Due Diligence of Company

Due diligence of a company is usually performed before the business sale, private equity investment, bank loan funding, etc., In the due diligence process, the financial, legal and compliance aspects of the company are usually reviewed and documented. In this article, we review the process for due diligence of a company (Private Limited Company or Limited Company) and provide a checklist for those performing due diligence on a company in India.

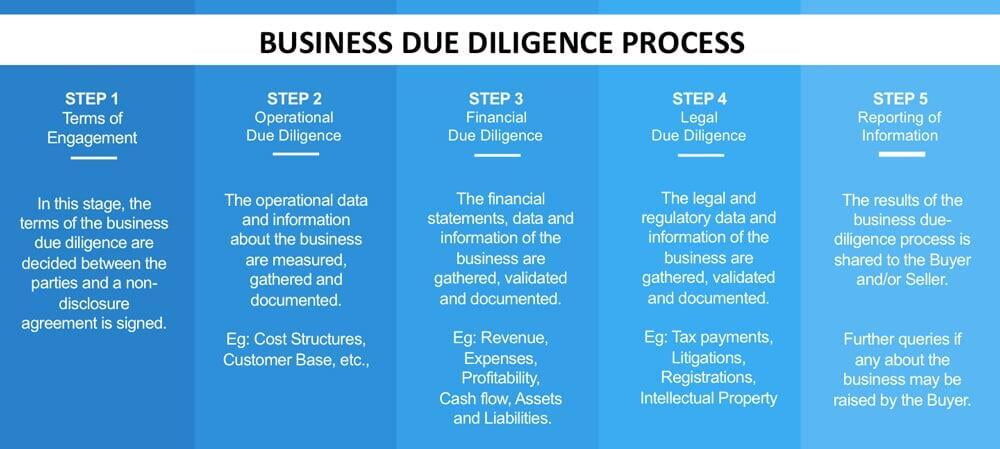

A business due diligence is usually performed prior to the purchase of a company or investment in a company by the acquirer or investor (“Buyer”). It is the responsibility of the seller of the business or shares (“Seller”) to provide the documents and information necessary for performing a due diligence on the company to the buyer. A due diligence helps the buyer take an informed investment decision and mitigate risks associated with a business purchase transaction. Both parties usually enter into a non-disclosure agreement prior to starting a business due diligence as sensitive financial, operational, legal and regulatory information would be divulged to the buyer during the due diligence process.

File your MSME 1 Return with the help of Team TAXAJ

It Usually takes 5 to 7 working days.

- Preparation of Due Diligence Report.

- Companies want to get their due diligence done before the business sale, private equity investment, bank loan funding, etc.,

- Company planning to invest or fund a company.

- Purchase the plan

- Share the documents/details as requested by us.

- Prepare the report as required and share it with you.

- Memorandum of Association

- Articles of Association

- Certificate of Incorporation

- Shareholding Pattern

- Financial Statements

- Income Tax Returns

- Bank Statements

- Tax Registration Certificates

- Tax Payment Receipts

- Statutory Registers

- Property Documents

- Intellectual Property Registration or Application Documents

- Utility Bills

- Employee Records

- Operational Records

Understanding Due Diligence

Due diligence became common practice (and a common term) in the United States with the passage of the Securities Act of 1933. With that law, securities dealers and brokers became responsible for fully disclosing material information about the instruments they were selling. Failing to disclose this information to potential investors made dealers and brokers liable for criminal prosecution.

The writers of the act recognized that requiring full disclosure left dealers and brokers vulnerable to unfair prosecution for failing to disclose a material fact they did not possess or could not have known at the time of sale. Thus, the act included a legal defense: as long as the dealers and brokers exercised "due diligence" when investigating the companies whose equities they were selling, and fully disclosed the results, they could not be held liable for information that was not discovered during the investigation.

