changed?

Before the launch of new online process applications for Certificates of Coverage had to be signed by the employee and the employer in hard copy and then had to be physically submitted with the Indian Social Security Authorities. A paper Certificate of Coverage was then issued by the Indian Social Security Authorities to the employer. This led to delays in the whole process for Certificate of Coverage.

With the Government’s Initiative towards Digital India, the Ministry of Labor and Employment, Government of India has come up with a simplified solution with the introduction of the online website. The new process is fully electronic eliminating the need to submit the application in hard copy with the regional provident fund offices.

What are the steps to be followed by an employee to get a Certificate of Coverage?

The steps that are involved in the employee’s end are as follows:

- Visit https://epfoportals.epfindia.gov.in/iwu/

- Select Application for CoC.

- Enter UAN, Captcha, and then Submit.

- Complete the application, shown in the image below.

- A reference number of the application will be generated upon submission and the pre-filled application will be available for download and print.

- Sign and upload the application .

- To upload the signed application, visit the international workers portal and select ‘UPLOAD SIGNED APPLICATION FOR COC

What are the steps to be followed by an employer to give Certificate of Coverage?

The steps that are involved in the employer’s end are as follows:

- Visit https://epfoportals.epfindia.gov.in/iwu/

- Enter User ID, Password, Caption, and then Login. You have to use the same login credential that you use for the Unified Portal (Employer).

- Go to Certificate of Coverage under Applications tab.

- Select a Reference number and verify the details.

- Approve/Reject the application after verification, as shown in the image below.

- After approval, go to Signed Application Members under the Download tab.

- Take the Print out of the application.

- Sign and Stamp the application.

- Upload the copy to the server.

Once, the employee and the employer have completed all the steps, they are required to wait for the processing at the end of PF office. They can track the application using the option Track application for CoC to get updated about the status of the application. Once approved, a link for the download of CoC would be available.

Issue of Certificate of Coverage to members of Social Security Schemes that are not administered by EPFO

On 5 Feb 2019, EPFO has allowed Certificate of Coverage to be issued to members of Social Security Schemes that are not administered by EPFO. But this process is offline and costs Rs 10,000. The image below shows the EPFO circular.

What are the advantages of the Online tool for Certificate of Coverage?

This new online tool has proved advantageous to the public by reducing the overall time incurred in the complete CoC generation process. The information submitted through the online tool is automatically transferred to CoC without any requirement to fill the information manually into the system. The process reduces the processing time, eliminate errors in CoC, and generates the CoC within 3 working days. The benefits of using this online tool are as follows:

- Flexible access

- Reduced Time

- Lower Cost

- Scalable and Integration

- Easy to use

- Secured access

- Transparency of Information

- Money not blocked for a longer time