Certificate Course on Secretarial Filings

The purpose of this course is to simplify and explain RoC filing (Corporate Compliance) for Indian Companies.

The course covers 20+ RoC forms in only 4-6 hours of premium lecture content, with lectures properly divided into small parts, crisply explaining both the Concept behind each form, and Practical aspects of filing that particular form. Special focus is on removing complexity through specifying what is relevant and what is not for Normal Small Companies.

This course is highly useful for -

Newly qualified CA/CS/CMA who want to learn the practical aspects of how to manage Compliance of a Company.

Experienced Professionals who lack experience in the Company filings domain, and looking to upgrade their skill sets.

Professionals who have some experience in form filings, but looking to gain enough confidence to Handle Company Clients independently.

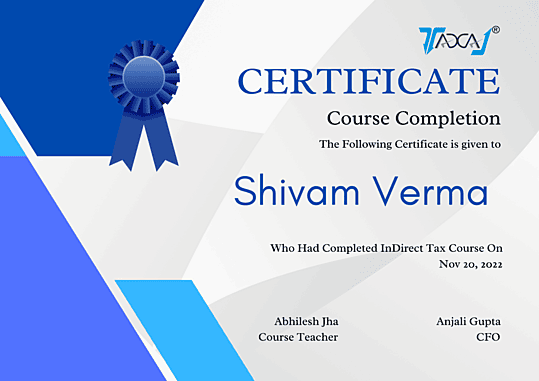

Both the faculties - CA Abhilesh Jha and CS Anjali Gupta, have had considerable experience in the field, and have created the course with the vision to share their knowledge and empower more professionals in confidently acquiring such assignments and properly executing them.

What You'll Learn:

- Practical Understanding of Company Form-Filing with RoC

- Logical explanation of Details required and Attachments to be submitted in the forms

- Compliances to be done by Companies throughout its life cycle

InDirect Tax Certification Course Highlights

| Full Form | Certificate in Secretarial Filings |

| Course Level | Certification |

| Duration | 10 to 15 Sessions |

| Eligibility | Knowledge of Companies Act 2013 |

| Admission Process | Based on Merit |

| Average Course Fees | INR 15,000 to INR 25,000 |

| Average Salary | INR 2-6 LPA |

| Top Job Positions | Secretarial Assistant, Company Secretary, Secretarial Head |

| Top Recruiting Areas | Banks, Accounting Firms, Secretarial Firms, Auditing Firms, Corporates, etc. |

Course Content or Sessions

Benefits of the Course:

Learn basics of GST.

Get complete understanding of GST registration process and return filing steps & procedure.

Learn how to extract data from Tally for the various return filing.

Business owners can do registration and file their GST return by their own.

Explanation on how to rectify some common errors encountered while filing the GST returns will assist the accountants in their job role.

Increases the job opportunities for newly passed out graduates and also for all others with the knowledge of practical aspects of GST.

On completion of this course, you will get a course completion certificate and a good understanding of theoretical as well as practical angle of GST and you will be GST ready for coming future. So hurry up and enroll now!!!

Trainer : FCS Anjali Gupta

Qualification: She is a Company Secretary and commerce graduate from Delhi University.

Key Strength:

- Indirect Taxation viz GST, DVAT, Customs, and Excise, etc., Company Law, Intellectual Property Law, LLP, Insolvency and Bankruptcy

- Direct Taxation viz Income Tax, etc

- Anjali Gupta is having 6+ years of experience including almost 4 years of consultancy In Secretarial Filings.

- She has worked in a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of Direct & Indirect Taxation.

- She is currently working as a partner in a reputed consultancy firm located in Delhi NCR Region.

- In her current role, she provides consultancy/advisory services after thoroughly analyzing models of business houses and providing solutions to the respective management.

- She is an expert in the field of litigation in Indirect, Direct Taxes, and Company matters and has presented cases against various Tax Authorities as well.

Training Expertise:

- She delivers training sessions on GST, Income Tax and Company Law Matter resolved numerous doubts for students.

- She also conducts various seminars/sessions where she interacts with students and professionals to guide them through the complex provisions of various Laws.