Documents required during Company Due Diligence

Usually, the following information and documents pertaining to a private limited company or limited company are required for performing due diligence:

- Memorandum of Association

- Articles of Association

- Certificate of Incorporation

- Shareholding Pattern

- Financial Statements

- Income Tax Returns

- Bank Statements

- Tax Registration Certificates

- Tax Payment Receipts

- Statutory Registers

- Property Documents

- Intellectual Property Registration or Application Documents

- Utility Bills

- Employee Records

- Operational Records

Review of MCA Documents

Most of the due diligence of a company starts with the Ministry of Corporate Affairs. On the Ministry of Corporate Affairs website, the master data about a company is made publicly available. Further, with the payment of a small fee, all documents filed with the Registrar of Companies is made available to anyone. This information from the MCA website is usually verified first. The documents and information gathered in this step include:

- Company Information

- Date of Incorporation

- Authorised Capital

- Paid-up Capital

- Date of Last Annual General Meeting

- Date of Last Balance Sheet

- Status of the Company

- Director Information

- Directors of the Company

- Date of Appointment of Directors

- Charges Registered

- Details of Secured Lenders of the Company

- Quantum of Secured Loans

- Documents

- Certificate of Incorporation

- Memorandum of Association

- Articles of Association

In addition to the above, the financial information of the company and other filings with the MCA pertaining to various aspects of the company can be downloaded and reviewed. The review of MCA documents of the company would provide a good overview of the company to the person performing the due diligence.

Review of Articles of Association

It is very important to review the articles of association of a company during the due diligence process to ascertain the different classes of equity shares and their voting rights. The articles of association of a company can restrict the transfer of shares of a company. Thus, the articles of association should be studied carefully to ascertain the procedure for transfer of shares.

Review of Statutory Registers of Company

Under Companies Act, 2013, a private limited company is required to maintain various statutory registers pertaining to share allotment, share transfer, board meetings, the board of directors, etc., Therefore, the statutory registers of a company must be reviewed to obtain and validate information pertaining to directorship and shareholding.

Review of Book of Accounts and Financial Statements

- Verification of bank statements

- Verification and valuation of all assets and liabilities

- Verification of cash flow information

- Verification of all financial statements against transactional information

Review of Taxation Aspects

Taxation aspects of a company must be thoroughly checked during the due diligence process to ensure that there are no unforeseen tax liabilities created on the company in a future date. The following aspects relating to the taxation aspect of a company must be checked:

- Income tax return filed

- Income tax paid

- Calculation of income tax liability by the company

- ESI / PF Returns Filed

- ESI / PF Payments

- ESI / PF Payment Calculation

- Service Tax / VAT Returns Filed

- Service Tax / VAT Payments

- Basis for Service Tax / VAT Payment Calculation

- TDS Returns

- TDS Payments

- TDS Calculations

Review of Legal Aspects

A comprehensive legal audit of the company must be performed by a legal practitioner to ascertain if there are any pending legal actions, suits by or against the company and liability in each. Further, the following aspects must be checked during the legal due diligence:

- Legal due diligence for all real estate properties of the company.

- No objection from Secured Creditor for transfer of the company.

- Verification of court documents and court filings, if any.

Review of Operational Aspects

It is important to obtain a thorough understanding of the business model, business operations and operational information during the due diligence process. The review of operational aspects must be extensive including site visits and employee interviews. Following are aspects that must be covered and documented in the operational aspects review:

- Business Model

- Number of Customers

- Number of Employees

- Production Information

- Vendor Information

- Machinery Information

- Utilities

In addition to the above, based on the business and business model, other operational aspects may be important. Those aspects must be thoroughly checked and documented during the due diligence process.

Types of Due Diligence

Due diligence is performed by equity research analysts, fund managers, broker-dealers, individual investors, and companies that are considering acquiring other companies. Due diligence by individual investors is voluntary. However, broker-dealers are legally obligated to conduct due diligence on a security before selling it.

How to Perform Due Diligence for Stocks

Below are 10 steps for individual investors undertaking due diligence. Most are related to stocks, but, in many cases, they can be applied to bonds, real estate, and many other investments.

