Why should you opt for Fixed Deposits as an Investment Option?

Types of Fixed Deposits

Normal Fixed Deposits

- Deposit money for a fixed tenure.

- Tenure can range from 7 days to 10 years.

- Interest rates higher than a normal savings account.

Tax-Saving Fixed Deposits

- Tax exemption on the principal deposit amount of up to Rs.1.5 lakh in a calendar year.

- Lock-in period of 5 years within which you cannot withdraw the amount.

- Allows only one-time lumpsum deposit.

Senior Citizens’ Fixed Deposits

- Applicable for individuals above 60 years of age.

- Senior citizens are eligible for special rates.

- Flexible tenures.

Cumulative Fixed Deposits

- Interest is compounded every quarter or year and paid at the time of maturity.

- Helps substantially grow your savings.

Non-Cumulative Fixed Deposits

- Interest is paid out monthly, quarterly, half-yearly, or annually, as per your choice.

- Better bet for pensioners looking for a regular source of income.

Flexi Fixed Deposits

- Fixed deposit linked to your bank account.

- Money shuttles between your FD and savings account.

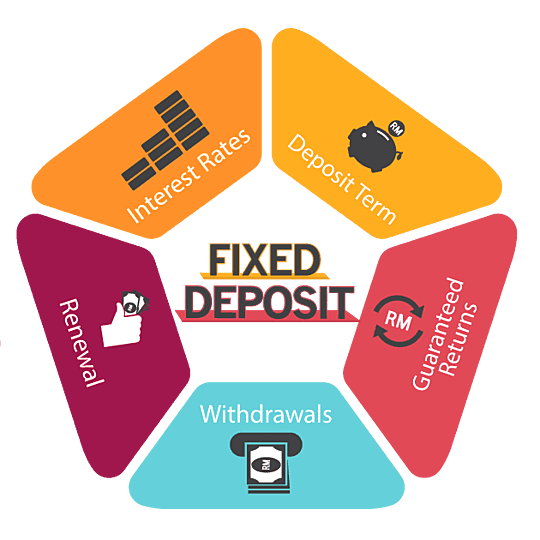

How Does a Fixed Deposit Account Work?

When you put your money to work in fixed deposits, you basically lock the amount for a fixed period of time. You can earn interest on the principal sum throughout the tenure on a cumulative basis. The interest earned gets added to the principal amount after every specific interval.

Since the tenures are flexible, you have the option to manage multiple FD accounts spread across different tenures. That way, you will be able to earn more on your investments. Senior citizens are eligible for additional rates, usually 0.25% to 0.65% more than the existing rate.

Other than this, even NRIs (Non-resident Indians) can open FD accounts in India in the form of NRE (Non-resident External) and NRO (Non-resident Ordinary) FDs.

You can open a term deposit account with a bank where you already have a savings account. There are banks that let you open an FD account even if you don’t have a savings account with that bank. However, with such banks, you have to go through a KYC process where you have to present relevant documents, including ID proof, address proof, passport size photographs, among others.

Eligibility Criteria for FD investment

The following entities are eligible to open an FD account in India:

- Indian resident

- NRI

- Minors

- Senior citizens

- Companies

- Partnership firms

- Individuals or joint investors

- Societies or clubs

- Sole proprietorship

Advantages of Fixed Deposit

Fixed deposits have several advantages, some of which are:

- Low risk: Market risks do not affect the returns on your fixed deposits.

- Insurance: Your deposits are insured for up to Rs.1 lakh by the RBI.

- Loan against FD: You can avail loans of up to 90% of your deposit amount at very low interest rates. This will usually be around 2% more than the FD interest rate.

- Easy liquidity: In the case of an emergency, you can easily liquidate your FD and release the funds.

- Regular income: You can get the interest sum credited as per your requirements on a monthly, quarterly, or annual basis.

- Tax benefits: Investing in tax-saving fixed deposits will fetch you tax deductions of up to Rs.1.5 lakh in a financial year.

- Senior citizens: Senior citizens are offered a higher interest rate compared to regular customers.

- Earn interest on your deposits and see your wealth grow.

- Flexible tenures.

Fixed Deposit Tax Benefits

There are many benefits to Tax Saving Fixed Deposits. These are as given below:

- Individuals, Hindu Undivided Family (HUFs), and minors investing jointly with adults can invest.

- The investment qualifies for tax deduction under Section 80C of the Income Tax Act.

