- Home

- Launch

- Manage

- License

- Popular Licenses

- Central Licenses

- State Licenses

- Global Licenses

- Legal Metrology

- RCMC Licenses

- Other Licenses

- Insurance Broker License

- BIS Hallmark Certification

- Shop & Establishment - HR

- AD Code Registration

- Factory License - HR

- EPR Authorisation

- Pesticides License

- Insecticides License

- Fertiliser License

- Stock Broker License

- DTH Operator License

- Legal Entity Identifier (LEI)

- Multimodal Transport Operator

- DIC Registration

- Gaming License in India

- More

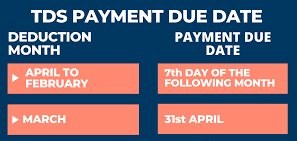

- Filings

- Legal

- Individual

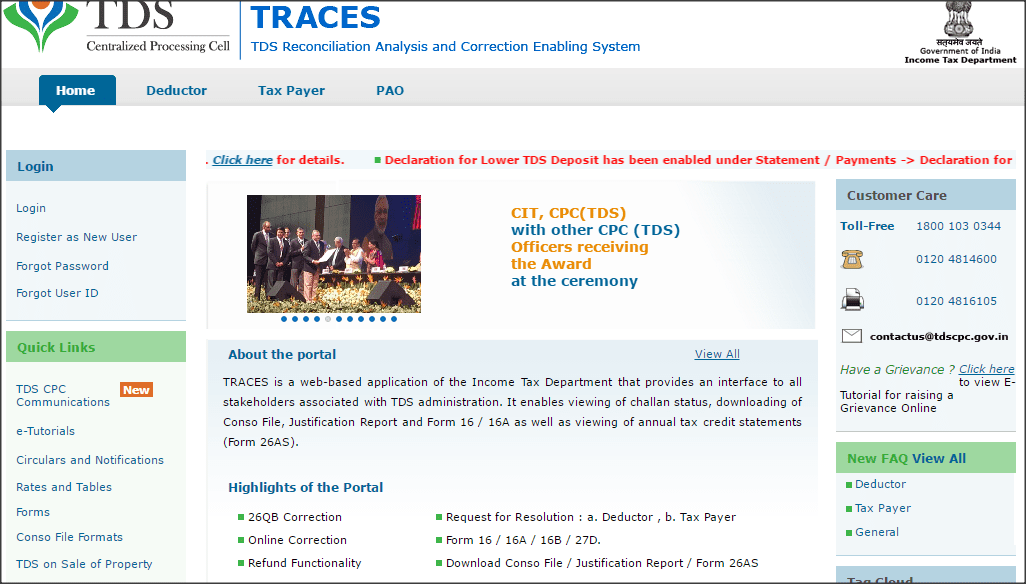

- Portal