After those 10 steps, we offer some tips when considering an investment in a startup company.

All of the information you need is readily available in the company's quarterly and annual reports and in the company profiles on financial news and discount brokerage sites.

Step 1: Analyse the Capitalisation of the Company

A company’s market capitalisation, or total value, indicates how volatile the stock price is, how broad its ownership is, and the potential size of the company's target markets. Large-cap and mega-cap companies tend to have stable revenue streams and a large, diverse investor base, which tends to lead to less volatility. Mid-cap and small-cap companies typically have greater fluctuations in their stock prices and earnings than large corporations.

Step 2: Revenue, Profit, and Margin Trends

The company's income statement will list its revenue or its net income or profit. That's the bottom line. It's important to monitor trends over time in a company's revenue, operating expenses, profit margins, and return on equity. The company's profit margin is calculated by dividing its net income by its revenue. It's best to analyse profit margin over several quarters or years and compare those results to companies within the same industry to gain some perspective.

Step 3: Competitors and Industries

Now that you have a feel for how big the company is and how much it earns, it's time to size up the industry in which it operates and its competition. Every company is defined in part by its competition. Due diligence involves comparing the profit margins of a company with two or three of its competitors.

For example, questions to ask are: Is the company a leader in its industry or its specific target markets? Is the company's industry growing?

Performing due diligence on several companies in the same industry can give an investor significant insight into how the industry is performing and which companies have the leading edge in that industry.

Step 4: Valuation Multiples

Many ratios and financial metrics are used to evaluate companies, but three of the most useful are the price-to-earnings (P/E) ratio, the price/earnings to growth (PEGs) ratio, and price-to-sales (P/S) ratio. These ratios are already calculated for you on websites such as Yahoo! Finance.

As you research ratios for a company, compare several of its competitors. You might find yourself becoming more interested in a competitor.

- The P/E ratio gives you a general sense of how much expectation is built into the company's stock price. It's a good idea to examine this ratio over a few years to make sure that the current quarter isn't an aberration.

- The price-to-book (P/B) ratio, the enterprise multiple, and the price-to-sales (or revenue) ratio measure the valuation of the company in relation to its debt, annual revenues, and balance sheet. Peer comparison is important here because the healthy ranges differ from industry to industry.

- The PEG ratio suggests expectations among investors for the company's future earnings growth and how it compares to the current earnings multiple. Stocks with PEG ratios close to one are considered fairly valued under normal market conditions.

Step 5: Management and Share Ownership

Is the company still run by its founders, or has the board shuffled in a lot of new faces? Younger companies tend to be founder-led. Research the bios of management to find out their level of expertise and experience. Bio information can be found on the company's website.

P/E ratio

The P/E ratio gives a sense of the expectations that investors have for the stock's near-term performance.

Whether founders and executives hold a high proportion of shares and whether they have been selling shares recently is a significant factor in due diligence. High ownership by top managers is a plus, and low ownership is a red flag. Shareholders tend to be best served when those running the company have a vested interest in stock performance.

Step 6: Balance Sheet

The company's consolidated balance sheet will show its assets and liabilities as well as how much cash is available.

Check the company's level of debt and how it compares to others in the industry. Debt is not necessarily a bad thing, depending on the company's business model and industry. But make sure those debts are highly rated by the rating agencies.

Some companies and whole industries, like oil and gas, are very capital intensive while others require few fixed assets and capital investment. Determine the debt-to-equity ratio to see how much positive equity the company has. Typically, the more cash a company generates, the better an investment it's likely to be because the company can meet its debts and still grow.

If the figures for total assets, total liabilities, and stockholders' equity change substantially from one year to the next, try to figure out why. Reading the footnotes that accompany the financial statements and the management's discussion in the quarterly or annual reports can shed light on what's really happening in a company. The firm could be preparing for a new product launch, accumulating retained earnings, or in a state of financial decline.

Step 7: Stock Price History

Investors should research both the short-term and long-term price movements of the stock and whether the stock has been volatile or steady. Compare the profits generated historically and determine how it correlates with the price movement.