- Tax Deducted at Source (TDS) is applicable on the interest earned, according to the income tax bracket, but this can be avoided by submitting Form 15G (for senior citizens it is Form 15H).

- Senior citizens can claim deduction of up to Rs.50,000 on interest earned under Section 80TTB.

- Nomination facility can be availed except if it is held by or on behalf of minors.

- Higher interest rates are offered for senior citizens.

- Fixed deposits in post offices can be transferred from one post office to another.

Features & Benefits of:

Fixed deposit accounts are ideal for investors who are averse to taking risks. Interest is accumulated on the deposited amount over a fixed period of time. The interest rate for deposits less than Rs.2 crore range from 3.00% p.a. (for deposits less than one year) to 9.54% p.a. (for deposits of up to 10 years). This depends on the type of financial institution as well (public sector, private sector, or small finance banks). The tenure can range from 7 days to 10 years. Senior citizens are offered higher interest rates. This is usually in the range of 0.25% to 0.65% more than the existing rates.

Systematic Deposit Plan

Systematic Deposit Plan Systematic Deposit Plan

Banks are now offering Fixed Deposit in Systematic Deposit Plan (SDP), – a monthly investment option that enables the customer to invest in small monthly deposits, in a disciplined manner. The maturity period of each monthly deposit under SDP shall be for a minimum period of 12 months to a maximum period of 60 months. The depositor will have option to choose between 6 to 48 numbers of monthly deposits under SDP. The interest rate prevailing on the date of each deposit will be applicable to that particular deposit. Each deposit under the SDP will be treated as a separate Fixed Deposit.

No Minimum Deposit

The minimum deposit required to invest in a Banks Finance Fixed Deposit is Rs. 25,000, which makes it easier to invest. With this minimum deposit amount, you can start investing any time, without having to wait to accumulate a larger corpus. Even with a smaller minimum deposit amount, you can ladder your investments, and earn better returns.

Upto 7.85% Return on FD

Banks offers a lucrative interest rate of up to 7.60%, which can go up to 7.85% for senior citizens. Investing in this FD can help you accumulate your wealth and grow your corpus, with assured returns.

High Stability/ Credibility

As the only Indian NBFC with an international rating of ‘BBB’ by S&P Global, Banks Finance Fixed Deposit is one of the safest investment options for investors, regardless of their risk type. Banks Finance Fixed Deposit has the highest stability ratings with CRISIL’s FAAA/Stable rating and ICRA’s MAAA (stable) rating, so your investments are never at risk.

Online Process

As an existing customer can easily invest in FD with an easy online application process, which saves you time and trouble. You can save the hassle of submitting lengthy documentation or waiting in queues for opening your Fixed Deposit with Banks Finance. As a new customer, you can fill in our online application form, so our representative can get in touch with you.

Higher Interest Rates for Senior Citizens

For senior citizens seeking safe investment avenues to invest their life savings, Banks Fixed Deposit offers the benefit of high safety with additional returns of 0.25% over and above the regular interest rate. Senior citizens can also choose the option of periodic payouts, to fund regular expenses.

Flexible Tenors

When investing in a Banks Finance Fixed Deposit, you can choose the tenor between 12 and 60 months, to suit your financial needs. This can help you with your liquidity needs, and you can ladder your investments to enjoy a higher cash inflow.

Loan against FD

In case of emergencies, you can withdraw prematurely from the fixed deposit, post the initial lock-in period of 3 months. However, in order to avoid loss of interest, you can choose to avail a Loan against Fixed Deposit, where you can take an easy loan. However, the amount of your Loan against FD cannot be more than 75% of FD value.

FAQ?

How much amount can be deposited in Fixed Deposit?

To invest in a Fixed Deposit, you can start investing with an amount of Rs. 25,000. In case you wish to deposit an amount higher than Rs. 5 crore, you need to get in touch with our representative.

What is the minimum period for a Fixed Deposit?

The minimum period for a Fixed Deposit is generally 12 Months.

What happens to FD after maturity?

You can always consider renewing your Fixed Deposit, as you approach the maturity period. However, in case you don’t choose to renew your Banks Fixed Deposit, you can receive the final maturity amount directly in the bank account linked with your FD.

Can I withdraw my deposit before maturity?

There is a fixed lock-in period of 3 months, when investing in a Fixed Deposit. While there is no penalty on withdrawing your deposit before maturity, you may incur losses in terms of interest you could earn. To help you avoid incurring such losses, Banks offers an easy Loan against Fixed Deposit, so you can cater to your urgent finance requirements, without having to break your FD.