Get e-Stamp Paper Online

Steps to be followed while Ordering Stamp Papers:

1. Fill up the form of Stamp Paper for your Desired State.

2. Make the Payment. If you are applying for multiple stamp, you may choose the Number of papers on Payment page.

3. Choose Physical Copy Delivering option (If you want the physical copy to be delivered to your address).

4. We Generally send the paper in 4 working hours. (Saturday and Sunday are generally holiday for us.)

5. There can be delays in delivering papers sometimes. (Stamp Papers are generated from Govt. Sites and not from our printers)

6. If the stamp paper is required very urgently, then please go to your nearby shop, with us there can be delays.

7. The quality of scan is subject to printer/ink/paper generation etc.

Watch This Video Before Buying E-Stamp Online

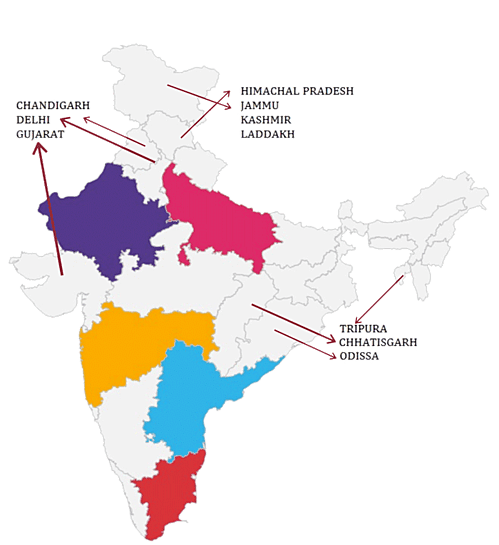

Stamp Paper Forms of available States:

Also need help with Legal Drafting from Experts?

5 Advantages of Outsourcing Legal Drafting Service

FAQ:

What is Stamp Paper?

Stamp papers are the legal authentication offered by the government of India in order to process the various transaction in-between the parties (buyers and sellers). Apart from the transactions, the stamp paper offered by the government of India is authenticates the agreements, bonds, certificates, deeds and so in-between the parties.

However, many people all over the nation, especially in the busy city like Delhi is facing very hard to get the legitimate stamp papers from the valid licensed stamp papers sellers. On clearing those difficulties faced by the many peoples in the city of Delhi, the state government of Delhi introduces the e-stamping system on 2008, with the launch of Delhi e-stamp paper, the needed people can able to avail the stamp papers by booking online and even they are allowed to pay their stamp duty in online itself.

How safe is e-Stamping system?

What is the necessity of e-Stamp Paper in Delhi?

What other Legal assistance can you provide?

We are a group of professionals who are trying our best to provide best of financial and tax solution at your finger tips. You can reach out to us for any and all legal and financial issues.

Key factors about getting e stamp papers online in Delhi

Can Taxaj help in Getting the Documents Notarized?

How to get e stamp paper online in Delhi through TAXAJ?

With us You get Following Types of Legal Stamp paper:

Adoption (3)

Award - Immovable (12)

Indemnity Bond (15)

Cancellation of Instrument (17)

Certificate of Sale (18)

Conveyance (23)

Sale Agreement (23-A)

Additional Copy of Document (25)

Divorce (29)

Exchange of Property (31)

Further Charge (32-A)

Declaration (4)

Gift (33)

Perpetual (35)

Lease - Rent Deed Upto 1 Year (35-i)

Lease - Rent Deed Upto 5 Year (35-ii)

Lease - Rent Deed Upto 10 Year (35-iii)

Lease - Rent Deed Upto 20 Year (35-iv)

Lease - Rent Deed Upto 30 Year (35-v)

Lease - Rent Deed Upto 100 Year (35-vi)

Lease - Rent Deed Upto 200 Year (35-vii)

General Agreement (5)

Mortgage (40)

Mortgage Collateral (40-C)

Partition (45)

Partnership (46)

Power of Attorney- SPA (48)

Power of Attorney- GPA (48-C)

More than one way to Pay Stamp Duty?

More than one way to Pay Stamp Duty?

As of now, Indian Govt. permits payment of Stamp Duty in more than one ways. They are –

- Through e-Stamping

- Through papers bearing impressed Stamps which would be the non-judicial Stamp paper

- Using a Franking machine

- Adhesive stamps, paying at the registrar office etc.

The above listed options may not be available in all states. While few states have all these methods, others have the provision for paying stamp duty by other methods. Among the methods listed here, e-Stamping is considered to be the most tech-savvy and convenient for the masses.

Traditional Stamp Paper

Procuring a non-judicial Stamp Paper would require you to find a licensed Stamp vendor paying the duty for it. The contents of the deed and the details of executants are then written on to the document.

There are some disadvantages to using physical Stamp Paper, they are-

- The procedure to procure one can be time consuming. Locating and approaching a licensed Stamp vendor can take quite a bit of time.

- Not all Stamp vendors will have stock of Stamp papers of all denominations. Some keep Stamp papers of very low value alone.

- The above two points often leave people with no choice but to approach non-licensed Stamp vendors which puts them in risk of purchasing counterfeit Stamp papers.

E-Stamp Paper & Rental Agreements

E-Stamping was the Indian Government’s solution to tackle counterfeit Stamp papers. In early 2000’s, the Indian Govt. appointed the Stock Holding Corporation of India Ltd (SHCIL) to implement and oversee e-Stamping operations. The SHCIL is also been given the duty of keeping record of all e-Stamp papers issued in the country.

If you wish to use e-Stamp paper for your rental agreements, the first thing you will need to do is verify whether your state facilitates this. This should be simple, all you need to do is log on to the website of SHCIL and check if your state is included in the list. As of now, the states that allow e-Stamping include Assam, Gujarat, Himachal Pradesh, Karnataka, Maharashtra, Delhi-NCR, Tamil Nadu, Uttarakhand, Ladakh and Uttar Pradesh.

To get a rental agreement printed on e-Stamp paper, you will first have to purchase an e-Stamp paper from allotted centres in your city. Once you have the e-Stamp paper, write/print your prepared rental deed on it, following which, the executants, namely the tenant and the landlord, must place their signatures at designated places along with the signatures of two witnesses. This makes the contract, legally binding.

Easy Alternative

For those of you with neither the time nor the inclination to go out and find a lawyer to draft a solid rental agreement or find an e-Stamp paper issuing centre, TAXAJ offers a very attractive alternative. We have pre-drafted, lawyer verified online rental agreements which you can just customize to suit your needs. If you are busy to make an elaborated format, then try our quick rental agreement. And the best part is that we will print it on Stamp paper and mail it to an address of your choice! You don’t have to step out of your house or find a lawyer, just spare a few minutes and you’ll have a rental agreement at your doorstep!

We also have online Will format and a host of other ready to use legal documents. Do take a look at them! And if you are looking to create a remtal agreement, click the button below and get started.