Keep in mind that past performance does not guarantee future price movements. If you're a retiree looking for dividends, for example, you might not want a volatile stock price. Stocks that are continuously volatile tend to have short-term shareholders, which can add extra risk for certain investors.

Step 8: Stock Dilution Possibilities

Investors should know how many shares outstanding the company has and how that number relates to the competition. Is the company planning on issuing more shares? If so, the stock price might take a hit.

Step 9: Expectations

Investors should find out what the consensus of Wall Street analysts is for earnings growth, revenue, and profit estimates for the next two to three years. Investors should also look for discussions of long-term trends affecting the industry and company-specific news about partnerships, joint ventures, intellectual property, and new products or services.

Step 10: Examine Long and Short-Term Risks

Be sure to understand both the industry-wide risks and company-specific risks. Are there outstanding legal or regulatory matters? Is there unsteady management?

Investors should play devil's advocate at all times, picturing worst-case scenarios and their potential outcomes on the stock. If a new product fails or a competitor brings a new and better product forward, how would this affect the company? How would a jump in interest rates affect the company?

Once you've completed the steps outlined above, you'll have a better sense of the company's performance and how it stacks up to the competition. You will be better informed to make a sound decision.

Special Considerations

In the mergers and acquisitions (M&A) world, there is a delineation between "hard" and "soft" forms of due diligence.

"Hard" due diligence is concerned with the numbers. "Soft" due diligence is concerned with the people within the company and in its customer base.

In traditional M&A activity, the acquiring firm deploys risk analysts who perform due diligence by studying costs, benefits, structures, assets, and liabilities. That's known colloquially as hard due diligence.

Increasingly, however, M&A deals are also subject to the study of a company's culture, management, and other human elements. That's known as soft due diligence.

Hard due diligence, which is driven by mathematics and legalities, is susceptible to rosy interpretations by eager salespeople. Soft due diligence acts as a counterbalance when the numbers are being manipulated or overemphasized.

There are many drivers of business success that numbers cannot fully capture, such as employee relationships, corporate culture, and leadership. When M&A deals fail, as more than 50% of them do, it is often because the human element is ignored.

The contemporary business analysis calls this element human capital. The corporate world started taking notice of its significance in the mid-2000s. In 2007, the Harvard Business Review dedicated part of its April issue to what it called "human capital due diligence," warning that companies ignore it at their peril

Performing Hard Due Diligence

In an M&A deal, hard due diligence is the battlefield of lawyers, accountants, and negotiators. Typically, hard due diligence focuses on earnings before interest, taxes, depreciation and amortization (EBITDA), the aging of receivables, and payables, cash flow, and capital expenditures.

In sectors such as technology or manufacturing, additional focus is placed on intellectual property and physical capital.

Other examples of hard due diligence activities include:

- Reviewing and auditing financial statements

- Scrutinizing projections for future performance

- Analyzing the consumer market

- Seeking operating redundancies that can be eliminated

- Reviewing potential or ongoing litigation

- Reviewing antitrust considerations

- Evaluating subcontractor and other third-party relationships

Performing Soft Due Diligence

Conducting soft due diligence is not an exact science. It should focus on how well a targeted workforce will mesh with the acquiring corporation's culture.

Hard and soft due diligence intertwine when it comes to compensation and incentive programs. These programs are not only based on real numbers, making them easy to incorporate into post-acquisition planning, but they can also be discussed with employees and used to gauge cultural impact.

Soft due diligence is concerned with employee motivation, and compensation packages are specifically constructed to boost those motivations. It is not a panacea or a cure-all, but soft due diligence can help the acquiring firm predict whether a compensation program can be implemented to improve the success of a deal.

Soft due diligence can also concern itself with the target company's customers. Even if the target employees accept the cultural and operational shifts from the takeover, the target customers and clients may well resent a change in service, products, or procedures. This is why many M&A analyses now include customer reviews, supplier reviews, and test market data.