Certificate Course on Indirect Taxation

Goods and Service Tax (GST) is an indirect tax in India that came into effect on 1st July 2017 which has replaced many indirect taxes. GST is levied on the supply of goods and services and the main advantage is that it has removed the cascading effect on the sale of goods and services. Also, GST is mainly technologically driven. All the activities like GST registration, GST return filing, application for refund needs to be done online on GST portal. So, get the basic knowledge on GST and learn about the practical aspects of GST with this GST course.

Want to start a new career as a GST professional in India or want to enhance your GST knowledge as an accountant or Tax executive? Goods and Services Tax(GST) specialists are in high demand as companies seek individuals with expertise to help them implement and comply with this landmark tax reform. They are responsible for preparing and filing tax returns, preparing payments, identifying tax savings, and analyzing tax issues.

Designed by TAXAJ, this program will help you gain in-demand skills in the field of GST. You’ll learn about India's GST landscape and fundamentals, understand GST compliances, how and when to apply GST, and how to undertake GST compliances and file returns. You’ll gain practical knowledge of GST and apply your new skills to real world scenarios by examining actual transactions and case studies.

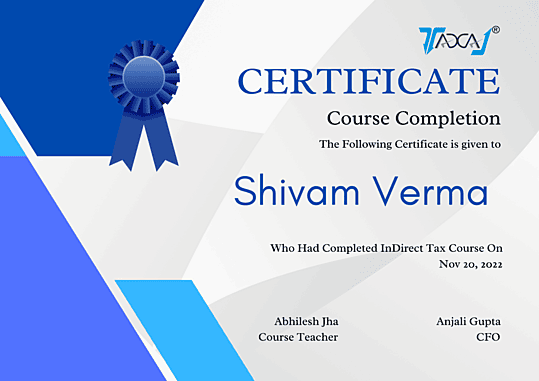

Upon completion, you will earn a Professional Certificate from TAXAJ and will have job-ready skills for entry level GST jobs in India. This is an industry-agnostic program relevant to anyone looking to acquire basic knowledge of India GST.

Learners can sharpen their skills in specific GST areas such as technical aspects, compliances, and tax dispute resolution.

To be successful, it will be helpful to be familiar with basic Excel, basic arithmetic formulas, and the concepts of purchase, sale, receipts, and payments.

What You'll Learn:

Basic understanding of GST Concepts - Introduction, Classification (CGST, SGST, IGST), GST Rates and Categorizing of GST(Input & Output)

GST online registration

Letter of Undertaking (LUT) registration

E Way Bill introduction and procedure to generate E Way bill online

GSTR 2A/2B data preparation and reconciliation

GSTR 1 data preparation and online return filing

GSTR 3B data preparation and online return filing

ITC 04: Job Work return filing

InDirect Tax Certification Course Highlights

| Full Form | Certificate in Indirect Taxation |

| Course Level | Certification |

| Duration | 10 to 15 Sessions |

| Eligibility | Qualifying 10+2 level |

| Admission Process | Based on Merit |

| Average Course Fees | INR 15,000 to INR 25,000 |

| Average Salary | INR 2-8 LPA |

| Top Job Positions | Accounts Assistant, Finance Manager, Corporate Analyst, Financial Controller, Tax Analyst, etc. |

| Top Recruiting Areas | Banks, Accounting Firms, Financial Firms, Auditing Firms, Corporates, etc. |

Course Details & Sessions:

Benefits of the Course:

Learn basics of GST.

Get complete understanding of GST registration process and return filing steps & procedure.

Learn how to extract data from Tally for the various return filing.

Business owners can do registration and file their GST return by their own.

Explanation on how to rectify some common errors encountered while filing the GST returns will assist the accountants in their job role.

Increases the job opportunities for newly passed out graduates and also for all others with the knowledge of practical aspects of GST.

On completion of this course, you will get a course completion certificate and a good understanding of theoretical as well as practical angle of GST and you will be GST ready for coming future. So hurry up and enroll now!!!

Course Trainer: FCA Abhilesh Jha

Qualification: He is a commerce graduate from Calcutta University with a Chartered Accountancy background from the Institute of Chartered Accountants of India.

Key Strength:

- Indirect Taxation viz Service Tax, GST, DVAT, Customs, and excise, etc.

- Direct Taxation viz Income Tax, Wealth Tax, Capital Gains Tax, etc.

- He is having 8 years of experience including almost 4 years of consultancy In GST, FDI, Income Tax.

- He has worked into a number of domains such as Consultancy, Advisory, Litigation, and analysis in the field of direct & indirect taxation.

- He is currently working as CEO in TAXAJ located in Delhi NCR Region.

Training Expertise:

- Highly capable of providing strategic advisory, tax planning on GST, and other indirect taxation, compliance management, litigation operations, departmental representation, filing appeals, and several others

- Excelled at leading indirect tax planning, reporting, and compliance efforts for domestic & cross border operations; proficient in minimising company’s tax exposure while ensuring compliance with all applicable laws and regulations